Trauma Fixation Devices Market Outlook:

Trauma Fixation Devices Market size was valued at approximately USD 8.9 billion in 2025 and is projected to reach around USD 18.9 billion by the end of 2035, rising at a CAGR of approximately 7.8% during the forecast period (2026-2035). In 2026, the industry size of the trauma fixation devices is estimated at USD 9.6 billion.

The supply chain for trauma fixation devices is directly linked to the supply of raw materials, such as alloys, metals, etc. Shortages or price swings directly affect the device costs and lead times of titanium alloys and specialty polymers. Additionally, various implants need high precision capabilities limited to a very small set of specialized suppliers. The large OEMs directly sell to hospitals and utilize Group Purchasing Organizations that make large demand nodes and stimulate the pricing.

Firms are dealing with challenges through dual sourcing and inventory strategy adjustments. Also, companies are investing in sterilization and contract manufacturing capacity to secure the capacity. Higher investment by the government expanded the scope of advanced research and development. Technological advancement is one of the key aspects that has created high reliability in trauma fixation devices. The longer lead times and higher costs for custom or advanced materials result in high costs and compressed margins.

Key Trauma Fixation Devices Market Insights Summary:

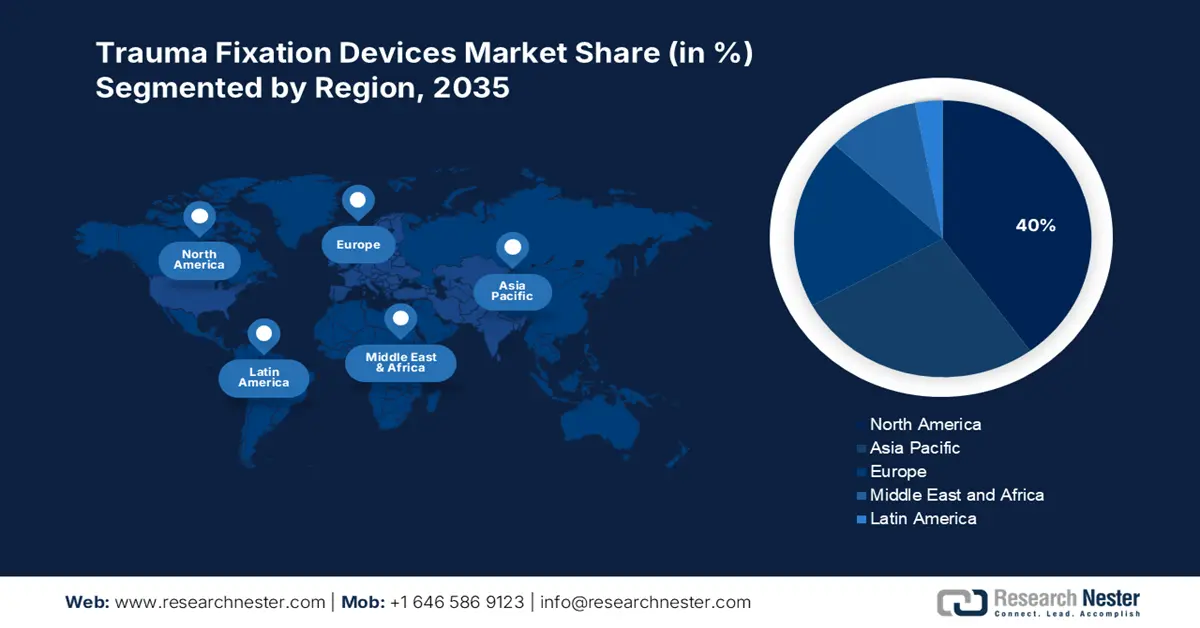

Regional Highlights:

- North America is projected to command a 40% share of the trauma fixation devices market by 2035, underpinned by the rapid uptake of premium implants and digitally integrated fixation systems.

- Asia-Pacific is expected to secure a 27% share by 2035, bolstered by expanded healthcare infrastructure investment and supportive local manufacturing initiatives.

Segment Insights:

- The internal fixation segment in the trauma fixation devices market is anticipated to hold a 44% share by 2035, supported by the growing elderly population and advancements in 3D-printed patient-specific plates.

- The metallic segment is set to capture a 50% share by 2035, strengthened by its biocompatibility advantages and cost-efficient manufacturing practices using recycled materials.

