Tire Cord Market Outlook:

Tire Cord Market size was over USD 9.78 billion in 2025 and is poised to exceed USD 19.97 billion by 2035, growing at over 7.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of tire cord is estimated at USD 10.43 billion.

The tire cord market growth is mainly owing to the growth of the automotive industry, particularly in emerging markets such as China and India. According to the International Organization of Motor Vehicle Manufacturers (OICA), global car production reached a record high of 95 million units in 2021, despite supply chain disruptions caused by the COVID-19 pandemic. In recent years, there has been a trend toward the use of high-performance tire cords, which offer greater strength and durability than traditional cords. This has led to increased investment in research and development by tire cord manufacturers, as they seek to develop new and innovative products to meet the evolving needs of the market.

In addition to this, electric vehicles (EVs) are becoming an increasingly important segment of the automotive industry. EV sales have been growing rapidly in recent years. According to the International Energy Agency (IEA), the global electric car stock surpassed 10 million vehicles in the year 2020, up from just a few hundred thousand a decade ago. Overall, the global tire cord market is expected to continue to grow in the coming years, driven by the ongoing expansion of the automotive industry and the increasing demand for high-performance tires. However, the market is also subject to various challenges, including price volatility and the potential for disruption from alternative materials and technologies.

Key Tire Cord Market Insights Summary:

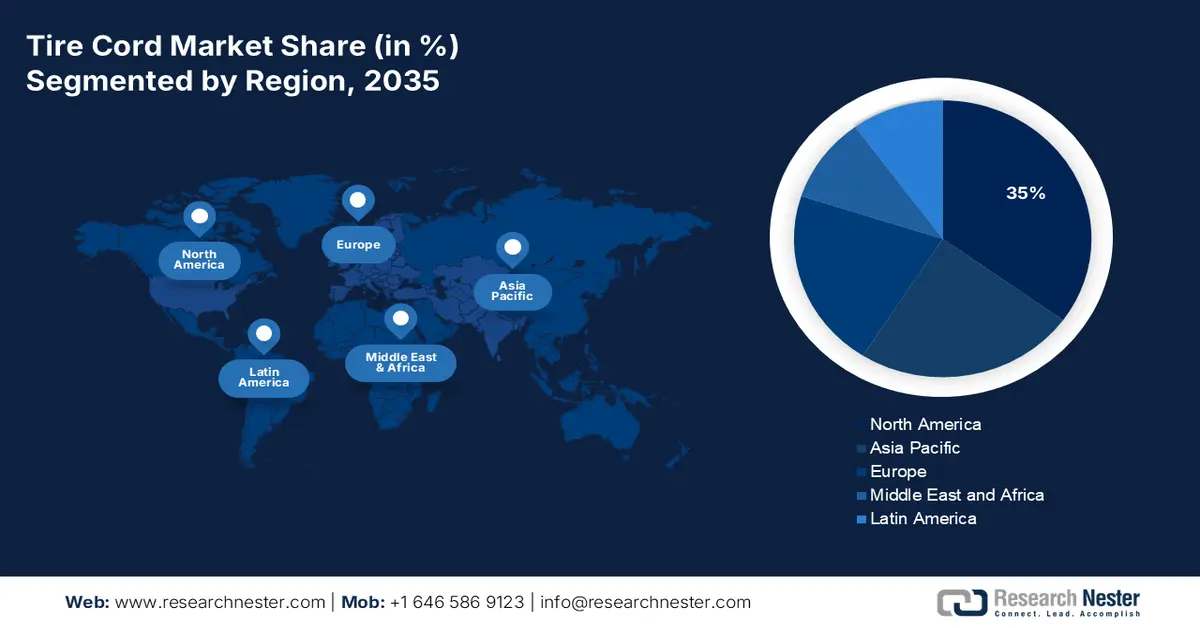

Regional Highlights:

- Asia Pacific is anticipated to hold about 35% share by 2035 in the tire cord market, supported by its position as the world’s largest automotive hub, rapid growth in light-vehicle production, and rising demand for high-performance and eco-friendly tire materials such as high-strength rayon and aramid cords.

- North America is projected to secure around 24% share by 2035, driven by strong consumer preference for eco-friendly tire products, rising demand for heavy-duty tires in the construction industry, and ongoing regulatory initiatives for tire recycling and sustainability.

Segment Insights:

- The passenger car segment is forecasted to capture around 35% share by 2035, owing to EV adoption, luxury car sales, and sustainability-driven demand for advanced tire cord materials.

- The polyester segment is expected to reach about 30% share by 2035, supported by cost-effectiveness, recyclability, and high usage across passenger car tires in emerging and developed markets.

