Step-Down Voltage Regulator Market Outlook:

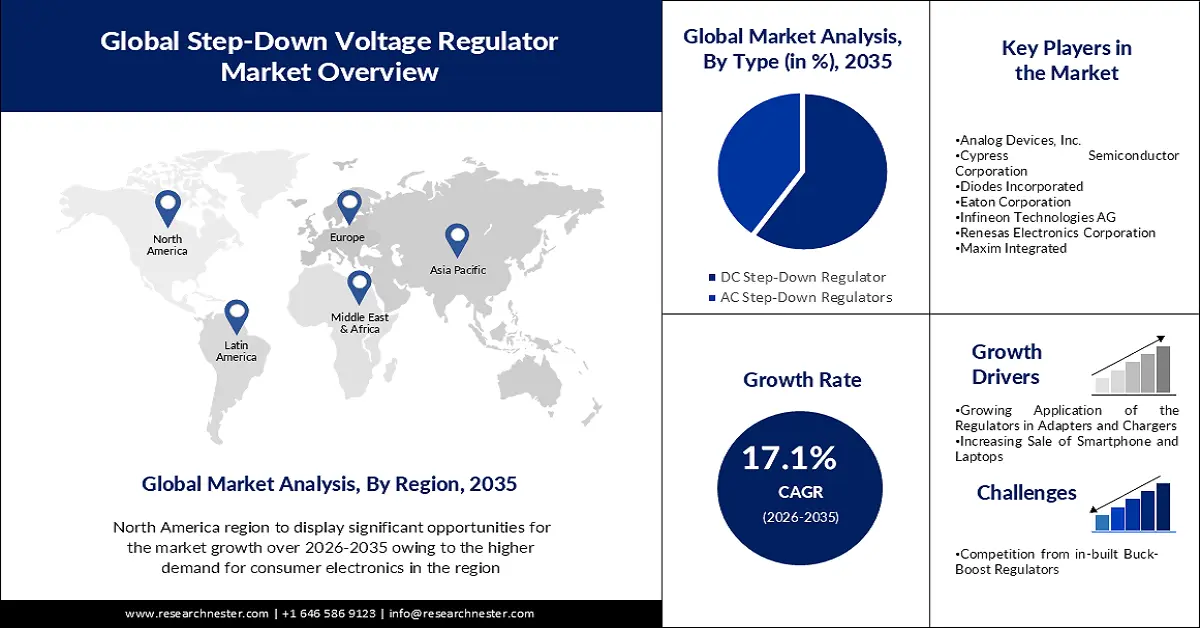

Step-Down Voltage Regulator Market size was over USD 3.54 billion in 2025 and is anticipated to cross USD 17.16 billion by 2035, witnessing more than 17.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of step-down voltage regulator is estimated at USD 4.08 billion.

The growth of this market can be ascribed to the rising demand for development in advanced technologies in various sectors such as the medical and industrial sectors is expected to drive the growth of the market in the forecast period. Increasing demand for smartphones, tablets, and other consumer electronics drives the growth of the market. These devices require a reliable and efficient power supply, and step-down voltage regulators help regulate the voltage to prevent damage to the device. The largest growth during this period was in 2020, with consumer electronics industry revenue increasing by 26.2% year-on-year. By comparison, the industry grew at a slower rate he 14.1% in 2019.

New and innovative technological developments in the market are driving the growth of the market. Manufacturers are investing in research and development to introduce more efficient, reliable, and better-performing regulators. The increasing adoption of renewable energy sources such as solar and wind have increased the demand for step-down voltage regulators. These regulators are used to regulate the output voltage of renewable energy sources to ensure compatibility with the grid and other electrical equipment. In 2021, renewable electricity generation increased by nearly 7%, a record increase of 522 TWh. Wind and solar technologies together account for nearly 90% of that increase.

Key Step-Down Voltage Regulator Market Insights Summary:

Regional Insights:

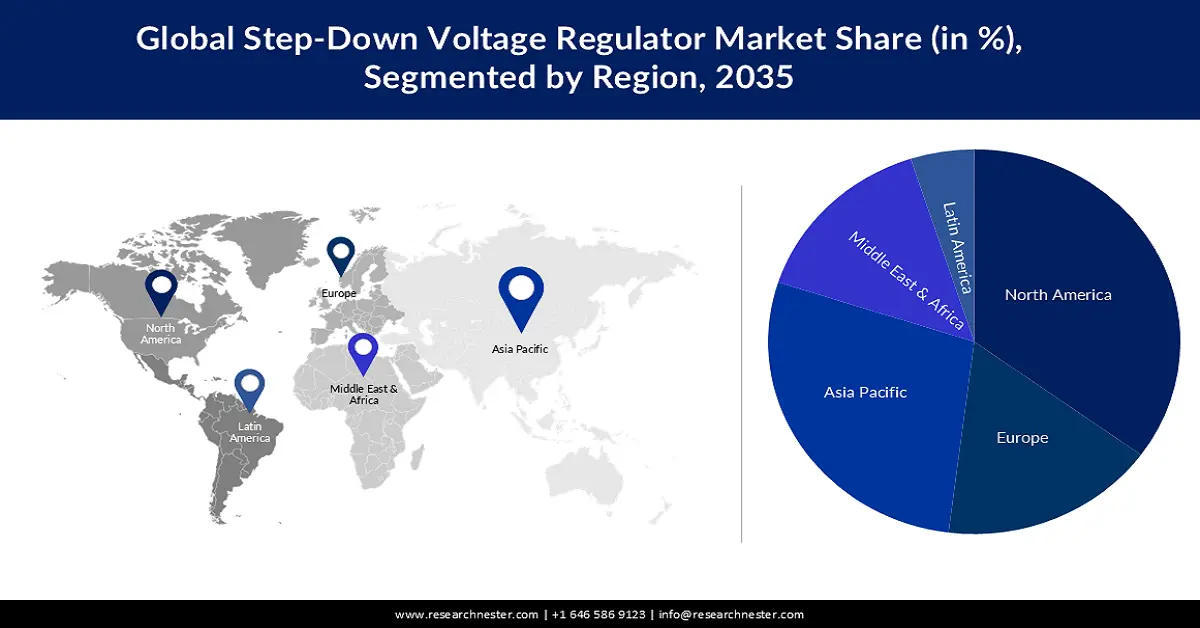

- By 2035, North America is anticipated to capture the dominant revenue share in the step-down voltage regulator market, underpinned by expanding technology adoption and elevated internet penetration across the U.S. and Canada owing to the rising need for efficient energy management.

- The Asia Pacific region is projected to record substantial growth by 2035 as the adoption of advanced electronics and energy-efficient systems accelerates across China, India, Japan, and Korea fueled by increasing uptake of smart grids and renewable energy systems.

Segment Insights:

- By 2035, the consumer electronics segment in the step-down voltage regulator market is projected to command the largest share, supported by expanded utilization of regulators in smartphones, tablets, and laptops propelled by rising global device output.

- By 2035, the DC step-down regulator segment is expected to secure the leading share as its low-power switching architecture becomes essential for next-generation digital imaging applications impelled by the demand for more efficient batteries.

Key Growth Trends:

- Growing Application of the Regulators in Adapters and Chargers

- Increasing Sale of Smartphone and Laptops

Major Challenges:

- Compatibility Problem

- Competition from in built Buck Boost Regulators

Key Players: ABB Ltd, .Analog Devices, Inc., Cypress Semiconductor Corporation, Diodes Incorporated, Eaton Corporation, Infineon Technologies AG, Renesas Electronics Corporation, Maxim Integrated, Microchip Technology Inc., Chroma ATE Inc.

Global Step-Down Voltage Regulator Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.54 billion

- 2026 Market Size: USD 4.08 billion

- Projected Market Size: USD 17.16 billion by 2035

- Growth Forecasts: 17.1%

Key Regional Dynamics:

- Largest Region: North America (Majority Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Vietnam, Indonesia, Mexico, Brazil

Last updated on : 20 November, 2025

Step-Down Voltage Regulator Market - Growth Drivers and Challenges

Growth Drivers

-

Growing Application of the Regulators in Adapters and Chargers – Rising utilization of step-down voltage regulators in adaptors and chargers is expected to drive the growth of step down voltage regulator market in the forecast period. In smartphone chargers, a step-down voltage regulator is used to regulate the voltage and current supplied to a smartphone battery so that the battery can be charged safely and efficiently. A regulator reduces the voltage from a power supply. Keeping the outlet or USB port at a low voltage is suitable for smartphone batteries. The regulator also regulates the current supplied to the battery to prevent overcharging and damaging the battery. The step-down voltage regulator used in smartphone chargers is Texas Instruments' LM7805 voltage regulator. This regulator regulates the voltage to 5V suitable for charging smartphones and other electronic devices.

-

Increasing Sale of Smartphone and Laptops – Step-down voltage regulators is widely used in consumer electronics especially in smartphones and laptops as devices require a reliable and efficient power supply, and step-down voltage regulators help regulate the voltage and prevent damage to the devices. In 2021, smartphone sellers sold almost 1.45 billion smartphones globally, and almost 280 million laptops were sold by laptop vendors worldwide.

