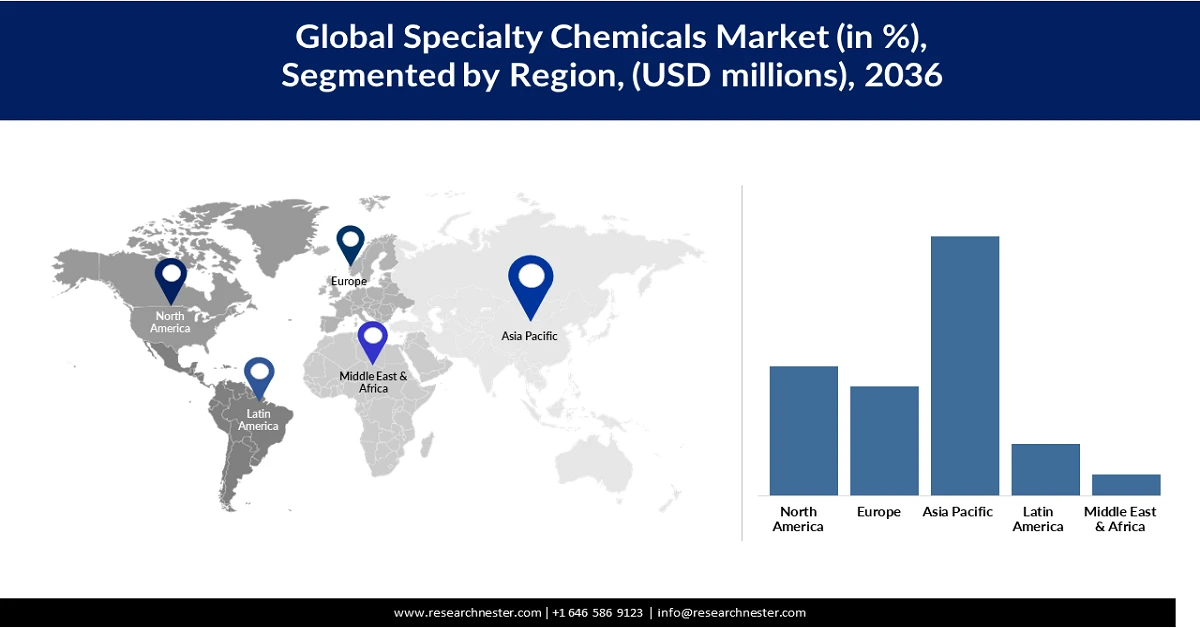

Specialty Chemicals Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific specialty chemicals market is predicted to garner 50% of the market share by 2036. The growth of the market can be attributed to the expanding technological innovation and rapid industrialization in the region. There is strong demand from prominent industries such as electronics, automotive, and agrochemicals is fostering the adoption of the sociality chemicals, which offer customization and sustainability. Moreover, the strong focus on eco-friendly chemical solutions and increasing disposable incomes is propelling the consumption of advanced materials. Also, the region is going through a green chemistry revolution, which is unlocking new opportunities.

The specialty chemicals market in China is propelled by the presence of strong manufacturing bases and the rapid growth of the end-use industries in the country. The growth of the market can also be attributed to the rising urbanization in the country. For instance, according to data published by the World Health Organization, by 2030, it is projected that about 70% of the people in China will live in cities. This illustrates that there will be a rising need for transportation networks and housing in the country, further augmenting the market growth. Furthermore, government-led industrial advancements initiatives, which are focusing on eco-friendly chemical solutions, are encouraging innovation and capacity expansion.

The market in India is witnessing staggering growth owing to the rising export opportunities and increasing shift toward value-added chemicals. There is a surge in acceptance of the country’s specialty chemicals in the regulated market is strengthening export revenues. The country’s strong API and formulation industry is raising demand for specialty intermediates and performance chemicals. Also, there is a surge in environmental regulations and customer preference for eco-friendly products, which is speeding the adoption of low-toxicity specialty chemicals. There has been a surge in improved crop protection needs, and export-oriented formulations are boosting specialty agrochemical consumption. Foreign Direct Investments (FDI) inflows in the chemicals sector (excluding fertilizers) in FY 2025 were USD 23.2 billion. Moreover, the IBEF estimated that the chemicals and allied product exports reached USD 108.59 in FY 2025. The India chemical market is presently stands at USD 220 billion and is projected to value at USD 300 billion by 2030 and USD 1 trillion by 2040.

