Sunitinib Malate Market Outlook:

Sunitinib Malate Market size was valued at USD 146.88 million in 2025 and is set to exceed USD 417.05 million by 2035, expanding at over 11% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of sunitinib malate is estimated at USD 161.42 million.

Sunitinib malate as an oral medication solution has gained immense exposure with substantial latent antineoplastic properties and antineoplastic activity. Both these properties make it a crucial agent against cell propagation and angiogenesis, thereby being suitable for the treatment of pancreatic neuroendocrine tumors and kidney cancer. According to the April 2021 Action Kidney Cancer Organization report, a clinical study was conducted on 102 patients by Clinical Genitourinary Cancer to evaluate the survival instinct of sunitinib. It was found that the survival rate was 57.5% for almost 15.6 months. Additionally, it shrank cancer among 22.5% of patients with 5.4 months of treatment, hence boosting the sunitinib market demand globally.

The evolution of the market also further depends upon its analysis and quantification with the use of instruments. These instruments include LC-MS/MS, HPLC with UV detection, UV-Vis spectrophotometers, and spectrometers. Among these, both spectrometers and spectrophotometers are easily available owing to their continuous import and export. As per the 2023 OEC report, the global trade valuation of these instruments is USD 4.4 billion, and it is the 825th most traded product with a complexity of 1.4. Besides, the U.S. is the top exporter with a worth of USD 934 million as well as the second-best importer with USD 665 million, and China is the top importer worth USD 712 million, and the fifth exporter worth USD 241 million.

Spectrometers and Spectrophotometers Export/Import

|

Countries |

Export |

Import |

|

Germany |

USD 798 million |

USD 264 million |

|

United Kingdom |

USD 341 million |

|

|

Malaysia |

USD 331 million |

|

|

Singapore |

|

USD 266 million |

|

Japan |

|

USD 181 million |

Source: OEC 2023

Key Sunitinib Malate Market Insights Summary:

Regional Highlights:

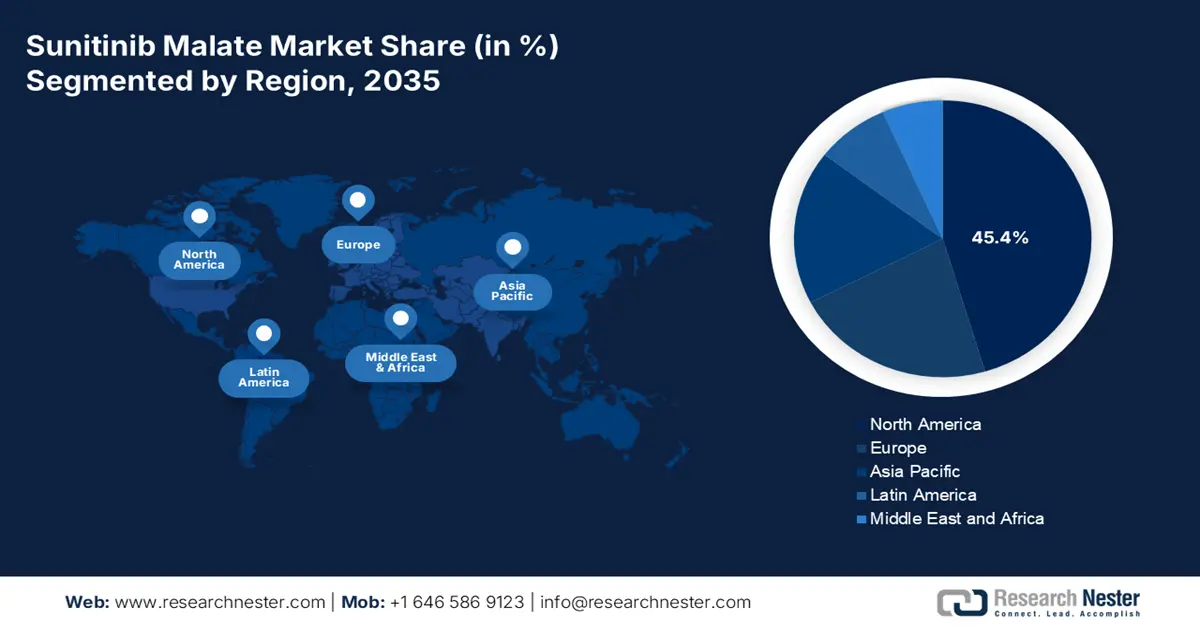

- North America commands a 45.4% share of the Sunitinib Malate Market, driven by well-developed healthcare infrastructure and health-conscious population, positioning it as a market leader through 2026–2035.

- Asia Pacific's sunitinib malate market expects the fastest growth by 2035, driven by the manufacture of innovative drugs and regional clinical studies.

