Global Tonometer Market

- An Outline of the Global Tonometer Market

- Market Definition

- Market Segmentation

- Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- SPSS Methodology

- Data Triangulation

- Executive Summary

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Comparative Analysis of the Current Technologies

- Up-Coming Technologies

- Growth Outlook

- Risk Overview

- SWOT

- Regional Demand

- Recent Development News

- Technology Analysis of the Global Tonometer Market: Overview by Technology

- Global Tonometer Market Analysis by Method Type

- End-User Analysis of the Global Tonometer Market: Overview by End-User Segment

- Growth Potential for Method Type of Tonometer Market

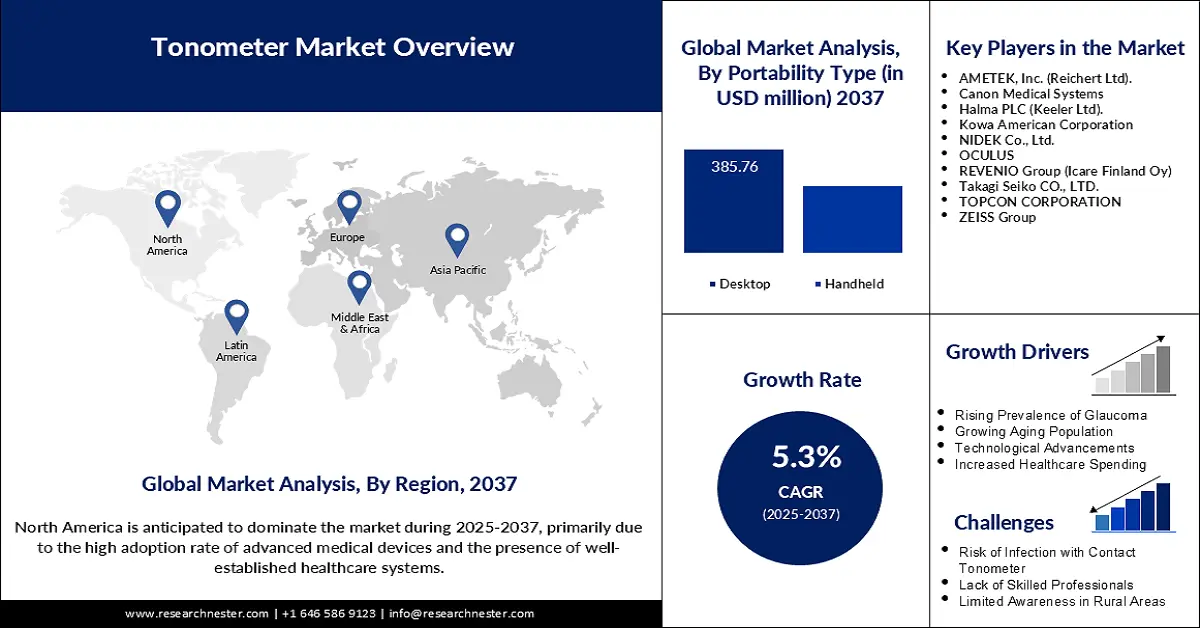

- Portability Type Analysis

- List of Manufacturers for the Tonometer Market by Portability Type

- Root Cause Analysis for discovering problems of the Tonometer Market

- Pricing Benchmarking

- Comparative Positioning

- Competitive Landscape

- Competitive Model

- Company Market Share, 2023 (%)

- Business Profile of Key Enterprise

- AMETEK, Inc. (Reichert Ltd).

- Canon Medical Systems

- Halma PLC (Keeler Ltd).

- Kowa American Corporation

- NIDEK Co., Ltd.

- OCULUS

- REVENIO Group (Icare Finland Oy)

- Takagi Seiko CO., LTD.

