Structure Directing Agents Market Outlook:

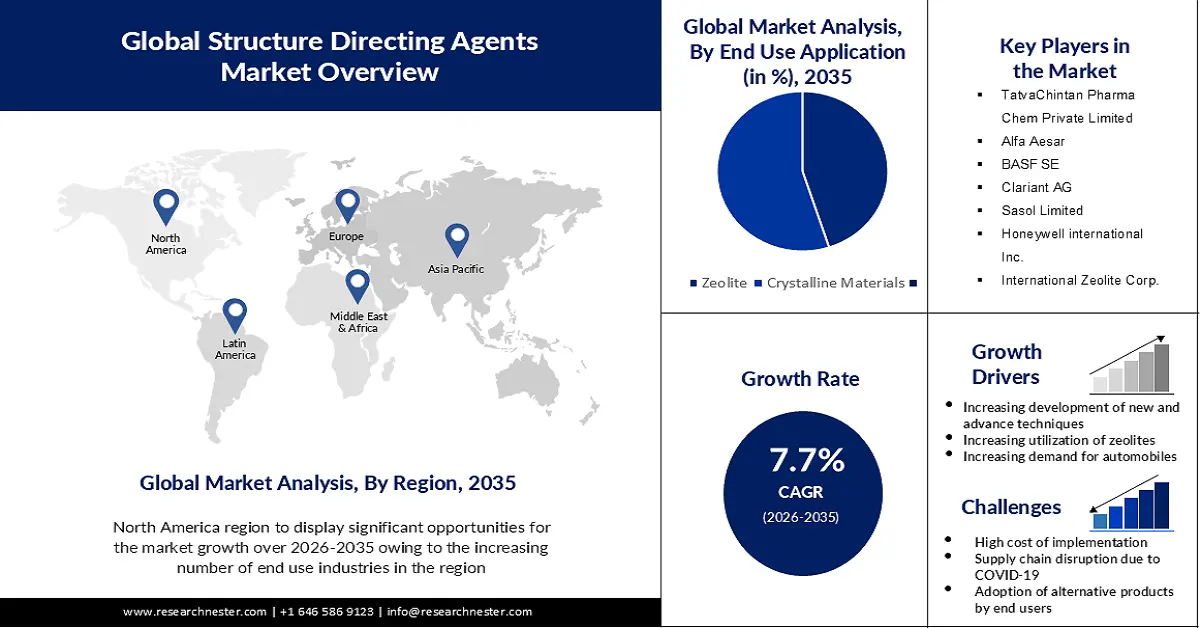

Structure Directing Agents Market size was valued at USD 629.07 million in 2025 and is likely to cross USD 1.32 billion by 2035, registering more than 7.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of structure directing agents is assessed at USD 672.66 million.

The market is seeing profitable potential due to the growing demand for sophisticated materials in the automotive and industry sectors. The industry produced 2,59,31,867 vehicles between April 2022 and March 2023, as opposed to 2,30,40,066 units between April 2021 and April 2022. These vehicles included passenger cars, commercial vehicles, three-wheelers, two-wheelers, and quadricycles.

In addition, the efficiency and effectiveness of SDAs have grown due to technical breakthroughs and material science advancements, opening up new applications. In the petrochemical, energy, and environmental sectors—where the performance of these industries depends on the synthesis of materials with certain properties-there is an especially strong demand for SDAs.

Key Structure Directing Agents Market Insights Summary:

Regional Insights:

