Truck Loader Crane Market Outlook:

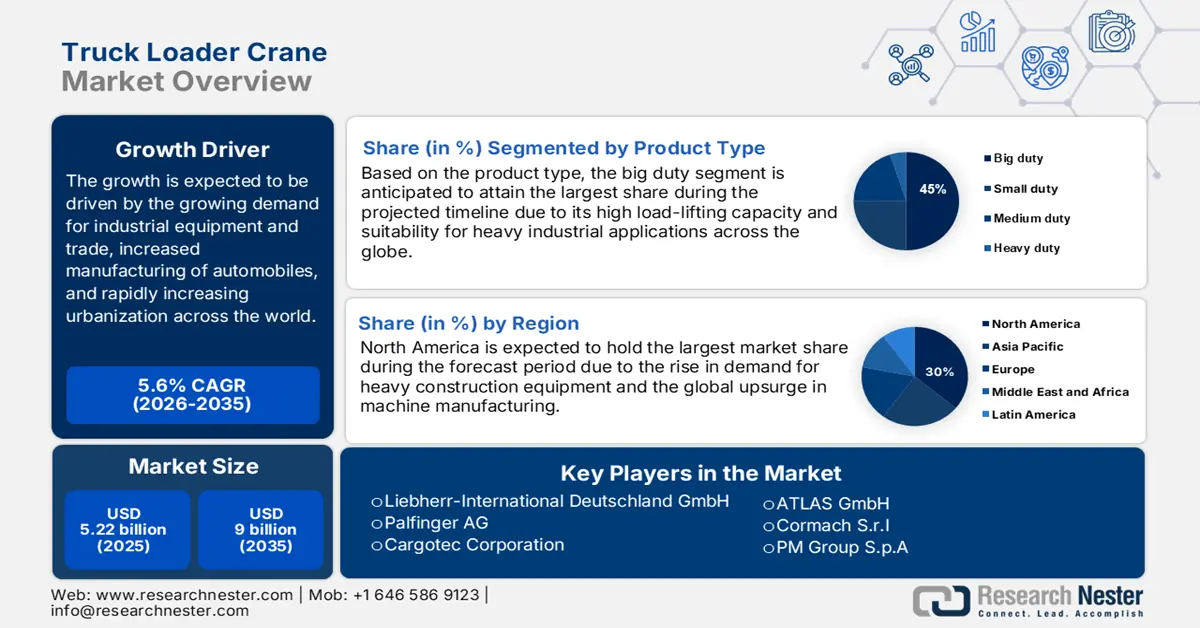

Truck Loader Crane Market size was over USD 5.22 billion in 2025 and is poised to exceed USD 9 billion by 2035, witnessing over 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of truck loader crane is estimated at USD 5.48 billion.

In the year 2025, the industry size of truck loader crane is evaluated at USD 1.97 billion. The increased construction activity is a factor that has contributed to the growth of the market. In view of the desire to build better and larger homes and workplaces, construction is increasing. In February 2023, the number of permits issued in the United States for construction was up by about 14 % to approximately 2 million per year on a seasonal basis.

Furthermore, it is believed that the increased demand for trucks with front-loading cranes and particularly truck tractors are factors that contribute to market growth. It is expected that India will experience an increased demand for mobile cranes in the 20 to 60 tons range, as well as a higher value between 80 and 100 tons on all-terrain models. For the 20 to 60 tons category, demand was set at approximately 50 units, and for the 80 to 100 tons category about 35 units in 2021.