- TOPCON CORPORATION

- ZEISS Group

- Global Tonometer Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Units), and Compound Annual Growth Rate (CAGR)

- Global Tonometer Market Segmentation Analysis (2025-2037)

- By Method Type

- Direct, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Indirect, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Applanation Tonometer, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Goldmann Applanation Tonometer (GAT), Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Perkin Tonometer, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Tono-Pen, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Others, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Indentation Tonometry, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Others, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Applanation Tonometer, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- By Portability Type

- Desktop, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Handheld, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- By Distribution Channel

- Direct Sales, Market Value (USD Million), and CAGR, 2025-2037F

- Distributors & Wholesalers, Market Value (USD Million), and CAGR, 2025-2037F

- Retail & Optical Stores, Market Value (USD Million), and CAGR, 2025-2037F

- Online, Market Value (USD Million), and CAGR, 2025-2037F

- Others, Market Value (USD Million), and CAGR, 2025-2037F

- By End users

- Hospitals, Market Value (USD Million), and CAGR, 2025-2037F

- Ophthalmic Centers, Market Value (USD Million), and CAGR, 2025-2037F

- Others, Market Value (USD Million), and CAGR, 2025-2037F

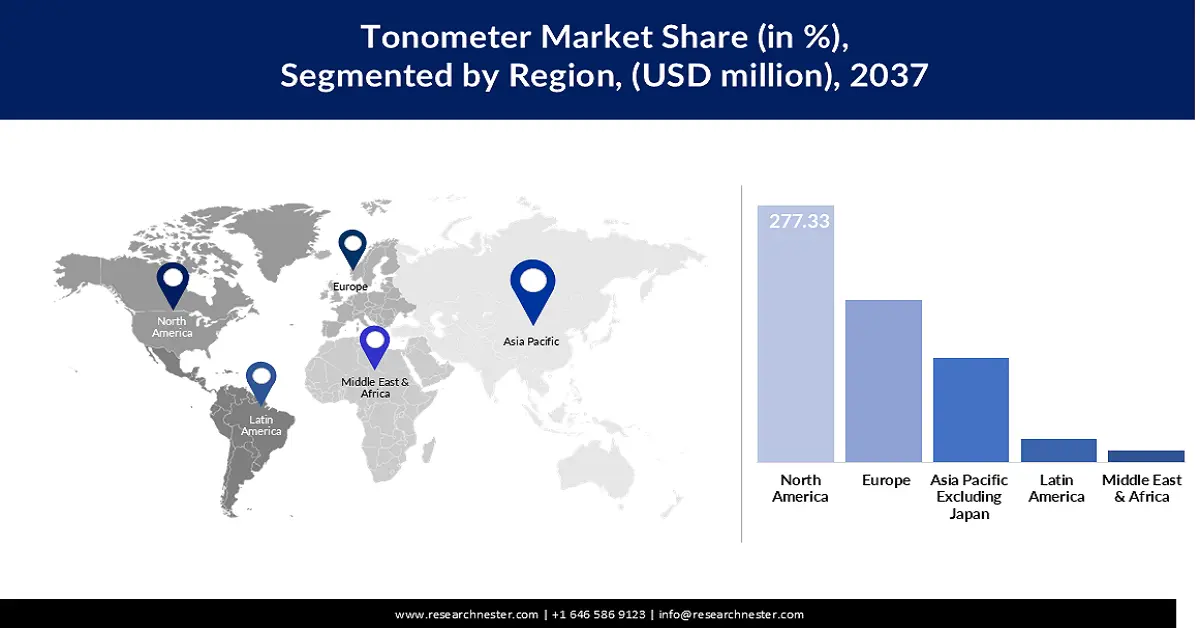

- By Region

- North America, Market Value (USD Million), Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Europe, Market Value (USD Million), Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Asia Pacific Excluding Japan, Market Value (USD Million), Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Japan, Market Value (USD Million), Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Latin America, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Middle East and Africa, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- By Method Type

- Cross Analysis of Method Type w.r.t. End users (USD Million), 2025-2037

- North America Tonometer Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Units), and Compound Annual Growth Rate (CAGR)

- North America Tonometer Market Segmentation Analysis (2025-2037)

- By Method Type

- Direct, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Indirect, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Applanation Tonometer, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Goldmann Applanation Tonometer (GAT), Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Perkin Tonometer, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Tono-Pen, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Others, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Indentation Tonometry, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Others, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Applanation Tonometer, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- By Portability Type

- Desktop, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Handheld, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- By Distribution Channel

