Surgical Sutures Market Outlook:

Surgical Sutures Market size was over USD 5.9 billion in 2025 and is estimated to reach USD 9.3 billion by the end of 2035, expanding at a CAGR of 5.3% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of surgical sutures is evaluated at USD 6.2 billion.

Technological developments in sutures have exceptionally increased the growth of surgical sutures globally. Biodegradable sutures are being adopted by healthcare infrastructures across regions, which ensures lower expenditure and safety to patients. These sutures can dissolve within the body and do not require additional procedures to extract them. Modern-day sutures are applied with antiseptics, which reduces the risk of infection among patients post-operations and enhances patient safety.

Advancements within sutures have significantly increased the use of monofilament and multifilament sutures, enhancing the scope of the market. Medical facilities rely on high-quality sutures to ensure surgical success and minimise the error in stitches. Skin tightening surgeries also employ surgical sutures that ensure precision during surgery. The demand for critical and cosmetic surgery is significantly enhancing the demand for the market. Regions such as North America and the Asia Pacific are witnessing a surge in demand because of improvements in healthcare facilities and increased insurance reimbursements, encouraging patients to undergo surgery.

Key Surgical Sutures Market Insights Summary:

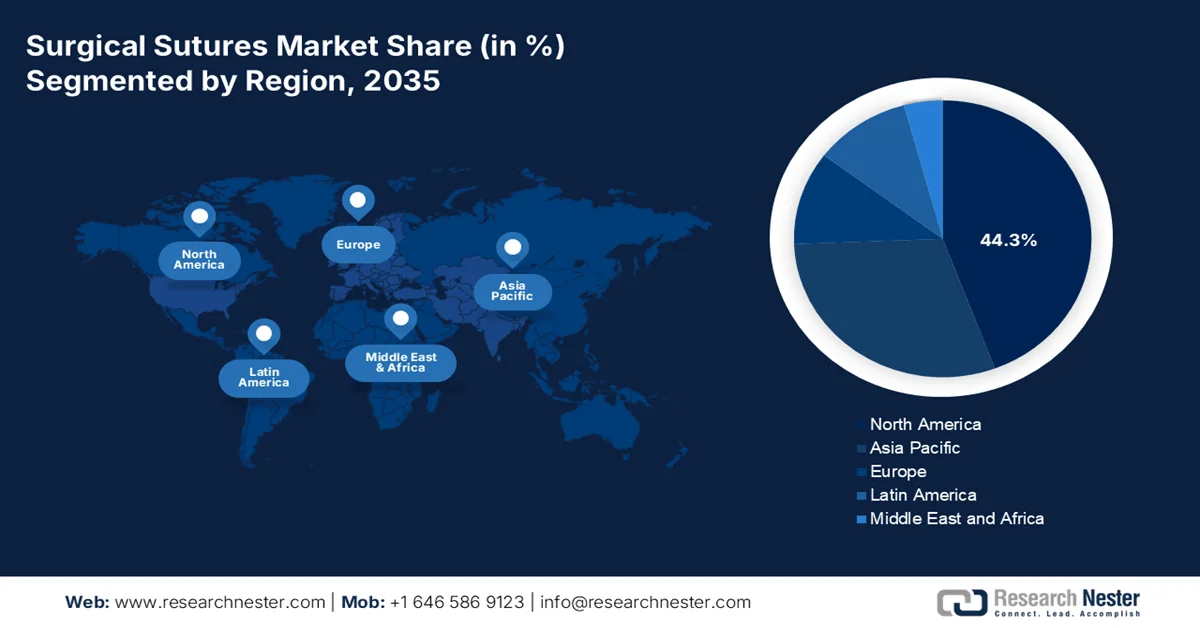

Regional Highlights:

- North America in the surgical sutures market is projected to account for a 44.3% share by 2035, supported by large-scale investments in advanced medical infrastructure, rising disposable income, and rapid adoption of premium surgical equipment improving surgical success outcomes.

- Europe is anticipated to register the fastest growth by 2035, stimulated by strong regulatory emphasis on quality of care, rising oncological surgery volumes, and increasing demand for antimicrobial-coated sutures enhancing patient safety.

Segment Insights:

- The multi-filament suture segment in the surgical sutures market is expected to hold a 57.6% share by 2035, attributed to its extensive use in complex surgeries, superior durability, improved safety assurance, and higher adoption supported by increasing procedure reimbursements.

