Terminal Automation Market Outlook:

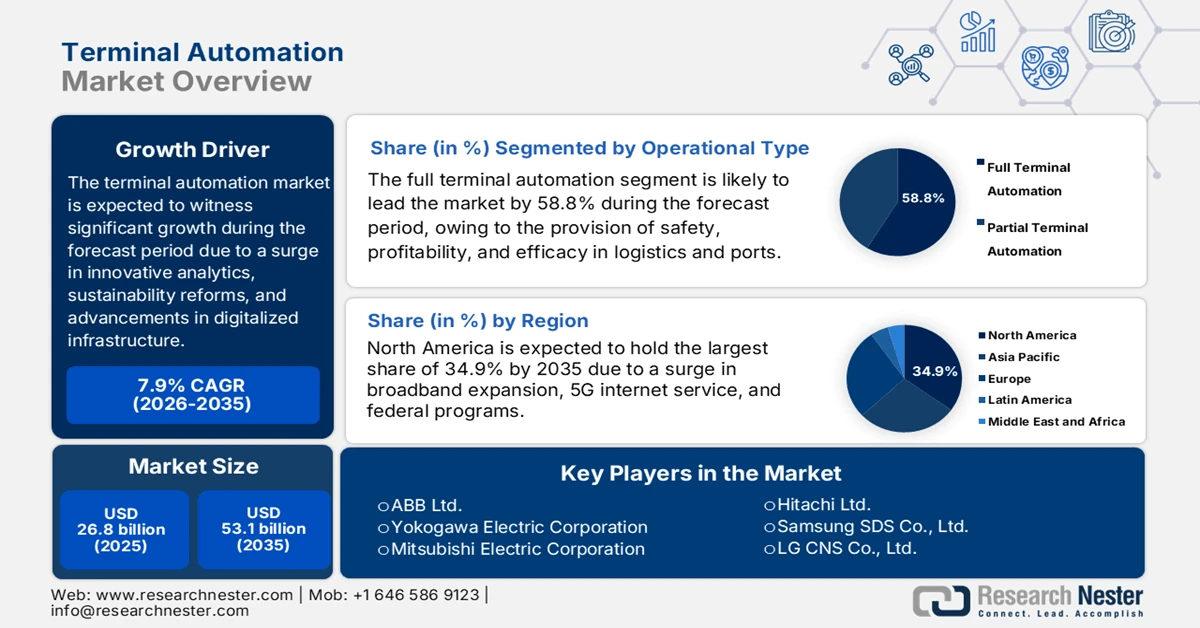

Terminal Automation Market size was over USD 26.8 billion in 2025 and is estimated to reach USD 53.1 billion by the end of 2035, expanding at a CAGR of 7.9% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of terminal automation is evaluated at USD 28.9 billion.

The international terminal automation market is rapidly evolving, with distinct growth drivers and new technological trends gradually reshaping operations. Factors such as advanced analytics, sustainability mandates, and innovations in digitalized infrastructure are responsible for boosting the market globally. According to official statistics published by the UNCTAD Organization in July 2024, the utilization and production of data centers, digital devices, as well as information and communications technology (ICT) networks, account for approximately 6% to 12% of international electricity use. Besides, the yearly smartphone shipments have readily doubled and successfully hit 1.2 billion in 2023. Likewise, Internet of Things (IoT) devices are expected to surge 2.5 times from 2023 to 39 billion by the end of 2029. Therefore, with the development in automation, there is a huge growth opportunity for the terminal automation market across different regions.

Region-wise Internet of Things (IoT) Devices Yearly Growth Analysis (2023-2029)