Key Growth Trends:

- Rising incidences of road accidents and trauma cases

- Rising geriatric population and osteoporosis cases

Major Challenges:

- Government price control and reimbursement policy

Key Players: DePuy Synthes (J&J), Stryker, Zimmer Biomet, Smith & Nephew, Medtronic, Orthofix, B. Braun, Wright Medical, Arthrex, Össur, DJO Global, Japan Medical Dynamic Marketing, Lima Corporate, Corin Group, MicroPort Scientific, Meril Life Sciences, Biometrix, Trauson (Mindray), OsteoMed, FH Orthopedics.

Global Trauma Fixation Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.9 billion

- 2026 Market Size: USD 9.6 billion

- Projected Market Size: USD 18.9 billion by 2035

- Growth Forecasts: 7.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Mexico, Indonesia

Last updated on : 2 September, 2025

Trauma Fixation Devices Market - Growth Drivers and Challenges

Growth Drivers

-

Rising incidences of road accidents and trauma cases: The primary drivers of the market are the rising number of road traffic accidents and trauma injuries. According to the World Health Organization, in December 2023, every year, more than 1.19 million people die as a result of road traffic crashes. Such a type of accident results in numerous injuries and various musculoskeletal damage, requiring fixation with the use of screws, rods, etc. Rising markets such as Brazil, China, and India have mainly extremely high rates of accidents owing to rising urbanization and a surge in vehicular traffic. These factors directly propel the demand for trauma fixation products.

-

Rising geriatric population and osteoporosis cases: The data published by the World Health Organization in October 2024, by 2030, 1 person in 6 across the world will be aged 60 years or over. The global surge in the aging population is a major factor propelling the growth of the market. The geriatric population is susceptible to fractures owing to lowered bone density and age-associated skeletal disorders. Moreover, the data published by the National Institute of Health in 2022 stated that about 200 million women globally suffer from osteoporosis. The rising number of cases is fueling the market growth during the forecasted period.

-

Technological advancements and adoption of bioabsorbable implants: There has been constant innovation in trauma fixation technology that has remarkably affected the market growth. The manufacturers are emphasizing making advanced materials, such as stainless steel and titanium alloys. In recent years, bioabsorbable implants have been gaining traction as they eradicate the requirement for secondary surgery for the removal of the implants. This further enhances the outcomes and lowers the healthcare costs. Additionally, the inclusion of robotic-enabled systems and navigation technologies into trauma surgeries is speeding up the trend toward minimally invasive solutions.

Challenges

- Government price control and reimbursement policy: Regulatory control on the price fixation of medical devices presents challenging aspects to the trauma fixation devices market growth. Medicare coverage provides minimum insurance that limits the accessibility of trauma fixation devices within the market. As per Medicaid Plain, up to some extent, trauma implant coverage is granted, which leads to a delay in surgery for U.S. patients. Addressing the challenge brings a barrier in accessibility of stakeholders within the concerned market and restrains free growth.

Trauma Fixation Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.8% |

|

Base Year Market Size (2025) |

USD 8.9 billion |

|

Forecast Year Market Size (2035) |

USD 18.9 billion |

|

Regional Scope |

|

Trauma Fixation Devices Market Segmentation:

Product Segment Analysis

The internal fixation is anticipated to gain a dominant trauma fixation device market share of 44% market share by 2035. The rising aging population is one of the market drivers that creates high demand for orthopedic implant surgeries. Developed technology in fixation through 3D-printed patient-customized plates is the most promising area to boost the market through the efficient outcome of the surgical operation. FDA clearance enabled the introduction of more than 12 new plate designs in the market by 2023.

Material Segment Analysis

The metallic segment is anticipated to thrive and garner a 50% market share in the trauma fixation devices market by the end of 2035. The market growth is significantly augmented by its attributes of biocompatibility, which reduces the risk of the body repudiating the inclusion of the implant. The metallic segment is safer and more reliable for both healthcare providers and patients, contributing to the surging demand. Moreover, manufacturers are launching cost-saving approaches such as utilizing recycled materials in the production process. These kinds of practices are viable to most stakeholders and streamline the operations, further minimizing the overall expenditure throughout the supply chain.

End-user Segment Analysis

The hospital segment is anticipated to register the highest market revenue. The growth can be attributed to the capability of the hospitals to handle the majority of the trauma and emergency cases. These hospitals are equipped with extensive surgical facilities and imaging systems. This allows the hospitals to perform intricate trauma surgeries that cannot be handled efficiently in small clinics. Above this, hospitals employ orthopedic surgeons who can handle severe fractures and render round-the-clock critical care. Almost all the insurance providers cover surgeries more comprehensively than any clinic or ASC.

