Thermal Camera Market Outlook:

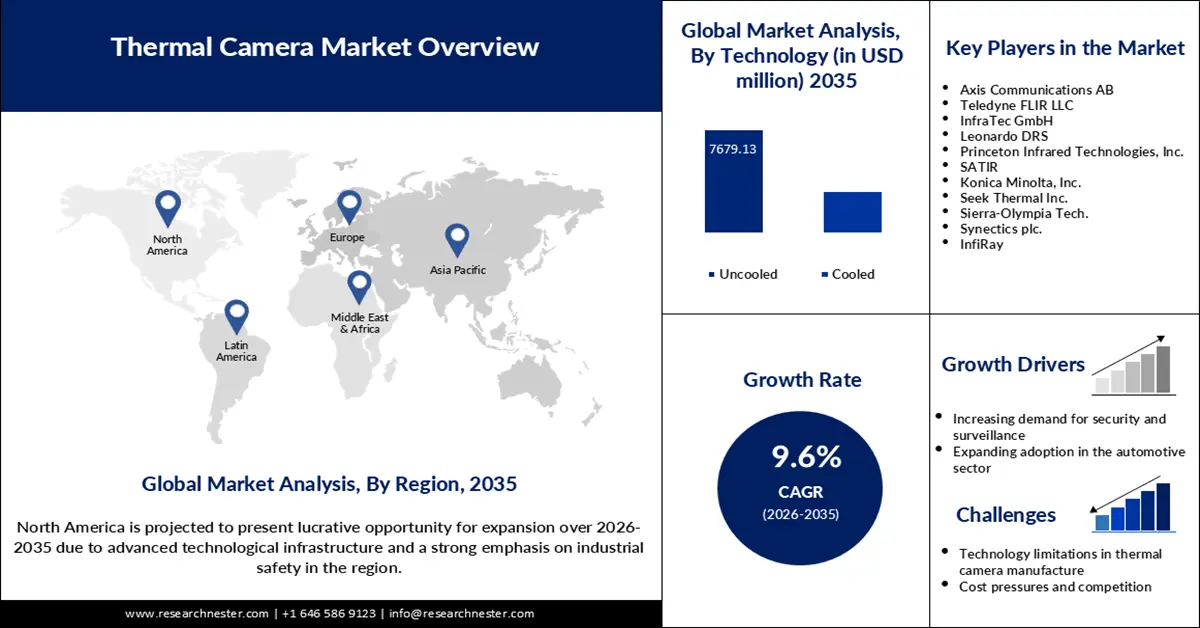

Thermal Camera Market size was valued at USD 5.51 billion in 2025 and is expected to reach USD 13.78 billion by 2035, expanding at around 9.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of thermal camera is evaluated at USD 5.99 billion.

The thermal camera demand is rising steadily due to its wide applications across security, surveillance, and industrial segments including predictive maintenance, fire detection, and environmental monitoring. The increasing interest in safety and automation will implore thermal camera adoption in smart city infrastructure and autonomous systems. Furthermore, their ability to detect heat beyond visible light makes them irreplaceable in extreme conditions and mission-critical environments, propelling the demand through 2037.

Leading companies also actively invest in innovation to have an edge over their competition. For example, in 2024, Hanwha Vision introduced AI-powered thermal cameras that promised better safety due to far superior object detection in low-visibility conditions such as fog or smoke. Governments are also driving growth in the market. The government in India began field testing thermal-smart cameras with C-DAC in smart cities for traffic policing in 2023. These efforts underline commitments to the improvement of safety and infrastructure by the public through advanced thermal imaging technologies.