|

Year |

Northeast Asia |

Southeast Asia, Oceania, and India |

North America |

West Europe |

Central and East Europe |

Middle East and Africa |

Latin America |

|

2023 |

207,063 |

209,179 |

279,746 |

223,723 |

108,316 |

75,152 |

77,529 |

|

2024 |

2,343,159 |

282,491 |

320,599 |

258,056 |

125,505 |

89,408 |

89,963 |

|

2025 |

2,626,821 |

348,723 |

367,095 |

293,293 |

143,104 |

106,101 |

103,955 |

|

2026 |

2,906,121 |

439,470 |

416,970 |

330,358 |

161,709 |

125,326 |

120,202 |

|

2027 |

3,185,421 |

524,475 |

466,140 |

366,780 |

180,117 |

144,352 |

136,252 |

|

2028 |

3,464,721 |

635,520 |

518,606 |

405,701 |

199,872 |

164,424 |

153,276 |

|

2029 |

3,744,021 |

765,537 |

573,523 |

446,426 |

220,643 |

185,331 |

171,05 |

Source: UNCTAD Organization

Furthermore, the digital twin technology integration, along with blockchain integrity for supply chain transparency, autonomous equipment deployment, sustainability and green automation, and cybersecurity-embedded automation are other drivers fueling the terminal automation market expansion. As stated in an article published by Decision Analytics Journal in March 2023, by the end of 2027, more than 40% of large-scale organizations globally are projected to utilize digital twins in their projects to enhance their revenue. Besides, the technology market size was USD 8 billion as of 2022, which is further expected to grow by 25% by the end of 2032. Besides, as per the January 2025 World Economic Forum data report, 60% of global organizations have stated that geopolitical tensions have readily impacted their cybersecurity strategy, leading to an increase in cyber threats, which in turn is enhancing the market’s demand by adopting innovative cybersecurity protocols.

Key Terminal Automation Market Insights Summary:

Regional Highlights:

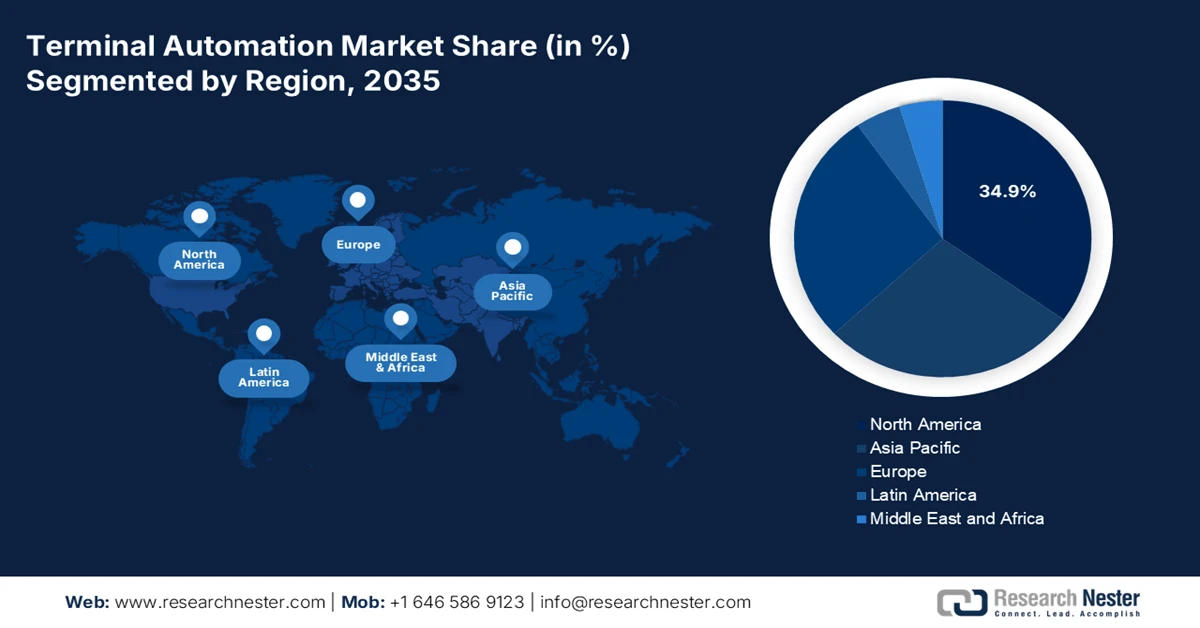

- North America is projected to command a 34.9% share of the terminal automation market by 2035, supported by sustained investments in broadband expansion, automation infrastructure, and 5G-enabled digitalization initiatives.

