Trommel Screen Market Outlook:

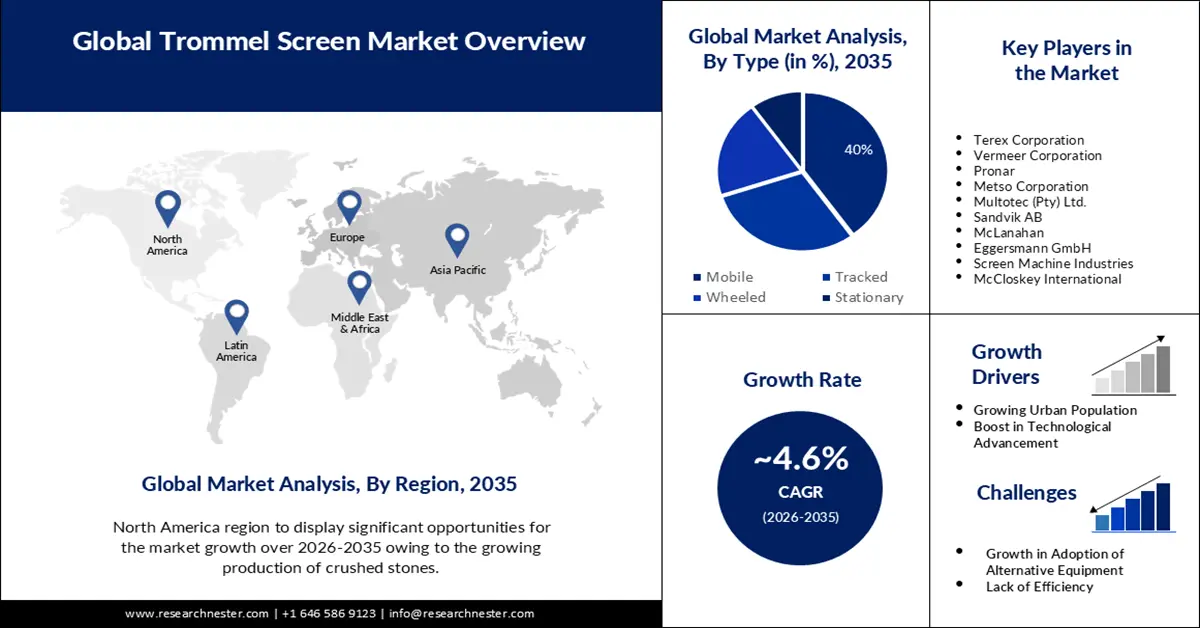

Trommel Screen Market size was over USD 2.35 billion in 2025 and is anticipated to cross USD 3.68 billion by 2035, growing at more than 4.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of trommel screen is assessed at USD 2.45 billion.

The growth of the market is majorly driven by the growth in municipal waste. Every year, the world produced 2.01 billion tonnes of municipal solid garbage, of which, at the very least, 33% is not managed in a manner that protects the environment. Hence, the use of trammel screens is growing by the municipal waste industry for the procedure of screening for the classification of solid waste sizes.

Additionally, the government is also playing a significant role in the trommel screen market expansion. The government is focusing on making the environment a better place to live. Hence, there are imposing various regulation which is further boosting the adoption of trommel screens for recycling products especially plastic. In order to eliminate some impurities that make it past the holed screen, a rotating trommel may be used to treat various types of plastic materials.

Key Trommel Screen Market Insights Summary:

Regional Highlights:

- By 2035, the demolition industry segment in the trommel screen market is projected to secure a 48% share, supported by the greater need to demolish old buildings to construct new ones.

- By 2035, the mobile segment is anticipated to account for a 40% share, bolstered by the ease of shifting units and rapid setup enabling operational expansion without permanent infrastructure.

Segment Insights:

- The demolition industry segment in the trommel screen market is projected to capture a 48% share by 2035, propelled by the growing need to replace aging buildings with new construction.

- The mobile segment is expected to achieve a 40% share by 2035, supported by the ease of relocating high-performance units and rapid on-site setup.

