Telecom Service Assurance Market Outlook:

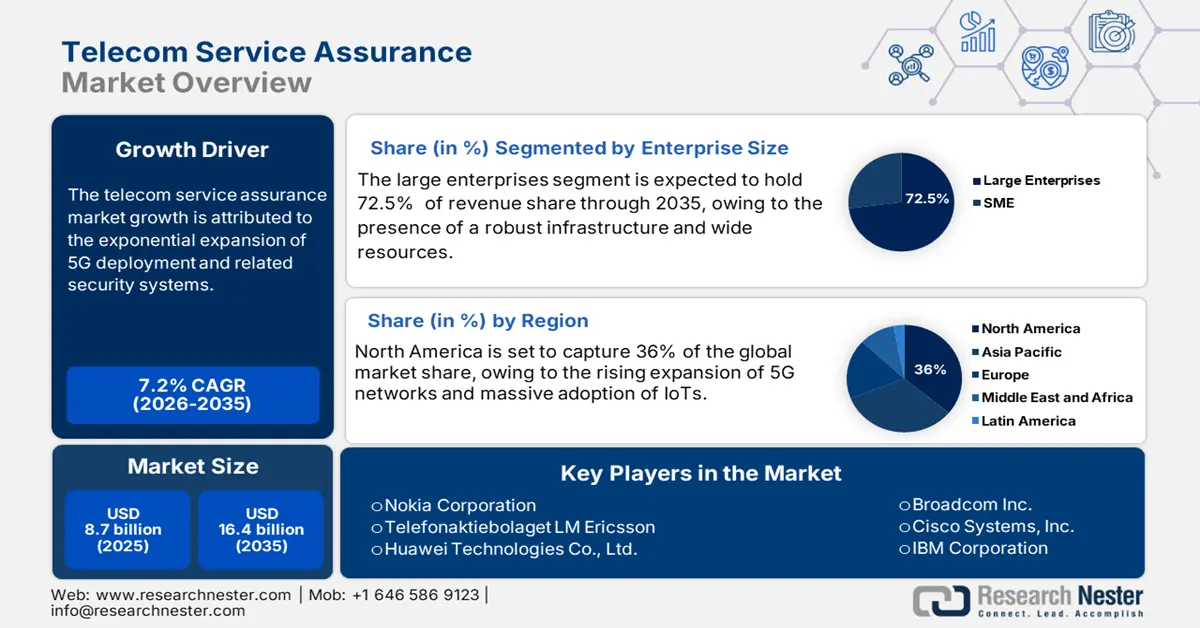

Telecom Service Assurance Market size was valued at USD 8.7 billion in 2025 and is projected to reach USD 16.4 billion by the end of 2035, rising at a CAGR of 7.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of telecom service assurance is estimated at USD 9.3 billion.

Distinguished economic indicators highlight the pricing dynamics influencing the overall market. The U.S. Bureau of Labor Statistics asserted that the Producer Price Index (PPI) for various telecommunication services has shown variations, owing to market competitiveness and technological upgradation. For example, the Federal Reserve Bank of St. Louis estimates that the PPI for telecommunication stood at 114.421 in June 2025. Also, the Consumer Price Index showcases alterations in consumer prices for telecommunications services, which condition investment decisions within the industry. The U.S. Bureau of Labor Statistics (BLS) discloses that the relative importance of education and communication, including telephone and IT services, was calculated at 5.732 in December 2024. Several governments are investing in cybersecurity and network resilience to enhance performance and reliability, which fuels the demand for advanced service assurance solutions.

Key Telecom Service Assurance Market Insights Summary:

Regional Insights:

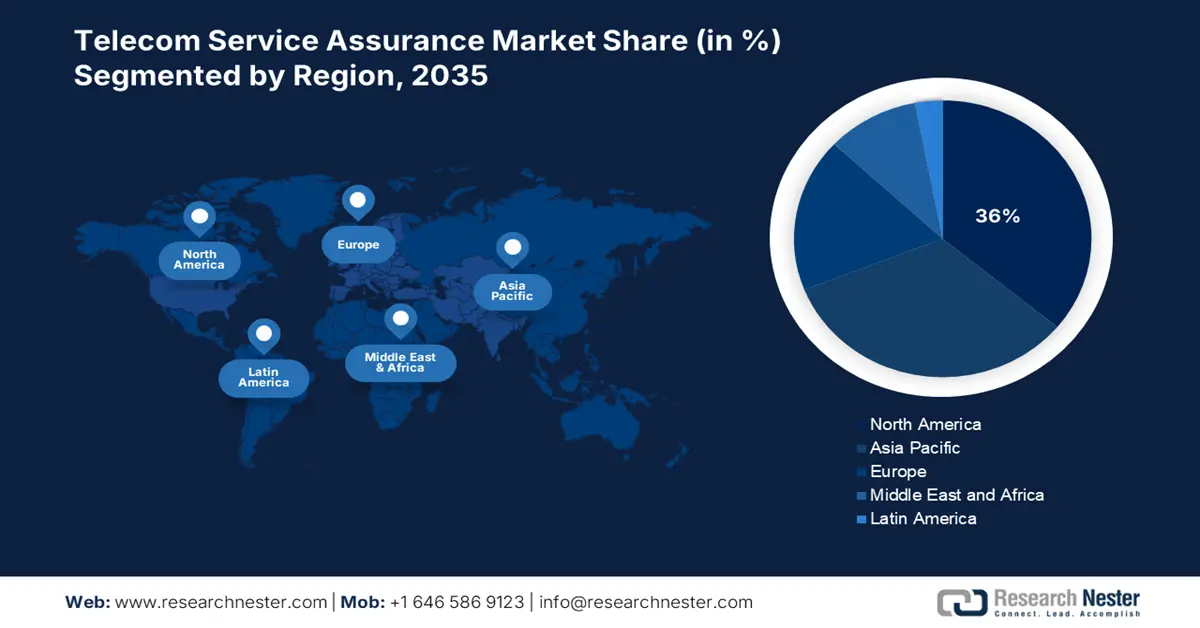

- By 2035, North America is forecast to secure a 36% share of the telecom service assurance market, attributable to rising 5G rollouts and expanding IoT adoption.

- By 2035, Asia Pacific is anticipated to command a 33.3% share, supported by rapid digital transformation and government-backed digital infrastructure initiatives.

Segment Insights:

- By 2035, the solution segment is expected to hold a 66.6% share in the telecom service assurance market, propelled by the increasing complexity of telecom networks.

- Through 2035, large enterprises are set to achieve a 72.5% share, underpinned by their well-established infrastructure and extensive operational resources.

Key Growth Trends:

- Rising 5G network deployment and associated security measures

- Standardization efforts for interoperability

Major Challenges:

- Regulatory complexity and compliance costs

- Lack of infrastructure readiness

Key Players: Telefonaktiebolaget LM Ericsson, Huawei Technologies Co., Ltd., Broadcom Inc., Cisco Systems, Inc., IBM Corporation, Hewlett Packard Enterprise, Amdocs Limited, Accenture PLC, Tata Consultancy Services Limited, NEC Corporation, Spirent Communications plc, Comarch S.A., TEOCO Corporation, EXFO Inc.

Global Telecom Service Assurance Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.7 billion

- 2026 Market Size: USD 9.3 billion

- Projected Market Size: USD 16.4 billion by 2035

- Growth Forecasts: 7.2%

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Brazil, Singapore, Australia

Last updated on : 22 August, 2025

Telecom Service Assurance Market - Growth Drivers and Challenges

Growth Drivers

- Rising 5G network deployment and associated security measures: The rollout of the 5G networks is fostering the demand for service assurance solutions. Service providers are required to ensure security and compliance. The 5G architecture is complex and is susceptible to vulnerabilities towards breaches and signaling storms. In August 2021, T-Mobile witnessed an API breach affecting more than 7.5 million customer records. These types of cases highlight security gaps in 5G infrastructure. Also, the World Economic Forum (WEF) estimates that nearly 45.0% of organizations are more vulnerable to ransomware attacks, followed by cyber-enabled fraud (20%). Considering this as an opportunity, telecom companies are investing in AI-driven service assurance platforms to overcome the cyber threat challenges.

