Luxury SUV Market Outlook:

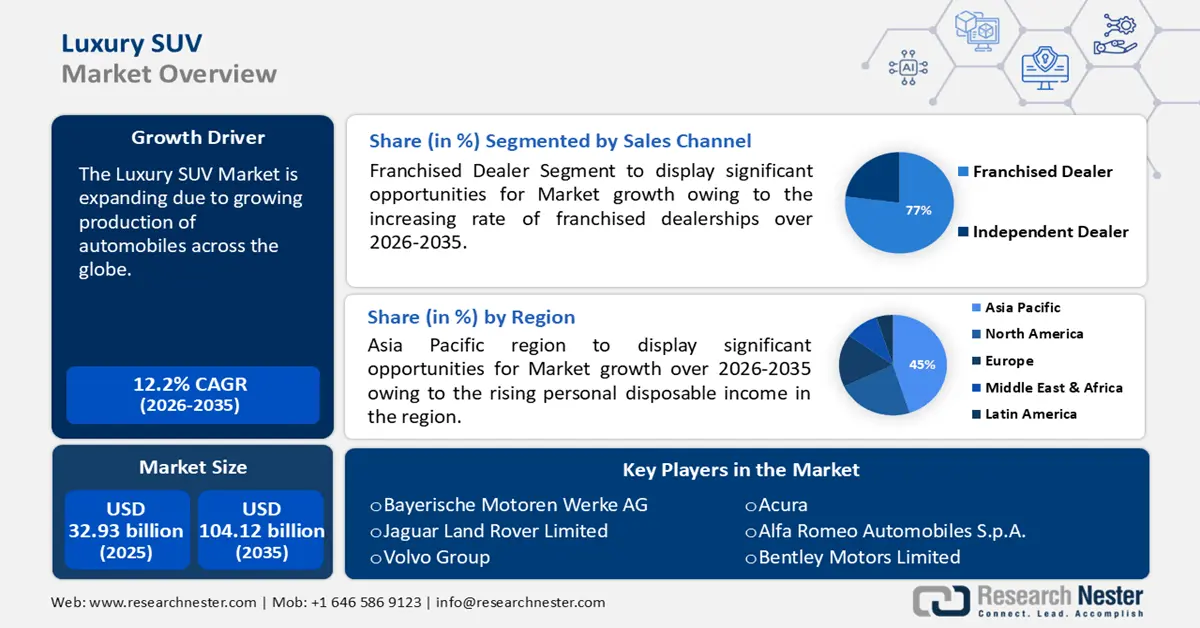

Luxury SUV Market size was valued at USD 32.93 billion in 2025 and is expected to reach USD 104.12 billion by 2035, registering around 12.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of luxury SUV is evaluated at USD 36.55 billion.

The reason behind the growth is the increasing production of automobiles across the globe, leading to more options in the luxury SUV landscape. According to the International Organization of Motor Vehicle Manufacturers (OICA), the estimated world vehicle motor production in the year 2023 was approximately 93546599 units. Global auto sales, on the other hand, grew significantly in 2023, and future growth is expected as a result of heightened consumer interest, new government regulations, and industry support.

Key Luxury SUV Market Insights Summary:

Regional Highlights:

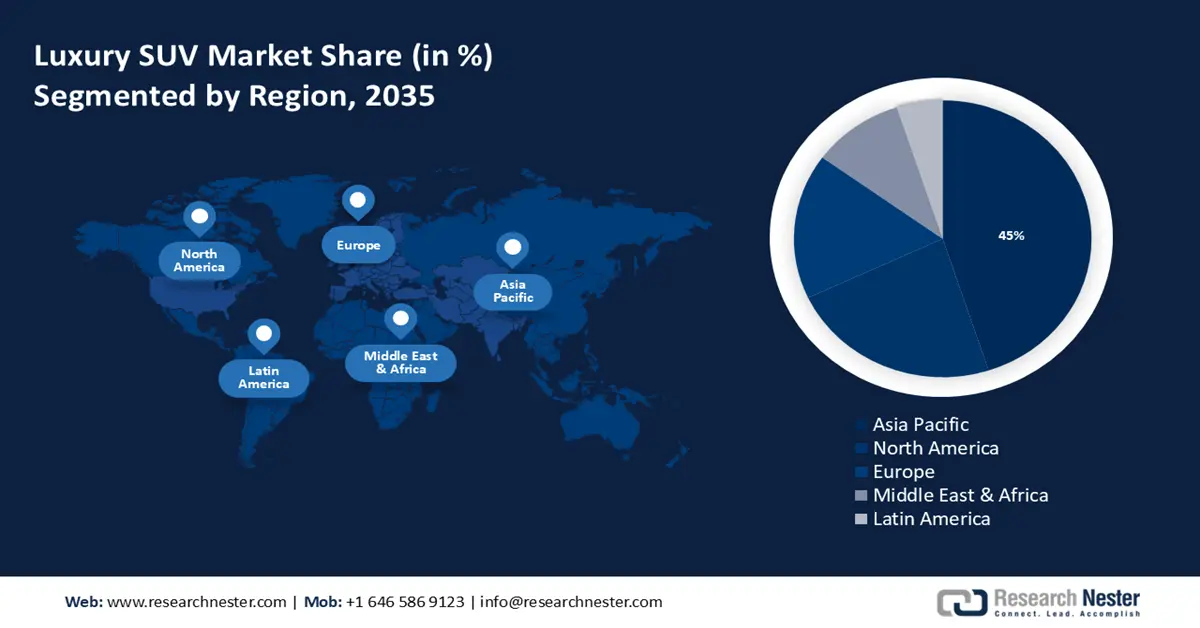

- Asia Pacific luxury SUV market is expected to capture 45% share by 2035, driven by rising personal disposable income and robust economic growth, increasing demand for luxury SUVs in countries like China, South Korea, and Japan.

- North America market will achieve substantial CAGR during 2026-2035, attributed to the increasing popularity of luxury SUVs driven by demand for status, advanced technology, and exceptional performance.

Segment Insights:

- The franchised dealer segment in the luxury suv market is projected to secure a 77% share by 2035, fueled by the increasing number of franchised dealerships and their role in global auto sales.

- The hybrid/electric segment in the luxury suv market is anticipated to hold a notable revenue share by 2035, driven by the rising launch of hybrid variants and the shift towards electric vehicles to reduce pollution.

Key Growth Trends:

- Surging number of road accidents

- Technological developments in the luxury SUV market

Major Challenges:

- Varying prices of fuel

- Stringent safety regulations

Key Players: AUDI AG, Bayerische Motoren Werke AG, Jaguar Land Rover Automotive PLC, Volvo Group, Acura, Alfa Romeo Automobiles S.p.A., Bentley Motors Limited, Cadillac, GMC.

Global Luxury SUV Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 32.93 billion

- 2026 Market Size: USD 36.55 billion

- Projected Market Size: USD 104.12 billion by 2035

- Growth Forecasts: 12.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Luxury SUV Market Growth Drivers and Challenges:

Growth Drivers

- Surging number of road accidents - Traffic accidents are "a worldwide tragedy that may augment the market demand for luxury cars as they have the best safety features, which include adaptive cruise control, automatic high beams, traffic sign recognition, blind-spot monitoring, and rear cross-traffic alert.

Also, automatic emergency braking and lane keeping are created to guard against collisions, shield passengers from harm, warn drivers of potential dangers, and even act independently to prevent crashes.

According to the World Health Organization (WHO), an estimated 1.19 million people lose their lives in traffic-related incidents each year. - Technological developments in the luxury SUV market- Technological developments in the luxury SUV sector have given rise to more sustainable and effective production techniques, and as electric car technology advances, more environmentally friendly luxury SUVs should hit the luxury SUV market.

For instance, 2025's next generation the new BMW X3 has been introduced with an improved battery with a larger net energy capacity that will increase the electric cruising range which will aid in saving gasoline. - Growing importance of fuel efficiency - It is observed that for those purchasing cars, fuel economy is a constant concern, which is anticipated to propel the demand for luxury SUVs with improved production techniques, designs, and drivetrain technology to the point that they are just as efficient as compact cars and aim to meet the same fuel efficiency requirements.

According to a World Economic Forum survey, over 66% of poll participants are considering purchasing a car, with fuel efficiency being critical to their decision.

Challenges

- Varying prices of fuel - Gas prices vary over time and between states and regions, and it has been observed that when gas prices increase, new buyers of luxury SUVs are discouraged, and the demand for smaller, more fuel-efficient cars grow proportionately to the desire for larger, less fuel-efficient vehicles.

- Stringent safety regulations - There are costs associated with enforcing rules aimed at enhancing vehicle safety, energy efficiency, and the environment since manufacturers will need to make large investments to comply with the new safety regulations, which often increase production costs and restrict the marketing and sales of luxury SUVs.

Luxury SUV Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 32.93 billion |

|

Forecast Year Market Size (2035) |

USD 104.12 billion |

|

Regional Scope |

|

Luxury SUV Market Segmentation:

Sales Channel Segment Analysis

Franchised dealer segment is estimated to dominate luxury SUV market share of over 77% by 2035. The segment growth can be attributed to the increasing rate of franchised dealerships. The franchise dealership business model has significantly impacted global auto sales during the last century and has continued to be a significant economic cornerstone since these companies are authorized and permitted to sell automobiles as a major automaker's direct representatives.

Expert mechanics at franchised dealerships are capable of providing a special combination of advantages that meet a variety of customer needs to distinguish themselves in the luxury SUV market with their assurance of authenticity and quality as well as their extensive assistance and customer care.

Franchised dealers sell new automobiles such as luxury SUVs since it is a profitable business model for manufacturers, local communities, and customers. Moreover, they offer financing and leasing options in addition to a large selection of new and used cars and provide unmatched dependability and quality assurance for their vehicles, which customers can rely on.