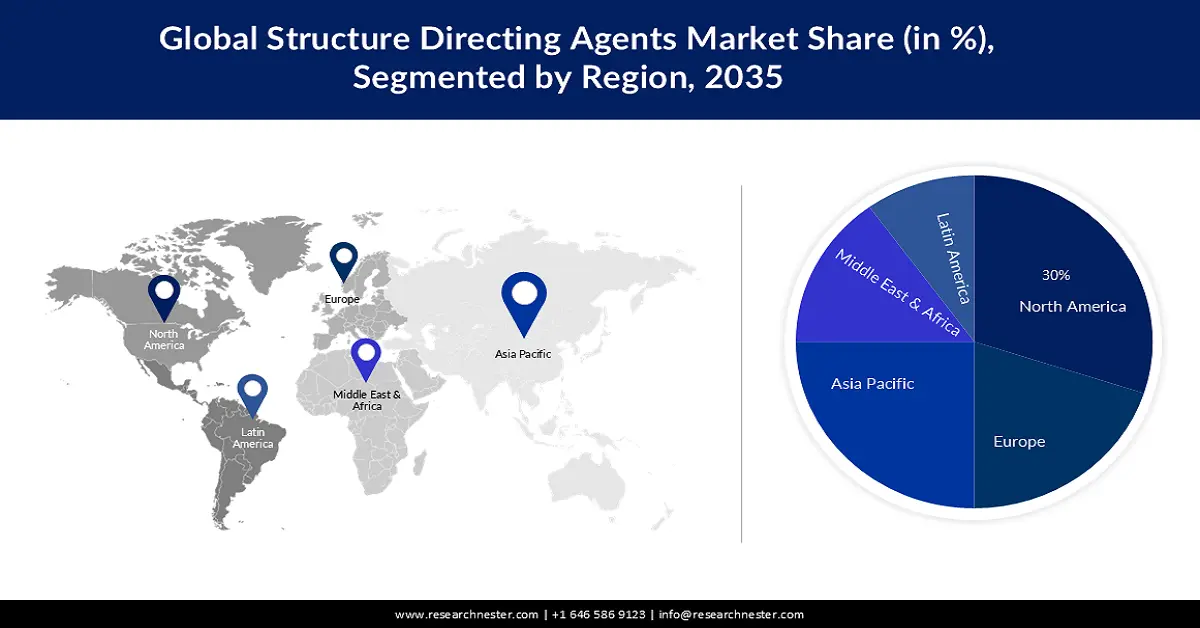

- North America is estimated to hold the largest revenue share of 30% by 2035, driven by strong demand from petrochemicals, construction, and automotive industries.

- Asia Pacific is predicted to capture 25% of the market by 2035, impelled by rapid growth in zeolite, chemical, and related catalyst industries.

Segment Insights:

- The crystalline materials segment is projected to account for 55% share by 2035, propelled by the increasing need for precise structural control in crystalline materials.

- The organic structure directing agents segment is expected to hold 52% share by 2035, owing to the growing demand for complex organic compounds in fine chemicals, material science, and pharmaceuticals.

Key Growth Trends:

- Expanding Construction Sector

- Increasing Utilization of Zeolites

Major Challenges:

- A Complete Lockdown Caused Supply Chain Disruption That Affected the Manufacturing Sector During COVID 19

- Risk of Substitution as a Catalyst Could Limit Product Adoption in a Range of Uses.

Key Players: TatvaChintan Pharma Chem Private Limited, Merck KGaA, Otto ChemiePvt Ltd, Alfa Aesar, BASF SE, Clariant AG, Sasol Limited.

Global Structure Directing Agents Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 629.07 million

- 2026 Market Size: USD 672.66 million

- Projected Market Size: USD 1.32 billion by 2035

- Growth Forecasts: 7.7%

Key Regional Dynamics:

- Largest Region: North America (30% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, France

- Emerging Countries: India, Indonesia, Malaysia, Thailand, Brazil

Last updated on : 26 November, 2025

Structure Directing Agents Market - Growth Drivers and Challenges

Growth Drivers

- Expanding Construction Sector- Because it enhances the mechanical strength and durability of cement & concrete composites, natural zeolite is widely utilized in the manufacturing of construction materials, including cement and concrete. It is extensively utilized in the production of lightweight concrete. It inhibits the creation of cracks and strengthens the concrete harness over time. Additionally, the building industry prefers this low-cost, environmentally friendly alternative, which is fuelling structure directing agents market expansion. By 2030, the size of the world construction market is expected to exceed USD 8 trillion. The construction sector is being driven by increasing government investment in new projects, rapid industrialization, and high infrastructure spending.

- Increasing Utilization of Zeolites- An important factor propelling the SDA market's expansion is the growing need for zeolites in a range of applications, such as separation, adsorption, and catalysis. An additional reason anticipated to propel the SDA market's expansion is the growing emphasis on sustainability and green chemistry practices. This is anticipated to fuel market innovation and product development by increasing demand for structure-directing agents that are more sustainable and kinder to the environment. Europe has invested USD 75.66 billion in resources necessary to deliver environmental protection (EP) services.

- Development of New and Advanced Techniques- The structure directing agents market is anticipated to gain from the creation of novel and cutting-edge synthesis methods that raise the manufacture of zeolite's efficiency and selectivity. The need for structure-directing agents that may be applied to these sophisticated processes is anticipated to rise as a result. R&D expenditures worldwide have risen to a record high of about USD 1.7 trillion. Approximately 10 nations make up 80% of the spending. Countries have committed to significantly raising public and corporate R&D spending as well as the number of researchers by 2030 as part of the Sustainable Development Goals (SDGs).

