Therapeutic Weighted Blankets Market Outlook:

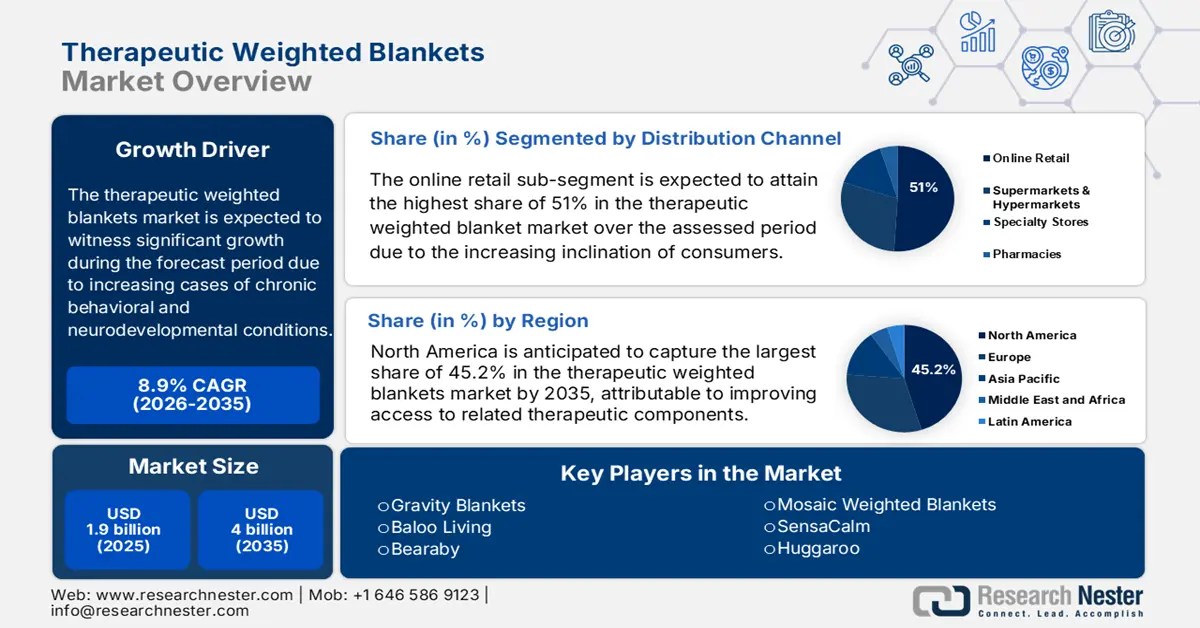

Therapeutic Weighted Blankets Market size was valued at USD 1.9 billion in 2025 and is projected to reach USD 4 billion by the end of 2035, rising at a CAGR of 8.9% during the forecast period 2026-2035. In 2026, the industry size of therapeutic weighted blankets is estimated at USD 2 billion.

The therapeutic weighted blankets market is growing due to increasing cases of chronic behavioral and neurodevelopmental conditions, such as anxiety, insomnia, ADHD, and autism. As these issues are becoming a major health concern, there is a surge for non-drug effective management solutions. According to the report by NIH in September 2024, in 2022, over one in five U.S. adults, approximately 59.3 million people, or 23.1% of the adult population, were living with a mental illness. This demography displays an ongoing growth in the patient pool, which can benefit from products from the market. Rising awareness of sensory-based therapies and consumer preference for holistic wellness solutions are further fueling market demand.

Moreover, the increasing economic burden on associated patients can engender disparity and hesitation among potential consumers and investors in the market. An upward trend in payers' pricing also seems to vindicate this growing pressure. As per a report by CMS in June 2025, in 2023, national health expenditures (NHE) in the U.S. reached USD 4.9 trillion 2023 or approximately USD 14,570 per capita, rendering it 17.6% of the gross domestic product (GDP) with a 7.5% increase. This sharp rise highlights the growing financial strain on individuals, further challenging the affordability and accessibility of non-covered therapeutic products such as weighted blankets.