- Rising Adoption of Renewable Energy Sources - The increasing adoption of renewable energy sources such as solar and wind power is expected to drive the growth of the step-down voltage regulators market in the forecast period. These regulators are used to regulate the output voltage of renewable energy sources to ensure compatibility with the grid and other electrical equipment. In 2020, around 29% of electricity worldwide was generated with renewable energy sources.

- Growing Industrial Automation – Growing industrial automation industry is expected to drive the market growth step-down voltage regulators market in the forecast period. This regulator is used to regulate voltage in industrial machines and equipment, ensuring they operate efficiently and safely. Industrial automation is expected to raise productivity by 0.8% to 1.4% yearly.

Challenges

-

Compatibility Problem - Step-down voltage regulator compatibility with different devices and systems can be a challenge. As electronic devices become more complex, voltage regulator compatibility becomes more important and manufacturers must ensure that their products are compatible with a wide range of devices and systems. This can hinder the growth of this market in the upcoming times.

-

Competition from in-built Buck-Boost Regulators

- Complexity in Design

Step-Down Voltage Regulator Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

17.1% |

|

Base Year Market Size (2025) |

USD 3.54 billion |

|

Forecast Year Market Size (2035) |

USD 17.16 billion |

|

Regional Scope |

|

Step-Down Voltage Regulator Market Segmentation:

End-user Segment Analysis

The global market is segmented and analyzed for demand and supply by end users into consumer electronics, aerospace and defense, telecommunications, semiconductors, healthcare, industrial, automotive, and others. Out of these, the consumer electronics segment is anticipated to account for the largest market share by the end of 2035. Step-down voltage regulators are widely used in consumer electronics such as smartphones, tablets, laptops, and other mobile devices. These devices require a reliable and efficient power supply, and a step-down voltage regulator helps to regulate the voltage and avoid damage to the equipment. In 2022, more than 2.2 billion consumer electronic units were produced globally.

Type Segment Analysis

The global market is segmented and analyzed for demand and supply by type into AC step-down regulators and DC step-down regulators. Out of this, the DC step-down regulator is anticipated to hold the largest market share by the end of 2035. A DC step-down voltage regulator is a device that converts direct current (DC) to alternating current (AC). It uses switching technology and consumes less power than an AC regulator. Currently, to produce high-resolution images for the latest digital cameras with higher pixel counts, a more efficient battery is required.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Application |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Step-Down Voltage Regulator Market - Regional Analysis

North American Market Insights

North America industry is poised to dominate majority revenue share by 2035. This is backed by the growing adoption of technology in the region. Moreover, higher internet penetration in the U.S. and Canada is estimated to boost market growth. As per the data from the World Bank, 89.43% of the population in the U.S. used Internet services in 2019. The United States is a large market for step-down voltage regulators in the region, with many leading manufacturers operating in the country. The growth of the market is also driven by the increasing adoption of renewable energy systems and the increasing demand for efficient energy management in various industries. The market is highly competitive, with many players offering a wide range of products to meet the diverse needs of customers.

APAC Market Insights

The market in the Asia Pacific region is estimated to witness noteworthy growth by the end of 2035. This can be attributed to the back of adoption of advanced technologies in the APAC region, along with the presence of various market leaders in the region. The Asia-Pacific step-down voltage regulator market growth is also driven by the increasing adoption of electronic devices and systems in countries such as China, India, Japan, and Korea. This region is home to many of the leading step-down voltage regulator manufacturers and the market is very competitive. Growing demand for efficient energy management solutions, especially in the industrial and automotive sectors, is also driving market growth in the region. The rise of renewable energy systems and smart grids is expected to continue to drive demand for diminishing voltage regulators in the coming years.

Europe Market Insights

The market in Europe is expected to witness significant growth by the end of 2035, owing to the growing demand for efficient energy management solutions and the increasing adoption of renewable energy systems. The automotive and industrial sectors are the main end users of step-down voltage regulators in Europe and the growing demand for electric and hybrid vehicles is expected to drive the market growth. in the area. The presence of stringent regulations regarding energy efficiency and emissions is also expected to boost demand for voltage regulators in Europe.

Step-Down Voltage Regulator Market Players:

- ABB Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Analog Devices, Inc.

- Cypress Semiconductor Corporation

- Diodes Incorporated

- Eaton Corporation

- Infineon Technologies AG

- Renesas Electronics Corporation

- Maxim Integrated

- Microchip Technology Inc.

- Chroma ATE Inc.

Recent Developments

- ABB Ltd. announced the acquisition of ASTI Group, with the insight to drive the next generation of flexible automation.

- Chroma ATE Inc. launched a battery stabilizer Chroma 61500 AC to provide immunity and stability to the electronics system.

- Report ID: 4009

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Step-Down Voltage Regulator Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.