- Direct Sales, Market Value (USD Million), and CAGR, 2025-2037F

- Distributors & Wholesalers, Market Value (USD Million), and CAGR, 2025-2037F

- Retail & Optical Stores, Market Value (USD Million), and CAGR, 2025-2037F

- Online, Market Value (USD Million), and CAGR, 2025-2037F

- Others, Market Value (USD Million), and CAGR, 2025-2037F

- By End users

- Hospitals, Market Value (USD Million), and CAGR, 2025-2037F

- Ophthalmic Centers, Market Value (USD Million), and CAGR, 2025-2037F

- Others, Market Value (USD Million), and CAGR, 2025-2037F

- By Country

- U.S., Market Value (USD Million), Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Canada, Market Value (USD Million), Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- By Method Type

- Cross Analysis of Method Type w.r.t. End Users (USD Million), 2025-2037

- Europe Tonometer Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Units), and Compound Annual Growth Rate (CAGR)

- Europe Tonometer Market Segmentation Analysis (2025-2037)

- By Method Type

- Direct, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Indirect, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Applanation Tonometer, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Goldmann Applanation Tonometer (GAT), Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Perkin Tonometer, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Tono-Pen, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Others, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Indentation Tonometry, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Others, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Applanation Tonometer, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- By Portability Type

- Desktop, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Handheld, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- By Distribution Channel

- Direct Sales, Market Value (USD Million), and CAGR, 2025-2037F

- Distributors & Wholesalers, Market Value (USD Million), and CAGR, 2025-2037F

- Retail & Optical Stores, Market Value (USD Million), and CAGR, 2025-2037F

- Online, Market Value (USD Million), and CAGR, 2025-2037F

- Others, Market Value (USD Million), and CAGR, 2025-2037F

- By End users

- Hospitals, Market Value (USD Million), and CAGR, 2025-2037F

- Ophthalmic Centers, Market Value (USD Million), and CAGR, 2025-2037F

- Others, Market Value (USD Million), and CAGR, 2025-2037F

- By Country

- UK, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Germany, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- France, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Italy, Market Value (USD Million), Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Spain, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Russia, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- BENELUX, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Poland, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Rest of Europe, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- By Method Type

- Cross Analysis of Method Type w.r.t. End Users (USD Million), 2025-2037

- Asia Pacific Excluding Japan Tonometer Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Units), and Compound Annual Growth Rate (CAGR)

- Asia Pacific Excluding Japan Tonometer Market Segmentation Analysis (2025-2037)

- By Method Type

- Direct, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Indirect, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Applanation Tonometer, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Goldmann Applanation Tonometer (GAT), Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Perkin Tonometer, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Tono-Pen, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Others, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Indentation Tonometry, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Others, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Applanation Tonometer, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- By Portability Type

- Desktop, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Handheld, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- By Distribution Channel

- Direct Sales, Market Value (USD Million), and CAGR, 2025-2037F

- Distributors & Wholesalers, Market Value (USD Million), and CAGR, 2025-2037F

- Retail & Optical Stores, Market Value (USD Million), and CAGR, 2025-2037F

- Online, Market Value (USD Million), and CAGR, 2025-2037F

- Others, Market Value (USD Million), and CAGR, 2025-2037F

- By End users

- Hospitals, Market Value (USD Million), and CAGR, 2025-2037F

- Ophthalmic Centers, Market Value (USD Million), and CAGR, 2025-2037F

- Others, Market Value (USD Million), and CAGR, 2025-2037F

- By Country

- China, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- India, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- South Korea, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Australia, Market Value (USD Million), Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Indonesia, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Malaysia, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Vietnam, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Thailand, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Singapore, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- New Zealand, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Rest of APEJ, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- By Method Type

- Japan Tonometer Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Units), and Compound Annual Growth Rate (CAGR)

- Japan Tonometer Market Segmentation Analysis (2025-2037)

- By Method Type

- Direct, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Indirect, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Applanation Tonometer, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Goldmann Applanation Tonometer (GAT), Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Perkin Tonometer, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Tono-Pen, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Others, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Indentation Tonometry, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Others, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Applanation Tonometer, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- By Portability Type

- Desktop, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Handheld, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- By Distribution Channel

- Direct Sales, Market Value (USD Million), and CAGR, 2025-2037F

- Distributors & Wholesalers, Market Value (USD Million), and CAGR, 2025-2037F

- Retail & Optical Stores, Market Value (USD Million), and CAGR, 2025-2037F

- Online, Market Value (USD Million), and CAGR, 2025-2037F

- Others, Market Value (USD Million), and CAGR, 2025-2037F

- By End users

- Hospitals, Market Value (USD Million), and CAGR, 2025-2037F

- Ophthalmic Centers, Market Value (USD Million), and CAGR, 2025-2037F

- Others, Market Value (USD Million), and CAGR, 2025-2037F

- By Method Type

- Cross Analysis of Method Type w.r.t. End Users (USD Million), 2025-2037

- Latin America Tonometer Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Units), and Compound Annual Growth Rate (CAGR)

