- 1. An Introduction to the Research Study

- Preface

- Market Taxonomy

- Definition of the Market and the Segments

- Acronyms and Assumption

- The Research Procedure

- Sources of Data

- Secondary

- Primary

- Manufacture Front

- End user Front

- Supplier/Distributor Front

- Calculation and Derivation of Market Size

- Top-Down Approach

- Bottom-Up Approach

- Sources of Data

- An Abstract of the Report

- Evaluation of Market Fluctuation and Outlook

- Market Growth Drivers

- Market Growth Definition

- Market Trends

- End User Based

- Product Based

- Fundamental Market prospects

- Strategic Competitive Opportunities

- Geographic Opportunities

- Application Centric Opportunities

- Decarbonization Strategy and Carbon Credit Benefits for Market Players

- Global Government Decarbonization Plans/Goals by Each Country under 2015 Agreement Agreed by 200 Countries

- Measures taken by Countries to Reduce Carbon Footprints

- Carbon Credits and Subsidy Plans/Benefits Rolled Out by the Government for Market Players

- Effective Ways to Harness Carbon-Credits and Impact on Profit Margins

- Demand Impact on the Companies Opting for Carbon Credits

- Regulatory & Standard Landscape

- Economic Outlook: Japan

- Limitations to Japan’s Economic Recovery

- Uplifting Policies to Foster the Growth of the Economy

- Future Outlook and Strategic: Move for Sustainable Economy

- Key Market Opportunities for Business Growth

- Industry Value Chain Analysis

- Regional Demand Analysis

- Pricing Analysis

- End-User Analysis

- Recent Technology Outlook in Medical Device Contract Manufacturing

- Analysis on Major Manufacturer and Original Equipment Manufacturers (OEM) Offering Contract Manufacturing Services

- Global Syringes & Needles Market Outlook & Projections, Opportunity Assessment, 2023 to 2036

- Market Summary

- Market Value (USD Million) Current and Future Projections, 2023-2036

- Market Volume (Million Units) Current and Future Projections, 2023-2036

- Market Increment $ Opportunity Assessment, 2023-2036

- Year on Year Growth Forecast (%)

- By Product

- Syringes, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- General Purpose Syringe, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Specialized Syringe, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Needles, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Conventional Needle, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Safety Needle, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Syringes, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- By Usability

- Disposable, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Reusable, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- By Patient Group

- Pediatric, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Adult, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Geriatric, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- By Type

- Blood Collection Syringes and Needles, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Ophthalmic Syringes and Needles, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Bone Marrow Syringes and Needles, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Catheter Syringes and Needles, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Others, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- By Application

- General Surgery, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Diagnostics, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Respiratory, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Orthopedics, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Cardiovascular, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Dental, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Others, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- By End-User

- Hospital, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Clinics, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Home Care Sites, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Others, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- By Geography

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Units), and Compound Annual Growth Rate (CAGR)

- North America, Market Value (USD million), and CAGR, 2023-2036F

- Europe, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Asia Pacific Excluding Japan (APEJ), Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Japan, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Latin America, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Middle East and Africa, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- By Product

- Cross Analysis of Product w.r.t. End-User (USD Million), 2023

- North America Syringes & Needles Demand Outlook & Projections, 2023 to 2036: A Comprehensive Study for Stakeholders

- Outline of the Segment

- Detailed Overview

- Market Value (USD Million) Current and Future Projections, 2023-2036

- Market Volume (Million Units) Current and Future Projections, 2023-2036

- Leading companies

- Recent trends in the market

- By Product

- Syringes, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- General Purpose Syringe, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Specialized Syringe, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Needles, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Conventional Needle, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Safety Needle, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Syringes, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- By Usability

- Disposable, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Reusable, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- By Patient Group

- Pediatric, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Adult, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Geriatric, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- By Type

- Blood Collection Syringes and Needles, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Ophthalmic Syringes and Needles, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Bone Marrow Syringes and Needles, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Catheter Syringes and Needles, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Others, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- By Application

- General Surgery, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Diagnostics, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Respiratory, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Orthopedics, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Cardiovascular, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Dental, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Others, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- By End-User

- Hospital, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Clinics, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Home Care Sites, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Others, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- By Geography

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Units), and Compound Annual Growth Rate (CAGR)

- US, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Canada, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- By Product