- Europe is expected to register the fastest growth trajectory through 2026–2035, reinforced by government-led digital infrastructure programs, port modernization efforts, and rising capital inflows into maritime logistics automation.

Segment Insights:

- The full terminal automation sub-segment under the operational scope category is forecast to account for a dominant 58.8% share of the terminal automation market by 2035, accelerated by its role in enhancing profitability, safety, and operational efficiency through reduced labor dependency and continuous port operations.

- The cloud-based deployment model is anticipated to secure the second-largest share by 2035, bolstered by its ability to centralize terminal operations, integrate IoT and AI analytics, and offer scalable, cost-efficient infrastructure management.

Key Growth Trends:

- Increase in government infrastructure investments

- Rise in international trade volumes

Major Challenges:

- Increased capital investment and integration expenses

- Cybersecurity risks and regulatory compliance

Key Players: Parker Hannifin, TechnipFMC, Weir Group, IMI plc, Samson AG,Petronas Digital Sdn Bhd, NEC Corporation, Wipro Limited, Infosys Limited.

Global Terminal Automation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 26.8 billion

- 2026 Market Size: USD 28.9 billion

- Projected Market Size: USD 53.1 billion by 2035

- Growth Forecasts: 7.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.9% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Vietnam, Indonesia, Brazil, Mexico

Last updated on : 27 January, 2026

Terminal Automation Market - Growth Drivers and Challenges

Growth Drivers

- Increase in government infrastructure investments: The presence of national programs in North America, Europe, and the Asia Pacific is readily funding smart port modernization, ICT equity, and broadband expansion, which is bolstering the terminal automation market’s adoption. Based on government estimates published by the Government of Canada in September 2025, the government in Canada deliberately made an investment of more than USD 180 billion for more than 12 years in infrastructure projects. These investments are being initiated by 21 federal departments and agencies within the country. Besides, the federal Canada Community-Building Fund effectively supports an estimated 5,000 infrastructure projects every year, with the New Building Canada Fund offering USD 11.8 billion in funding for ongoing projects, thus suitable for the market’s growth.