Key Growth Trends:

- Expansion of the Automotive Industry

- Increasing Demand for High Performance Tires

Major Challenges:

- Fluctuating raw material prices

- Increasing competition

Key Players: Bekaert Corporation, Century Enka Limited, Cordenka GmbH & Co. KG, Formosa Taffeta Co., Ltd., Hyosung Corporation, Indorama Ventures Public Company Limited, Kordsa Global Endüstriyel Öplik ve Kord Bezi Sanayi ve Ticaret A.Ş., Kolon Industries, Inc., SRF Limited, Teijin Limited.

Global Tire Cord Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.78 billion

- 2026 Market Size: USD 10.43 billion

- Projected Market Size: USD 19.97 billion by 2035

- Growth Forecasts: 7.4%

Key Regional Dynamics:

- Largest Region: Asia Pacific (~35% share by 2035)

- Fastest Growing Region: North America (~24%)

- Dominating Countries: China, India, United States, Germany, Japan

- Emerging Countries:Mexico, Indonesia, Brazil, Turkey, Vietnam

Last updated on : 24 November, 2025

Tire Cord Market - Growth Drivers and Challenges

Growth Drivers

- Expansion of the Automotive Industry: The automotive industry is a major driver of demand for tire cords market , as they are essential components of tires. Tesla is currently the world's leading manufacturer of electric vehicles, with a market share of around 15% in 2020, according to a report. China is the world's largest market for electric vehicles, accounting for more than 40% of global sales in 2020, according to the IEA.

- Increasing Demand for High-Performance Tires: There is a growing demand for high-performance tires, which require specialized tire cords made from materials such as aramid, nylon, and polyester. This demand is driven by factors such as increasing safety standards, rising disposable incomes, and a growing preference for sporty and high-performance vehicles. In a survey conducted, 52% of new vehicle owners reported that they were willing to pay extra for high-performance tires.

- Growth of the Construction Industry: Tire cords are also used in the manufacturing of construction materials such as conveyor belts, hoses, and industrial fabrics. The growth of the construction industry is expected to drive demand for tire cords, particularly in emerging markets such as China and India. The global construction industry is expected to reach a value of nearly USD 15 trillion by the year 2025.

- Surge in Urbanization- Urbanization, which usually results in an increase in the population of cities and the size of urban regions, is mostly attributed to people migrating from rural to urban areas. According to the statistics provided by the Department of Economic and Social Affairs of the United Nations, in 2018, 55% of the total population of the world was living in urban areas and the same is anticipated to grow to 68% by 2050.

- Rise in Research Spending – Growth in the global market during the forecast period can be further attributed to increased investment in research and development activities to continuously find more viable solutions for tire cords. Research reports show that global R&D spending has more than tripled in real terms since 2000, rising from about USD 680 billion to more than USD 2.5 trillion in the year 2019.

Challenges

- Fluctuating raw material prices: The price of raw materials such as nylon, polyester, and steel can be volatile due to factors such as supply chain disruptions, geopolitical tensions, and changing market demand. This can affect the production costs and profitability of tire cord market manufacturers.

- Increasing competition

- Environmental concerns

Tire Cord Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.4% |

|

Base Year Market Size (2025) |

USD 9.78 billion |

|

Forecast Year Market Size (2035) |

USD 19.97 billion |

|

Regional Scope |

|

Tire Cord Market Segmentation:

Vehicle Type Segment Analysis

The global tire cord market is segmented and analyzed for demand and supply by vehicle type into passenger car, heavy commercial vehicles, and light commercial vehicles. Out of the three types of vehicle types, the passenger car segment is estimated to gain the largest market share of about 35% in the year 2035. The growth of the segment can be accredited to growth of the electric vehicle industry. The rise of electric vehicles (EVs) is expected to drive demand for specialized tire cord products, such as high-strength copper wires for use in EV batteries. According to a report, global EV sales are expected to reach 56 million by 2040, up from 2.1 million in 2019. Tire cord manufacturers are investing in research and development to improve the performance and durability of their products, such as developing new cord designs and coatings to enhance traction and reduce wear. The growth of the luxury and high-performance car segments is expected to drive demand for specialized tire cord products, such as high-strength steel wires and rayon cords. Consumers are increasingly conscious of their carbon footprint and are demanding more fuel-efficient and eco-friendly tires. This has led to the development of new tire cord materials, such as high-strength rayon, which can help reduce fuel consumption and emissions.

