Tire Cord Fabric Market Outlook:

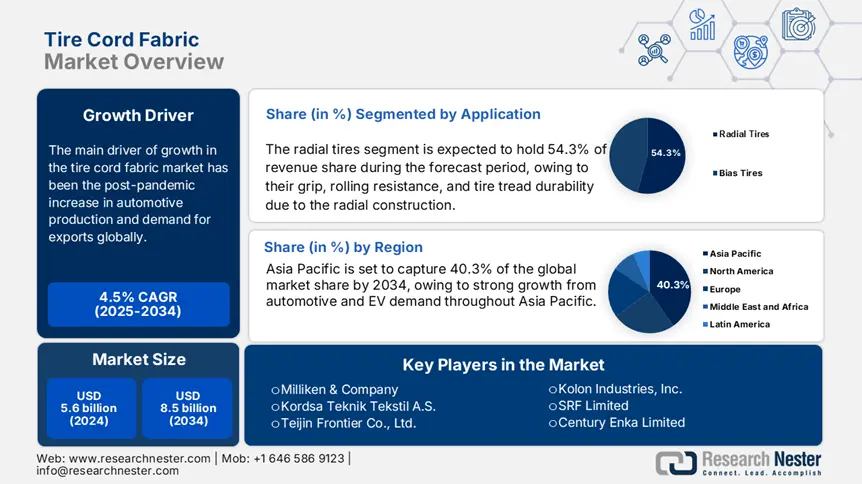

Tire Cord Fabric Market size was valued at USD 5.6 billion in 2024 and is projected to surpass USD 8.5 billion by the end of 2034, rising at a CAGR of 4.5% during the forecast period, from, 2025-2034. In 2025, the industry size of tire cord fabric is estimated at USD 5.8 billion.

The main driver of growth in the market has been the post-pandemic increase in automotive production and demand for exports globally. The USDA reports that in 2021, the rope, cordage, twine, tire cord, and tire fabric mills generated approximately $374 million of revenue with a 14.9% increase from the previous year, reflecting a 5-year average growth rate of 4.4%. U.S. imports and exports of specialty/industrial fabrics that also included tire cord alike were evolving, and the overall market for specialty and industrial fabrics was recovering after trade disruptions that appeared to stabilize in 2021.

Material sourcing for tire cord is highly dependent on polyester and steel wire. U.S. textile producers have allocated between 5-7% of sales to upgrade or modernize production capabilities, especially for cord dipping and coating lines. Maine state imports reported $22.7 million in rope, cordage, tire cord, and tire fabric for 2021, while assembly houses operate from North Carolina. The U.S. BLS reports prices for tire cord and tire fabric producers under the commodity code of 350301. For RDD, investments have been focused on line efficiency, dipping, and fabric strength. In summary, the inputs and outputs continue to impact import and export balance sheets, and reported expansions of capacity show concerted scaling efforts in response to burgeoning automotive sector demand.