Top 5 Countries in Agrochemical Exports from India in 2022

|

Country |

Export Value (USD Billion) |

|

China |

11.1 |

|

India |

5.5 |

|

United States |

5.4 |

|

France |

4.1 |

|

Germany |

3.9 |

Source: CCFI

North America Market Insights

In North America, the growth of the market is augmented by the sustainability priorities and supportive infrastructure. There is a rapid expansion in the construction and electronics is propelling the requirement for application-specific chemical solutions. The robust research and development capabilities and manufacturing infrastructure, boosting the development of varied products, with low-VOC and bio-based formulations, are speeding the innovation toward sustainable specialty chemicals. Cumulatively, these factors are placing the region as a dynamic market with robust growth momentum for specialty chemicals.

The U.S. specialty chemicals market growth is propelled by the growth in electric vehicles and lightweight materials. Also, there is a resurgence of semiconductor manufacturing in the U.S., mainly owing to support from the CHIPS Act, which has reignited the demand for ultra-high-purity specialty chemicals used in photolithography. Moreover, market forces are propelling the shift towards bio-based specialty chemicals. Producers in the country are increasingly manufacturing low-VOC formulations and eco-friendly materials in response to environmental mandates. The quantifiable outcomes of these green chemistry initiatives are demonstrable as by the year 2022, more than 133 winning green chemistry technologies in the U.S. have eradicated 830 million pounds of hazardous chemicals and solvents annually. This illustrates the industry’s transition to environmentally compliant and sustainable production pathways. Such progress reinforces sustainability as a key structural growth driver for the U.S. specialty chemicals market. According to the analysis by the American Chemistry Council (ACC), the U.S. chemical demand is expected to increase at a growth rate of 15.5% by 2033. This highlights that investing in the U.S. is likely to double the revenues of specialty chemical producers. The green chemistry trends are also expected to drive the overall market growth in the coming years.

The specialty chemicals market in Canada is set to witness significant growth on the back of the country’s strategy for critical minerals and modern material ecosystem, mainly nickel and rare earth processing. These procedures need specialized reagents and high-purity processing additives. The country is pioneering in low-carbon industrial processes, which is stimulating demand for specialty chemicals that foster emissions reduction. Additionally, the expansion of precision farming across prominent provinces such as Manitoba and Saskatchewan is augmenting the consumption of specialty agrochemicals, micronutrients, and formulation additives tailored to local crop conditions.

Europe Market Insights

In Europe, a strict regulatory framework such as the EU Green Deal and REACH is speeding up the demand for eco-friendly specialty chemicals. The region has an impeccable base for aerospace, automotive, and industrial manufacturing sectors, which is continuing to generate steady demand for performance chemicals. Other than this, the rapid transition to renewable energy and battery manufacturing is propelling the consumption of specialty chemicals used in energy storage and electronic components. Robust R&D intensity and collaboration between chemical producers further support innovation and act as a catalyst for market growth.

The market in Germany is propelled by the presence of industrial specialization, which generates a highly localized demand for modern chemical solutions. For instance, Ludwigshafen is home to the world’s largest integrated chemical complexes, fostering the demand for specialty intermediates with the help of a vertically integrated manufacturing ecosystem. Moreover, the country has leadership in the Energiewende (energy transition), which is speeding the demand for specialty chemicals utilized in wind turbines and hydrogen technologies.

Annually Licensed Onshore Wind Power Capacity in Germany

|

Year |

Newly Licensed Onshore Wind Capacity (MW) |

|

2015 |

3,722 |

|

2016 |

9,411 |

|

2017 |

1,387 |

|

2018 |

1,580 |

|

2019 |

1,964 |

|

2020 |

2,959 |

|

2021 |

4,136 |

|

2022 |

4,246 |

|

2023 |

7,574 |

|

2024 |

14,056 |

Source: Fachagentur Wind und Solar, 2024

The UK specialty chemicals market growth is driven by the country’s leadership in modern materials and high-value manufacturing. Additionally, post-Brexit environmental regulations are accelerating innovation in green chemistry and the development of sustainable specialty chemicals. Similarly, the expansion of the fragrance industry in the country is leading to an increased demand for specialty ingredients. Fragrance formulations need a wide range of specialty aroma chemicals, solvents, stabilizers, etc., that are produced through advanced chemical synthesis, further propelling the market growth.

Top Export Destinations from the UK in 2024 (USD)

|

Country |

Value (USD) |

|

Ireland |

USD 126.3 million |

|

Belgium |

USD 77.0 million |

|

Netherlands |

USD 76.6 million |

|

United States |

USD 75.0 million |

|

United Arab Emirates |

USD 37.1 million |

Source: OEC