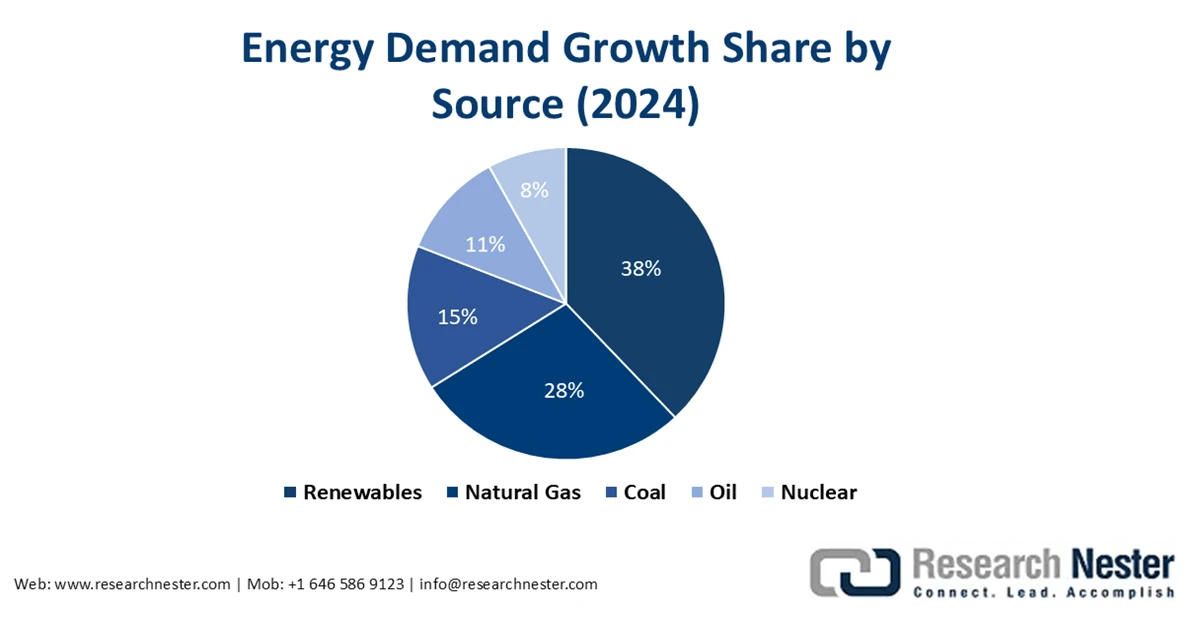

- Rise in international trade volumes: An increase in the energy and container traffic demand is significantly pushing terminals to automate rapid turnaround, which is proliferating the terminal automation market globally. According to official statistics published by the IEA Organization in 2025, there has been a surge in the global energy demand by 2.2% as of 2024, denoting a rapid rate than the yearly average of 1.3% as observed in 2023. This growth is recorded partly owing to the impact of extreme weather conditions, which has been estimated to add 0.3% points to the 2.2% growth. Despite this, the energy demand continuously grew, which further expanded by 3.2% in 2024. This growth is based on different sources, which is creating an optimistic outlook for the market’s growth and upliftment.

Source: IEA Organization

- Surge in private sector partnerships: The aspect of tactical collaborations between logistics operators and firms is escalating advancements in cloud-based, AI, and IoT automation, which is positively driving the terminal automation market globally. For instance, in November 2025, Rittal LLC and Eplan LLC jointly introduced 3 latest manufacturing automation products, along with a partnership with Rockwell Automation and Microsoft. This particular partnership accounted for the benefit of the 9.3% growth demand for manufacturing automation systems, which is further predicted to grow to more than USD 300 billion by the end of 2030. These products include RiLineX Power Platform, Eplan Platform 2026, and VX Hybrid Double Door, thus making it suitable for proliferating the market’s exposure.

Challenges

- Increased capital investment and integration expenses: The terminal automation market requires significant upfront investment in hardware, software, and ICT infrastructure. Deploying automated guided vehicles, IoT-enabled cranes, and advanced control systems can cost billions, particularly for large container and oil and gas terminals. Smaller operators struggle to justify these expenses, especially in regions with limited government subsidies. Integration with legacy systems adds complexity, as many terminals still rely on outdated manual processes. The cost of retraining staff, upgrading cybersecurity frameworks, and ensuring compliance with international standards further increases the financial burden. This challenge is particularly acute in developing economies, where funding constraints limit adoption.

- Cybersecurity risks and regulatory compliance: As the terminal automation market adopts IoT, cloud, and AI-driven automation, it becomes vulnerable to cyberattacks targeting critical infrastructure. Ports, along with oil and gas terminals, are high-value targets, with potential disruptions affecting global trade and energy supply chains. Governments are enforcing stricter compliance standards, such as GDPR in Europe and NIST frameworks in the U.S., requiring costly upgrades to meet cybersecurity mandates. The challenge lies in balancing automation efficiency with robust security protocols. Many operators lack skilled cybersecurity professionals, creating vulnerabilities in deployment. Additionally, regulatory fragmentation across regions complicates compliance, forcing multinational operators to adapt systems for different jurisdictions.

Terminal Automation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.9% |

|

Base Year Market Size (2025) |

USD 26.8 billion |

|

Forecast Year Market Size (2035) |

USD 53.1 billion |

|

Regional Scope |

|

Terminal Automation Market Segmentation:

Operational Scope Segment Analysis

The full terminal automation sub-segment, which is part of the operational scope segment, is anticipated to garner the highest share of 58.8% in the terminal automation market by the end of 2035. The sub-segment’s upliftment is highly driven by effectively bolstering profitability, safety, and efficiency in logistics and ports by reducing human error and labor expenses, and in turn, ensuring 24/7 handling and operations of large vessels. According to official statistics published by the Port Economics Management Organization in 2026, 75 major container terminals are partially or completely automated internationally, demonstrating almost 8.3% of overall terminal availability. Besides, automation has the ability to diminish operating expenses by 25% to 50%, and meanwhile, increase productivity by nearly 30%, thereby denoting a huge growth opportunity for the sub-segment.