Key Therapeutic Weighted Blankets Market Insights Summary:

Regional Highlights:

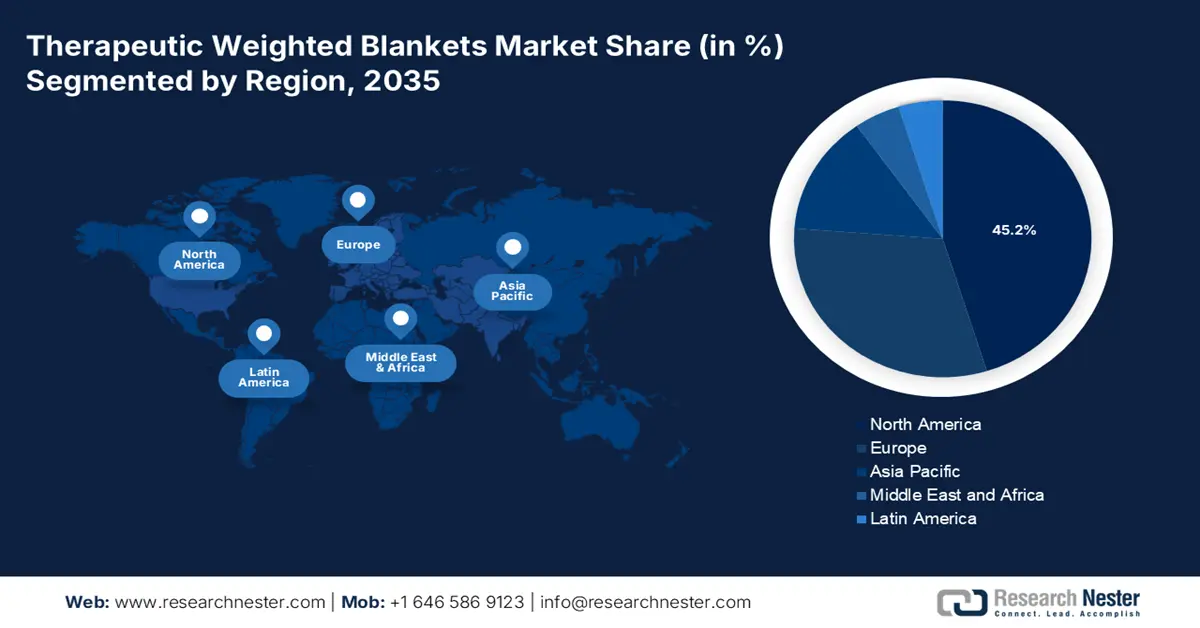

- By 2035, North America is expected to secure a 45.2% share of the therapeutic weighted blankets market, attributed to rising incidences of anxiety, autism, and insomnia.

- By 2035, the Asia Pacific region is projected to advance as the fastest-growing market, supported by robust domestic production capacity and increasing government initiatives promoting mental-health awareness.

Segment Insights:

- By 2035, the online retail sub-segment in the therapeutic weighted blankets market is anticipated to command a 51% share, supported by the increasing inclination of consumers to shop conveniently and the availability of a wide range of products.

- By 2035, the 10–15 lbs weighted blankets sub-segment is projected to secure the highest share in the weight category, bolstered by their balanced therapeutic benefits and comfort for the end user.

Key Growth Trends:

- Benefits and cost-effectiveness in disease management

- Activities and investments in product innovation

Major Challenges:

- Limitations in cost-optimization and accessibility

Key Players: Gravity Blankets, Bearaby, SensaCalm, Baloo Living, Huggaroo, Mosaic Weighted Blankets, YnM Weighted Blankets, ZonLi, Layla Sleep, Quility, Helix, Calming Blankets, Nuzzie, Hush Blankets, Dream Weighted Blankets.