Challenges

- A Complete Lockdown Caused Supply Chain Disruption That Affected the Manufacturing Sector During COVID-19 - To maintain growth and development throughout the COVID-19 pandemic, the majority of enterprises have made significant investments in maintaining their manufacturing facilities in the available markets. Global product demand was impacted by the pandemic. The ensuing lockdown orders and disruptions to the supply chain caused the market to decline. During the projected period, end-use industry verticals like detergent, petroleum, and construction will impede structure directing agents market expansion. The state-wide lockdown caused a severe labour shortage in the detergent industry, which had an effect on overall production capacity. Additionally, because of the epidemic, people are now buying laundry items online out of concern that they might get the illness from physical stores.

- Risk of Substitution as a Catalyst Could Limit Product Adoption in a Range of Uses.

- Limited availability of specific agents may impede the growth of the market.

Structure Directing Agents Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.7% |

|

Base Year Market Size (2025) |

USD 629.07 million |

|

Forecast Year Market Size (2035) |

USD 1.32 billion |

|

Regional Scope |

|

Structure Directing Agents Market Segmentation:

End Use Application Segment Analysis

The crystalline materials segment is expected to hold 55% share of the global structure directing agents market by the end of 2035. The global market for structure-directing agents is anticipated to gain from the increasing need for a specific structure in crystalline materials because of its unique structure-directing properties. In addition, the catalyst growth is correlated with the expansion of the chemical sector. The global chemical sector generated about 4.7 trillion dollars in revenue in 2021. In the upcoming years, it is anticipated that expanding catalyst industries will increase demand for structure-directing agents since many catalysts have certain structural requirements. This increases the need for agents that can precisely control the development of crystalline materials, or organic structure guiding agents.

Type Segment Analysis

The organic structure directing agents market is projected to hold the largest revenue share of about 52% by the end of 2035. The growth of the segment in this market is owing to the critical role they play in the manufacture of zeolites. Organic structure-directing agents are anticipated to continue to be the leading category in terms of type during the projected period. The growing need for complex organic compounds in sectors including fine chemicals, material science, and medicines is one of the main growth drivers. The need for organic structure-directing agents rises along with the necessity for these chemicals. The market is expanding due in part to improvements in synthetic techniques and the creation of new, more effective structure guiding agents.

Our in-depth analysis of the global structure directing agents market includes the following segments:

|

Type |

|

|

End Use Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Structure Directing Agents Market - Regional Analysis

North American Market Insights

Structure directing agents market in the North America industry is estimated to account for largest revenue share of 30% by 2035. For a number of reasons, the market in North America is anticipated to rise steadily in the upcoming years. Firstly, several significant end-use sectors, including petrochemicals, construction, and the automotive industry, are concentrated in the region and are projected to have a significant impact on the demand for structure-directing agents. An important part of the American economy is the construction sector. In the first quarter of 2023, there were over 919,000 construction establishments in the United States. Each year, the industry generates structures valued at around USD 2.1 trillion and employs 8.0 million people. The area is also known for its sophisticated and well-established chemical sector, which places a major emphasis on research and development. This is anticipated to stimulate product development and innovation in the market for structure directing agents, resulting in the launch of novel and cutting-edge goods.

APAC Market Insights

Structure directing agents market in Asia Pacific region is attributed to hold 25% of the revenue share by the end of 2035. The growth of the market in this region is due to the region's rapid growth in zeolite, chemical, and other related catalysts. Furthermore, the supply and pricing of structure directing agents benefit by the existence of significant market players in the area. Moreover, a notable pace of growth for the structure directing agents market is because of the existence of a robust chemical hub in nations like Indonesia, Malaysia, Thailand, India, and Thailand.

Structure Directing Agents Market Players:

- SACHEM, INC.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- TatvaChintan Pharma Chem Private Limited

- Merck KGaA

- Otto ChemiePvt Ltd

- Alfa Aesar

- BASF SE

- Clariant AG

- Sasol Limited

- Honeywell international Inc.

- International Zeolite Corp.

Recent Developments

- Tatva Chintan Pharma Chem - Ex-Structure Directing Agent Portfolio Facing Demand Headwinds: Nirmal Bang. We visited Dahej special economic zone plant of Tatva Chintan Pharma Chem Ltd. after commercialisation of the new capacity (capex Rs 1.5 billion) and interacted with the management. While SDAs are expected to grow in FY24 on a favorable base, ex-structure directing agent portfolio is under pressure due to subdued demand and pricing as most of customers are cutting down inventory levels. Prices of select key raw material are back to 1998 levels, as per management. After ~50% cut in majority of the basket over last six months, prices are expected to stabilise at current levels.

- International Zeolite Corp. and CoTec Holdings Corp. announced that CoTec agreed to make a USD 2 million strategic investment in IZ to support its go-to-market activities in the agricultural and green tech segments. The investment from CoTec is expected to fast-track IZ's ability to move rapidly to full commercialization, marketing, and sales capabilities for its disruptive agricultural products and solutions.

- Report ID: 5464

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Structure Directing Agents Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.