Luxury car brands are elevating their exclusivity game, making them more reliable. The franchise dealer business model has grown in popularity as a means of purchasing and maintaining automobiles, leading to an increase in the number of brand dealerships worldwide. The BMW brand is represented by over 4,400 dealers in 150 countries.

Furthermore, due to their minimal overhead, independent used automobile dealers frequently provide the cheapest deals available, which only sell used automobiles as they do not have the overhead costs involved with franchise dealers, and may cause lesser operating expenditures than other dealers, which could lead to lower prices.

Fuel Type Segment Analysis

The hybrid/electric segment in the luxury SUV market is set to garner notable revenue in the coming years. The growth of the segment can be propelled by the increasing launch of hybrid variants. Sales of battery-electric, plug-in hybrid, and hybrid luxury SUVs have surged in recent years as the future belongs to electric vehicles, and manufacturers are introducing more of them to their portfolios every year to reduce pollution.

For instance, Hyundai Motor Co. announced the introduction of hybrid vehicles under its premium brand Genesis, which includes the GV60, GV70, and GV80 sports utility vehicles in addition to the G70, G80, and G90 sedans to boast lower pollutants and better economy and to increase their profit margins more than other vehicle types.

Product Segment Analysis

By 2035, the mini segment is predicted to witness significant luxury SUV market share owing to the rising introduction of new models. In November 2023 Toyota introduced a compact SUV in India, the Land Cruiser 250 series with its choices for an electric and hybrid drivetrain, and is expected to pose a serious threat to Thar and Jimny.

Our in-depth analysis of the luxury SUV market includes the following segments:

|

Fuel Type |

|

|

Sales Channel |

|

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Luxury SUV Market Regional Analysis:

APAC Market Insights

Asia Pacific in luxury SUV market is poised to account for around 45% revenue share by 2035. The region's luxury sector is flourishing, since a growing number of new automobile purchasers are selecting luxury SUVs due to rising personal disposable income. The region's economy is predicted to increase modestly in the coming years, with consumer spending shifting toward discretionary items. In real terms, the total disposable income is expected to double between 2021 and 2040, quicker than in any other region, according to a report released by Euromonitor International.

The luxury SUV market has expanded in China as a result of the country's robust economic growth and increased disposable income. For instance, in 2023, the disposable income per capita of Chinese citizens rose by more than 6%.

The South Korean automotive business has undergone extraordinary growth, with Korean SUVs emerging as showcases models, resulting in increased sales. SUVs have recently gained popularity in the country, accounting for more than 65% of local passenger car sales in 2022.

Japan is known for being a global leader in the production of automobiles because it is home to automakers such as Daihatsu, Mitsubishi, Mazda, Suzuki, Subaru, Honda, and Nissan, as well as a large number of companies that manufacture motors, motorbikes, ATVs, cars, electric vehicles, and construction vehicles. As a result, there is increased demand in the area for luxury SUVs. As per the statistics, the number of passenger cars produced in Japan increased to over 7 million in 2023 from around 6 million the year before.

North American Market Insights

North American luxury SUV market revenue is anticipated to hold substantial share by the end of 2035, owing to the increasing popularity of luxury SUVs in this region.

Luxury SUVs are especially well-liked by people with busy lifestyles and families in the United States, driven by several variables, such as the need for status and prestige, cutting-edge technological features, and exceptional performance. Moreover, customers in the US place a high value on luxury vehicles since possessing a luxury vehicle is regarded as a status symbol, and they value the enhanced performance and driving pleasure that luxury automobiles provide.

In Canada, premium and luxury car sales are anticipated to increase in the online space, where luxury manufacturers such as Mercedes-Benz, Audi, BMW, Jaguar, Ford, Bentley, Land Rover, Maserati, Nissan, Lexus, Toyota, Volvo, and Porsche have established a notable presence by providing a varied selection of sedans, and luxury SUVs, to suit a wide range of tastes.

Luxury SUV Market Players:

- AUDI AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bayerische Motoren Werke AG

- Jaguar Land Rover Automotive PLC

- Volvo Group

- Acura

- Alfa Romeo Automobiles S.p.A.

- Bentley Motors Limited

- Cadillac

- GMC

The luxury SUV market is dominated by key market players who are gaining traction in the market by adopting several strategies including mergers and acquisitions.

Recent Developments

- AUDI AG announced the launch of a new luxury electric SUV Q6 e-tron featuring an 800-volt battery charging system, an entirely new electronics architecture, and a range of over 600 kilometers, consisting of twelve modules and 180 prismatic cells with a total gross capacity of 100 kWh.

Furthermore, the new Q6 e-tron may be fully charged at high-power charging stations in a mere ten minutes which will enable the company to adapt to changing client needs in the upcoming years. - Jaguar Land Rover Limited announced investment in JLR’s industrial footprint, vehicle programs, autonomous, AI, and digital technologies, and people skills, and revealed ambitious plans to fast-track its transformation into the world's top producer of contemporary luxury vehicles.

- Report ID: 6030

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Luxury SUV Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.