Key Growth Trends:

- Growing Urban Population

- Boost in Technological Advancement

Major Challenges:

- Growth in Adoption of Alternative Equipment

- Lack of Efficiency

Key Players: Terex Corporation, Vermeer Corporation, Pronar, Metso Corporation, Multotec (Pty) Ltd., Sandvik AB, McLanahan, Eggersmann GmbH, Screen Machine Industries, McCloskey International.

Global Trommel Screen Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.35 billion

- 2026 Market Size: USD 2.45 billion

- Projected Market Size: USD 3.68 billion by 2035

- Growth Forecasts: 4.6%

Key Regional Dynamics:

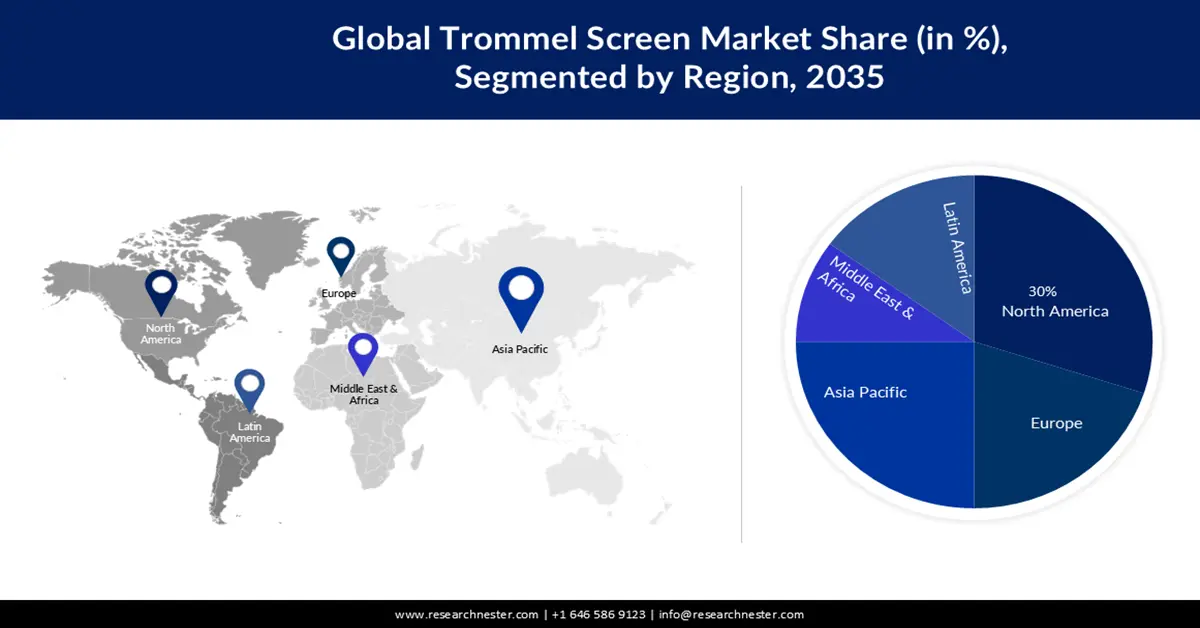

- Largest Region: North America (30% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, Indonesia, Mexico, South Korea

Last updated on : 25 November, 2025

Trommel Screen Market - Growth Drivers and Challenges

Growth Drivers

- Growing Urban Population

About 4.4 billion individuals; or 56% of the globe's population, reside in urban regions. By 2050, roughly 7 out of 10 people would live in cities, with the urban population anticipated to more than double from its current level. Hence with the growing urbanization, the need to construct more infrastructure is also on the surge. The construction industry makes use of this trammel screen for segregating construction waste along with gravel and sand.

- Boost in Technological Advancement

Over the decades there has been made various advancements in trommel screens which include automated control, improvement in screening capabilities, and self-cleaning mechanism. Additionally, the recent deployment of IoT sensors and artificial intelligence owing to the surge in digitalization is also boosting. Hence, this has increased the productivity and functioning of the machines.