- Latin America Tonometer Market Segmentation Analysis (2025-2037)

- By Method Type

- Direct, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Indirect, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Applanation Tonometer, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Goldmann Applanation Tonometer (GAT), Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Perkin Tonometer, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Tono-Pen, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Others, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Indentation Tonometry, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Others, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Applanation Tonometer, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- By Portability Type

- Desktop, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Handheld, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- By Distribution Channel

- Direct Sales, Market Value (USD Million), and CAGR, 2025-2037F

- Distributors & Wholesalers, Market Value (USD Million), and CAGR, 2025-2037F

- Retail & Optical Stores, Market Value (USD Million), and CAGR, 2025-2037F

- Online, Market Value (USD Million), and CAGR, 2025-2037F

- Others, Market Value (USD Million), and CAGR, 2025-2037F

- By End users

- Hospitals, Market Value (USD Million), and CAGR, 2025-2037F

- Ophthalmic Centers, Market Value (USD Million), and CAGR, 2025-2037F

- Others, Market Value (USD Million), and CAGR, 2025-2037F

- By Country

- Brazil, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Argentina, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Mexico, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Rest of Latin America, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- By Method Type

- Cross Analysis of Method Type w.r.t. End Users (USD Million), 2025-2037

- Middle East & Africa Tonometer Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Units), and Compound Annual Growth Rate (CAGR)

- Middle East & Africa Tonometer Market Segmentation Analysis (2025-2037)

- By Method Type

- Direct, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Indirect, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Applanation Tonometer, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Goldmann Applanation Tonometer (GAT), Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Perkin Tonometer, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Tono-Pen, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Others, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Indentation Tonometry, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Others, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Applanation Tonometer, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- By Portability Type

- Desktop, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Handheld, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- By Distribution Channel

- Direct Sales, Market Value (USD Million), and CAGR, 2025-2037F

- Distributors & Wholesalers, Market Value (USD Million), and CAGR, 2025-2037F

- Retail & Optical Stores, Market Value (USD Million), and CAGR, 2025-2037F

- Online, Market Value (USD Million), and CAGR, 2025-2037F

- Others, Market Value (USD Million), and CAGR, 2025-2037F

- By End users

- Hospitals, Market Value (USD Million), and CAGR, 2025-2037F

- Ophthalmic Centers, Market Value (USD Million), and CAGR, 2025-2037F

- Others, Market Value (USD Million), and CAGR, 2025-2037F

- By Country

- GCC, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- Israel, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- South Africa, Market Value (USD Million), Volume (Tons) CAGR & Y-o-Y Growth Trend, 2025-2037F

- Rest of Middle East & Africa, Market Value (USD Million), Volume (Units), and CAGR, 2025-2037F

- By Method Type

- About Research Nester

Tonometer Market Outlook:

Tonometer Market size was valued at USD 330.1 million in 2024 and is projected to reach a valuation of USD 637.5 million by the end of 2037, rising at a CAGR of 5.3% during the forecast period, i.e., 2025-2037. In 2025, the industry size of tonometer is assessed at USD 343.1 million.

The tonometer market is experiencing a stable growth rate owing to the increase in the number of patients with glaucoma and other eye pathologies associated with age. The World Health Organization estimates that more than 76 million people are already blind due to glaucoma, and this number is set to grow because of changes in lifestyles and increased life spans. Smart tonometers have been integrated into primary eye care due to the trends in point of care and tele-ophthalmology. They are particularly interested in portable, painless, and noncontact screening devices to enhance glaucoma diagnosis in the early stages in emerging markets.

The growth of digital technology in the eye care sector and the advancement in telehealth are paving the way for tonometer development. In September 2024, Topcon released the TRK-3 OMNIA, which merges auto kerato, refracto, and tonometry in one platform, hence the need for the patient to swap from one device to the other. This is in line with the other integrated diagnostic solutions that are designed to suit high throughput eye care facilities. At the same time, governments and worldwide organizations are focusing on avoidable blindness. New technologies in digital tonometry and portable screening gadgets are emerging as core to vision care provision to the general population.