- Europe Syringes & Needles Demand Outlook & Projections, 2023 to 2036: A Comprehensive Study for Stakeholders

- Outline of the Segment

- Detailed Overview

- Market Value (USD Million) Current and Future Projections, 2023-2036

- Market Volume (Million Units) Current and Future Projections, 2023-2036

- Leading companies

- By Product

- By Usability

- By Patient Group

- By Type

- By Application

- By End-User

- By Geography

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Units), and Compound Annual Growth Rate (CAGR)

- Germany, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- UK, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Italy, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- France, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Spain, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- BENELUX, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Russia, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Poland, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Rest of Europe, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Asia Pacific Excluding Japan (APEJ) Syringes & Needles Demand Outlook & Projections, 2023 to 2036: A Comprehensive Study for Stakeholders

- Outline of the Segment

- Detailed Overview

- Market Value (USD Million) Current and Future Projections, 2023-2036

- Market Volume (Million Units) Current and Future Projections, 2023-2036

- Leading companies

- Recent trends in the market

- By Product

- By Usability

- By Patient Group

- By Type

- By Application

- By End-User

- By Geography

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Units), and Compound Annual Growth Rate (CAGR)

- China, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- India, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Indonesia, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- South Korea, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Australia, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Singapore, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Malaysia, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- New Zealand, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Rest of APEJ, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Japan Syringes & Needles Demand Outlook & Projections, 2023 to 2036: A Comprehensive Study for Stakeholders

- Outline of the Segment

- Detailed Overview

- Market Value (USD Million) Current and Future Projections, 2023-2036

- Market Volume (Million Units) Current and Future Projections, 2023-2036

- Leading companies

- Recent trends in the market

- By Product

- By Usability

- By Patient Group

- By Type

- By Application

- By End-User

- Latin America Syringes & Needles Demand Outlook & Projections, 2023 to 2036: A Comprehensive Study for Stakeholders

- Outline of the Segment

- Detailed Overview

- Market Value (USD Million) Current and Future Projections, 2023-2036

- Market Volume (Million Units) Current and Future Projections, 2023-2036

- Leading companies

- Recent trends in the market

- By Product

- By Usability

- By Patient Group

- By Type

- By Application

- By End-User

- By Geography

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Units), and Compound Annual Growth Rate (CAGR)

- Brazil, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Mexico, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Argentina, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Rest of Latin America, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Middle East and Africa Syringes & Needles Demand Outlook & Projections, 2023 to 2036: A Comprehensive Study for Stakeholders

- Outline of the Segment

- Detailed Overview

- Market Value (USD Million) Current and Future Projections, 2023-2036

- Market Volume (Million Units) Current and Future Projections, 2023-2036

- Leading companies

- Recent trends in the market

- By Product

- By Usability

- By Patient Group

- By Type

- By Application

- By End-User

- By Geography

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Units), and Compound Annual Growth Rate (CAGR)

- GCC, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Israel, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- South Africa, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Rest of MEA, Market Value (USD Million), Volume (Million Units), and CAGR, 2023-2036F

- Comprehensive Analysis of Leading Players in the Market

- Market share of Key Competitors in the Market, (%) 2023

- Profile of the Major Vendors

- Cardinal Health

- Business Overview

- Key Business Strategies for the Growth of Revenue

- Financial Performance and Revenue Representation

- Major Products Offered

- Mergers and Acquisitions

- Latest Trends

- Regional and Worldwide Presence

- Becton, Dickinson and Company

- Allison Medical, Inc.

- B. Braun SE

- Argon Medical Devices.

- Smiths Medical (ICU Medical, Inc.)

- Teleflex Incorporated.

- Apexmed International B.V.

- EXELINT International, Co.

- Hindustan Syringes & Medical Devices Ltd.

- Cardinal Health

- Key Japanese Players

- Terumo Medical Corporation

- NIPRO Corporation

- Misawa Medical Industry Co., Ltd.