- Surge in Use of Trommel Screen by Mineral Processing Industry

The quantity of concentrate of the desired mineral that may be recovered from the ore determines the profitability of a mine. Therefore, before goods are released onto the trommel screen market, mineral processing is created to generate the most mineral concentrate possible. Hence, the adoption of trommel screen is growing in this industry.

Challenges

- Growth in Adoption of Alternative Equipment - Trommels merely are unable to handle a comparable volume of materials as other approaches, including vibrating screens. Only a piece of the screen is used for sizing when it is rotating. In contrast, some material screening methods that use the entire screen surface may efficiently size materials. This not only puts the trommel drum at a volumetric disadvantage in comparison to other screening machinery, additionally, it may also cause problems with material flow.

- Lack of Efficiency

- Risk of Drum Damage

Trommel Screen Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.6% |

|

Base Year Market Size (2025) |

USD 2.35 billion |

|

Forecast Year Market Size (2035) |

USD 3.68 billion |

|

Regional Scope |

|

Trommel Screen Market Segmentation:

Application Segment Analysis

The demolition industry segment in the trommel screen market is set to garner the highest revenue of 48 percent by 2035. This could be owing to the greater need to demolish the old building in order to construct a new one. In order to reduce the wastage of materials such as freshwater, and other inputs large number of industries are estimated to make use of resource from the demolished old building. According to the research, more than 140 million tonnes of demolition, and construction waste are generated every year in India. Hence, the trommel screen plays a significant role in this process.

Furthermore, the compost segment is also anticipated to grow. The composition of aerobics is growing in recent years owing to its advantages of safety, high efficiency, and environmental protection. Hence, the deployment of trommel screens is on the rise.

Type Segment Analysis

Trommel screen market from the mobile segment is expected to show noteworthy growth over the forecast period with a share of 40% by the end of 2035. The upcoming generation of trommel screens, which provides high-performance screening solutions, are mobile trommel screen units. They could be simple to shift to new sites and set up quickly which makes it easier for companies to grow their operations without having to build new, permanent infrastructure specifically for each site.

Our in-depth analysis of the global trommel screen market includes the following segments:

|

Type |

|

|

Applications |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Trommel Screen Market - Regional Analysis

North American Market Insights

North America industry is predicted to dominate majority revenue share of 30% by 2035, backed by growing production of crushed stones. The total quantity of crushed stone produced in the US in 2022 was expected to be 1.5 billion metric tonnes. Hence, the utilization of trommel screens is growing in order to segregate the properties of stones in the region.

Moreover, North America is growing technologically, and it is updating its present infrastructure with the goal of rendering it a top-notch framework. Additionally, the environmental conditions are made worse by the significant discharge of dust particles. Modern tools including trommel screens are employed to address these issues. In addition, the presence of significant players and capital investments have fueled the expansion of the market in this area.

APAC Market Insights

The trommel screen market in Asia Pacific is anticipated to have significant growth with a share of 25 percent during the forecast period. This growth of the market in this region could be influenced by growing soil pollution in this region which is further boosting demand for soil screening. There has been rising adoption of sustainability concepts in the region, followed by increasing awareness related to environmental problems. Furthermore, there has been surging investment made in the smart waste management industry which has made them possible to install this technology in order to manage waste in the Asia Pacific region.

Trommel Screen Market Players:

- Terex Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Vermeer Corporation

- Pronar

- Metso Corporation

- Multotec (Pty) Ltd.

- Sandvik AB

- McLanahan

- Eggersmann GmbH

- Screen Machine Industries

- McCloskey International

Recent Developments

- A distribution contract was signed between MGL Engineering Inc. and Vermeer Corporation. Through the arrangement, MGL has been given the authority to market equipment for handling and processing organic materials that enhances Vermeer's market-leading selection of trommel screens, horizontal grinders, and tub grinders.

- Multotec (Pty) Ltd., a manufacturer of trommel projects for the mining of heavy minerals, started two significant trommel projects in 2022. The first job was finished in July, and it entailed producing two new replacement trommels for a mine. The second project was finished in December, and it involved repairing the trommel tyre and returning it to the plant within 30 days.

- Report ID: 5091

- Published Date: Nov 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Trommel Screen Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.