Key Tonometer Market Insights Summary:

Regional Highlights:

- North America in the tonometer market is projected to secure a dominant 43.4% share by 2037, supported by advanced healthcare infrastructure and widespread uptake of vision care technologies, culminating in expanding tele-optometry services across rural and remote areas.

- Asia Pacific excluding Japan is expected to register robust growth at a 6.4% CAGR during 2025–2037, aided by a vast patient base and expanding healthcare coverage frameworks, reinforced by national insurance initiatives incorporating routine eye care.

Segment Insights:

- The indirect tonometer segment in the tonometer market is forecast to represent approximately 64.6% share over the 2026–2035 period, benefitting from its non-contact configuration, portability, and operational simplicity, stimulated by accelerating approvals of wearable and AI-enabled indirect tonometry systems.

- The desktop tonometer segment is projected to account for about 58.8% share by 2037, anchored in its integration with diagnostic workstations and consistent measurement precision, strengthened by ongoing enhancements in automated alignment and contactless capabilities.

Key Growth Trends:

- Aging population and glaucoma prevalence

- Tele-ophthalmology and remote patient monitoring

Major Challenges:

- Skewed access in low-income regions

- Regulatory compliance and standardization issues

Key Players: AMETEK, Inc. (Reichert Ltd), Canon Medical Systems, Halma PLC (Keeler Ltd), Kowa American Corporation, NIDEK Co., Ltd., OCULUS, REVENIO Group (Icare Finland Oy), Takagi Seiko CO., LTD., TOPCON CORPORATION, ZEISS Group.

Global Tonometer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2024 Market Size: USD 330.1 million

- 2025 Market Size: USD 343.1 million

- Projected Market Size: USD 637.5 million by 2037

- Growth Forecasts: 5.3% CAGR (2025-2037)

Key Regional Dynamics:

- Largest Region: North America (43.4% Share by 2037)

- Fastest Growing Region: Asia Pacific excluding Japan

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, South Korea, Mexico

Last updated on : 12 August, 2025

Tonometer Market - Growth Drivers and Challenges

Growth Drivers

- Aging population and glaucoma prevalence: The global population of people aged 60 years and above is a key factor that is causing the cases of intraocular pressure conditions. This demographic shift will increase the need for routine tonometry for diseases like glaucoma and diabetic retinopathy. In April 2023, NIDEK released the NT-1/1e series of non-contact tonometer with fully automated measurements to improve the screening of elderly patients. The device facilitates high throughput in outpatient clinics, given the increasing cases of vision disorders associated with aging in the global population.

- Tele-ophthalmology and remote patient monitoring: Technology integration in the field of digital health has been making a significant impact in the delivery of eye care. A survey revealed that 92% of patients using iCare home devices found remote monitoring useful, and 88% made fewer clinic visits. The trend is thus toward the use of smart tonometer in home care models. In September 2023, Eyecbetter launched a home tonometer without the need for an air puff, utilizing wearable technology, accompanied by real human coaches. This innovation is helping to ensure that those patients who cannot attend physical screenings frequently do not miss out on the opportunity to be screened.

- Government spending and technological funding: Many developed countries that spend a significant amount per capita on health care are now directing more funds towards the development of advanced ophthalmic diagnostic systems. For instance, the U.S. spends the most on healthcare per capita in the world, and tonometer are used in most basic eye examinations. In September 2023, OCULUS brought to the clinics in the U.S. the DARWIN and LUCENT systems to provide enhanced eye treatment. These technologies, coupled with the funding for AI-based diagnostics, are making way for the use of multifunctional tonometry devices in clinical environments.

Challenges

- Skewed access in low-income regions: The availability of tonometry is still a challenge in the underserved and rural populations, which reduces the chances of early management of avoidable blindness. According to WHO, while there are actually 2.2 billion people with low vision or blindness, 1 billion of them could have been treated if they had been diagnosed at an earlier stage. Such discrepancies are mainly attributed to the absence of infrastructure, clinical equipment, and qualified healthcare workers in these areas, which underlines the importance of utilizing novel and affordable approaches to address this issue.

- Regulatory compliance and standardization issues: The tonometer market faces challenges due to ongoing changes in the safety and performance standards of medical devices, which results in constant updating and adjustment of standards to meet safety concerns and product outcomes. Also, variations in the regulatory environment across the world may lead to the slow deployment of devices across the global markets, which affects the market growth and timely availability of innovative tonometry solutions for patients around the world.

Tonometer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Period |

2025-2037 |

|

CAGR |

5.3% |

|

Base Year Market Size (2024) |

USD 330.1 million |

|

Forecast Year Market Size (2037) |

USD 637.5 million |

|

Regional Scope |

|

Tonometer Market Segmentation:

Method Type Segment Analysis

The indirect tonometer segment is anticipated to account for about 64.6% of the market share during the forecast period due to their non-contact nature, compact size, and operation simplicity. These devices are particularly useful in primary health care and diagnosing in mobile stations, especially in the developing world. In September 2024, Icare released a new tonometer called the ST500, which is mounted on a slit lamp and uses rebound technology that does not require topical anesthesia. This enhances the workflow and the comfort of the patients, which are vital to the adoption of indirect tonometry in busy clinical centers. As more approvals come through for wearable and AI-integrated indirect systems, the segment is expected to expand.

Portability Type Segment Analysis

The desktop tonometer segment is projected to dominate the market with a share of 58.8% by 2037, owing to the compatibility with the diagnostic stations in specialized clinics and hospitals. Such systems are usually characterized by improved calibration stability, detailed patient documentation, and versatility. In April 2023, Haag-Streit released a Reliance Optometry Workplace, which incorporates the AT 870 Goldman applanation tonometer and other exam room essentials for patients. The high level of accuracy and reliability of the desktop units makes them the best when it comes to tertiary care. Furthermore, the segment is witnessing constant advancements, including automatic alignment and contactless technology adoption, making the segment an essential tool in clinical diagnosis.

Our in-depth analysis of the tonometer market includes the following segments:

|

Segment |

Subsegments |

|

Method Type |

|

|

Portability Type |

|

|

Distribution Channel |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Tonometer Market - Regional Analysis

North America Market Insights

North America is expected to lead with a 43.4% market share through 2037 due to well-developed healthcare systems and the adoption of vision care technologies. The increasing number of geriatric population, especially in the U.S., which has one of the largest populations of centenarians, is driving demand for tonometry for glaucoma and eye pressure checks. Preventative care mandates and Medicare coverage for eye exams also underpin demand even more. The growth of the tonometer market here is driven by increasing tele-optometry services, particularly in the rural and remote regions.

The U.S. continues to be a top innovator in the field of tonometry with constant development in mobility, accuracy, and home use. In May 2024, Reichert Technologies introduced the Tono-Vera Tonometer, a portable handheld device with innovative ActiView positioning for accurate intraocular pressure measurement. This solution is in line with the increasing need for easy-to-use and portable point-of-care diagnostic devices. The per capita healthcare expenditure of the nation guarantees that sophisticated diagnostic equipment like desktop and handheld tonometers are available in most clinics. The use of AI and data monitoring in the diagnosis of ophthalmological diseases contributes to the shift from reactive to preventive eye care. The U.S. market is still saturated and competitive, and new players have emerged, offering wearable and app-integrated tonometry solutions.

The tonometer market in Canada is driven by the growth of the public healthcare system and an increasing number of elderly people to diagnose glaucoma and diabetic retinopathy. Screening programs for vision conditions across the country are incorporating tonometry for the early identification of patients with normal-appearing eyes. In August 2024, Revenio Group’s subsidiary Icare started strengthening its position in North America and introduced ST500 – slit-lamp rebound tonometry for increased patient comfort. The clinics in Canada are incorporating technology and contactless methods to help reduce the patient waiting list and make the experience more comfortable. With the development of virtual healthcare, there is an increasing interest in handheld and app-integrated tonometer. Localized manufacturing and engagement with optometry groups are key strategies that will define the next phase of market development in Canada.

Asia Pacific Market Insights

The tonometer market in Asia Pacific excluding Japan is anticipated to rise at a CAGR of 6.4% between 2025 and 2037 due to factors such as rising population and healthcare technology trends. This region incorporates India and China, which are home to more than 36% of the global population, thus increasing the need for large-scale vision screening. The changes in lifestyles in urban areas that result in increased incidences of diabetes and glaucoma are making it necessary to regularly monitor IOP. National health insurance initiatives that many local governments are implementing also encompass eye care and, hence, the further drive toward device adoption.