Global Therapeutic Weighted Blankets Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.9 billion

- 2026 Market Size: USD 2 billion

- Projected Market Size: USD 4 billion by 2035

- Growth Forecasts: 8.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Canada

Last updated on : 26 September, 2025

Therapeutic Weighted Blankets Market - Growth Drivers and Challenges

Growth Drivers

- Benefits and cost-effectiveness in disease management: As more clinical studies successfully establish the efficiency of non-pharmacological interventions, the cash inflow in the market is increasing. As per a report by the World Health Organization, September 2025, depression and anxiety alone cost the global economy an estimated USD 1 trillion annually. Significant disparities exist between countries, with high-income nations spending up to USD 65 per person on mental health, while low-income countries allocate way less than that. Additionally, the global median number of mental health workers is 13 per 100,000 people, with severe shortages especially in low- and middle-income countries.

- Activities and investments in product innovation: The search for advanced materials and functions is pushing investors and dedicated companies to invest in extensive R&D, which is expanding the pipeline in the market. As per a report by UNESCO, February 2025, global research and development (R&D) expenditure as a proportion of GDP increased from 1.7% to 1.9%, indicating a growing commitment to innovation across various sectors. This increased investment is expected to accelerate the development of more effective and customizable therapeutic weighted blanket products in the coming years.

- Rising consumer awareness and preference for non-pharmacological solutions: Consumer awareness is increasing about overall well-being and the growing need for mental health services, thereby giving impetus to the demand for non-pharmacological remedial therapies in the market. Weighted blankets are increasingly preferred as novel, natural, and drug-free solutions to be used for managing anxiety, stress, and sleep disorders. Social media and the wellness influencers have been instrumental in normalizing and popularizing these products. Healthcare practitioners are now endorsing weighted blankets within integrative care plans. In this preventative and supportive approach, there is a shift towards broader acceptance and adoption.

Therapeutic Weighted Blankets and Their Effectiveness Trend in Pediatric Care

Feasibility, Acceptability, and Perceived Effectiveness of Weighted Blankets in Pediatric Care (2024)

|

Survey Item |

Child |

Caregiver |

Dentist |

|

Blanket is easy to use |

4.4 (0.7), 4.5 (2-5) |

4.8 (0.4), 5 (4-5) |

4.7 (0.5), 5 (3-5) |

|

Looked nice |

4.2 (0.8), 4 (2-5) |

4.8 (0.3), 5 (4-5) |

4.8 (0.3), 5 (4-5) |

|

Blanket comfortable |

4.2 (0.9), 4 (2-5) |

4.65 (0.5), 5 (3-5) |

4.7 (0.5), 5 (3-5) |

|

Overall comfort mean |

4.2 (0.8), 4 (1-5) |

4.6 (0.7), 5 (1-5) |

4.6 (0.5), 5 (3-5) |

|

The child seemed relaxed |

4.1 (0.9), 4 (2-5) |

4.4 (0.9), 5 (2-5) |

4.4 (0.6), 4.5 (3-5) |

|

Enjoyed using the blanket |

4.2 (0.8), 4 (2-5) |

4.5 (1.0), 5 (2-5) |

4.3 (0.8), 4.5 (3-5) |

|

Would to use it next time |

4.2 (0.9), 2.5 (2-5) |

4.6 (0.6), 5 (3-5) |

4.7 (0.5), 5 (3-5) |

Source: NLM September 2024

Challenges

- Limitations in cost-optimization and accessibility: The need to depend on imported materials and key parts for making therapeutic weighted blankets creates a big challenge in keeping prices affordable. Due to high tariff duties and logistics expenses, the manufacturing cost spirals, thereby escalating the retail price. Moreover, it forms another factor for delays and price hikes through international supply chain disruptions, further hampering the availability for the market. Market penetration and consumer reach are restricted due to gradual diffusion in developing areas. Therefore, the combined factors constrain the pleas to make the therapeutic weighted blankets readily available for the greater populace.

