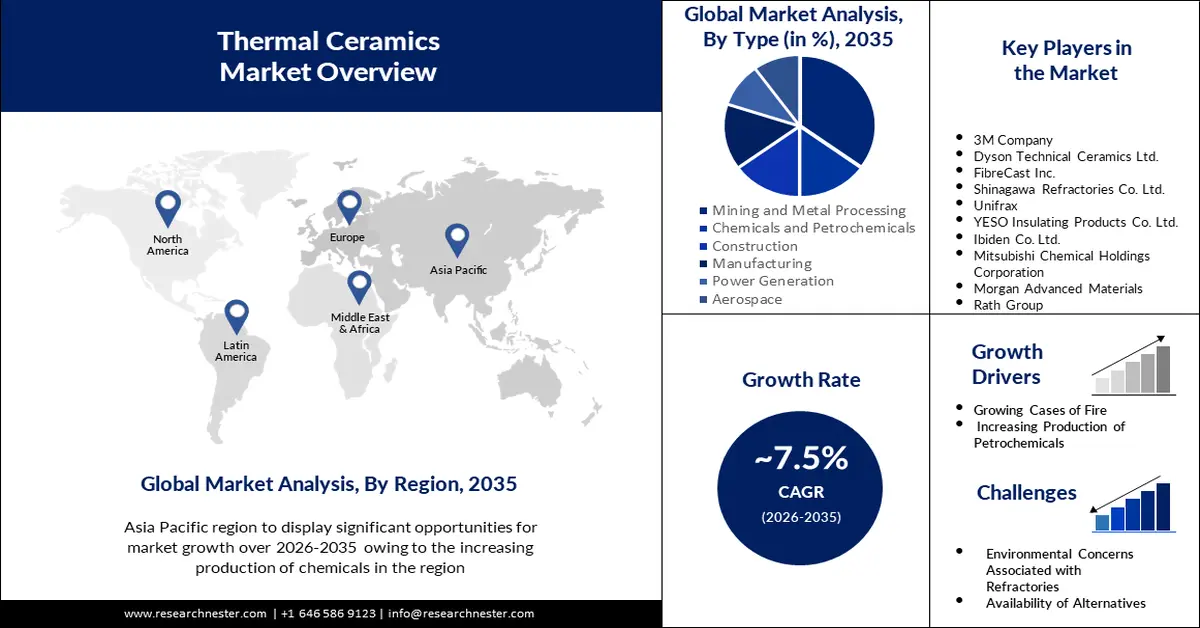

Thermal Ceramics Market Outlook:

Thermal Ceramics Market size was over USD 5.3 billion in 2025 and is poised to exceed USD 10.92 billion by 2035, growing at over 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of thermal ceramics is evaluated at USD 5.66 billion.

The market is growing due to increasing demand for energy across the globe. For instance, the Asia-Pacific region has the largest primary energy consumption of any region. With a population of more than one billion people and a rapidly expanding economy, China is currently the world's greatest main energy consumer. Also, the world's electricity consumption has steadily increased during the last half-century, reaching around 25,500 terawatt-hours in 2022. In addition, the rise in demand for non-metallic materials will boost the market expansion. Because of their chemical stability, non-metallic raw materials serve as good electrical component insulators and are predicted to increase demand for thermal ceramics.

Key Thermal Ceramics Market Insights Summary:

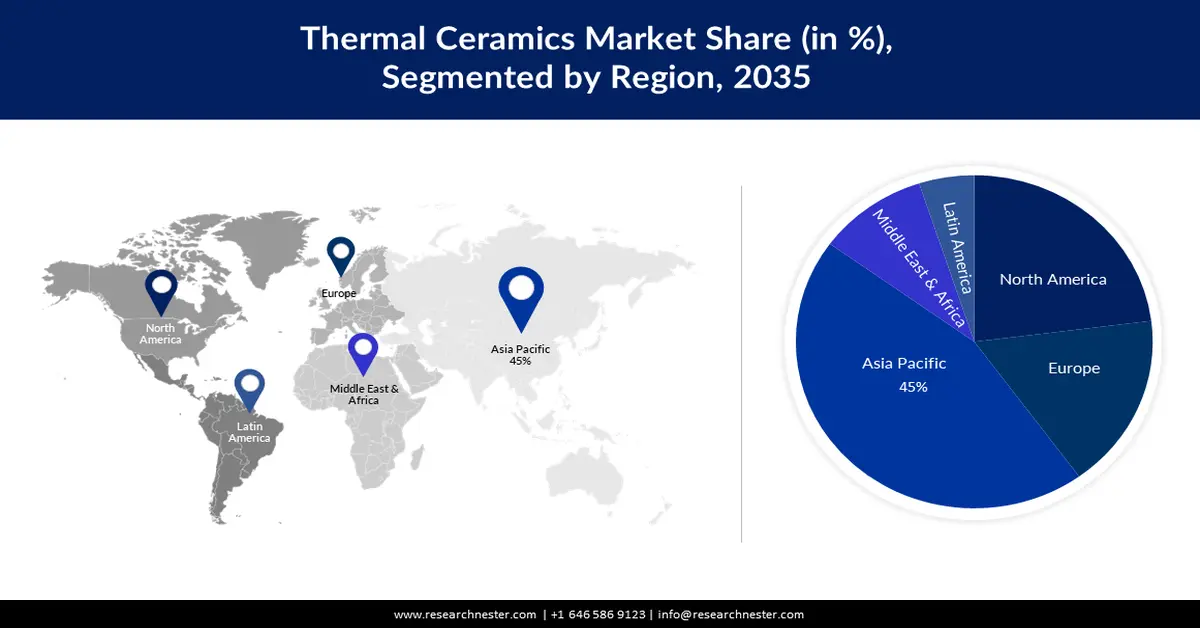

Regional Highlights:

- Asia Pacific thermal ceramics market will dominate over 36% share by 2035, driven by increasing chemical production, strong domestic demand, and rising exports.

- North America market projects huge growth during the forecast timeline, driven by increased need for boilers and rapid growth of the refractory industry in the United States.

Segment Insights:

- The ceramic fabrics segment in the thermal ceramics market is anticipated to capture a 57% share by 2035, propelled by the material's strength, low heat conductivity, and superior heat insulation performance.

- The mining and metal processing segment in the thermal ceramics market is forecasted to secure a 35% share by 2035, fueled by demand for thermal ceramics in high-temperature industrial equipment and furnaces.

Key Growth Trends:

- Growing demand in the chemical industry

- Increased adoption in industrial settings

Major Challenges:

- Availability of alternatives such as polyurethane foam or metallic foams

- Concerns related to the environment may hinder the market growth

Key Players: 3M, Alteo, Coherent Corp., CeramTec, Morgan Advanced Materials, FiberCast Inc., IBIDEN CO., LTD., Rath Group, Rauschert GmbH, RHI Magnesita GmbH.

Global Thermal Ceramics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.3 billion

- 2026 Market Size: USD 5.66 billion

- Projected Market Size: USD 10.92 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 8 September, 2025

Thermal Ceramics Market Growth Drivers and Challenges:

Growth Drivers

- Growing demand in the chemical industry – The expanding demand in the chemical industry as well as the rising investment in this sector and its manufacturing facilities adds to the growth of the thermal ceramics market. There is an increase in thermal insulation, as evidenced by the expansion of the chemical and petrochemical industries as well as the variety of applications.

Thermal ceramics made of alumina, zirconia, aluminum nitride, and other materials can be utilized with acids, alkalis, and solvents. This suggests that enterprises in the chemical sector may improve the efficiency of their manufacturing processes by using high-quality, high-performance ceramic components. - Increased adoption in industrial settings - Due to the rise in industrial applications, fire safety gear including blankets resistant to high temperatures and ceramic wool for insulation has gained popularity in recent years. Elevated temperatures and aluminum furnaces are used in the growing thermal and power generation industries.

For instance, from 2017 to 2040, the power generation industry is projected to invest around USD 10.2 trillion in new power generation capacity globally. As a result, the employees who operate these furnaces must be appropriately dressed; these aspects are creating significant growth prospects for the thermal ceramics sector as a whole. - Rising application in the automotive and aerospace industry - Advanced ceramics are commonly used in engine and exhaust systems, heat protection shields, and other aerospace applications such as feed-through, temperature sensors, electrical connectors, and thermocouple sheaths because they can withstand high temperatures while providing insulation or thermal resistance. Aside from that, thermal ceramics help automobile designers achieve the greatest possible passive fire protection and thermal management. They are also generally robust and can withstand high pressures and temperatures. Ceramic fuel cells generate relatively little pollution while efficiently converting chemical energy to electrical energy. Although they can operate on a range of fuels, a conventional hydrogen-powered ceramic fuel cell offers a clean substitute for fossil fuels. Therefore, this factor is propelling the market growth.

Challenges

- Availability of alternatives such as polyurethane foam or metallic foams - Owing to their superior qualities, polyurethane systems are among the most popular materials used for insulation in buildings as they offer exceptional insulating qualities. It increases the airtightness and waterproofness of building envelopes, and provides architects and designers greater creative freedom when designing buildings, and may hinder the growth of the market.