Key Thermal Camera Market Insights Summary:

Regional Highlights:

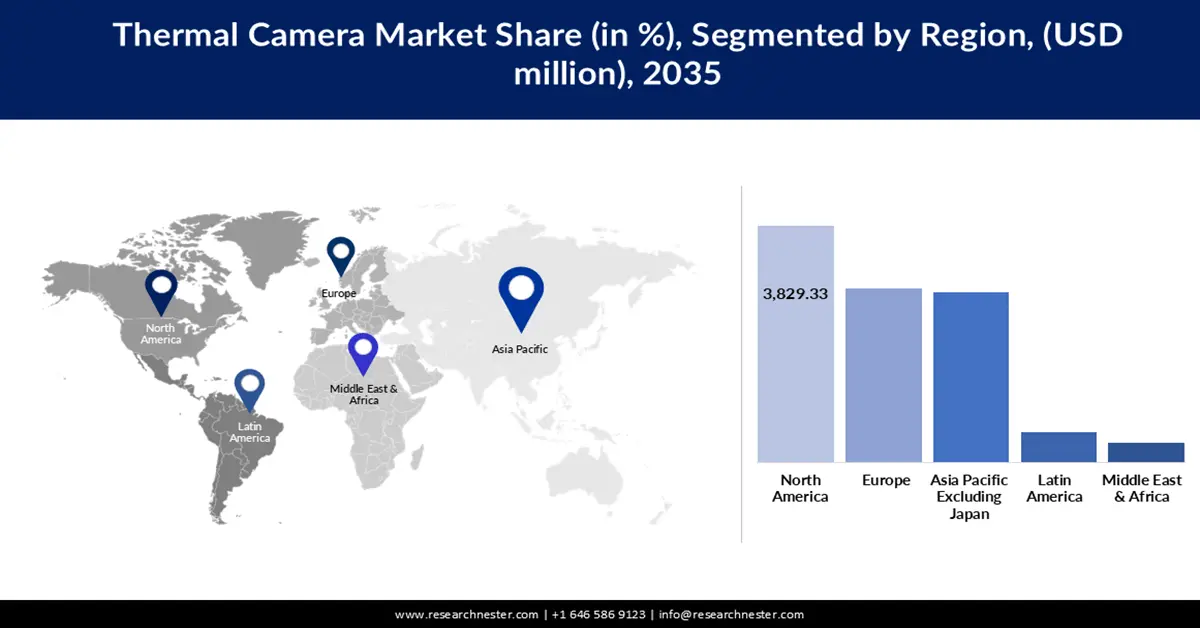

- North America thermal camera market is anticipated to capture 31% share by 2035, driven by the presence of advanced technological infrastructure and strong emphasis on industrial safety.

Segment Insights:

- The uncooled segment in the thermal camera market is projected to achieve a 71.90% share by 2035, attributed to the low maintenance and cost-effectiveness of uncooled thermal cameras.

Key Growth Trends:

- Increasing demand for security and surveillance

- Rising adoption in automotive

Major Challenges:

- Limitations of technology

- Higher maintenance and installation costs

Key Players: Axis Communications AB, Teledyne FLIR LLC, InfraTec GmbH, Leonardo DRS, Princeton Infrared Technologies, Inc., SATIR, Konica Minolta, Inc., Seek Thermal Inc., Sierra-Olympia Tech., Synectics plc., and InfiRay.

Global Thermal Camera Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.51 billion

- 2026 Market Size: USD 5.99 billion

- Projected Market Size: USD 13.78 billion by 2035

- Growth Forecasts: 9.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (31% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 18 September, 2025

Thermal Camera Market Growth Drivers and Challenges:

Growth Drivers:

-

Increasing demand for security and surveillance: High crime rates recorded across the globe have shifted more attention towards security-related solutions, increasing thermal camera demand globally. Artificial Intelligence-based thermal surveillance systems are gaining huge traction due to their application in high-level detection and real-time analysis in urban as well as industrial areas. Prama India, in association with C-DAC, launched thermal surveillance systems for Urban security in April 2024. Such innovations further drive the adoption of thermal cameras.

- Rising adoption in automotive: Thermal cameras find their increasing adoption in autonomous vehicles and ADAS systems since they are able to provide clear visibility even when the light condition is low, which proves to be very helpful while driving at night. Teledyne FLIR launched the FLIR ADK in 2024 for detecting pedestrians in autonomous vehicles. This application further acts as a growth driver for the thermal camera market.