Therapeutic Weighted Blankets Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.9% |

|

Base Year Market Size (2025) |

USD 1.9 billion |

|

Forecast Year Market Size (2035) |

USD 4 billion |

|

Regional Scope |

|

Therapeutic Weighted Blankets Market Segmentation:

Distribution Channel Segment Analysis

The online retail sub-segment in the distribution channel for the therapeutic weighted blankets market is expected to capture the largest market share of 51% during the forecast period, driven by the increasing inclination of consumers to shop conveniently and the availability of a wide range of products. The rise of e-commerce platforms and direct selling has enabled consumers to procure a wide array of weighted blankets easily, effectively pushing sales upwards. This trend undoubtedly favors the dominance of online channels for therapeutic weighted blankets, especially among younger people who value convenience and variety above anything else. The rise of e-commerce platforms and direct selling has enabled consumers to easily procure a wide array of weighted blankets, effectively pushing sales upwards.

Weight Category Segment Analysis

The 10-15 lbs weighted blankets sub-segment of the market is projected to capture the highest market share in the weight category segment during the forecast period due to their balance of therapeutic benefits and comfort for the end user. This market segment has seen steady growth between 2022 and 2025, fueled by increased solutions in sleep therapies. As per a report by NLM 2024 April, in Western Sweden, weighted blankets cost just under €190 (USD 222.8) for six-month prescriptions, compared with sleep medications at a bit under €86 (USD 100.7) for the same duration, thus emphasizing preferences towards non-pharmaceutical solutions. These weighted blankets are extensively recommended by occupational therapists as they provide efficient deep pressure stimulation without discomfort, suitable for both children and adults.

Product Type Segment Analysis

The cotton-weighted blankets sub-segment of the therapeutic weighted blankets market is expected to dominate under the product-type segment during the forecast period, due to cotton's natural channeling of air and hypoallergenic restrictions. Those blankets are highly preferred for comfort and temperature regulation and suit the needs of worn-out discomfort and prolonged sleep therapy treatments. Natural breathable fabrics, such as cotton, keep the therapeutic process free from skin irritation and are not too warm on the skin, which must be a prime concern. Demand increased for cotton-based therapeutic blankets in the market, highlighting consumers' choices of sustainable and comfortable materials in healthcare products.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Sub-segments |

|

Product Type |

|

|

Application |

|

|

End user |

|

|

Distribution Channel |

|

|

Weight Category |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Therapeutic Weighted Blankets Market - Regional Analysis

North America Market Insights

North America is anticipated to capture the largest share of 45.2% in the market throughout the forecast period due to increasing incidences of anxiety, autism, and insomnia, which are the primary drivers behind the region's proprietorship over other global landscapes. In this regard, the NIH September 2024 report showed that in 2022, Young adults aged 18 to 25 years had the highest prevalence of any mental illness. This number represented 23.1% of all U.S. adults. As a result, manufacturers are increasingly investing in research and development to design innovative, clinically backed weighted blankets tailored to specific therapeutic needs.

U.S. market is growing due to the efforts of governing bodies and authorized insurers to improve public access to advanced care for associated ailments. As per the NIH September 2024 report in 2022, among the adults with any mental illness, 30.0 million (50.6%) received mental health treatment in the past year. Furthermore, there is growing awareness about the excessive and inappropriate use of sedatives to manage chronic behavioral and mental disorders, such as anxiety and insomnia. This is pushing nationwide healthcare service providers to adopt non-interventional and non-pharmacological methods, such as therapeutic blankets, which is the therapeutic weighted blankets market.