- Concerns related to the environment may hinder the market growth

- Fluctuating cost of raw materials can impact the overall cost of production

Thermal Ceramics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 5.3 billion |

|

Forecast Year Market Size (2035) |

USD 10.92 billion |

|

Regional Scope |

|

Thermal Ceramics Market Segmentation:

Type Segment Analysis

In thermal ceramics market, the ceramic fabrics segment is poised to capture over 57% share by 2035. Ceramic fiber fabric, which is made of materials with excellent strength, low heat conductivity, outstanding heat insulation performance, and stability at high temperatures, is one example of refractory materials with high melting temperatures.

Ceramic fibers, which are also utilized in the production of continuous-fiber-reinforced composite materials such as metal matrix composites (MMCs), polymer matrix composites (PMCs), and ceramic matrix composites (CMCs), satisfy the strictest requirements for thermal, mechanical, and electrical performance. Because of its large porosity, low thermal mass, and low heat storage, insulation bricks are primarily used to stop heat loss and retain heat. For instance, bricks having a porosity of above 40%, known as high-porosity bricks, are utilized as insulation.

Industry Vertical Segment Analysis

The mining and metal processing segment is estimated to dominate around 35% thermal ceramics market share by the end of 2035. Due to its special properties, such as improved process security and longer service lives, thermal ceramics are becoming more and more in demand in the creation and processing of metals, in industrial equipment, and furnaces, which is responsible for the segment's rise. Because they offer superior temperature tolerance, resistance to thermal shock, thermal insulation, and temperature expansion, advanced technical ceramics are commonly used to replace metals in heaters and furnaces, which are then used in the metal processing industry.

Thermal ceramics are required for kilns, furnaces, and other high-temperature insulation applications due to a significant rise in metal production. They are also utilized in casting nozzle covers, secondary insulation for reheating furnaces, hot-face lining for heat treatment furnaces, and annealing furnace cover seals.

Our in-depth analysis of the global thermal ceramics market includes the following segments:

|

Type |

|

|

Temperature Range |

|

|

Industry Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Thermal Ceramics Market Regional Analysis:

APAC Market Insights

By the end of 2035, Asia Pacific region is expected to dominate around 36% thermal ceramics market share. The market domination in the region is owing to increasing production of chemicals. Due to strong domestic demand, growing exports, and the most lucrative category being specialty chemicals, India's chemicals industry has surpassed others globally in terms of demand growth.

The chemical industry is a significant contributor to the Indian economy. It is highly varied, manufacturing about 80,000 commercial products, and is a leading manufacturer of intermediates, paints, dyestuffs, pesticides, fertilizers, and basic organic compounds, among other products. For instance, in 2021 the country generated about 29 million metric tons of basic primary chemicals and petrochemicals. Furthermore, the nation's economic growth is driven by the infrastructure that India has jointly created and is supported by increased government investment and development initiatives.

North America Market Insights

The North America region will experience huge expansion for the thermal ceramics market during the forecast period, led by increased need for boilers. In addition, the region's growth can be attributed to the refractory industry in the United States, which has grown rapidly due to the presence of large corporations. The aircraft industry uses thermal ceramics extensively because of their remarkable resistance to high temperatures. They can accomplish this while still fulfilling the rigorous weight, temperature, and performance specifications of spacecraft.

Thermal Ceramics Market Players:

- 3M

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Alteo

- Coherent Corp.

- CeramTec

- Morgan Advanced Materials

- FiberCast Inc.

- IBIDEN CO., LTD.

- Rath Group

- Rauschert GmbH

- RHI Magnesita GmbH

Recent Developments

- Coherent Corp., a leading manufacturer of metal matrix composites and ceramics worldwide, announced that it has created an additive manufacturing process that can create sophisticated ceramic components for high-performance thermal management applications, such as capital equipment for next-generation semiconductors. The globe has seen enormous investments in the construction of semiconductor production facilities outfitted with the most cutting-edge semiconductor capital equipment due to severe shortages of integrated circuits based on cutting-edge nodes.

- Alteo announced the introduction of its HYCal® brand of aluminas. With its focus on cutting-edge ceramics, the new brand upholds Alteo's dedication to excellence and quality to foster the expansion of our clients. Manufacturers of high alumina ceramics for a variety of industries can achieve exceptional mechanical and dielectric performance with the help of the HYCal® range.

- Report ID: 3062

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Thermal Ceramics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.