- Industrial application expansion: Thermal cameras have become important tools in various industrial sectors due to their role in ensuring safety and enabling predictive maintenance. Energy industries, manufacturing industries, and utilities apply the thermal imaging technique in the early detection of impending equipment failure, checking heat distribution and potential hazards before they cause financial setbacks due to downtimes or accidents. For instance, continuous electrical component monitoring, overheating or inefficient motors, and other mechanical systems make wide usage of thermal cameras. Predictive maintenance, preventive maintenance, or reliability-centered maintenance ensure that thermal cameras reach or exceed their design life. Federal Energy Management Program (FEMP) estimates that a predictive maintenance program enables 30% to 40% cost-savings over reactive maintenance.

Challenges:

-

Limitations of technology: One of the most important limitations to thermal camera adoption is linked to the inherent limitation of infrared radiation in specific environments. Infrared cannot pass through glass or water, for instance, resembling the effectiveness of thermal cameras in applications where observing through windscreens or seeing items submerged underwater is required. These are areas where such a limitation has consequences in places like the monitoring of traffic, where clear visibility of the condition of vehicles is paramount.

- Higher maintenance and installation costs: Although thermal cameras ensure worthy services, their high initial costs and maintenance contribute to potential improvement in the general adaptability of these devices on large-scale projects. These projects, as well as initiatives with considerable infrastructure needs, such as smart cities, require heavy investment costs in implementing thermal cameras due to large implementations.

Thermal Camera Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.6% |

|

Base Year Market Size (2025) |

USD 5.51 billion |

|

Forecast Year Market Size (2035) |

USD 13.78 billion |

|

Regional Scope |

|

Thermal Camera Market Segmentation:

Technology Segment Analysis

Uncooled segment is likely to dominate thermal camera market share of around 71.9% by 2035. This is because uncooled thermal cameras require low maintenance and are cost-effective. Unlike thermal cameras, uncooled thermal cameras don't need cryogenic cooling owing to the ability of their core components to work at ambient temperatures, hence making them largely suitable for several applications in security surveillance and industrial monitoring. Their ability to function without complex cooling systems makes them a more affordable option for widespread deployment.

In April 2024, LightPath Technologies added to this segment by introducing an uncooled long-wave infrared thermal camera with higher sensitivity. This development is likely to extend the applications of uncooled thermal cameras in industrial settings where accurate temperature measurement provides process monitoring and equipment maintenance.

Product Type Segment Analysis

In thermal camera market, handheld thermal camera segment is set to observe high growth till 2035. Handheld thermal cameras are increasingly preferred for mobility-related aspects in many applications, including on-the-move inspection, emergency response, and industrial maintenance. The compact design allows users to manage it with ease in field conditions, providing comfort and convenience during operations. In May 2024, NASA launched the Compact Infrared camera for forest fire detection and secured its position in this segment. This invention underlines the growing importance that handheld thermal cameras will assume in critical applications related to safety and operational efficiency in both emergency and routine tasks.

Our in-depth analysis of the thermal camera market includes the following segments:

|

Technology |

|

|

Wavelength |

|

|

Product Type |

|

|

Application |

|

|

End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Thermal Camera Market Regional Analysis:

North America Market Insights

North America industry is expected to hold largest revenue share of 31% by 2035, owing to the presence of an advanced technological infrastructure and a strong emphasis on industrial safety. In January 2023, Multi Radiance Medical announced its unique global distribution partnership with Digatherm Thermal Imaging, embedding laser therapy and thermal imaging technologies. Multi Radiance Medical seeks to take advantage of such a synergistic relationship between the two technologies through this partnership. Together, thermal imaging and laser therapy give veterinarians a complete toolset.

The U.S. leads in the adoption of thermal cameras, mainly for application in security, automotive, and defense areas. Further development in the integration of thermal cameras with the IoT and AI technologies enhanced their potential by making them more effective for different types of surveillance and defense systems. The launch finally answers the demand for high national security and continued interest by the U.S. market in using advanced thermal imaging technology to protect complex infrastructures and further develop security operations.

