Solid State Relay Market Outlook:

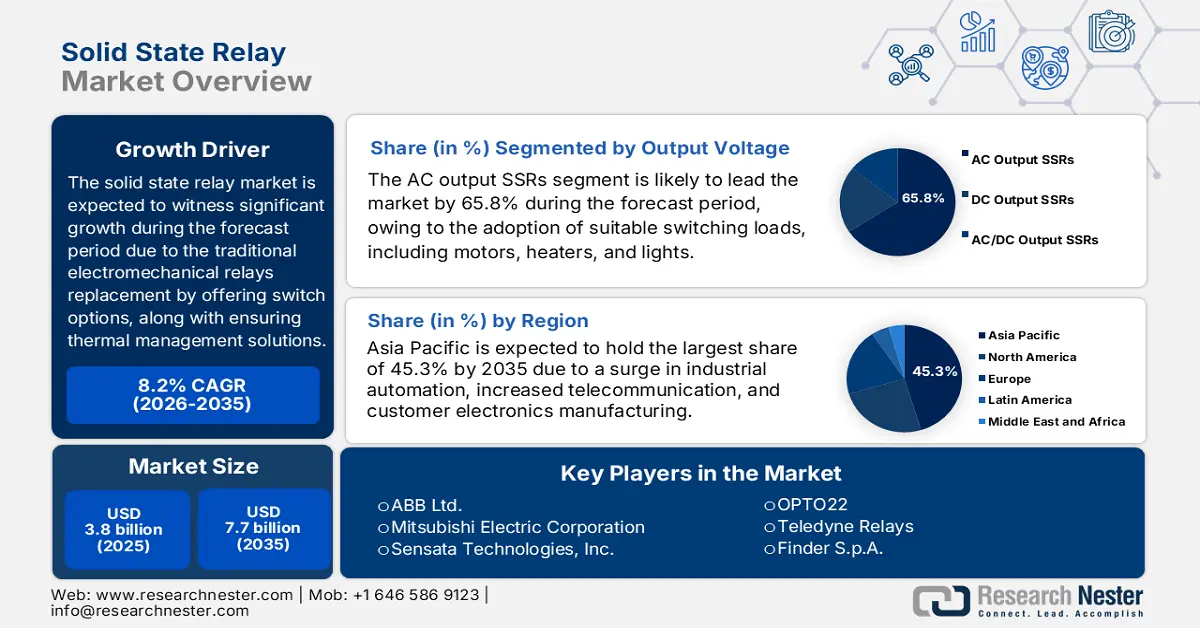

Solid State Relay Market size was over USD 3.8 billion in 2025 and is estimated to reach USD 7.7 billion by the end of 2035, expanding at a CAGR of 8.2% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of solid state relay is assessed at USD 4.1 billion.

The international solid state relay market is presently experiencing a shifting phase, which is fueled by the worldwide transition towards energy and electronics efficiency across different industries. Besides, as a silent enabler of modernized technology, solid state relays are increasingly supplanting conventional electromechanical relays by providing superior dependability, silent operation, and rapid switching speeds. According to an article published by the IFR Organization in September 2024, there have been 4,281,585 units operating in factories globally, which denotes a 10% increase. Besides, yearly installations also exceeded half a million units, and regionally, 70% of overall deployed robots have been installed in Asia, followed by 17% in Europe, and 10% in America. Therefore, solid state relays are indispensable in the modern landscape of industrial automation, which is uplifting the overall market globally.

Yearly Operational Stock of Industrial Robots

|

Years |

Stock in units |

|

2013` |

1,332 |

|

2014 |

1,472 |

|

2015 |

1,632 |

|

2016 |

1,838 |

|

2017 |

2,125 |

|

2018 |

2,441 |

|

2019 |

2,737 |

|

2020 |

3,027 |

|

2021 |

2,479 |

|

2022 |

3,904 |

|

2023 |

4,282 |

Source: IFR Organization

Furthermore, the aspect of high-power density and miniaturization, integration of smart features, advancements in thermal management, and tactical consolidation are also propelling the solid state relay market globally. As per an article published by the NIELIT Government in May 2022, there has been a modification in the Internet of Things (IoT)-based policy wherein internet-connected devices account for 12.5 billion, which has further surpassed human beings by 7 billion. In addition, these particular devices are further projected to surge, accounting for 26 billion to 50 billion in the upcoming years, thereby making it suitable for bolstering the market’s exposure across different nations. Besides, as per the February 2025 NASA Government report, the active thermal architecture (ATA) can optimize baseline thermal performance by more than 200%, which is also driving the overall solid state relay market.