- Standardization efforts for interoperability: The efforts for standardization for smoothly conducting 5G interoperability are acting as a catalyst for the telecom service assurance market. This standardization is important to ensure seamless integration and boost security. Various organizations are fabricating protocols to unify multi-vendor networks and bolstering demand for the service assurance market. Many end users are adopting service assurance platforms to adhere to the compliance with the 3rd Generation Partnership Project standards and reduce network outages. Furthermore, the new ITU-T standards updates between 2022 and 2024 made it easier for telecom companies to monitor network quality automatically. These updates use the same measurements to spot problems across different types of networks, helping companies find and fix issues consistently.

Challenges

- Regulatory complexity and compliance costs: The compliance costs significantly rise when numerous parameters across countries change. This also results in a delay in entering in particular market. For example, technical regulations and conformity assessments in India impose significant barriers for foreign firms, requiring exhaustive testing and certification processes.

- Lack of infrastructure readiness: The unavailability of adequate infrastructure, particularly in underdeveloped and developing regions, is hampering the deployment of assessment solutions in the telecom industry. For instance, one in four towers in India are not effective in incorporating advanced telecom services, as these limit the capability of harnessing the advanced telecom services.

Telecom Service Assurance Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.2% |

|

Base Year Market Size (2024) |

USD 8.7 billion |

|

Forecast Year Market Size (2037) |

USD 16.4 billion |

|

Regional Scope |

|

Telecom Service Assurance Market Segmentation:

Component Segment Analysis

The solution segment is projected to dominate the market with a 66.6% share, owing to the increasing complexity of the telecom networks. The sales of telecom service assurance solutions are also driven by the surge in adoption of various technologies such as 5G and IoT. Network management and fault management services are the most commonly in demand among telecom service vendors. The ability to render real-time data analysis is imperative for telecom operators willing to enhance their overall service delivery.

Enterprise Size Segment Analysis

Large enterprises are expected to hold 72.5% of the global market share through 2035, owing to the presence of well-established infrastructure and extensive resources. The TSA tools aid in managing ultra-complex networks and render enhanced services across various countries. For instance, large enterprises such as BMW utilize ATS solutions, particularly 5G network slicing, in their production factories for maintaining low latency. There has been increased focus on enhancing customer experience, which is compelling large companies to allocate budget for buying solutions to enable proactive management.

Deployment Segment Analysis

The on-premise segment is likely to hold a leading market share throughout the forecast period, owing to a mix of regulatory, operational, and security priorities among telecom operators. The data sovereignty and compliance needs are fueling the deployment of on-premise telecom service assurance platforms. The strict data protection regulations are prompting service providers to install network performance data in-house to maintain control over sensitive information. On-premise systems allow telecom companies to tailor their service assurance tools to fit their specific network setup, which also increases their adoption rates. The increasing cases of cyber threats targeting telecom networks are necessitating companies to invest in on-premise solutions as they provide better control over security measures.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Operator Type |

|

|

Deployment |

|

|

Enterprise Size |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Telecom Service Assurance Market - Regional Analysis

North America Market Insights

North America is expected to capture 36% of the global market share through 2035, owing to the increasing 5G rollouts and expanding adoption of IoT devices. The presence of well-established infrastructure and prominent companies is also contributing to the high trade of telecom service assurance solutions. The U.S. and Canada are both the most profitable marketplaces due to hefty public spending in the telecommunications sector.

U.S. market is experiencing significant growth owing to rising demand for reliable internet services. The Federal Communications Commission (FCC) plays a crucial role in this expansion, executing policies that stimulate the adoption of service assurance solutions to upgrade service quality. Also, the Cybersecurity & Infrastructure Security Agency 2023 guidelines highlight the importance of incorporating TSA to make a robust infrastructure against any cyber threats. The efforts from the government and investment from the private sector in advanced telecommunication are also fueling the market growth in the country.