Deployment Model Segment Analysis

By the end of the forecast period, the cloud-based segment is projected to hold the second-largest share in the terminal automation market. The segment’s growth is highly fueled by the ability to centralize operations, integrate IoT devices, and leverage AI-driven analytics without the need for heavy on-premise infrastructure. This model reduces capital expenditure, offering scalability and flexibility for operators managing multiple terminals across geographies. Real-time data sharing between stakeholders, such as shipping lines, customs authorities, and logistics providers, enhances transparency and efficiency. Cloud-based systems also support predictive maintenance, cybersecurity updates, and remote monitoring, which are critical for modernizing oil and gas and container terminals. The rise of hybrid cloud adoption further strengthens resilience, balancing local control with global scalability.

Terminal Type Segment Analysis

The container terminals sub-segment, part of the terminal type segment, is expected to account for the third-largest share in the terminal automation market during the stipulated duration. The sub-segment’s development is highly attributed to international trade expansion, rising container traffic, and port modernization initiatives. Automated guided vehicles (AGVs), robotic cranes, and terminal operating systems (TOS) are being deployed to reduce vessel turnaround times and increase cargo throughput. Container terminals benefit significantly from IoT-enabled monitoring, which provides real-time visibility into cargo movements and equipment performance. Governments worldwide are investing in smart port infrastructure, with the Asia Pacific leading through large-scale projects in China, India, and Singapore.

Our in-depth analysis of the terminal automation market includes the following segments:

|

Segment |

Subsegments |

|

Operational Scope |

|

|

Deployment Model |

|

|

Terminal Type |

|

|

Offering |

|

|

Automation Technology |

|

|

End user Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Terminal Automation Market - Regional Analysis

North America Market Insights

North America terminal automation market is anticipated to hold the largest share of 34.9% by the end of 2035. The market’s upliftment in the region is primarily attributed to generous investments in broadband, automation infrastructure, and 5G, along with digitalized equity strategies and federal programs. According to official statistics published by the Benton Institute for Broadband and Society Organization in August 2024, the Bipartisan Infrastructure Law significantly developed the Broadband Equity, Access, and Deployment (BEAD) Program to allocate a portion of the USD 42 billion investment. This particular investment provision makes the government responsible for distributing suitable grants among internet service providers to keep the population connected. Therefore, this denotes an optimistic outlook for the market’s exposure in the overall region.

The terminal automation market in the U.S. is growing significantly due to the provision of federal investments, port modernization, enabling automation in terminals and logistics, and ensuring domestic 5G coverage. As per a data report published by the CTIA Organization in April 2023, the 5G economy in the country readily contributed from USD 1.4 trillion to USD 1.7 trillion. In addition, the deployment of this wireless system is poised to create 3.8 million to 4.6 million employment opportunities and is further expected to uplift advancement throughout the nation. Besides, the high-band spectrum, which is commonly known as millimeter wave, is required to achieve the highest speeds, owing to its utilization of large amounts of spectrum above 10 GHz. Therefore, based on all the 5G coverage advancements, there is a huge growth opportunity for the terminal automation market in the country.

The terminal automation market in Canada is also growing, owing to the provision of high-speed internet services, automation implementation in energy terminals, along with industrial collaborations for digitalized transformation. As stated in an article published by the Government of Canada in August 2025, the USD 3.2 billion Universal Broadband Fund readily supports high-speed internet projects throughout the country. These projects tend to provide internet at speeds of 50 or 10 Megabits per second (Mbps) to remote and rural communities. Additionally, the funding comprises USD 50 million for mobile internet projects, along with USD 750 million for high-impact and large projects. These funds are generated through a rapid response stream for shovel-based projects that can be rapidly completed, thus denoting a positive impact on the market’s expansion in the country.

Europe Market Insights

Europe terminal automation market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by government-backed digital infrastructure programs, port modernization, and robust investments. According to official statistics published by the Europe Blue Economy Report as of 2025, 74% of goods enter or leave the region through transportation by sea. Besides, almost 400 million passengers disembark or embark in regional ports every year. Meanwhile, the gross value added (GVA) generated by the port activities industry amounted to €33 billion, denoting a 12% rise. In addition, the reported turnover amounted to €89.8 billion as of 2022, which marked the sharpest year-on-year (YoY) increase by 19% on a record of €14.2 billion. This has led to a surge in gross profit, making it suitable for bolstering the terminal automation market in the region.