China is currently witnessing a rise in the demand for ophthalmic diagnostic equipment due to the country’s growing population of elderly people and refractive errors. This is due to government awareness campaigns encouraging people to undergo eye tests for glaucoma and myopia, hence the increased usage of tonometers. In February 2025 Keeler started production in a new factory in Shanghai to meet the increasing local demand and to cut import reliance. China's healthcare reforms are now focusing on early diagnosis. The increasing use of slit-lamps and handheld tonometers in public hospitals ensures that vision monitoring is now within the reach of many people. It is also witnessing investments in remote monitoring platforms based on Artificial Intelligence.

The tonometer market in India is expanding due to increased accessibility of healthcare services in semi-urban and rural areas and the Ayushman Bharat scheme. Since a large number of people remain undiagnosed for chronic eye issues, tonometers are critical to the advancement of primary eye health. In May 2023, OCULUS India was established to address the rapidly growing domestic market for diagnostic ophthalmic equipment. The healthcare workers in India are functioning in dispersed settings, which makes affordable and portable models important in this region. Tele-ophthalmology, along with digital screening camps, is contributing to the growth of the indirect and handheld tonometer market. There are over 1.4 billion people in India, and this is the reason why it has the potential for scale.

Key Tonometer Market Players:

- AMETEK, Inc. (Reichert Ltd).

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Canon Medical Systems

- Halma PLC (Keeler Ltd).

- Kowa American Corporation

- NIDEK Co., Ltd.

- OCULUS

- REVENIO Group (Icare Finland Oy)

- Takagi Seiko CO., LTD.

- TOPCON CORPORATION

- ZEISS Group

The tonometer market is fragmented, especially due to innovations in the market and the focus on regional expansion. Some of the key players that are involved in the production of ophthalmic instruments and devices are AMETEK, Inc. (Reichert Ltd), Canon Medical Systems, Halma PLC (Keeler Ltd), Kowa American Corporation, NIDEK Co., Ltd., OCULUS, REVENIO Group (Icare Finland Oy), Takagi Seiko CO., LTD., TOPCON CORPORATION, and ZEISS Group. These players target multiple modality diagnostic systems, precision accuracy, and portable and AI solutions.

Technological advancement in home monitoring devices, particularly in glaucoma, is creating new product opportunities for new entrants as well as existing players. In April 2023, NIDEK CO., LTD. released the NT-1/1e Non-Contact Tonometer, a revolutionary tonometer that improves the assessment of intraocular pressure (IOP) in terms of productivity. The NT-1 model has automatic measurement for the whole procedure, starting with the positioning of the patient and the NT-1e model has manual control but has high operability. Some of the strategic takeovers, like Carl Zeiss’s acquisition of D.O.R.C. in April 2024, can be seen as portfolio consolidation to boost global distribution and technology complementarities. As regulatory barriers to entry for digital tools continue to open up, companies with robust research and development capabilities and integrated global manufacturing operations will be well-positioned to benefit.

Here are some leading companies in the tonometer market:

Recent Developments

- In February 2025, AMETEK, Inc. announced its acquisition of Kern Microtechnik, a specialist in high-precision machining and optical inspection systems. Kern’s capabilities in ultra-precision manufacturing—achieving sub-micron level accuracy—make it a strategic addition for applications across the medical, semiconductor, aerospace, and research industries. The acquisition strengthens AMETEK’s position in sectors demanding extreme engineering accuracy.

- In December 2024, Canon Medical Systems USA expanded its AI-driven CT imaging portfolio with new tools that automate end-to-end workflows. The updates include remote scan support, centralized protocol management, and intelligent processing for neuro and chest studies. These enhancements aim to boost operational efficiency while maintaining consistent imaging quality across clinical environments.

- In May 2024, Reichert Technologies, a division of AMETEK, introduced the Tono-Vera Tonometer to the U.S. market. Equipped with the patented ActiView Positioning System, the device simplifies intraocular pressure measurements through advanced rebound tonometry. The system automates alignment and improves reliability, streamlining eye care diagnostics with minimal operator intervention.

- Report ID: 7483

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Tonometer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.