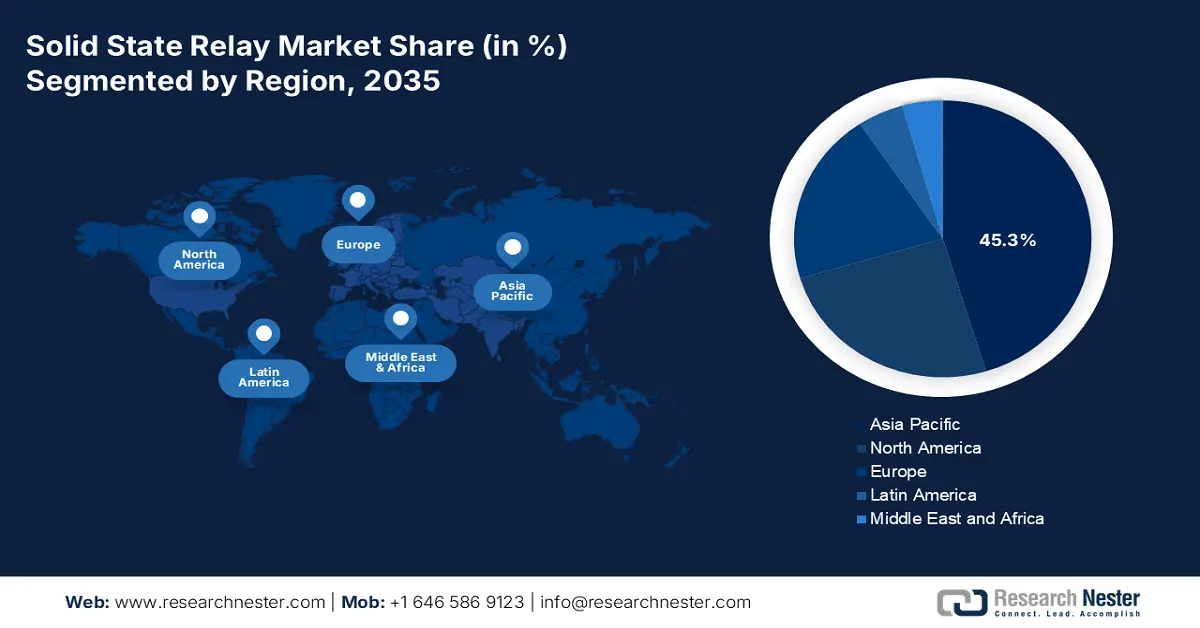

Solid State Relay Market - Regional Analysis

APAC Market Insights

Asia Pacific in the solid state relay market is anticipated to hold the largest share of 45.3% by the end of 2035. The market’s upliftment in the region is highly attributed to generous investments in consumer electronics manufacturing, telecommunications, and industrial automation. China is considered the primary manufacturing center, driven by the Made in China 2025 strategy, while India’s data center ecosystem expansion, rapid digitalization, and production-linked incentive (PLI) schemes are also driving the market in the region. Meanwhile, South Korea and Japan deliberately contribute to the advanced needs of the leading 5G infrastructure, robotics, and semiconductor industries, which cater to the market’s development in the region. According to an article published by the GDRC Organization in November 2023, the region’s population accounts for 50% of the total population by the end of 2050, which is bolstering the solid state relay market.

China in the solid state relay market is gaining increased exposure, owing to its centralized role in international electronics supply chains. In addition, the governmental expenditure on power electronics and industrial automation is essential for solid state relay adoption. This has increased in the past five years, with a further increase in industrial robots that are operational in the country’s factories. As per an article published by the ITIF Organization in July 2024, domestic automakers produced 21% of the global passenger vehicles, which is estimated to reach 33% by the end of 2030. Besides, between 2020 to 2023, the country’s electric vehicle exports surged by 851%, while organizations are 30% rapid in creating and unveiling the latest car models, which is creating an optimistic approach for the market to develop in the country.