Export and Import of Medical Devices in North America (2023)

|

Country |

Exports (2023) |

Imports (2023) |

|

Mexico |

3.1 billion |

11.8 billion |

|

Canada |

1.8 billion |

876 million |

|

Costa Rica |

582 million |

3.5 billion |

|

Dominican Republic |

92.3 million |

1.4 billion |

|

Guatemala |

29.9 million |

- |

Source: OEC, August 2025

Asia Pacific Market Insights

The therapeutic weighted blankets market in the Asia Pacific is predicted to be the fastest-growing market by 2035. With a robust domestic production capacity and product innovation, the region is progressing at a remarkable pace. Besides, the frequent government initiatives and investments to spread knowledge about mental health and available solutions are also fuelling growth in this landscape. As per a report by NLM in November 2024, the growing number of psychiatric out-patient clinics in Japan now serving approximately 5,861,000 individuals, including 1,693,000 with mood disorders, 1,237,000 with neurotic disorders, 737,000 with schizophrenia, and 929,000 with dementia, highlights the escalating demand for accessible and non-invasive therapeutic solutions such as therapeutic weighted blankets.

China is one of the biggest contributors to the remarkable propagation of the regional therapeutic weighted blankets market. As per a report by NLM in July 2023, China, as one of the largest countries in the world, has a current population of over 1.4 billion. According to the World Health Organization, 54 million people in China are readily affected by depression, and about 41 million suffer from anxiety disorders. China has made significant efforts to overcome the barriers that prevent people from accessing diagnosis and care, including the introduction of the mental health law, which calls for more facilities, an increase in mental health professionals, and more awareness.

Europe Market Insights

Europe market is steadily growing due to rising awareness of mental illness, a greater prevalence of anxiety, depression, and sleep disorders, and a trend towards non-pharmacologic treatments. Governments and health departments in the region are proactively focusing on mental well-being through funding and programs, and promoting the use of care aids such as weighted blankets. As demand from consumers keeps growing and penetration on the internet expands, producers are investing in sustainable materials and new-generation designs to meet varied consumer preferences.

The therapeutic weighted blankets market in the UK is growing due to increasing mental illness, higher public awareness, and the demedicalization of non-medical therapy. As per a report by NATCEN in June 2025, 22.6% of 16 to 64 to year-old UK adults were diagnosed with a common mental disorder, such as depression and anxiety. Increased mental burden, particularly among the younger generation, is driving demand for therapy products such as weighted blankets. The products are being linked more and more with calming properties, notably in the treatment of anxiety, insomnia, and sensory disorders.

Key Therapeutic Weighted Blankets Market:

- Gravity Blankets

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bearaby

- SensaCalm

- Baloo Living

- Huggaroo

- Mosaic Weighted Blankets

- YnM Weighted Blankets

- ZonLi

- Layla Sleep

- Quility

- Helix

- Calming Blankets

- Nuzzie

- Hush Blankets

- Dream Weighted Blankets

The market trends with key players are oriented now toward regulatory criteria and government-issued guidelines alignment. Besides these, PPPs have strategized and newer product launches aimed at expanding this sector globally, even into underdeveloped terrains, thereby fostering the market. These are efforts to get related products into the market using cost-optimized manufacturing, localizing the resources, and, in extension, promoting the growth of this product, drawing in more developers investing in mental health in the category. Furthermore, competition among lead innovators is creating a variety of opportunities all across the value chain.

Here is a list of key players operating in the market:

Recent Developments

- In August 2025, Cybin received approval to initiate the EMBRACE Phase 3 study of CYB003 for Major Depressive Disorder in Ireland, Poland, Greece, and the UK. EMBRACE is the second pivotal study in PARADIGM, the Phase 3 multinational program of the company.

- In January 2024, Jaguar Gene Therapy, a biotechnology company, announced FDA clearance of its Investigational New Drug (IND) application for JAG201. This is a gene therapy targeting genetic autism spectrum disorder (ASD) and Phelan-McDermid syndrome (PMS) caused by SHANK3 mutations.

- Report ID: 2299

- Published Date: Sep 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.