Product Segment Analysis

The global tire cord market is also segmented and analyzed for demand and supply by product into polyester, rayon cord, and steel cord. Amongst these three segments, the polyester segment is expected to garner a significant share of around 30% in the year 2035. The growth of the segment can be accredited to the cost-effectiveness. Polyester is a cost-effective alternative to other tire cord market materials such as nylon and steel. It offers high tensile strength and abrasion resistance while being less expensive to produce. As a result, it is widely used in the tire cord industry, particularly for high-volume applications such as passenger car tires. The automotive industry is a major consumer of polyester tire cord products, particularly for passenger car tires. The growth of the automotive industry, particularly in emerging markets such as China and India, is expected to drive demand for polyester tire cord products. Polyester tire cord products are recyclable and can be reused in other applications, making them an environmentally friendly alternative to other tire cord materials such as steel. This is particularly important as governments around the world are implementing regulations related to tire recycling and sustainability. Tire cord manufacturers are investing in research and development to improve the performance and durability of polyester tire cord products, such as developing new coatings and adhesives to enhance bonding with rubber.

Our in-depth analysis of the global market includes the following segments:

|

By Vehicle Type |

|

|

By Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Tire Cord Market - Regional Analysis

APAC Market Insights

The tire cord market in the Asia Pacific region, amongst the market in all the other regions, is projected to hold the largest market share of about 35% by the end of 2035. The regional growth can majorly be attributed to the growth of the automotive industry. The Asia Pacific region is the largest automotive market in the world, with China and India leading the way. The growth of the automotive industry in this region is expected to drive demand for tire cord products, particularly for passenger car tires. According to a report, the Asia Pacific region is expected to account for 54% of global light vehicle production by 2023. The tire cord market demand for high-performance tires is increasing in the Asia Pacific region, as consumers seek improved handling, durability, and performance. This has led to the development of new tire cord materials and technologies, such as high-strength rayon and aramid cords, which are well-suited for use in high-performance tires. Consumers in the Asia Pacific region are becoming increasingly conscious of their carbon footprint and are demanding more eco-friendly tire products. This has led to the development of new tire cord materials, such as high-strength rayon, which can help reduce fuel consumption and emissions.

North American Market Insights

The tire cord market in the North America region, amongst the market in all the other regions, is projected to hold the second largest share of about 24% during the forecast period. The growth of the market in this region can primarily be attributed to increasing demand for eco-friendly products. Consumers in North America are becoming more environmentally conscious and are demanding eco-friendly tire products. This has led to the development of new tire cord materials, such as rayon and aramid cords, which can help reduce fuel consumption and emissions. Tire cord manufacturers in North America are investing in research and development to improve the performance and durability of their products. The North American region has a large construction industry and demand for heavy-duty tires is expected to grow in the coming years. This is expected to drive demand for specialized tire cord products such as high-strength steel wires, which are used in the construction of heavy-duty tires. Governments in North America are implementing regulations related to tire recycling and sustainability, which is expected to drive demand for eco-friendly tire products. This is expected to create new opportunities for tire cord manufacturers that can produce eco-friendly tire cord products that can be reused in other applications.

Europe Market Insights

Further, the tire cord market in the Europe region, amongst the market in all the other regions, is projected to hold a majority of the share by the end of 2035. The growth of the market can be attributed majorly to the increasing demand for high-performance tires. The demand for high-performance tires is growing in Europe, driven by the popularity of sports cars and the increasing focus on safety and performance. Governments in Europe are implementing regulations related to sustainability and tire recycling, which is expected to drive demand for eco-friendly tire products. Tire cord manufacturers in Europe are investing in research and development to improve the performance and durability of their products. The demand for light commercial vehicles is growing in Europe, driven by the increasing popularity of e-commerce and delivery services. This is expected to drive demand for specialized tire cord products, such as high-strength polyester cords, which are used in the construction of light commercial vehicle tires.

Tire Cord Market Players:

- Bekaert Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Century Enka Limited

- Cordenka GmbH & Co. KG

- Formosa Taffeta Co., Ltd.

- Hyosung Corporation

- Indorama Ventures Public Company Limited

- Kordsa Global Endüstriyel Ä°plik ve Kord Bezi Sanayi ve Ticaret A.Åž.

- Kolon Industries, Inc.

- SRF Limited

- Teijin Limited

Recent Developments

- Bekaert Corporation: Bekaert announced that it had signed an agreement to acquire Puma Advanced Materials, a leading producer of tire cord and bead wire in China. The acquisition is expected to strengthen Bekaert's position in the Asian tire cord market and expand its product portfolio.

- SRF Limited: SRF Limited announced that it had signed an agreement to acquire the technical textiles business of Feroze1888 Mills Limited, a Pakistan-based textile company. The acquisition is expected to expand SRF's product portfolio and enhance its position in the global technical textiles market.

- Report ID: 4921

- Published Date: Nov 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Tire Cord Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.