Syringes and Needles Market Outlook:

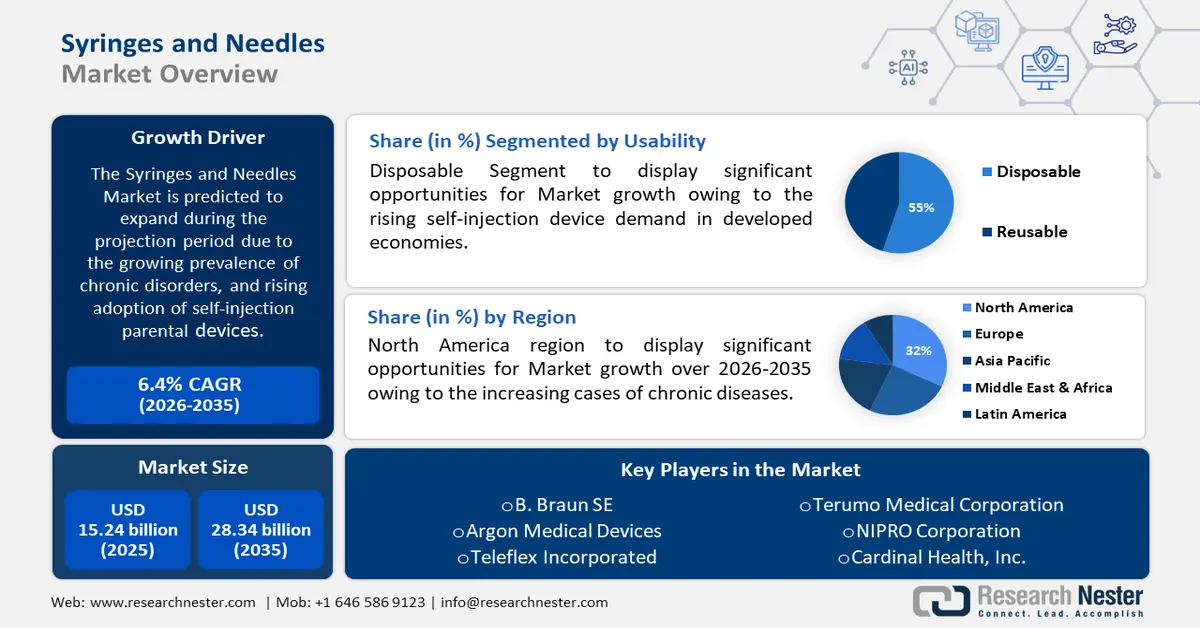

Syringes and Needles Market size was over USD 15.24 billion in 2025 and is anticipated to cross USD 28.34 billion by 2035, witnessing more than 6.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of syringes and needles is assessed at USD 16.12 billion.

The industry growth is attributed to the growing prevalence of chronic disorders, and rising adoption of self-injection parental devices. With the surging chronic condition, the treatment using syringes and needles is performed at home.

In addition to these, there are different types of syringes, and needles that are used for different surgical procedures such as ophthalmic syringes & needles, bone marrow syringes & needles, catheter syringes & needles, and others. It is important to choose the right needles and syringes that must be according to the volume of medication, injection site, and viscosity. Hence, the increase in the number of surgical procedures is surging the demand for syringes, and needles.

Key Syringes and Needles Market Insights Summary:

Regional Highlights:

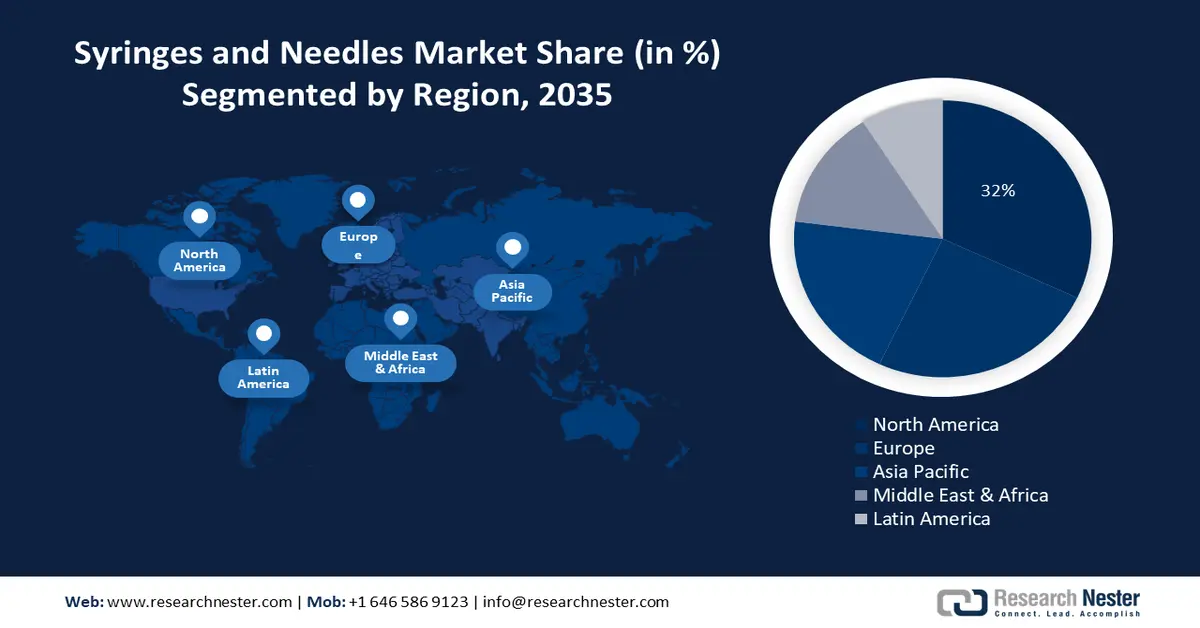

- North America syringes and needles market will secure around 32% share by 2035, driven by growth in demand for syringes and needles, increasing availability of advanced healthcare services and insurance plans, and increasing innovations in product portfolio.

- Europe market will hold the second largest share by 2035, driven by increasing awareness among healthcare providers related to the use of safety syringes and needles.

Segment Insights:

- The disposable syringes segment in the syringes and needles market is forecasted to achieve the highest CAGR through 2035, driven by their sterilized condition, cost advantage, and growing self-injection device demand.

- The syringes segment in the syringes and needles market is projected to experience the fastest growth over 2026-2035, driven by the need to minimize virus transmission and rising demand for medicine administration tools.

Key Growth Trends:

- Increasing geriatric population across the globe

- Surging Global Disease Outbreaks Such as Epidemics and Pandemics

Major Challenges:

- Rising Risk of Needle Stick Injuries

- Increasing Adoption of Alternative Drug Delivery Technologies

Key Players: Cardinal Health, Inc., Becton, Dickinson and Company, Allison Medical, Inc., B. Braun SE, Argon Medical Devices, Smiths Medical (ICU Medical, Inc), Teleflex Incorporated, Apexmed International B.V, Exelint International, Co., Hindustan Syringes and Medical Devices Ltd.

Global Syringes and Needles Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.24 billion

- 2026 Market Size: USD 16.12 billion

- Projected Market Size: USD 28.34 billion by 2035

- Growth Forecasts: 6.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 11 September, 2025

Syringes and Needles Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing geriatric population across the globe – The global elderly population continues to increase at an exceptional rate that is increasing the demand for injectable medicines. Currently, 8.5% of the global population (617 million) is aged 65 and older. Between 2015 and 2050, the worldwide number of "oldest old people" aged 80 and older is projected to more than triple, from 126.5 million to 446.6 million.

-

Surging Global Disease Outbreaks Such as Epidemics and Pandemics– Pandemics are broad-scale epidemics of infectious diseases that can significantly increase mortality as well as morbidity across an extensive geographical region and cause substantial disruptions in the economy, society, and politics. The influence of COVID-19 on pharmacological packing is anticipated to be high owing to the prompt production of vaccines for coronavirus variants. The growing epidemics of diseases increases the need for syringes and needles for the treatment and administration of drugs. BD (Becton, Dickinson, and Company) announced in 2021 that it had received contracts for 2 billion injection products to support global COVID-19 vaccination initiatives.

- Rapid Technological Advancement in Syringes and Needles – In 2022, Terumo Pharmaceutical Solutions (TPS) introduced a pre-fillable polymer syringe for low-dose applications, such as ophthalmic medications. The PLAJEX 0.5 mL Luer Lock Silicone free of oil pre-fillable syringe was developed specifically for difficult low-dose pre-filled syringe (PFS) products, making it appropriate for high-value drug applications.

- There have been other growth factors in the syringes and needles market such as the surging use of VR and AR for the manufacturing of needles, and syringes. Moreover, the increasing use of prefilled syringes that are used for the treatment of chronic diseases.