Turnover, GVA, and Gross Operating Surplus for Ports in Europe (2013-2023)

|

Year |

Turnover (€ Billion) |

GVA (€ Billion) |

Gross Operating Surplus (€ Billion) |

|

2013 |

63.5 |

15.8 |

6.4 |

|

2014 |

63.8 |

15.8 |

6.2 |

|

2015 |

64.9 |

16.4 |

6.7 |

|

2016 |

65.3 |

16.7 |

6.4 |

|

2017 |

70.4 |

18.9 |

7.4 |

|

2018 |

72.9 |

19.7 |

7.6 |

|

2019 |

74.2 |

20.3 |

7.9 |

|

2020 |

58.1 |

14.1 |

4.8 |

|

2021 |

68.9 |

18.8 |

8.2 |

|

2022 |

89.1 |

25.1 |

12.1 |

|

2023 |

93.3 |

26.3 |

12.3 |

Source: Europe Blue Economy Report

The terminal automation market in Germany is gaining increased traction due to the presence of port modernization programs, government-based digitalized infrastructure, and robust investments. As stated in an article published by Global Trade Alert, in December 2024, the Europe Commission deliberately approved EUR 4.0 billion as a financial grant for Deutsche Energy Terminal's (DET). This significantly supports DET’s operation of 4 storage and regassification units for importing liquified natural gas. Besides, as per the 2024 Telecoms Annual Report, there has been an increase in the external revenue of the country’s telecommunications industry to €61.1 billion as of 2024, denoting a YoY surge by 2.2%, in comparison to €59.8 billion in 2023. Additionally, there has also been a rise by 6.6% against the previous year to €27.4 billion, thus creating a positive impact on the market.

The terminal automation market in the UK is also developing due to expansion in the digital infrastructure, smart logistics, compliance and cybersecurity, achieving net zero objectives, and industrial collaborations. As per an article published by the UK Government in January 2025, the public sector in the country comprises enormous digital resources and spends more than £26 billion yearly on digital technology. Additionally, the sector also employs a workforce of almost 100,000 data and digital professionals for delivering millions of online transactions per day. Moreover, the country’s cloud-first policy has been accelerated by suitable cloud transformation budgets, denoting that 55% of central government organizations stated that more than 60% of estate are on the cloud, thus proliferating the market’s growth.

APAC Market Insights

The Asia Pacific terminal automation market is projected to witness considerable expansion by the end of the stipulated timeline. The market’s growth in the region is highly fueled by artificial intelligence-based predictive analytics, IoT-enabled monitoring, rising demand among consumers, and oil and gas terminals. According to official statistics published by the OECD in 2023, the substantial transformation of the broadband landscape in Southeast Asia has successfully reached 769 million subscriptions. In addition, mobile subscriptions constitute more than 92% of overall subscriptions, denoting a dynamic mobile broadband sector with an average yearly growth rate of 25%. Besides, fixed broadband subscriptions in Singapore are the highest, according to 27.4 per 100 inhabitants and 21.7 in Vietnam, thus creating a huge growth opportunity for the market in the region.

The terminal automation market in China is gaining increased exposure due to spending on automation technologies, rapid adoption across enterprises, smart port, belt, and road initiative, as well as the IoT and AI integration. As per an article published by the State Council Information Office in July 2024, the number of AI-based language models globally has reached 1,328, with 36% deriving from the country, which is considered the second-largest proportion. Besides, among almost 30,000 AI-driven enterprises internationally, the country accounted for 15%. Simultaneously, the country has developed more than 3.8 million 5G base stations, readily accounting for over 60% of the international total. Moreover, as per the May 2025 State Council Information Office article, smart factories in the country result in the Midea factory delivering over 80,000 industrial robots, which is positively impacting the market’s growth.