- The absorbable segment is projected to hold the largest share by the end of 2035, driven by widespread surgical adoption, natural biodegradation benefits, reduced hospital stays, intensive R&D-driven innovation, and rising demand for high-performance sutures in complex medical interventions.

Key Growth Trends:

- Increased surgical procedures

- Rising cardiovascular diseases

Major Challenges:

- Safety concerns

- High cost of production

Key Players: Ethicon, Smith & Nephew, Coviden, B. Braun Melsungen AG, Medtronic, Surgical Specialties Corporation, Zimmer Biomet, Mölnlycke Health Care, Apollo Endosurgery, Inc.

Global Surgical Sutures Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.9 billion

- 2026 Market Size: USD 6.2 billion

- Projected Market Size: USD 9.3 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.3% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, Japan, China, France

- Emerging Countries: India, Brazil, South Korea, Spain, Italy

Last updated on : 10 February, 2026

Surgical Sutures Market - Growth Drivers and Challenges

Growth Drivers

- Increased surgical procedures: Globally, surgical procedures have significantly increased, fueling the growth of the market. Trauma surgeries such as accidents, injuries and cancer surgeries have risen in the past few decades, which has advanced the scope of surgical sutures. An ageing population is also a major concern affecting the market's growth. An ageing population is often affected by falls, where injuries such as deep cuts and skull haemorrhage are common. Thus, the ageing population directly impacts the growth of surgical sutures. According to data from the World Bank, more than 30% of the population in Japan is more than 65 years old, which demonstrates the rising demand for surgeons, impacting the growth of the market.

- Rising cardiovascular diseases: CVDs are a high threat to individuals, which can often challenge survival among aged patients. The growth of cardiovascular diseases has ramped up the open-heart surgeries, where surgical sutures play a vital role. Sutures effectively join two layers of the skin and ensure natural healing. The growing antiseptic features of the sutures make them widely adopted in surgical requirements, which prevents infections from penetrating the skin and impacting the surgical success. The World Health Organisation, in July 2025, stated that 19.8 million deaths in 2022 due to cardiovascular diseases, out of which 85% belonged to cardiac arrests. The rising prevalence of cardiovascular diseases is impacting the growth of the global surgical sutures market.

- Expanding healthcare facilities and infrastructure: The rise in healthcare infrastructure is fuelling the expansion of the surgical sutures market as the healthcare facilities expect a large volume of patients with varied needs of medical attention, including surgeries. Developing countries are accelerating the development of healthcare facilities where different types of surgeries are performed, fueling the market of surgical sutures. According to the National Library of Medicine 2022 publication, India reported more than 217 thousand public healthcare facilities where surgical demands are high, increasing the scope of the market. Advancements in robotic and cosmetic surgeries have also propelled the growth of the market.

Challenges

- Safety concerns: The products are manufactured in bulk, which often leads to quality issues and product recalls. Surgical equipment, such as sutures need to be in proper shape and size for implantation. Despite efforts to advance sutures with anti-bacterial properties, the risk of infection remains high, leading to lower adoption and decline of the market. Infections during the surgery can lead to longer recovery, for which practitioners often depend on traditional fibres to join the skin.

- High cost of production: The production cost associated with the development of surgical sutures is exceptionally high because of advancements and the complexity of procuring the materials. Silk and nylon are some of the components used to make the component durable. The prices of these components are quite high, which can lead to a decline in the adoption of surgical sutures. Antibacterial coatings and biocompatibility testing of the sutures further tend to enhance the prices, leading to the adoption of alternatives.

Surgical Sutures Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 5.9 billion |

|

Forecast Year Market Size (2035) |

USD 9.3 billion |

|

Regional Scope |

|

Surgical Sutures Market Segmentation:

Filament Segment Analysis

The multi-filament suture is expected to hold a share of 57.6% by the end of 2035 due to its use in complex surgeries where multiple skin types need to be stitched together. The thread materials used in multi-filament are more durable and less brittle, which helps in enhancing safety and provides long-term assurance of quality. Multi-filament sutures are expensive to implant; however, with the rise in reimbursements for surgical procedures, the demand for multi-filament sutures has increased. Healthcare facilities are rapidly expanding the innovation and integration of premium surgical equipment to provide patients with precision care. The adoption of multi-filament suture is leading to the growth of the market.