Our in-depth analysis of the trauma fixation devices market includes the following segments:

|

Segment |

Subsegments |

|

Product |

|

|

Material |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Trauma Fixation Devices Market - Regional Analysis

North America Market Insights

The trauma fixation devices market in North America is identified as the dominant player within the global market and is anticipated to have a market share of 40% by 2035. The growth of the aging population and an increase in demand are the primary driving factors of growth for the concerned market. The adoption rate of premium implantation and digitally integrated trauma fixation devices is the current trend in the trauma fixation devices market of North America. The market in North America is also propelled by the presence of a well-established healthcare infrastructure.

In the U.S. trauma fixation devices market performance of trauma fixation devices is rising due to the increased number of geriatric fractures. According to the Population Reference Bureau, the older population aged 65 and above is anticipated to reach 82 million by 2050. Additionally, adoption of the AI or robotics-assisted trend is considerably high within the U.S. market due to the presence of a developed health infrastructure. Furthermore, there is a surge in the introduction of minimally invasive surgical techniques, such as 3D-printed/customized implants and smart sensors.

Asia Pacific Market Insights

High possibility as an emerging trauma fixation devices market is possessed by the Asia-Pacific region, with an ability to achieve a market share of 27% by 2035. Sincere focus on the advancement of the healthcare infrastructure is the leading factor that encourages the adoption of trauma fixation devices. The key strategies that are making the market hold a high market share are increased government spending for the betterment of the healthcare infrastructure and favorable local manufacturing strategies. Better research and development led the concerned market to be digitally integrated and set the trend of robotic surgery adoption.

China is identified as the dominant player in the trauma fixation devices market of the Asia Pacific region. According to data published by the National Institutes of Health, trauma is the 5th leading cause of death in the country. Additionally, the growing aging population is one of the key reasons for the high demand for osteoporosis fractures in China. Additionally, the latest developments, such as minimally invasive surgical strategies and the advent of 3D printed devices, are upgrading the outcomes of the treatment and propelling the adoption.

Europe Market Insights

The market in Europe is also witnessing a significant surge driven by its elderly demographic, mainly in the prominent markets. Also, there is a presence of well-established healthcare system with strong frameworks for reimbursement. Additionally, there is a shift towards achieving quicker healing outcomes, which further leads to increased market growth. Additionally, the market growth is driven by rising participation in sports, which has led to increased incidences of trauma-related cases. These factors are contributing to the heightened demand for trauma fixation solutions.

In Germany, the rising aging population is resulting in increased demand for trauma fixation solutions. According to the International Osteoporosis Foundation in February 2024, osteoporosis affects 5.6 million people in the country. Also, the presence of a robust healthcare infrastructure and stringent quality benchmarks is further supporting the market growth. The country fosters the swift acceptance of the advanced fixation systems, making it a pioneering hub in Europe for trauma fixation innovation and growth. The country also faces a significant burden of fragility fractures, indirectly benefiting the market growth.

Key Trauma Fixation Devices Market Players

- DePuy Synthes (J&J)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Stryker

- Zimmer Biomet

- Smith & Nephew

- Medtronic

- Orthofix

- B. Braun

- Wright Medical

- Arthrex

- Össur

- DJO Global

- Japan Medical Dynamic Marketing

- Lima Corporate

- Corin Group

- MicroPort Scientific

- Meril Life Sciences

- Biometrix

- Trauson (Mindray)

- OsteoMed

- FH Orthopedics

The trauma fixation devices market possesses five top players that acquired more than 60% of the market share. A highly competitive market is experienced that is mobilized with key strategies like premiumization of the products in the western market, domestication strategy in the Asia market, and sustainability. For instance, Stryker is dominating the market through their smart implant product and acquisition strategy. Stryker has acquired Wright Medical in exchange for approximately 4.1 billion to expand their global performance. On the other hand, Zimmer Biomet is focusing on controlled cost of production through ASC bundles and bioabsorbable. Local manufacturing is the key strategy for Meril in the Indian market of India to offer affordable products in the concerned market.

Here is a list of key players operating in the global trauma fixation devices market:

Recent Developments

- In March 2025, Smith + Nephew, the global medical technology company, announces its pioneering efforts to develop technology in the field of Spatial Surgery - a revolutionary new frontier in arthroscopic surgical innovation. They have envisioned spatial surgery as an opportunity to provide personalized planning, augmented reality, and real-time data processing into platforms that interpret the surgical field intraoperatively.

- In March 2024, Stryker introduced the SmartScrew Pro, an advanced orthopedic trauma fixation screw integrated with real-time bone healing monitoring capabilities. This innovation allows surgeons to track postoperative healing progress using embedded sensor technology, enhancing clinical decision-making and reducing complications.

- Report ID: 8041

- Published Date: Sep 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Trauma Fixation Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.