Asia Pacific Market Insights

Asia Pacific is anticipated to account for 33.3% of the global telecom services assurance market share throughout the study period. This can be attributed to the rapid digital transformation and supportive government schemes. In Japan, the Ministry of Economy, Trade and Industry (METI) raises a hefty ICT budget, focusing on upgrading digital infrastructure and service assurance technologies. The transition to cloud-native and software-defined networks is also amplifying the demand for assurance platforms. Furthermore, end users in South Korea and Australia are focusing on AI-driven predictive analytics to reduce downtime, while Southeast Asian countries are adopting scalable, cost-effective TSA solutions to support rural connectivity expansion.

The telecom service assurance market in India is foreseen to increase at the fastest CAGR from 2026 to 2035, primarily due to the robust rollout of 5G and fiber broadband solutions. The Digital India and BharatNet Phase III initiatives are also accelerating network expansion into rural areas, creating a profitable space for telecom service assurance producers. For instance, the Telecom Regulatory Authority of India (TRAI) in its annual report (2023-24) reveals that the country is home to the world’s second-largest pool of 825 million mobile broadband users. Further, it also states that the 5G service launched in 2022 took a boom in just 18 months, and crossed 4,38,000 sites covering over 700 districts. Overall, India is the most lucrative marketplace for telecom service assurance companies.

Europe Market Insights

Europe market is set to increase at a robust pace, owing to the rise in fiber-to-the-home (FTTH) penetration and regulatory emphasis on quality of service (QoS). According to the European Commission, nearly 94% of EU households had access to the Internet in 2024, driving the need for advanced telecom analytics solutions. Also, the EU telecom regulations necessitating operators to meet strict service quality benchmarks on latency, packet loss, and uptime are driving investments in automated fault management and predictive analytics solutions. Furthermore, the advanced infrastructure and industrial digitalization moves are fueling the sales of advanced telecom service assurance solutions.

Germany leads the sales of telecom service assurance solutions due to the strong 5G rollout momentum and high fiber adoption rates. According to Bundesnetzagentur (BNetzA), 5G coverage reached over 90% of the population by late 2024. Also, more than 75.5% of households have access to gigabit-capable connections. The massive investment in real-time network monitoring and automated root cause analysis is further creating high-earning opportunities for telecom service assurance companies.

Key Telecom Service Assurance Market Players:

- Nokia Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Telefonaktiebolaget LM Ericsson

- Huawei Technologies Co., Ltd.

- Broadcom Inc.

- Cisco Systems, Inc.

- IBM Corporation

- Hewlett Packard Enterprise

- Amdocs Limited

- Accenture PLC

- Tata Consultancy Services Limited

- NEC Corporation

- Spirent Communications plc

- Comarch S.A.

- TEOCO Corporation

- EXFO Inc.

The competitive landscape of the telecom services assurance market is rapidly evolving as established key players, IT giants, and new entrants are investing in novel technologies. Key players in the market are focused on developing products catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies, such as mergers and acquisitions, joint ventures, partnerships, and novel product launches, to enhance their product base and strengthen their market position.

Here is a list of key players operating in the global telecom service assurance market:

Recent Developments

- In June 2025, Anritsu announced the launch of its Fixed Broadband Assurance Solution. This new tool gives fixed broadband providers clear insights, smart analytics, and automation to improve their services worldwide.

- In November 2024, SK Telecom implemented an AI-driven customer service system using multimodal models. These advancements enhance service efficiency and consumer satisfaction by leveraging AI-driven consumer interaction.

- In June 2024, Cognizant introduced Telco Assurance 360 solutions. This is an AI-powered service assurance for the telecommunications industry

- In February 2023, Tech Mahindra launched Sandstorm, a remote network monitoring and smart device assurance service. This solution renders real-time insights into app-network interactions, upgrading development speed and lowering time-to-market for operators.

- Report ID: 1928

- Published Date: Aug 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Telecom Service Assurance Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.