Type Segment Analysis

The absorbable segment is anticipated to hold the largest share by the end of 2035, owing to the widespread adoption of the component in surgical requirements. The natural degradation process of the sutures has further enhanced the growth of the segment and propelled the growth of the surgical sutures market. The increased research and development of the manufacturers is amplifying innovation, leading to wider adoption of advanced sutures. Traditional sutures demanded manual removal, which includes additional cost and length of hospital stays. Absorbable sutures cost more than traditional sutures but are more reliable and safer to use. The rising cases of complex medical interventions, such as oncological surgeries, demand high-performance sutures because of the risk potential of alternatives.

Application Segment Analysis

The cardiovascular segment is expected to dominate the market by the end of 2036, owing to the rise in CVDs, which demand open-heart surgeries. The prevalence of cardiovascular diseases across regions is propelling the growth of the market. An unhealthy lifestyle and improper work-life balance are increasing the threats from cardiovascular diseases, which require the use of surgical sutures to join the skin. The healing process with surgical sutures is effective, which significantly reduces the recovery time and eliminates the chances of infection in the operated areas. North America is heavily investing in advanced medical equipment to develop sound medical infrastructure and optimise patient-centric care, fulfilling the demand for surgical sutures.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

By Filament |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Surgical Sutures Market - Regional Analysis

North America Market Insights

North America is anticipated to hold a share of 44.3% due to the large-scale investment in the medical infrastructure, where they aim to improve the diagnostic care and surgical success. The investment in healthcare also ensures that top-notch equipment is being used to deliver higher patient success outcomes. The growing investment in the country and adoption of modern-day equipment are fueling the growth of the North America surgical sutures market. The increased disposable income of the region is further encouraging consumers to avail premium diagnosis, which enables effective usage of multi-filament sutures that are of high quality and have better antibacterial properties, enhancing the scope of expansion.

The U.S. has undertaken minimally invasive surgeries where small cuts and incisions are made to operate on the patient. The demand for surgical sutures is high in such surgeries where the small incisions are joined using sutures. The adoption of degradable surgical sutures in the U.S. healthcare infrastructure has accelerated the growth of the medical sutures market as patients demand limited hospitalisation stays and faster recovery. The large population level of the country is also quite prone to certain chronic diseases that demand surgical intervention, propelling the growth of the market in the U.S.

Canada has focused on improving positive patient outcomes by increasing surgical effectiveness and minimising post surgical complications such as infections. It has developed protocols which include the utilisation of anti-bacterial coated medical products such as bandages and sutures that can reduce the risk of infection and improve patient health. Technological advancements within the medical suture market have further advanced the growth of the market in the country. The acceleration of robotic surgery, especially in oncology and gynecology has effectively fueled the growth of the market in Canada.

Europe Market Insights

The surgical sutures market in Europe is the fastest-growing and driven by the quality of care, where regulatory bodies are working efficiently to enhance medical care and develop precision surgical success. According to the National Library of Medicine, in March 2025, more than 4,471,422 new cancer cases were registered in Europe, which demonstrates the rising demand for oncological surgeries, ramping up the growth of the market. The healthcare facilities largely demand safer sutures to minimise the potential risk of infection, propelling the expansion of the market. Antimicrobial coating sutures are being widely used across healthcare facilities, which enhances faster recovery and enhances patient safety.

UK healthcare is monitored and managed by the NHS, which plays a vital role in increasing the success rates of medical interventions. The agency monitors the safety processes used by the healthcare facilities to enhance patient-centric care. The rising infection, especially among surgery patients, is declining the positive patient outcomes, leading to the usage of advanced medical sutures in the country that can effectively reduce the risk of infection. The surgical precision and focus on patient safety are propelling the market expansion of surgical sutures in the UK.

Germany is witnessing large-scale innovation within the healthcare infrastructure, propelling the expansion of advanced surgical sutures. Biodegradable sutures are being adopted within the country to ensure faster recovery and safety among patients. Da Vinci Surgical Systems are being rapidly adopted, where small incisions are made to operate on patients, which effectively increases the demand for advanced surgical sutures that can degrade automatically and reduce the chances of infection, giving rise to precision care and expansion of the Germany surgical sutures market.

