SUV (Sports Utility Vehicle) Overview

SUV (Sports Utility Vehicle) is also termed as suburban utility vehicle classified as a light truck, but used as family vehicle. It is featured with raised grounds clearance and roughness. Basically, SUV type vehicle is meant for rough road and commonly used on streets and highways. It also features with high seating position, upright build body, tall interior packaging and also include the towing capacity of a pickup truck. It is a kind of vehicle in which all the four wheels works at the same time, based on regular automotive platforms for lighter weight and better fuel efficiency. It is segmented to petrol cars, diesel cars and electric cars. In USA, SUV is considered not as a car but as a light truck. Some SUV’s are 7-8 seated vehicle and some are hatch bag vehicle.

Market Size and Forecast

Global SUV market is anticipated to register a CAGR of 11.2% over the forecast period 2018-2027. Additionally, the market of SUV sales is projected to reach 53.2 Million units by 2027 from 26.8 Million units registered in 2017. This significant growth of the SUV market can be attributed to rising awareness about the advantages of SUV such as more cargo space, off-road capabilities and others. Further, development and manufacturing of advance light truck vehicle is expected to strengthen the growth of SUV market.

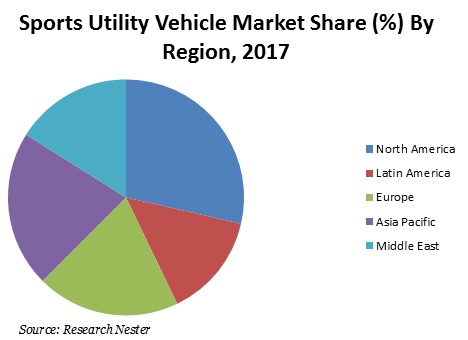

In the regional platform, Asia Pacific is the largest market in the term of market share of overall SUV market. Further, Asia Pacific countries such as China and Japan are expected to continue its dominance over the forecast period. The market of SUV is majorly driven by the rising demand for heavy passenger vehicle in SUVs segments. Asia Pacific is expected to contribute significant revenue to global SUV market during the forecast period. Growing replacement needs are anticipated to generate sustainable demand for SUVs in the upcoming years. Europe SUV market is expected to grow at a significant pace over the forecast period. Further, the market of SUV in North America is projected to grow at highest CAGR during the forecast period. The demand for SUV in North America is expected to get escalated by the ongoing automotive modernization programs. Increasing automotive spending by population is envisioned to positively impact the growth of SUV market. Moreover, rising standard of living in Asia Pacific countries is expected to fuel the demand for SUV during the forecast period.

Market Segmentation

By Product type

- SUV-C

- SUV-D

- SUV-E

- SUV-F

By Fuel Type

- Diesel

- Petrol

- Electric SUV

- Others

By Price Range

- Medium

- Premium

By Region

Global SUV market is further classified on the basis of region as follows:

- North America (United States, Canada), Market size, Y-O-Y growth Market size, Y-O-Y growth & Opportunity Analysis, Future forecast & Opportunity Analysis

- Latin America (Brazil, Mexico, Argentina, Rest of LATAM), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis

- Europe (U.K., Germany, France, Italy, Spain, Hungary, BENELUX (Belgium, Netherlands, Luxembourg), NORDIC (Norway, Denmark, Sweden, Finland), Poland, Russia, Rest of Europe), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis

- Asia-Pacific (China, India, Japan, South Korea, Malaysia, Indonesia, Taiwan, Hong Kong, Australia, New Zealand, Rest of Asia-Pacific), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis

- Middle East and Africa (Israel, GCC (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman), North Africa, South Africa, Rest of Middle East and Africa), Market size, Y-O-Y growth, Future forecast & Opportunity Analysis

Growth Drivers and Challenges

Increasing demand and sale of the light truck and off road car is anticipated to be the key factor behind the growth of the SUV market. Further, rising disposable income coupled with increasing purchasing power of the population is resulting in more demand of the automotive. This factor is likely to boost the growth of the automotive market over the forecast period. SUV cars market is primarily driven by the adoption of the diesel SUV cars in the populated cities across the globe. In future, electric SUV cars are anticipated to drive the growth of the market. Further, the rapid pace of urbanization and growth in the automotive industry is expected to positively influence the SUV car industry.

There are some countries that showcase the markets where SUVs still have big growth potential. This is particularly the case with Argentina, Malaysia, Turkey, Brazil, Mexico, India and South Africa, where the SUV’s market share is still under 28%, but growth is quite fast. Car sales in these seven markets totaled 10.2 Million Units – or around 10% of the global total SUV sales and SUVs market share was 20.6%, leaving a lot of room for further growth. Moreover, the automotive car manufacturers are trying to cater to the metropolitan ways of life of consumers and are adding appealing features to the cars. Therefore, the manufacturers in order to meet the rising needs of the consumers are diversifying their product portfolio. This factor is believed to growth of the market.

The SUV market is expected to grow at a higher pace in North America, Asia Pacific and Europe. The growing demand for sub-compact SUVs can be attributed to the various advantages offered by the vehicle segment, including greater fuel efficiency than passenger cars due to its small engine, compact body (as compared to full-sized SUVs) and excise duty rebate in a majority of countries. In India, sub-4 meter vehicles have 8% excise duty, compared to 27% for vehicles that are over 4 meters in length. In contrast, high cost of the light truck SUV cars is anticipated to hinder the growth of the global SUV market. On the other hand, lower fuel efficiency is very high as compared to other vehicle and it also burns more gas, which leads many to refer it gas “guzzler”. In many countries SUV cars has also increased the car insurance rates because of increased risk of accidental cases.

Top Featured Companies Dominating the Market

- Daimler AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- General Motors Corporation

- Toyota Motor Corporation

- Mitsubishi Motors Corporation

- BYD Auto Co. Ltd

- Volkswagen AG

- BMW AG

- Honda Motor Co. Ltd

- Hyundai Motor Company

- Other Key Players

- Report ID: 799

- Published Date: Feb 09, 2023

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Sports Utility Vehicle Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert