Instantaneous Overcurrent Relay Market Outlook:

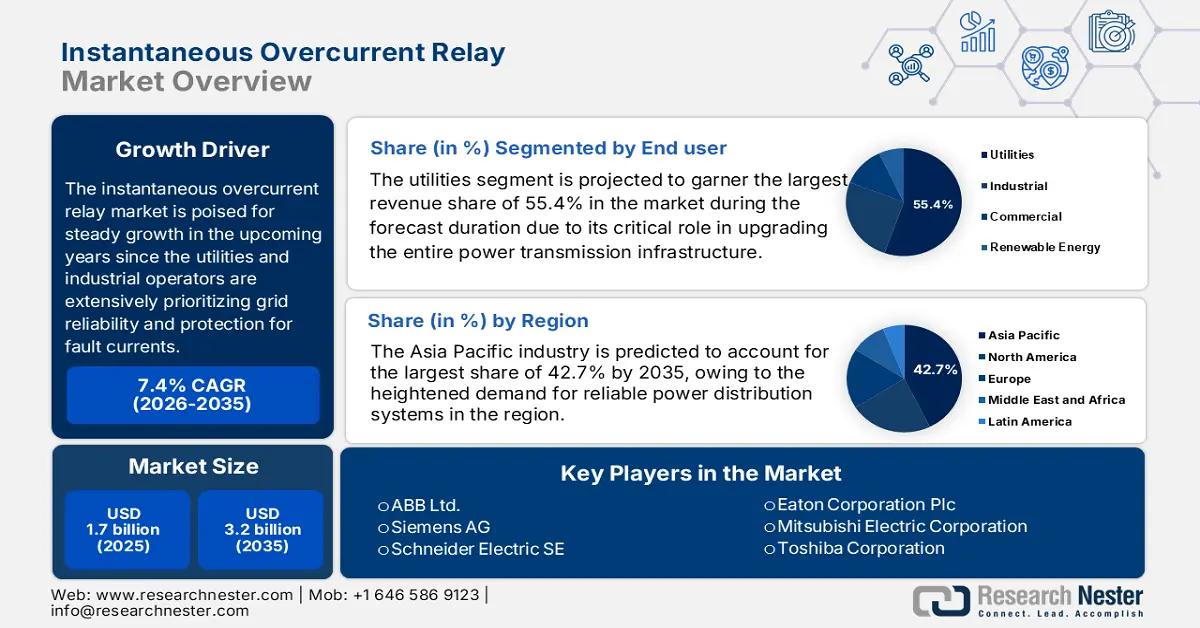

Instantaneous Overcurrent Relay Market size was valued at USD 1.7 billion in 2025 and is projected to reach USD 3.2 billion by the end of 2035, rising at a CAGR of 7.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of instantaneous overcurrent relay is evaluated at USD 1.8 billion.

The instantaneous overcurrent relay market is poised for steady growth in the upcoming years since the utilities and industrial operators are extensively prioritizing grid reliability and protection for fault currents. On the supply chain dynamics, WITS reported that imports of electrical machinery parts of electrical machines & apparatus having machine parts were about USD 1.735 billion in 2023, of which imports from Japan - USD 441 million and from China ~USD 398 million, which together constituted nearly half the total. It also underscored that during the same time, the U.S. exported a worth of approximately USD 1.256 billion. Hence, these figures reflect the assembly‑line dependency upon global sourcing of components and sub-assemblies, such as current transformers, communication modules, and housing enclosures that feed into protective relay manufacturing.

U.S. Imports of Electrical Machine Parts by Partner Country in 2023

|

Partner |

Trade Value (1000 USD) |

|

World |

1,735,170.17 |

|

Japan |

440,683.62 |

|

China |

397,796.47 |

|

Mexico |

178,399.65 |

|

Germany |

114,343.61 |

|

Other Asia, nes |

84,253.59 |

|

Vietnam |

70,320.12 |

|

U.K. |

62,039.45 |

|

Canada |

60,794.61 |

Source: WITS

Furthermore, in terms of raw materials, the manufacturers of protective relays must access inputs such as specialty steel, magnetics, copper windings, and semiconductors, many of which flow through regional supply hubs; hence, the supply‑chain remains global, with high sensitivity to logistics, tariff shifts, and currency volatility. In this regard, the U.S. Bureau of Labor Statistics report stated that the producer price index for electrical equipment and appliance manufacturing was 212.252 in August 2025, which is continuing to grow. Therefore, the rising input or output prices underscore the increased cost pressures for manufacturers of instantaneous overcurrent relays. Hence, these fluctuations are constantly driving innovation and investment in more efficient, reliable protective relay technologies, ultimately supporting long-term instantaneous overcurrent relay market growth by increasing demand for advanced, high-performance solutions.

Key Instantaneous Overcurrent Relay Market Insights Summary:

Regional Highlights:

- By 2035, Asia Pacific is anticipated to secure a 42.7% share in the instantaneous overcurrent relay market, stemming from heightened demand for reliable power distribution systems.

- North America is projected to attain a substantial share by 2035, underpinned by regulatory requirements prompting utilities to replace legacy protection systems.

Segment Insights:

- By 2035, the end user utilities segment is expected to command a 55.4% share in the instantaneous overcurrent relay market, propelled by its expanding role in ensuring grid reliability and robust fault management.

- The medium voltage segment is forecasted to achieve a 48.6% share by 2035, supported by rising investments in grid modernization and resilience programs.

Key Growth Trends:

- Integration of renewable energy

- Grid modernization investments

Major Challenges:

- Integration with legacy systems

- High initial investment costs

Key Players: ABB Ltd. - Switzerland, Siemens AG - Germany, Schneider Electric SE - France, Eaton Corporation Plc - U.S., Mitsubishi Electric Corporation - Japan, Toshiba Corporation - Japan, Schweitzer Engineering Laboratories, Inc. - U.S., Fuji Electric Co., Ltd. - Japan, Rockwell Automation, Inc. - U.S., Crompton Greaves Limited - India, Mikro MSC Berhad - Malaysia, Hitachi, Ltd. - Japan, Lucy Electric - U.K., Omron Corporation - Japan.

Global Instantaneous Overcurrent Relay Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.7 billion

- 2026 Market Size: USD 1.8 billion

- Projected Market Size: USD 3.2 billion by 2035

- Growth Forecasts: 7.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.7% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Indonesia

Last updated on : 26 November, 2025

Instantaneous Overcurrent Relay Market - Growth Drivers and Challenges

Growth Drivers

- Integration of renewable energy: This is the primary driver for the global instantaneous overcurrent relay market since the expansion in terms of renewable energy sources, such as wind and solar, introduces variable and intermittent power flows in the grid. Therefore, these fluctuations increase the risk of overcurrent faults and voltage instability, wherein the instantaneous overcurrent relays provide rapid fault detection and isolation, preventing equipment damage. Testifying to this, Invest India reported that in India, the renewable energy sector is readily expanding, wherein the installed non-fossil fuel capacity exceeds 205 GW, including growth in solar and wind power, supported by targets such as 500 GW of non-fossil energy by the end of 2030. On the other hand, government initiatives, such as 100% FDI, renewable purchase obligations, and development of solar parks and bio-gas projects, are encouraging investments, which in turn will drive demand for advanced grid protection solutions, elevating the potential of the market.

- Grid modernization investments: The increasing investments in terms of smart grids, digital substations, and distribution networks to meet modern energy demands are fostering an extremely profitable business environment for the instantaneous overcurrent relay market. Instantaneous overcurrent relays are integral to these upgrades due to their speed and reliability, which in turn drives consistent adoption across utility and industrial segments. In this regard, Avangrid in May 2025 announced that it made an investment of USD 41 million to modernize Ithaca, which is New York’s electrical grid, adding 22 miles of transmission lines and upgrading five substations. This initiative builds on over USD 500 million invested in 265 projects since 2023 under the Reliable Energy NY Rate Plan and supports Avangrid’s broader USD 20 billion grid modernization program through 2030. Therefore, these upgrades, including new transformers and capacitor banks, aim to improve reliability, increase capacity, and support regional growth.

- Reliability and safety requirements: The existence of stricter regulations and the high cost of outages emphasize network reliability and safety. Also, the industrial and utility operators need protective devices that can clear faults immediately to avoid cascading failures, which supports a very sustained instantaneous overcurrent relay market growth. Therefore, the Federal Energy Regulatory Commission, along with the North America’s Electric Reliability Corporation, enforces more than 80 mandatory reliability standards to ensure the bulk power system remains secure, stable, and resilient against faults and disturbances. Also, these standards require utilities to implement protective devices, vegetation management, and contingency plans to prevent cascading outages and maintain a continuous electricity supply. Hence, the existence of these strict operational and security measures, FERC and NERC regulations are rearranging the growth dynamics of the market for high-reliability protective and monitoring equipment in the power sector.

Challenges

- Integration with legacy systems: This is one of the most considerable challenges witnessed by the instantaneous overcurrent relay market. Many utilities and industrial facilities are still operating with outdated electromechanical or analog protection systems, where integrating modern digital instantaneous overcurrent relays with these legacy systems can be both complex and expensive. On the other hand, compatibility issues with communication protocols such as IEC 61850 are further exacerbating this difficulty. In addition, the aspect of retrofitting often demands downtime, engineering redesign, and training, which in turn slows large-scale modernization in older grids, thus hindering widespread adoption in this field.

- High initial investment costs: This is yet another factor restraining growth in the instantaneous overcurrent relay market. The advanced microprocessor-based and digital relays come with higher upfront costs when compared to traditional models, which makes it quite challenging for small-scale industries to afford them. Therefore, utilities in cost-sensitive markets may delay upgrades due to limited budgets. Other than that, the expense is also for hardware, installation, configuration, and personnel training as well. Furthermore, smaller industrial users often opt for cheaper, less capable devices to control expenses, thereby slowing down instantaneous overcurrent relay market penetration, especially in emerging regions.

Instantaneous Overcurrent Relay Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.4% |

|

Base Year Market Size (2025) |

USD 1.7 billion |

|

Forecast Year Market Size (2035) |

USD 3.2 billion |

|

Regional Scope |

|

Instantaneous Overcurrent Relay Market Segmentation:

End user Segment Analysis

Based on the end user utilities segment is projected to garner the largest revenue share of 55.4% in the instantaneous overcurrent relay market during the forecast duration. The dominance of the segment is attributable to its critical role in operating, maintaining, and upgrading the entire power transmission and distribution infrastructure. These utilities are also responsible for grid reliability and fault management, making rapid fault detection and isolation capabilities, such as those provided by instantaneous overcurrent relays, highly essential. Additionally, the integration of renewable energy sources and distributed generation introduces variable load and fault conditions, hence providing an encouraging opportunity for pioneers in this field. Further utilities are investing in adaptive and faster-acting relay systems to maintain coordination and ensure uninterrupted service.

Voltage Range Segment Analysis

In terms of voltage range medium voltage segment is projected to attain a significant share of 48.6% in the instantaneous overcurrent relay market by the end of 2035. The increasing investments in modernizing and hardening the core electrical distribution grid against rising outage events are the key factors driving the growth of this subtype. In this regard, the U.S. Department of Energy’s Grid Deployment Office reported that its grid resilience and innovation partnerships program provides substantial USD 10.5 billion to enhance grid flexibility and resilience against extreme weather. It also stated that through its first and second funding rounds, USD 7.6 billion has been allocated to 105 projects across all 50 states and D.C., supporting initiatives such as grid modernization, smart grid deployment, and innovative transmission and distribution solutions. The program includes three funding mechanisms: grid resilience utility and industry grants, smart grid grants, and the grid innovation program, which are aimed at ensuring reliable, affordable electricity in the U.S. communities.

Application Segment Analysis

Based on the application power distribution segment is expected to gain a lucrative revenue share of 42.5% in the instantaneous overcurrent relay market during the analyzed timeframe. The subtype remains the primary layer where overcurrent faults occur and must be isolated to prevent cascading failures. Most of the prominent organizations are reporting that expanding and digitalizing electricity distribution networks is a major priority to integrate renewables and meet the heightened demand, which in turn necessitates advanced protection systems such as instantaneous overcurrent relays. Furthermore, utilities expand and digitalize distribution networks to integrate renewable energy and manage higher loads, wherein the adoption of advanced protection systems, such as instantaneous overcurrent relays, becomes highly essential for preventing equipment damage and minimizing service interruptions.

Our in-depth analysis of the instantaneous overcurrent relay market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Voltage Range |

|

|

Application |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Instantaneous Overcurrent Relay Market - Regional Analysis

APAC Market Insights

Asia Pacific is likely to capture the largest revenue share of 42.7% in the instantaneous overcurrent relay market by the end of 2035. The dominance of the region in this field is effectively attributable to the heightened demand for reliable power distribution systems. Governments in the region are readily making investments in the expansion of transmission and distribution networks, creating encouraging opportunities for protection devices. In October 2025 World Energy Council announced that China Southern Power Grid had joined the World Energy Council as a patron, thereby strengthening its role in the global energy sector. It covers five provinces and enables its service to nearly 300 million people. The organization leads in ultra-high-voltage and HVDC technologies while advancing grid modernization and green energy integration. Therefore, this collaboration enables knowledge exchange on innovative energy solutions and supports global energy transitions through CSG’s experience in transmission, interconnection, and sustainable power infrastructure, hence denoting a positive instantaneous overcurrent relay market outlook.