Canada thermal camera market is growing due to the rising demand for remote environmental monitoring and managing resources. The government has been investing in thermal imaging technologies that keep watch over pipelines transporting oil with much ease, hence decreasing risks of environmental hazards. Its investment has been a reflection that Canada is indeed being proactive towards the use of thermal cameras in protecting the environment and managing resources, making sure that all key infrastructures in the country are at par to monitor the traffic of leaks and other issues.

APAC Market Insights

The thermal camera demand in Asia Pacific is anticipated to surge at a rapid pace during the forecast period, driven by increasing urbanization and industrial development headed by India and China. Both countries are making significant investments in smart city initiatives and industrial safety, driving demand for advanced thermal imaging solutions. In countries like China and India, thermal cameras secure an indispensable place in precision agriculture for crop health monitoring, irrigation management, and pest infestation. Such applications allow farmers to perform yield optimization with minimal usage of resources, hence enhancing profitability and sustainability.

India is anticipated to witness a steady rise in the thermal camera market in Asia Pacific. The country has been installing thermal cameras for urban surveillance and smart city projects. In 2023, in collaboration with Prama India, the Government of India started deploying thermal cameras in the country's traffic management systems. This would guarantee smooth passage and safety by monitoring and analyzing traffic accurately in real-time and further demonstrates interest on the part of India in deploying this technology into urban infrastructure.

With several government-led initiatives in place to further industrial automation, China has become a global hub of thermal camera manufacturers. As per SIPRI, in 2023, China became the world's second-largest military spender, allocating an estimated USD 296 billion to the military, up 6.0% from 2022. Military expenditure by China accounted for 12.0% of global spending and 50.0% of spending in Asia. Companies are also pushing this growth momentum further. For example, Hanwha Vision introduced, in 2024, AI-powered thermal cameras designed for application in China's expanding surveillance market. This further underlines the leading position of China in thermal imaging technologies that support the growing vigilance needs and drive innovations in industrial automation.

Thermal Camera Market Players:

- Axis Communications AB

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Teledyne FLIR LLC

- InfraTec GmbH

- Leonardo DRS

- Princeton Infrared Technologies, Inc.

- SATIR

- Konica Minolta, Inc.

- Seek Thermal Inc.

- Sierra-Olympia Tech.

- Synectics plc.

- InfiRay

Competition in the thermal camera market is fierce, from technological innovations to expanded global footprints taken by several key players. Among the leading companies are Teledyne FLIR, Hanwha Vision, and Axis Communications, aggressively devoted to the advanced integration of AI and the development of expanded application areas, among others. These companies interact with governments and industries in order to fulfill growing demands coming from a number of sectors. MoviTHERM partnered with Optris in 2024, leading to the sale of thermal imaging solutions at relatively lower costs. This provides the possibility of good performance quality cameras for energy management and security industries. These are some of the developments shaping competition based on technologies and price competition.

Here are some leading companies in the thermal camera market:

Recent Developments

- In March 2024, FLIR demonstrated a shift in its latest camera technology by moving away from traditional thermal imaging to focus on acoustics. Their new range is designed to leverage sound as a means of detecting and analyzing environmental conditions.

- In February 2024, UK-based Norden Communication partnered with the Centre for Development of Advanced Computing (C-DAC) to manufacture thermal cameras in India, marking a significant step towards localized technology production and boosting the country's capabilities in thermal imaging solutions.

- In July 2023, Topodrone announced its advancements in thermal mapping technology with a new camera launch, promising to enhance the efficiency of aerial surveys and environmental monitoring. This innovative approach is set to redefine how professionals engage with thermal imaging for mapping purposes.

- In January 2023, M5Stack unveiled the M5Stick T Lite, a pocket-friendly development kit featuring an ESP32-based thermal camera, designed for developers and hobbyists. This innovative tool aims to enhance accessibility in thermal imaging technology, offering a compact solution for various applications.

- Report ID: 6418

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Thermal Camera Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.