Asia Pacific Market Insights

APAC is recognised as a low-cost manufacturer for medical equipment, including surgical sutures. The low-cost production of equipment is encouraging patients to undergo surgery as the cost of treatment is significantly reduced, enabling wider adoption in the market. The rising prevalence of chronic diseases in the region is enhancing surgical procedure which requires sutures to join skin. The growing demand for anti-microbial coated sutures within surgeries has massively impacted the growth of surgical sutures, leading to market expansion. Cosmetology has also increased within the region because of skilled beauticians and plastic surgeons who use sutures in their surgical processes.

The surgical sutures market in China is one of the leading with low-cost manufacturing of products, including medical equipment such as surgical sutures, which are essential in surgical processes. The rapid population growth is supporting the development of new medical infrastructures with state of the art facilities and medical equipment. The advanced facilities experience various surgeries where surgical sutures are used. China is ahead in research and development, where advanced and high-performance medical equipment is being researched and innovated to enhance patient safety and increase surgical success.

India has also accelerated in terms of healthcare infrastructure, especially after the pandemic, when medical facilities across the country collapsed. The rapid expansion and investment from public and private sources are fueling the expansion of advanced medical surgeries belonging to CVDs and Oncology. These surgeries demand the use of surgical sutures to maintain patient safety, propelling the growth of the market. According to India Brand Equity Funding, in November 2025, the Indian government allocated USD 11.50 billion for the healthcare sector for maintenance and development of hospitals and diagnostic centres, propelling the demand of cost effective surgeries, impacting the growth of the market in India.

Key Surgical Sutures Market Players:

- Ethicon (U.S.)

- Medtronic (Ireland)

- B. Braun Melsungen AG (Germany)

- Smith & Nephew (UK)

- Covidien – (Ireland)

- Surgical Specialties Corporation (U.S.)

- Zimmer Biomet (U.S.)

- Mölnlycke Health Care (Sweden)

- Apollo Endosurgery, Inc. (U.S.)

- ConMed Corporation (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ethicon: A subsidiary of Johnson and Johnson, which is a leading developer of medical equipment such as surgical sutures and others. The subsidiary specialises in suture wound closure technology for which it has manufactured different devices and components. The business operates in a wide range of portfolios such as absorbable, non-absorbable and antimicrobial sutures, used in various surgical procedures.

- Medtronic: A healthcare technology company with a presence across the globe that manufactures surgical sutures and implantable devices. It holds a diverse portfolio of medical sutures used especially in vascular and cardiovascular surgeries. The business is widely known for its innovative product portfolio and advanced medical. The business is also actively investing in suture-assisted robotic surgery, which is leading to larger sales volume.

- B. Braun Melsungen AG: A medical device manufacturer with a focus on advanced wound care and surgical site infection. The equipment and the sutures are coated with anti-microbial properties, which can significantly reduce the risk of infections. The business is serves in key areas such as cardiovascular, neurovascular and oncological surgeries to ensure patient safety and positive outcomes.

- Smith & Nephew: The firm is operating diversely with portfolios in wound care, orthopedic and sports medicine. The business also has a specific focus on surgical equipments including sutures. It has a range of products, including barbed and absorbable sutures, which are widely used in cosmetic and trauma surgeries. Fast Fix is one of the popular products used by healthcare facilities because of its durability, developed by Smith & Nephew

- Covidien: Currently a part of Medtronic, is a global manufacturer of surgical sutures and closure devices. Healthcare facilities have been using the product for years, owing to the years of trust and experience. The sutures are developed for cosmetic, cardiovascular and gastrointestinal surgeries where they have high performance and superior durability.

Here is a list of key players operating in the global market:

The players operating in the market are witnessing powerful competition during the forecast period. The market is moderately fragmented, housing both established key players and new entrants. These players are participating in major growth strategies, including launches, mergers & acquisitions, partnerships, collaborations, and more. Specialised manufacturers maintain a competitive landscape in the market. Key players in the market are significantly supported by the governments for research and innovation.

Corporate Landscape of Surgical Sutures Market Players

Recent Developments

- In July 2025, Zimmer Biomet acquired Monogram Technologies to expand the robotic surgery portfolio and gain market traction. Monogram is developing advanced and new-age systems that would drive safety and security in surgery.

- In May 2022, Medtronic acquired Intersect ENT to innovate the ear, nose and throat portfolio and bring innovative anti-sinus products. The product lines and the customer base will help Medtronic to navigate entry to various markets and support people suffering from chronic diseases.

- Report ID: 2199

- Published Date: Feb 10, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Surgical Sutures Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.