India in the solid state relay market is growing significantly due to an upsurge in governmental spending in electronics manufacturing through the Production Linked Incentive (PLI) scheme. This has been continuously growing with generous funding provision for the solid state relay market, which is supported by the domestic electronics field that is manufacturing increased products, all demanding solid state relay-based components for power control. As stated in the October 2025 PIB Government report, the country’s government has approved 7 projects with an investment of more than ₹5,500 crores under the Electronics Component Manufacturing Scheme (ECMS). Additionally, these projects are expected to generate production, amounting to ₹36,559 crore, and develop over 5,100 direct employment opportunities. Therefore, with this huge contribution from the government, the market is set to boom in the country.

Different ECMS Funding Programs in India for the Electronic Field (2025)

|

Applicant Name |

Product |

Project Location |

Cumulative Investment (Rs crores) |

Cumulative Production (Rs crores) |

Incremental Employment (in persons) |

|

Kaynes Circuits India Private Limited |

Multi-Layer Printed Circuit Board (PCB) |

Tamil Nadu |

104 |

4,300 |

220 |

|

Kaynes Circuits India Private Limited |

Camera Module Sub-Assembly |

Tamil Nadu |

325 |

12,630 |

480 |

|

Kaynes Circuits India Private Limited |

HDI PCB |

Tamil Nadu |

1,684 |

4,510 |

1,480 |

|

Kaynes Circuits India Private Limited |

Laminate |

Tamil Nadu |

1,167 |

6,875 |

300 |

|

SRF Limited |

Polypropylene Film |

Madhya Pradesh |

496 |

1,311 |

225 |

|

Syrma Strategic Private Limited |

Multi-Layer Printed Circuit Board (PCB) |

Andhra Pradesh |

765 |

6,933 |

955 |

Source: PIB Government

Europe Market Insights

Europe in the solid state relay market is expected to emerge as the fastest-growing region during the predicted period. The market’s development in the region is highly driven by its robust industrial base and strict focus on industrial digitalization and energy efficiency. In addition, the commitment towards the Green Deal and Industry 4.0, along with modernization in manufacturing infrastructure, investments in renewable energy integration, and expansion of data centers to support regional data sovereignty, are also driving the solid state relay market. As stated in the 2024 Europe Commission report, the regional Green Deal approach has deliberately aimed to reduce emissions by almost 50% by the end of 2030, which is rapidly rising to 55%, while binding the 2050 neutrality objective. To achieve this goal, €275 billion has been invested in REPower and NextGeneration, and 42% of this fund has been dedicated to climate action.

Germany in the solid state relay market is gaining increased traction, owing to the presence of its leading manufacturing sector’s strong adoption of Industry 4.0. In addition, the nation’s Plattform Industrie 4.0 strategy, which is backed by the Federal Ministry for Economic Affairs and Energy, has provided a tactical framework for implementing cyber-physical systems into production. This, in turn, inherently depends on precise electronics components, such as solid state relays for automation and control. According to a data report published by the ITA in August 2025, 64% of the country’s organizations have planned to initiate investments in enterprise resource planning (ERP), 70% in cybersecurity, 72% in cloud-based systems, and 75% in manufacturing execution systems (MES), which positively impacts the overall market’s growth.

The UK in the solid state relay market is also developing due to the presence of its huge data center expansion and renewable energy objectives. The country’s National Grid ESO's Future Energy Scenarios has outlined a pathway to decarbonize the power system, readily depending on flexible and renewable demand. This requires innovative power electronics for control and conversion. According to an article published by Tech UK Organization in November 2024, data centers are projected to experience unprecedented growth, constituting a potential contribution of £44 billion to the country’s economy by the end of 2035. Besides, data centers are also contributing £4.7 billion in gross value added (GVA) every year, along with 43,500 employment opportunity, and £640 million in tax revenue to the exchequer.

North America Market Insights

North America in the solid state relay market is predicted to witness steady growth by the end of the forecast duration. The market’s growth in the region is driven primarily by advancements in industrial modernization and ICT infrastructure, significant investments in data center expansion, innovative manufacturing reshoring, and 5G network deployment. Besides, the U.S. CHIPS and Science Act is also fueling the market’s demand, particularly in semiconductor fabrication equipment, while the Inflation Reduction Act has accelerated investments in renewable energy and smart grid technologies. As per an article published by the U.S. Department of Energy in September 2023, the Inflation Reduction Act offers approximately USD 11.7 billion to ensure loan issuing, enhances the current loan program by providing USD 100 billion, and ensures USD 5 billion for a new loan program. This has been possible with the Loan Programs Office (LPO) association, which is positively impacting the market in the region.

The U.S. in the solid state relay market is growing significantly, owing to strong ICT investments and federal strategies. Besides, the CHIPS and Science Act allocates generous funding to boost domestic semiconductor production, which directly uplifts the need for solid state relays in the precision-based fabrication tools, which are further crucial for the market’s expansion. Additionally, huge data center construction, backed by cloud providers, needs solid state relays for thermal management and efficient power distribution. As stated in the 2023 Semiconductor Industry Association article, based on the CHIPS Act, global organizations positively responded and declared the latest semiconductor ecosystem projects in the country, with more than USD 200 billion in private investments. Besides, the Advanced Power Electronics Design for Solar Applications (Power Electronics) funding program is also creating a huge opportunity and expansion for the overall market in the country.

Advanced Power Electronics Design for Solar Applications (Power Electronics) Funding Program in the U.S. (2025)

|

Project Name |

Location |

U.S. Department of Energy Fund |

Project Summary |

|

Modular, Multifunction, Multiport, and Medium-Voltage Utility Scale Silicon Carbide PV Inverter |

University of Texas at Austin |

USD 2,999,400 |

Next-generation utility-scale photovoltaic inverter development |

|

Modular HF Isolated Medium-Voltage String Inverters Enable a New Paradigm for Large PV Farms |

Georgia Institute of Technology |

USD 1,927,973 |

Newest inverter development for reducing the balance-of-system expense |

|

PV Inverter Systems Enabled by Monolithically Integrated Silicon Carbide-Based Four Quadrant Power Switch |

North Carolina State University |

USD 1,517,146 |

Creating low-cost power and ultra-high-density conversion device |

|

A Reliable, Cost-Effective Transformerless Medium-Voltage Inverter for Grid Integration of Combined Solar and Energy Storage |

University of Arkansas |

USD 2,765,138 |

Enhance PV plant reliability with diminished lifetime expenses |

|

Compact and Low-Cost Microinverter for Residential Systems |

University of Maryland: College Park |

USD 1,872,818 |

Develop microinverters with a holistic design approach |

|

Modular Wide-Bandgap String Inverters for Low-Cost Medium-Voltage Transformerless PV Systems |

University of Washington |

USD 2,837,106 |

Ultra-low-cost medium-voltage transformerless photovoltaic (PV) inverters production |

Source: U.S. Department of Energy

Canada in the solid state relay market is also growing due to tactical investments in green technology and telecommunications. Besides, the national Connect to Innovate program, along with continuous 5G spectrum auctions, are also escalating the network infrastructure deployment, especially in north and rural locations, thereby uplifting the consistent demand for solid state relays in base power systems. Moreover, the country’s commitment to a net-zero grid is readily catalyzing investments in smart grid and renewable energy projects. According to the 2025 Efficiency Canada article, the organization has committed USD 1.5 billion in federal funding for low-income energy efficiency and operates with existing programming and provinces as of 2024. Meanwhile, in 2023, the organization introduced a proposal for the Codes Acceleration Fund, amounting to USD 100 million to assist territories, municipalities, stakeholders, indigenous governments, and territories to decarbonize the building sector.