Segment Insights:

- The Pancreatic Neuroendocrine Tumors segment is projected to achieve substantial growth during 2026-2035, fueled by clinical studies and medical recommendations targeting the condition with sunitinib malate.

- The >98% Purity segment is anticipated to achieve a 51.8% share by 2035, fueled by its efficiency and high purity for treatment applications.

Key Growth Trends:

- Increase in cancer occurrence

- Progression in research and development activities

Major Challenges:

- Poor tolerance capacity restrains therapy

- High cost of treatment

- Key Players: Topcare Pharmaceutical Co. Ltd, Hetero Drugs Ltd INDIA, Reliance Life Sciences Pvt. Ltd, Target Molecule Corp..

Global Sunitinib Malate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 146.88 million

- 2026 Market Size: USD 161.42 million

- Projected Market Size: USD 417.05 million by 2035

- Growth Forecasts: 11% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, Brazil, Mexico

Last updated on : 12 August, 2025

Sunitinib Malate Market Growth Drivers and Challenges:

Growth Drivers

-

Increase in cancer occurrence: The sunitinib malate market is subjected to expansion owing to a surge in cancer cases globally. According to the May 2024 NLM article, the incidence of this disorder was 440.5 per 100,000 men and women every year in 2021. In addition, approximately 2,001,140 cancer cases were diagnosed in the U.S. in 2024, out of which 611,720 people faced death. However, to combat this, sunitinib malate has proven to be effective in inhibiting numerous receptor tyrosine kinases linked with cancers such as gastrointestinal stromal tumors and kidney cancer, thereby driving market growth.

- Progression in research and development activities: The ongoing investigation and progress to manufacture and produce the latest drugs is a huge growth factor for the market. Additionally, the introduction of novel therapies, formulations, and applications is increasingly fueling the market expansion. In December 2024, Affimed N.V. announced the U.S. FDA approval of RMAT designation to the combination therapy of Affimed’s innate cell engager acimtamig and Artiva Biotherapeutic’s AlloNK for the treatment of cancer, thus positively impacting the market internationally.

Challenges

- Poor tolerance capacity restrains therapy: The sunitinib malate market has proven to be successful, but with the presence of side effects it is facing a huge challenge. The occurrence of hematologic abnormalities, gastrointestinal disturbances, and fatigue are a few critical side effects that are caused after the therapy that patients readily suffer. There is a reduction in their tolerating level, which often impedes the widespread expansion of the market globally. Therefore, it is essential to cater to these issues and develop strategies, in consultation with healthcare providers, to mitigate these concerns.

- High cost of treatment: This is another barrier affecting the upliftment of the market. This majorly affects patients from low- and middle-income countries where there is a huge financial burden and limited research capabilities. This, in turn, results in the absence or restricted production of medications, further leading to the unavailability and affordability of poor healthcare resources. Therefore, efforts need to be undertaken to make sunitinib malate cost-effective and ensure suitable reimbursement policies to overcome this challenge.

Sunitinib Malate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11% |

|

Base Year Market Size (2025) |

USD 146.88 million |

|

Forecast Year Market Size (2035) |

USD 417.05 million |

|

Regional Scope |

|

Sunitinib Malate Market Segmentation:

Purity (>99%, >98%, >97%)

Based on purity, the >98% segment is expected to capture around 51.8% sunitinib malate market share by the end of 2035. The segment’s growth is highly driven by its efficiency and higher eminence which determines the purity level of sunitinib, making it useful for treatment purposes. This results in the absence of any kind of risks for patients undergoing surgical treatments. As per a clinical study published by Clinical Genitourinary Cancer in October 2020, 467 patients were evaluated with the use of high-purity sunitinib and the response rate was 42.1% without the presence of any form of risk, thereby attributing the segment’s upliftment.

Application (Pancreatic Neuroendocrine Tumors, Kidney Cancer, Gastrointestinal Stromal Tumor)

Based on application, pancreatic neuroendocrine tumors segment in the sunitinib malate market is expected to witness growth rate of around 46.5% till 2035. According to the July 2022 NLM article, a clinical study was conducted on 8,944 patients suffering from the condition, wherein the incidence rate increased from 0.27% to 1.0% per 100,000. Therefore, with the implementation of sunitinib malate, the multiple receptor tyrosine kinases are targeted, thus making it an attractive therapeutic option against pancreatic neuroendocrine tumors. Even medical professionals highly recommend sunitinib to get rid of the condition, thereby driving the market demand globally.