Key Solid-state Relay Market Insights Summary:

Regional Insights:

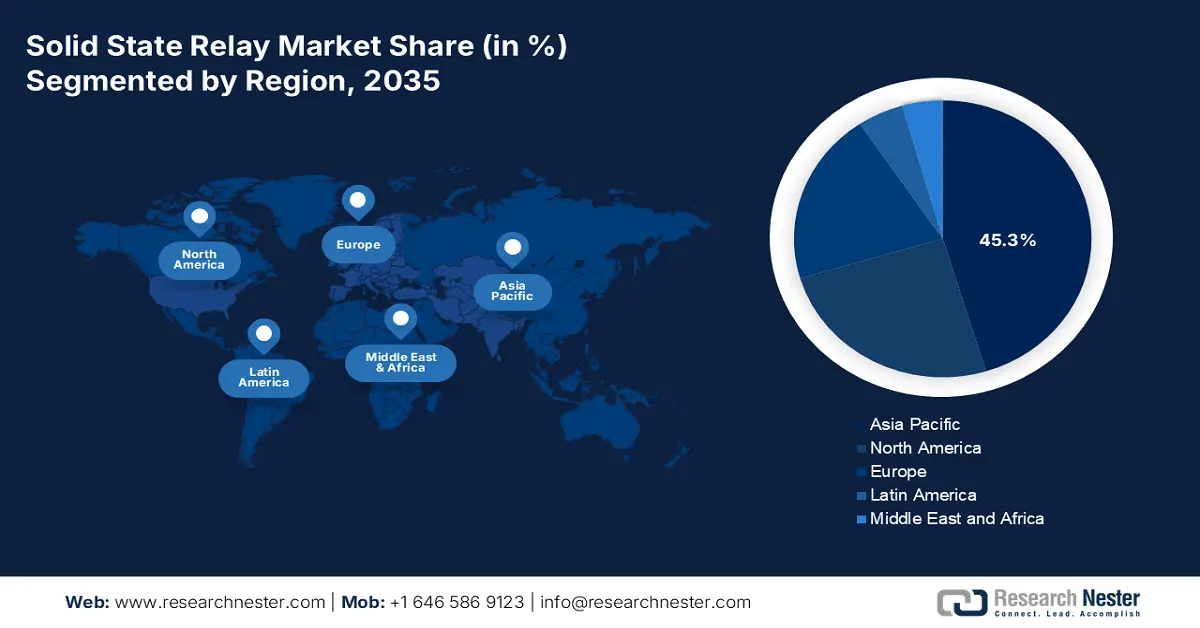

- Asia Pacific in the solid state relay market is projected to secure a 45.3% share by 2035, underpinned by intensifying investments in consumer electronics manufacturing, telecommunications, and industrial automation.

- Europe is anticipated to be the fastest-growing region by 2035, supported by its strong industrial base and stringent emphasis on industrial digitalization and energy efficiency.

Segment Insights:

- The AC output SSRs in the output voltage segment are expected to command a 65.8% share by 2035 in the solid state relay market, propelled by their capability to reliably switch AC loads with precise, fast, and silent performance.

- The photo-coupled SSRs segment is projected to capture the second-largest share by 2035, enabled by its optical isolation design that mitigates voltage transients and enhances noise immunity.

Key Growth Trends:

- Automation and industrial IoT

- Expansion in data centers

Major Challenges:

- High initial cost and price sensitivity

- Heat dissipation and technical complexities

Key Players: OMRON Corporation (Japan), Panasonic Corporation (Japan), Celduc Relais (France), Vishay Intertechnology, Inc. (U.S.), IXYS Corporation (U.S.), TE Connectivity (Switzerland), Fujitsu Limited (Japan), Sharp Corporation (Japan), Rockwell Automation, Inc. (U.S.), Siemens AG (Germany), ABB Ltd. (Switzerland), Mitsubishi Electric Corporation (Japan), Sensata Technologies, Inc. (U.S.), OPTO22 (U.S.), Teledyne Relays (U.S.), Finder S.p.A. (Italy), COSMO Electronics Co., Ltd. (South Korea), Littelfuse, Inc. (U.S.), Crydom, Inc. (U.S.)

Global Solid-state Relay Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.8 billion

- 2026 Market Size: USD 4.1 billion

- Projected Market Size: USD 7.7 billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45.3% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, Japan, South Korea, India, Taiwan

Last updated on : 21 November, 2025

Solid State Relay Market - Growth Drivers and Challenges

Growth Drivers

- Automation and industrial IoT: The proliferation of Industry 4.0 and smart factories has necessitated data-capable, reliable, and precise switching components, which is driving the massive adoption of the solid state relay market in process control systems, robotics, and programmable logic controllers (PLCs). According to a report published by the ISA Organization in June 2025, stakeholder consultations have recommended that Smart Energy Management strategies can diminish energy consumption by 3% to 5%. In addition, a condition monitoring solution can optimize machine health by 8% to 10%, while camera-specific quality inspection can lower the defect rate by 6% to 8%, and also overcome the issue associated with unit expense.

- Expansion in data centers: The international boom in 5G network deployment and cloud computing needs highly dependable power management as well as thermal control in base stations and servers. This has created a sustained demand for the solid state relay market in cooling systems and Uninterruptible Power Supplies (UPS). As per an article published by the Department of Energy in December 2024, data centers readily consumed almost 4.4% of the U.S. electricity as of 2023, and are projected to consume an estimated 6.7% to 12.0% of the overall electricity by the end of 2028. It has been further estimated that total data center electricity utilization has increased from 58 TWh in 2014 to 176 TWh as of 2023, which is further predicted to surge between 325 TWh to 580 TWh by the end of 2028.

- Integration of renewable energy: The shift from solar to wind energy depends on innovative power electronics for grid management and inversion, wherein solid state relays are extremely severe for reliable and efficient power control and conversion. According to a data report published by the IEA Organization in 2025, the international renewable electricity generation is projected to increase to more than 17,000 terawatt-hours, denoting a surge by 90% from 2023. Besides, there has been growth in over renewables by 34.5% in 2025, along with 17.5% in variable renewables, 14.2% in hydropower, 9.2% in wind, 8.3% in solar PV, and 2.8% in other renewables. Therefore, with continuous development and upliftment in renewable sources, there is a huge growth opportunity for the solid state relay market globally.

Challenges

- High initial cost and price sensitivity: The superior performance of the solid state relay market comes at a premium, which has created an effective adoption barrier. While solid state relays provide a suitable overall expense of ownership through reliability and longevity, the usual procurement expense can be immensely higher than equivalent electromechanical relay (EMR). Besides, across cost-driven and highly competitive industries, including consumer appliance manufacturing, this particular upfront expense difference is considered the primary decision factor. Meanwhile, budget constraints frequently force engineers to select low-cost EMR, despite its short-term maintenance and lifespan. This is usually prevalent across small and medium-sized enterprises, as well as emerging nations, thus negatively impacting the market’s growth.

- Heat dissipation and technical complexities: A fundamental physical restriction of the solid state relay market is the inherent power dissipation in the form of heat. While conducting current, the semiconductor output comprises an on-state voltage drop, which generates significant waste heat after multiplying the load current. This heat, in turn, needs to be dissipated effectively to combat the component from increasing its maximum junction-based temperature and failing catastrophically. Besides, managing this particular thermal load has necessitated the utilization of external heatsinks, which has provided substantial expense, physical volume, and weight to the final assembly. This process complicates the entire system design, particularly in space-constrained applications, such as compact control panels, thus lowering the market’s exposure.

Solid State Relay Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 3.8 billion |

|

Forecast Year Market Size (2035) |

USD 7.7 billion |

|

Regional Scope |

|

Solid State Relay Market Segmentation:

Output Voltage Segment Analysis

The AC output SSRs in the output voltage segment are anticipated to garner the largest share in the solid state relay market of 65.8% by the end of 2035. The sub-segment’s upliftment is highly propelled by its importance for reliably switching AC loads, such as lights, heaters, and motors, since they provide precise, fast, and silent switching with no moving parts, along with increased reliability. According to an article published by Heliyon in January 2025, the flexible alternating current transmission (FACTS) devices market is valued at USD 1,350.5 million, which is predicted to increase to USD 2,688.4 million by the end of 2032. This is exhibited by a 5.9% growth rate, which is positively impacting the segment’s growth. Besides, the overall segment is comprehensively utilized in industrial automation, home appliances, renewable energy systems, and HVAC, which enhances the segment’s growth.

Input/Output Circuit Segment Analysis

The photo-coupled SSRs segment, which is part of the input or output circuit, is projected to constitute the second-largest share in solid state relay market during the forecast period. The segment’s development is highly fueled by its fundamental design, which uses a photo-sensitive semiconductor and a light-emitting diode (LED) to develop an isolation gap between the high-voltage load output and low-voltage control input. This optical isolation overcomes damaging voltage transients and provides outstanding noise immunity. As a result, this has made this particular SSR category the standard choice for the majority of ICT and industrial applications, wherein signal integrity is paramount. In addition, the cost-effectiveness, compact form factor, and reliability for standard switching activities have also bolstered its position. Therefore, with the presence of such benefits, the segment is poised to gain increased exposure in the overall market.

Current Rating Segment Analysis

The low current (up to 40A) segment under the current rating is expected to account for the third-largest share in the solid state relay market by the end of the stipulated timeline. The segment’s growth is highly propelled by the core of the ICT and digitalized revolution, along with the proliferation of signal switching applications and low-power control. This particular rating range significantly covers the majority of demands in modernized electronics, which include interfacing Programmable Logic Controllers (PLCs) with solenoids and sensors, automating processes in robotics, and controlling signals in telecommunications equipment. These drivers are multifaceted, readily centering around the exponential development of the IIoT, which actively connects countless actuators and low-power sensors. Meanwhile, expansion in data centers has resulted in SSRs managing fan control and board-level power distribution, which is also uplifting the segment’s demand.

Our in-depth analysis of the solid state relay market includes the following segments:

|

Segment |

Subsegments |

|

Output Voltage |

|

|

Input/Output Circuit |

|

|

Current Rating |

|

|

Mounting Type |

|

|

Application |

|

|

End user Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Solid State Relay Market - Regional Analysis

APAC Market Insights

Asia Pacific in the solid state relay market is anticipated to hold the largest share of 45.3% by the end of 2035. The market’s upliftment in the region is highly attributed to generous investments in consumer electronics manufacturing, telecommunications, and industrial automation. China is considered the primary manufacturing center, driven by the Made in China 2025 strategy, while India’s data center ecosystem expansion, rapid digitalization, and production-linked incentive (PLI) schemes are also driving the market in the region. Meanwhile, South Korea and Japan deliberately contribute to the advanced needs of the leading 5G infrastructure, robotics, and semiconductor industries, which cater to the market’s development in the region. According to an article published by the GDRC Organization in November 2023, the region’s population accounts for 50% of the total population by the end of 2050, which is bolstering the solid state relay market.

China in the solid state relay market is gaining increased exposure, owing to its centralized role in international electronics supply chains. In addition, the governmental expenditure on power electronics and industrial automation is essential for solid state relay adoption. This has increased in the past five years, with a further increase in industrial robots that are operational in the country’s factories. As per an article published by the ITIF Organization in July 2024, domestic automakers produced 21% of the global passenger vehicles, which is estimated to reach 33% by the end of 2030. Besides, between 2020 to 2023, the country’s electric vehicle exports surged by 851%, while organizations are 30% rapid in creating and unveiling the latest car models, which is creating an optimistic approach for the market to develop in the country.

India in the solid state relay market is growing significantly due to an upsurge in governmental spending in electronics manufacturing through the Production Linked Incentive (PLI) scheme. This has been continuously growing with generous funding provision for the solid state relay market, which is supported by the domestic electronics field that is manufacturing increased products, all demanding solid state relay-based components for power control. As stated in the October 2025 PIB Government report, the country’s government has approved 7 projects with an investment of more than ₹5,500 crores under the Electronics Component Manufacturing Scheme (ECMS). Additionally, these projects are expected to generate production, amounting to ₹36,559 crore, and develop over 5,100 direct employment opportunities. Therefore, with this huge contribution from the government, the market is set to boom in the country.

Different ECMS Funding Programs in India for the Electronic Field (2025)

|

Applicant Name |

Product |

Project Location |

Cumulative Investment (Rs crores) |

Cumulative Production (Rs crores) |

Incremental Employment (in persons) |

|

Kaynes Circuits India Private Limited |

Multi-Layer Printed Circuit Board (PCB) |

Tamil Nadu |

104 |

4,300 |

220 |

|

Kaynes Circuits India Private Limited |

Camera Module Sub-Assembly |

Tamil Nadu |

325 |

12,630 |

480 |

|

Kaynes Circuits India Private Limited |

HDI PCB |

Tamil Nadu |

1,684 |

4,510 |

1,480 |

|

Kaynes Circuits India Private Limited |

Laminate |

Tamil Nadu |

1,167 |

6,875 |

300 |

|

SRF Limited |

Polypropylene Film |

Madhya Pradesh |

496 |

1,311 |

225 |

|

Syrma Strategic Private Limited |

Multi-Layer Printed Circuit Board (PCB) |

Andhra Pradesh |

765 |

6,933 |

955 |

Source: PIB Government

Europe Market Insights

Europe in the solid state relay market is expected to emerge as the fastest-growing region during the predicted period. The market’s development in the region is highly driven by its robust industrial base and strict focus on industrial digitalization and energy efficiency. In addition, the commitment towards the Green Deal and Industry 4.0, along with modernization in manufacturing infrastructure, investments in renewable energy integration, and expansion of data centers to support regional data sovereignty, are also driving the solid state relay market. As stated in the 2024 Europe Commission report, the regional Green Deal approach has deliberately aimed to reduce emissions by almost 50% by the end of 2030, which is rapidly rising to 55%, while binding the 2050 neutrality objective. To achieve this goal, €275 billion has been invested in REPower and NextGeneration, and 42% of this fund has been dedicated to climate action.

Germany in the solid state relay market is gaining increased traction, owing to the presence of its leading manufacturing sector’s strong adoption of Industry 4.0. In addition, the nation’s Plattform Industrie 4.0 strategy, which is backed by the Federal Ministry for Economic Affairs and Energy, has provided a tactical framework for implementing cyber-physical systems into production. This, in turn, inherently depends on precise electronics components, such as solid state relays for automation and control. According to a data report published by the ITA in August 2025, 64% of the country’s organizations have planned to initiate investments in enterprise resource planning (ERP), 70% in cybersecurity, 72% in cloud-based systems, and 75% in manufacturing execution systems (MES), which positively impacts the overall market’s growth.

The UK in the solid state relay market is also developing due to the presence of its huge data center expansion and renewable energy objectives. The country’s National Grid ESO's Future Energy Scenarios has outlined a pathway to decarbonize the power system, readily depending on flexible and renewable demand. This requires innovative power electronics for control and conversion. According to an article published by Tech UK Organization in November 2024, data centers are projected to experience unprecedented growth, constituting a potential contribution of £44 billion to the country’s economy by the end of 2035. Besides, data centers are also contributing £4.7 billion in gross value added (GVA) every year, along with 43,500 employment opportunity, and £640 million in tax revenue to the exchequer.

North America Market Insights

North America in the solid state relay market is predicted to witness steady growth by the end of the forecast duration. The market’s growth in the region is driven primarily by advancements in industrial modernization and ICT infrastructure, significant investments in data center expansion, innovative manufacturing reshoring, and 5G network deployment. Besides, the U.S. CHIPS and Science Act is also fueling the market’s demand, particularly in semiconductor fabrication equipment, while the Inflation Reduction Act has accelerated investments in renewable energy and smart grid technologies. As per an article published by the U.S. Department of Energy in September 2023, the Inflation Reduction Act offers approximately USD 11.7 billion to ensure loan issuing, enhances the current loan program by providing USD 100 billion, and ensures USD 5 billion for a new loan program. This has been possible with the Loan Programs Office (LPO) association, which is positively impacting the market in the region.

The U.S. in the solid state relay market is growing significantly, owing to strong ICT investments and federal strategies. Besides, the CHIPS and Science Act allocates generous funding to boost domestic semiconductor production, which directly uplifts the need for solid state relays in the precision-based fabrication tools, which are further crucial for the market’s expansion. Additionally, huge data center construction, backed by cloud providers, needs solid state relays for thermal management and efficient power distribution. As stated in the 2023 Semiconductor Industry Association article, based on the CHIPS Act, global organizations positively responded and declared the latest semiconductor ecosystem projects in the country, with more than USD 200 billion in private investments. Besides, the Advanced Power Electronics Design for Solar Applications (Power Electronics) funding program is also creating a huge opportunity and expansion for the overall market in the country.

Advanced Power Electronics Design for Solar Applications (Power Electronics) Funding Program in the U.S. (2025)

|

Project Name |

Location |

U.S. Department of Energy Fund |

Project Summary |

|

Modular, Multifunction, Multiport, and Medium-Voltage Utility Scale Silicon Carbide PV Inverter |

University of Texas at Austin |

USD 2,999,400 |

Next-generation utility-scale photovoltaic inverter development |

|

Modular HF Isolated Medium-Voltage String Inverters Enable a New Paradigm for Large PV Farms |

Georgia Institute of Technology |

USD 1,927,973 |

Newest inverter development for reducing the balance-of-system expense |

|

PV Inverter Systems Enabled by Monolithically Integrated Silicon Carbide-Based Four Quadrant Power Switch |

North Carolina State University |

USD 1,517,146 |

Creating low-cost power and ultra-high-density conversion device |

|

A Reliable, Cost-Effective Transformerless Medium-Voltage Inverter for Grid Integration of Combined Solar and Energy Storage |

University of Arkansas |

USD 2,765,138 |

Enhance PV plant reliability with diminished lifetime expenses |

|

Compact and Low-Cost Microinverter for Residential Systems |

University of Maryland: College Park |

USD 1,872,818 |

Develop microinverters with a holistic design approach |

|

Modular Wide-Bandgap String Inverters for Low-Cost Medium-Voltage Transformerless PV Systems |

University of Washington |

USD 2,837,106 |

Ultra-low-cost medium-voltage transformerless photovoltaic (PV) inverters production |

Source: U.S. Department of Energy

Canada in the solid state relay market is also growing due to tactical investments in green technology and telecommunications. Besides, the national Connect to Innovate program, along with continuous 5G spectrum auctions, are also escalating the network infrastructure deployment, especially in north and rural locations, thereby uplifting the consistent demand for solid state relays in base power systems. Moreover, the country’s commitment to a net-zero grid is readily catalyzing investments in smart grid and renewable energy projects. According to the 2025 Efficiency Canada article, the organization has committed USD 1.5 billion in federal funding for low-income energy efficiency and operates with existing programming and provinces as of 2024. Meanwhile, in 2023, the organization introduced a proposal for the Codes Acceleration Fund, amounting to USD 100 million to assist territories, municipalities, stakeholders, indigenous governments, and territories to decarbonize the building sector.