Challenges

-

Rising Risk of Needle Stick Injuries – Needlestick injuries (NSIs) that expose healthcare workers to blood-borne pathogens pose a significant threat to both healthcare workers and patients. These incidents are capable of transmitting numerous blood-borne infectious illnesses, particularly viruses. These include hepatitis B (HBV), hepatitis C (HCV), and HIV. OSHA estimates that nearly five million healthcare professionals are at risk of occupational exposure to various pathogens transmitted by blood due to NSIs

-

Increasing Adoption of Alternative Drug Delivery Technologies

- Stringent Government Regulation

Syringes and Needles Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.4% |

|

Base Year Market Size (2025) |

USD 15.24 billion |

|

Forecast Year Market Size (2035) |

USD 28.34 billion |

|

Regional Scope |

|

Syringes and Needles Market Segmentation:

Product Segment Analysis

Syringes segmented is expected to grow at the fastest CAGR during the forecast period. Syringes minimize the possibility of virus transmission from patient to patient, and are primarily used for medicine administration using specialized and general-purpose approaches. Hazardous injecting practices result in around 33,800 HIV infections, 315,000 hepatitis C transmissions, and 1.7 million hepatitis B infections each year.

Usability Segment Analysis

The syringes and needles market from disposable segment is expected to grow at the highest CAGR during the upcoming years. In veterinary and medical research, disposable plastic syringes are used. Disposable syringes are rapidly replacing traditional glass syringes because they are more frequently available in sterilized condition and are less expensive. Conventional syringes and pre-filled syringes are some of the types of disposable syringes. The demand for prefilled syringes is growing as a result of rising self-injection device demand in developed economies. Sterilization and safety are the two key benefits of using a disposable syringe among others.

Our in-depth analysis of the syringes and needles market includes the following segments:

|

Product |

|

|

Usability |

|

|

Patient Group |

|

|

Type |

|

|

By Application |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Syringes and Needles Market Regional Analysis:

North American Market Insights

North America is anticipated to dominate 32% syringes and needles market share by 2035, led by growth in demand for syringes, and needles in the region. In North America, the increasing availability of advanced and proactive healthcare services and insurance plans is expanding the market for syringes and needle supplies. Several variables, notably a high rate of medical inflation, lead to the United States having much greater medical costs than other North American countries. Expatriates, on the other hand, have a range of insurance options, and the American healthcare system is superior to that of other North American regions. Furthermore, an increasing number of innovations in the product portfolio in the region. For instance, Cardinal Health has issued a voluntary recall for certain Monoject Flush prefilled saline syringes (0.9% sodium chloride) intended for flushing appropriate intravenous tubing systems and indwelling intravascular access devices.

European Market Insights

The syringes and needles market market in the Europe region is predicted to hold the second largest share by 2035. The increasing awareness among healthcare providers related to the use of safety syringes, and needles. By obscuring the needle before and after use, safety syringes are designed to prevent needlestick injuries. There are numerous advantages to utilizing a safety hypodermic. It can aid in the prevention of needlestick injuries.

Syringes and Needles Market Players:

- Cardinal Health, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Becton, Dickinson and Company

- Allison Medical, Inc.

- B. Braun SE

- Argon Medical Devices

- Smiths Medical (ICU Medical, Inc)

- Teleflex Incorporated

- Apexmed International B.V

- Exelint International, Co.

- Hindustan Syringes and Medical Devices Ltd

- Other major players

- Terumo Medical Corporation

- NIPRO Corporation

- Misawa Medical Industry Co., Ltd.

Recent Developments

- BD created a next-generation glass pre-fillable syringe (PFS) that raises the bar for vaccine PFS performance, with new and stronger requirements for processability, cosmetics, contamination, and integrity. In order to fulfill the complicated and changing needs of vaccine manufacture, the innovative BD EffivaxTM Glass Prefillable Syringe was created in partnership with top pharmaceutical companies.

- Terumo India introduced FineGlide, a sterile pen needle for individuals who require routine insulin injections or other self-medication, by improving patient comfort and consequently drug compliance, FineGlide is the first item from Terumo Medical Care Solutions' Life Care Solutions to be released in India with a high-grade silicone surface and a 3-bevel design, it is a gentler and more comfortable needle for patients. When compared to other options on the market, it is developed with Thin Wall Technology to ensure a greater flow rate and better penetration while requiring less injection effort. It is available in different sizes ranging from 4 mm to 12.7 mm in length and 29-32 Gauge thickness for a variety of uses and is compatible with the majority of regularly used pen devices in India.

- Report ID: 4983

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Syringes and Needles Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.