Key Truck Loader Crane Market Insights Summary:

Regional Highlights:

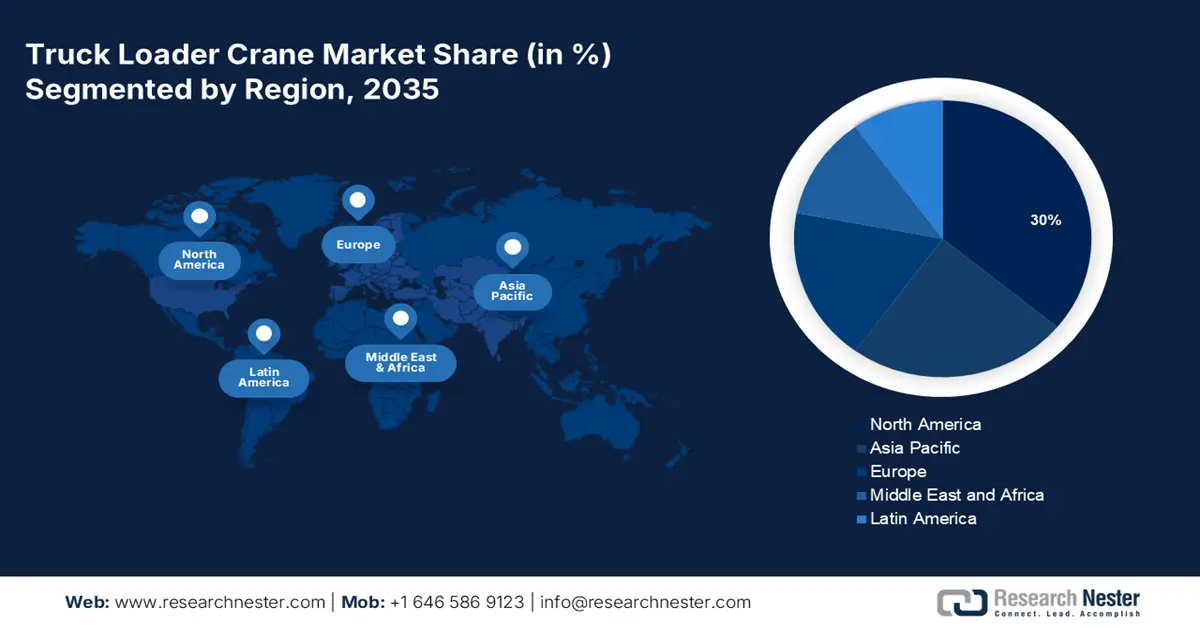

- North America truck loader crane market will dominate more than 30% share by 2035, driven by rising demand for heavy construction equipment and increasing manufacturing of machines globally.

- Asia Pacific market will account for 28% share by 2035, attributed to growing population, increasing housing demand, and rapid urbanization in the region.

Segment Insights:

- The big duty segment in the truck loader crane market is projected to hold a 45% share by 2035, driven by the high maneuverability and cost efficiency of large-duty cranes.

- The construction segment in the truck loader crane market is anticipated to achieve a 21% share by 2035, driven by rising construction activity and housing demand globally.

Key Growth Trends:

- Growing Demand for Industrial Equipment and Trade

- High Manufacturing of Automobiles

Major Challenges:

- Use of the Equipment in a Reckless Manner

- Maintenance and Repair Costs of the Cab Loader's Crane are Considerable.

Key Players: Liebherr-International Deutschland GmbH, Palfinger AG, Cargotec Corporation, Fassi Gru S.p.A., ATLAS GmbH, Cormach S.r.l., PM Group S.p.A., Zoomlion Heavy Industry Science & Technology Co., Ltd., Prangl Gesellschaft m.b.H.

Global Truck Loader Crane Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.22 billion

- 2026 Market Size: USD 5.48 billion

- Projected Market Size: USD 9 billion by 2035

- Growth Forecasts: 5.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (30% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, Italy

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

Truck Loader Crane Market Growth Drivers and Challenges:

Growth Drivers

- Growing Demand for Industrial Equipment and Trade- The development of industrial machines remains at the same pace as technological innovation. In Canada about USD 34,000 and USD 69,000 respectively are the minimum requirement for industrial machinery and equipment today in almost all manufacturing, construction, or production activities.

- High Manufacturing of Automobiles- The truck crane is a large machinery, used for loading and unloading heavy vehicles in the automotive industry. It is also used to move cables, engines, tires, and a wide variety of materials. By 2021, about 80 million vehicles were manufactured around the world, which means that by 2020 it will have increased by a little over 1%.

- Rapidly Increasing Urbanization- The growth of demand for energy, housing, and all commodities is likely to be driven by rising urbanization and the development of smart cities. In turn, that will lead to different sectors being stimulated. Moreover, studies suggest that there may be an additional 2.5 billion urban dwellers around the world by 2050.

Challenges

- Use of the Equipment in a Reckless Manner- Careful use of truck loader cranes should be made to ensure that they are used properly, it can lead to early deterioration and wear on the equipment. Moreover, during the loading and unloading of equipment or other material, the failure to take due care with regard to crane safety can lead to accidents and risks. Thus, growth in the market will likely be impeded by incorrect use of equipment.

- Maintenance and Repair Costs of the Cab Loader's Crane are Considerable.

- Lack of skilled Workers on Cranes' Production Lines.

Truck Loader Crane Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 5.22 billion |

|

Forecast Year Market Size (2035) |

USD 9 billion |

|

Regional Scope |

|

Truck Loader Crane Market Segmentation:

End User Industry Segment Analysis

The construction segment is poised to hold 21% share of the global truck loader crane market by the end of 2035. Increased construction activity, in view of the increased demand for housing, constitutes a factor that is likely to underpin this segment's growth. Nearly 2 billion new housing units have been built in the US since June 2022. This increased by 0.4% compared to the same period last year.

Product Type Segment Analysis

Truck loader crane market from the big duty segment is expected to garner a significant share of about 45% in the year 2035. Growth in the segments, for example, is an important factor that contributes significantly to a wide range of benefits achieved at effective costs. Thanks to the excellent quality of a large wheel loader crane, it is more economical than heavy-duty cranes with better maneuverability. They have a way of adapting and are quite adaptable. The center of it has a huge truck unloading crane that is being supported by an automobile.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Sales |

|

|

End User Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Truck Loader Crane Market Regional Analysis:

North American Market Insights

The truck loader crane market in North America is projected to be the largest with a share of about 30% by the end of 2035. Factor influencing the market's expansion is the rise in demand for heavy construction equipment and the rising manufacturing of machines globally. It is anticipated that new orders for construction equipment in the US will increase significantly in 2021, by about 12% over the previous year. US industrial production climbed by approximately 3% in the third month of October compared to the same period last year.

APAC Market Insights

The Asia Pacific truck loader crane market is estimated to be the second largest, registering a share of 28% during the forecasted timeframe. Both the population and the demand for housing are growing. The demand for homes in India has grown by almost 35% since the fiscal year of the Low Basic Income in 2021 and is expected to grow another 10% this year. Additionally, it is predicted that urbanization would cause this sector to grow at a faster rate going forward. As of 2021, India's urbanization had increased by 4% over the previous ten years.

Truck Loader Crane Market Players:

- Liebherr-International Deutschland GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Palfinger AG

- Cargotec Corporation

- Fassi Gru S.p.A.

- ATLAS GmbH

- Cormach S.r.l.

- PM Group S.p.A.

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

- Prangl Gesellschaft m.b.H

Recent Developments

- Liebherr launched the new tough terrain crane LRT 1090-2.1. The company showcased the new model at MINExpo in Las Vegas. The LRT 1090-2.1 is a crane designed with safety in mind. It has a VarioBase changeable support base and a cozy, secure cabin for crane operators.

- Palfinger AG announced the launch of PK 37.002 TEC 7 loader crane in Hong Kong. The pk 37.002 TEC 7 is made to be a technological masterpiece for precise and safe lifting.

- Report ID: 4761

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Truck Loader Crane Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.