The terminal automation market in India is also growing, owing to the rapid adoption across energy and logistics terminals, digitalized equity programs, and government-based technological investments. As stated in a data report published by the NITI Government in September 2025, the AI adoption in the country is projected to add USD 17 trillion to USD 26 trillion to the international economy. Besides, the country’s combination of a massive STEM workforce, expanded research and development ecosystem, along with growth in technology and digital capabilities, has readily positioned the country to be a part of this transformation, with the potential to achieve 10% to 15% of worldwide AI valuation. Based on this, the country’s present growth rate is 5.7%, with a projected gross domestic product (GDP) accounting for USD 6.6 trillion by the end of 2035, which is suitable for bolstering the market’s growth.

Key Terminal Automation Market Players:

- Honeywell International Inc. (U.S.)

- Emerson Electric Co. (U.S.)

- Rockwell Automation Inc. (U.S.)

- Schneider Electric SE (France)

- Siemens AG (Germany)

- ABB Ltd. (Switzerland)

- Yokogawa Electric Corporation (Japan)

- Mitsubishi Electric Corporation (Japan)

- Hitachi Ltd. (Japan)

- Samsung SDS Co., Ltd. (South Korea)

- LG CNS Co., Ltd. (South Korea)

- Tata Consultancy Services (India)

- Infosys Limited (India)

- Wipro Limited (India)

- NEC Corporation (Japan)

- Panasonic Corporation (Japan)

- Telstra Corporation Limited (Australia)

- Sapura Energy Berhad (Malaysia)

- Petronas Digital Sdn Bhd (Malaysia)

- BP p.l.c. (UK)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- Honeywell International Inc. is a leading provider of integrated terminal automation solutions, particularly in oil & gas and logistics terminals. Its focus on IoT-enabled monitoring and cybersecurity frameworks has positioned it as a key player in modernizing global terminal infrastructure.

- Emerson Electric Co. specializes in automation systems for liquid and bulk terminals, leveraging advanced SCADA and control technologies. The company’s emphasis on predictive analytics and energy efficiency supports compliance with global sustainability mandates.

- Rockwell Automation Inc. delivers industrial automation platforms that integrate with terminal operating systems. Its strength lies in modular solutions that enhance operational efficiency and reduce downtime across container and energy terminals.

- Schneider Electric SE provides cloud-based automation and energy management systems for terminals. Its solutions emphasize sustainability, aligning with Europe decarbonization goals while enabling smart port and logistics automation.

- Siemens AG is a major player in terminal automation, offering digital twin and AI-driven solutions for container and bulk terminals. Its strong presence in Europe is supported by government-backed port modernization and Industry 4.0 initiatives.

Here is a list of key players operating in the global terminal automation market:

The international terminal automation market is highly competitive, with U.S., Europe, and Asia-based players dominating through strategic investments in digital infrastructure, AI-driven solutions, and cloud-based platforms. Companies such as Honeywell, Siemens, and Yokogawa leverage government-backed ICT programs to expand market share, while Indian firms like TCS and Infosys focus on cost-efficient automation services. South Korea and Japan-specific manufacturers emphasize IoT integration and smart port modernization. Strategic initiatives include mergers, research and development collaborations, and sustainability-driven automation. Besides, in September 2025, INVT and Qingdao Port successfully set the latest benchmark for conventional terminal automated upgradation. This has been possible by developing the Research and Application of Fully Autonomous Key Technologies for Automated Rail-Mounted Gantry Cranes project, which is positively impacting the terminal automation industry’s growth.

Corporate Landscape of the Terminal Automation Market:

Recent Developments

- In January 2026, Changi Airport effectively deployed its first fleet of completely driverless autonomous tractors for airside operations. This particular launch signaled Singapore’s commitment to readily pioneering smart airport technologies that have set a suitable benchmark for operations.

- In December 2025, Kalmar notified the signing of the newest 10-year tactical supply deal with Patrick Terminals. This has significantly reinforced a partnership that has been notable to Australia’s leading container terminal operator for over 2 decades.

- In October 2025, Rockwell Automation, Inc. introduced a lineup of the latest technologies, including the ControlLogix 5590 Controllers, which is followed by the EtherNet/IP In-cabinet Solution, M100 Electronic Motor Starter, the Armor PowerFlex 330 Distributed Drive Motor, along smart software technologies.

- Report ID: 8363

- Published Date: Jan 27, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Terminal Automation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.