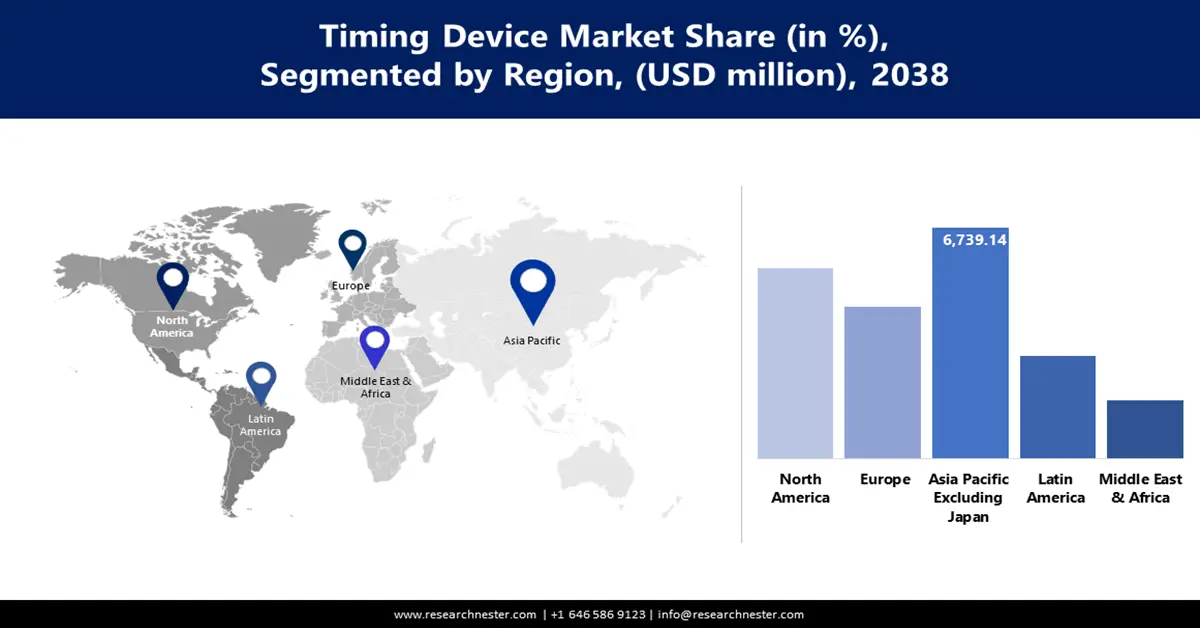

Timing Devices Market - Regional Analysis

Asia Pacific Excluding Japan Market Insight

The Asia Pacific excluding Japan market is expected to be dominant, holding a share of over 40.2% by 2038, owing to the rapid industrial automation ecosystem. Companies in the Asia Pacific are making significant investments in industrial automation. For instance, in October 2022, an agreement was signed between Omron Corporation and Kirin Brewery Company for the stock purchase of the Kirin Techno-System Company to develop Digital Transformation (DX) solutions collaboratively. The solutions will use inspection data, and for that, timing devices are required.

China is setting itself up as a growing market, expanding at a CAGR of 8.8% during the forecast period due to the dominance of the country in the manufacturing of electronics. As reported by the Centre for the National Interest in August 2024, through the Made in China 2025 initiative, billions of dollars have been invested to funnel state subsidies into companies to produce electronics products, including smartphones and advanced digital displays. These electronic goods cannot function appropriately without precise timing technologies.

South Korea is poised to expand at a CAGR of 7.7% during the forecast period due to rapid digitalisation across the nation. As a digital powerhouse globally, heavy investment is made in South Korea for innovative technologies, including semiconductors, AI, next-generation networks, big data, cybersecurity, and quantum computing. As per the International Trade Administration, spending on AI in South Korea is anticipated to reach USD 3.4 billion in 2027. In addition, increasing adoption of automation technologies is expected to fuel the market due to the requirement for precise timing in different automation systems. With the installation of 1,012 robots against 10,000 manufacturing workers, South Korea emerges as the country with the highest density of robots.

North America Market Insight

North America is projected to emerge as one of the fastest-growing timing devices markets by 2038, with an expansion at a CAGR of 6.6% during the forecast period due to the rapid advancement of AI. The expansion of data centres across the nation is another factor expected to fuel the market growth. In April 2025, the International Energy Agency reported that due to the increasing AI use, more electricity consumption is expected to take place in the U.S economy by 2030 for data processing purposes in the manufacturing of goods that are energy-intensive, such as steel, aluminium, cement, and others. By 2030, a 20% growth in electricity demand can be influenced by data centres in advanced economies. The likelihood of more data processing using AI and the growth of electricity consumption can surge the demand for timing devices in the coming years.

Rising industrial automation is the primary factor fuelling the market growth in the U.S. As reported by The International Federation of Robotics in April 2024, investing heavily in automation, U.S companies have contributed to the growth of the installation of robots by 12% by 2023, which accounts for 44,303 units in total. Robotic arms, such as AGVs and cobots, are synchronized by the precise timing devices to ensure efficient coordination, minimization of latency, and optimization of task accomplishment, which reflects industrial automation’s effective safety management and efficiency.

Government initiatives, such as the establishment of the National Institute of Standards and Technology (NIST), also play a crucial role in the growth of the timing devices market by carrying out wider research and development programs. Such initiatives have resulted in the development of precise atomic clocks, the creation of encryption standards, and the advancement of relevant technologies.

Canada market is expected to register a CAGR of 5.5% during the forecast period due to rising smart grid implementation across the nation. Investments by the government in smart technologies also fuel the market growth. By the end of 2025, the government plans to spend USD 32.7 million in Canada Plan for green infrastructure, transit, trade, social infrastructure, and tourism projects. The rising smart grid implementation influences the need for more precise synchronization in the grid.

Europe Market Insight

The timing devices market of Europe is poised to expand at a CAGR of 5.4% during the forecast period, owing to rapid 5G adoption in infrastructure. Initiatives by the regulatory bodies for the advancement of digital infrastructure also influence the market growth. For example, in December 2024, the approval of the conclusions on the White Paper regarding the provision of assistance for future initiatives related to digital infrastructure by the EU Council has led to an investment of around USD 349.29 million in nationwide technological advancement, including innovation for the next-generation networks. 5G adoption and the development of digital infrastructure drive the requirement for precise time synchronization across various applications.

In 2025, Germany dominated the timing devices market in Europe and is likely to retain its dominance during the forecast period, expanding at a CAGR of 7.1% due to the growth of the telecommunication sector. In 2023, around USD 15.8 billion was invested in Germany for network expansion and novel technologies, including private networks and 5G. Advancements in the automation sector in Germany also fuel the growth of the timing devices market. With the motive of replacing the Industry 4.0 forum, Manufacturing-X was initiated in July 2023 in Germany with an emphasis on the formation of a resilient, connected, and sustainable landscape of manufacturing. As a result, the demand for solutions for more precise and reliable synchronization is expected to increase in Germany.

The UK timing devices industry is likely to experience a CAGR of 5.7% during the forecast period due to high government investment in Research and Innovation (R&I). As reported by the UK Parliamentary and government publications in July 2025, the government is committed to making a total investment of USD 27.4 million in 2025, exclusively for the improvement of nationwide digitalization.

Growing investment in autonomous vehicles in the UK is also a key driver behind the growth of the timing devices industry. For instance, in May 2024, an investment of USD 1.5 billion in autonomous vehicles was announced by the AI company Wayve. Investment in research and innovation increases the chances of the emergence of more advanced timing devices, and investment in autonomous vehicles increases the likelihood of rising adoption of different timing devices.