Key Solid State Relay Market Players:

- Carlo Gavazzi Holding AG (Switzerland)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- OMRON Corporation (Japan)

- Panasonic Corporation (Japan)

- Celduc Relais (France)

- Vishay Intertechnology, Inc. (U.S.)

- IXYS Corporation (U.S.)

- TE Connectivity (Switzerland)

- Fujitsu Limited (Japan)

- Sharp Corporation (Japan)

- Rockwell Automation, Inc. (U.S.)

- Siemens AG (Germany)

- ABB Ltd. (Switzerland)

- Mitsubishi Electric Corporation (Japan)

- Sensata Technologies, Inc. (U.S.)

- OPTO22 (U.S.)

- Teledyne Relays (U.S.)

- Finder S.p.A. (Italy)

- COSMO Electronics Co., Ltd. (South Korea)

- Littelfuse, Inc. (U.S.)

- Crydom, Inc. (U.S.)

- Carlo Gavazzi Holding AG is one of the most specialized Europe-based leaders, well-known for its extended portfolio of industrial-grade solid state relays, controls, and sensors. The organization accounts for a significant solid state relay market share in building and automation management systems, further recognized for its reliable and robust components, designed for critical environments. Therefore, based on these and as stated in its 2024 annual report, the organization generated CHF 172.2 million in revenue from good sales, CHF 94.7 million in gross profit, CHF 31.9 million as EBITDA, and CHF 25.3 million as EBIT.

- OMRON Corporation is considered an international automation pioneer and a dominating force in the solid state relay market, offering highly reliable relays that are integral to its very own industrial components and factory automation systems. The firm is acclaimed for its progression in miniaturization and high-performance SSRs that effectively serve the semiconductor equipment and precision-based electronics sectors.

- Panasonic Corporation is regarded as a notable international supplier, providing a comprehensive array of SSRs, especially known for its compact and high-quality PCB-based relays in customer appliances, industrial controls, and office equipment. Its aggressive presence in the customers' electronics manufacturing supply chain has solidified its substantial market position. In this regard, and as stated in its 2024 annual report, the company generated ¥8,496.4 billion in sales, ¥390.0 billion as adjusted operating profit, and ¥805.9 billion in EBITDA.

- Celduc Relais is considered an influential and highly specialized Europe-specific manufacturer, readily focused on the production and design of sensors and SSRs. The organization has significantly carved a robust niche with its advanced and high-performance products, particularly in applications demanding precise current control and isolation.

- Vishay Intertechnology, Inc. is one of the major international manufacturers of passive components and discrete semiconductors, which include a wide range of SSR products for aerospace, military, and industrial applications. The organization also significantly contributes to the market, with increased focus on high-temperature and high-reliability products, thus leveraging its vertical integration for quality control.

Here is a list of key players operating in the global solid state relay market:

The international solid state relay market is highly fragmented, with intensified competition among established global players. Notable strategies for market leadership and growth comprise strong product advancement by focusing on enhanced thermal performance, higher power density, and miniaturization to meet the demands of the industrial automation and ICT sectors. Organizations are heavily investing in research and development to adopt progressive features, such as diagnostics and IoT connectivity. Besides, in September 2024, Toward Technologies, Inc. joined Semicon Taiwan to introduce its innovative high-voltage relay solutions. In addition, the company also unveiled next-generation technologies, which are designed for electric vehicle battery management systems, industrial control systems, automated test equipment, and semiconductor testing, thereby suitable for boosting the solid state relay market.

Corporate Landscape of the Solid State Relay Market:

Recent Developments

- In May 2025, Littlefuse, Inc. declared the extended provision of the industry-based solid state relays products. These are considered as an additional three series of products and accessories that are crucial for heating applications that need dependable and affordable switching and compliance with global standards.

- In March 2024, Siemens has successfully developed one of the most advanced circuit protection devices with next-generation electronics switching technology. These devices provide ultra-fast, sustainable, parametrizable, and multifunctional properties which are 1,000 times rapid.

- Report ID: 5200

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Solid-state Relay Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.