Our in-depth analysis of the global market includes the following segments:

|

Purity |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sunitinib Malate Market Regional Analysis:

North America Market Analysis

North America in sunitinib malate market is likely to hold over 45.4% revenue share by the end of 2035. The region, being a developed nation, comprises well-developed healthcare facilities and infrastructures, high-income rates, and standard health insurance and reimbursement services based on which cancer treatment solutions are cost-effective. Additionally, the population is also aware of cancer and its symptoms and thrive to live healthy lifestyles, thereby driving the demand of the market in an increasing way in the region.

The market in the U.S. is highly driven by the presence of administrative bodies, responsible for the approval of drugs that are suitable for treatment purposes. For instance, in December 2024, the U.S. FDA initiated the accelerated approval of zenocutuzumab-zbco, especially for adults undergoing advanced non-small cell lung cancer (NSCLC) as well as metastatic pancreatic adenocarcinoma. This has been accepted as a systematic therapy for these categories of patients, thereby driving the need for sunitinib malate in the country.

The market in Canada is witnessing growth due to the involvement of the government in making investments to overcome the prevalence of cancer. For instance, in January 2023, the Canada Institute of Health Research provided funding of over USD 1.0 billion for cancer research for more than five years. In this, emphasis has been laid on the acquisition of scientific knowledge and catering to children and adolescents. Besides, in October 2024, Health Canada invested USD 12.29 million to prevent and aid cancer, especially for firefighters for the upcoming five years. Hence, such generous contributions by the government are subjected to market expansion in the country.

APAC Market Statistics

The Asia Pacific sunitinib malate market is projected to witness the fastest growth during the forecast timeline. The aspect of manufacture and production of innovative drugs by both research and pharmaceutical organizations is fueling market expansion in the region. This eventually has resulted in the conduction of clinical studies, especially in countries such as China and India to make products available in the region. Also, the region has increasingly focused on initiating the cost-effectiveness of sunitinib malate to make it affordable for patients.

The market in India is expanding majorly since regional organizations are minutely making contributions to provide affordable products for the population. For instance, in February 2021, Glenmark Pharmaceuticals unveiled SUTIB to aid kidney cancer in the country. This drug was introduced at an affordable price which was less than 96% with costs ranging from ₹7,000 (USD 82.1) for 50 mg, ₹3,600 (USD 42.2) for 25 mg, and ₹1,840 (USD 21.5) for 12.5 mg based on each month. Therefore, the continuous research to launch the latest drugs with approval from regulatory bodies poses an optimistic outlook for the market in the country.

The sunitinib malate market in China is witnessing steady growth owing to the presence of regulatory bodies to approve the latest products, suitable for diagnosis and treatment. For instance, in May 2021, sunitinib malate capsules, a product of Sino Biopharmaceutical Limited, received the drug registration certificate from the National Medical Products Administration of the People’s Republic of China. This denotes its usage for adult patients to overcome gastrointestinal tumors, pancreatic tumors, and renal cell carcinoma. This product has been in huge demand since its launch, which is responsible for uplifting the market in the country.

Key Sunitinib Malate Market Players:

- Brawn Laboratories Ltd INDIA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Topcare Pharmaceutical Co. Ltd

- Hetero Drugs Ltd INDIA

- Reliance Life Sciences Pvt. Ltd

- Target Molecule Corp.

- J&K Scientific

- Nanjing First Pharmaceutical Co. Ltd.

- Biotechnica Pharma Global

- Affimed N.V.

- Glenmark Pharmaceuticals

- Sino Biopharmaceutical Limited

- Exelixis, Inc.

- IDRx, Inc.

- Zai Lab Limited

- Lantern Pharma

Companies in the sunitinib malate market are enthusiastically engaged in countless development strategies, including product launches, acquisitions, collaborations, and investments to foster expansion both in developed as well as developing nations. For instance, in August 2024, IDRx, Inc. publicized the accomplishment of an oversubscribed USD 120 million Series B Preferred Stock financing to make potential advancements in treatment options for gastrointestinal stromal tumors. This funding was backed by several investors which included Rock Springs Capital. The funding ensured clinical trials of IDRX-42 which is a potent and highly selective KIT inhibitor, thereby amplifying the market demand across nations.

Here's the list of some key players:

Recent Developments

- In December 2024, Zai Lab Limited and Novocure notified the endpoint for its Phase 3 PANOVA-3 trial, demonstrating a statistically significant improvement in median overall survival (mOS) versus control to aid pancreatic adenocarcinoma.

- In July 2021, Lantern Pharma stated the positive new data from its ongoing pancreatic cancer collaboration with the Pancreatic Cancer Institute at Fox Chase Cancer Center. It demonstrated that LP-184 is useful for rapid pancreatic tumor shrinkage by more than 90%.

- Report ID: 7486

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sunitinib Malate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.