China is solidifying its leadership over the regional dynamics of the instantaneous overcurrent relay market owing to the massive support and industrial growth. Utilities in the country are replacing aging protection systems with digital relays, which are capable of instantaneous overcurrent detection. In October 2025, Hitachi Energy celebrated 30 years of high-voltage switchgear innovation at its Beijing factory, highlighting investments in SF₆-free EconiQ circuit breakers and hybrid switchgear to support China’s low-carbon grid transition. It also stated that the facility has contributed to both major domestic and international projects, including UHVDC transmission and offshore wind integration, delivering over 40,000 switchgear units and 3 million cable accessories. Hence, this has appreciably strengthened domestic manufacturing and innovation, suitable for standard market growth.

India has become the hub of innovation in the instantaneous overcurrent relay market, wherein the rural electrification initiatives are accelerating the demand for protection devices. These relays are extremely benefited from the expansion of renewable energy, especially solar and wind, which requires them to manage intermittent generation. In August 2025, the Ministry of Power reported that the country’s government launched the Pradhan Mantri Sahaj Bijli Har Ghar Yojana (SAUBHAGYA) to provide electricity connections to all willing un-electrified households in rural areas and poor households in urban areas. It further stated that by the scheme’s closure on March 31, 2022, around 2.86 crore households had been electrified across the country. In addition, support continues under the Revamped Distribution Sector Scheme for remaining households, with works sanctioned for 13.59 lakh households. Furthermore, off-grid solar electrification has been implemented for 9,961 households under the New Solar Power Scheme as of June 2025.

North America Market Insights

North America is predicted to hold a lucrative share in the global instantaneous overcurrent relay market throughout the discussed tenure. The leadership of the region in this field is primarily driven by the presence of regulatory requirements, which are encouraging utilities to replace the legacy protection systems. Also, the integration of distributed energy sources and renewables necessitates relays with advanced fault detection and communications features. In April 2025, FCL Components America announced that it had launched the FTR-B3, FTR-B4, and FTR-C1 series of signal switching relays, which are designed for automotive applications, including EV battery monitoring and protection against over-voltage and over-current. It also underscored that these relays can handle up to 1mA at 400VDC, offering reliable signal switching for in-vehicle equipment while meeting UL, CSA, RoHS, and IATF16949 standards, hence making it suitable for standard market growth.

The U.S. is identified to be the major contributor to growth in the regional instantaneous overcurrent relay market due to the presence of stringent reliability and safety standards. Also, the utilities in the country are focused on modernizing their grid protection with digital and communication-enabled relays. Smart grid programs and renewable energy integration require fast and accurate fault detection, wherein the manufacturers in the country provide relays with advanced diagnostic and reporting features to support utility operations. In addition, the grid resilience initiatives and regulatory enforcement are readily enhancing market adoption, wherein the country’s market emphasizes high-performance and technology-rich relay solutions. Therefore, the presence of all of these factors is creating an extremely profitable business environment for both domestic and international pioneers in the U.S.

Canada represents steep growth in the instantaneous overcurrent relay market owing to the harsh weather and distributed generation necessitating reliable and fast fault-clearing solutions. Moreover, the country’s focus on system reliability and operational efficiency drives the adoption of advanced protection relays. In August 2025, Canada’s Minister of Energy and Natural Resources announced over USD 13 million in funding for five projects aimed at modernizing Ontario’s electricity grid under the Energy Innovation Program, Smart Grids Demonstration. Projects include Alectra Utilities’ Centricity initiative to enable customer-owned devices in electricity markets, HIAH Corp.’s multi-port power conversion system for rural industrial facilities, Peak Power Inc.’s distributed energy resource management platform, and Enova Power’s AI-based distribution-level electricity industry. Therefore, these investments support renewable integration, grid optimization, and international knowledge sharing to enhance the reliability, efficiency, and sustainability of the power system in Ontario.

Europe Market Insights

The instantaneous overcurrent relay market in Europe is poised for extensive growth in the years ahead due to increasing integration of renewable energy. The region benefits from distributed energy resources, which require fast and accurate fault detection, wherein the demand is strong for relays with communication capabilities and advanced diagnostic features. On the other hand, countries across the region are replacing traditional mechanical relays with intelligent electronic devices, presenting encouraging opportunities for both domestic and international players in this field. In November 2024, ABB announced that it released Version 2.5 of its Relion 601 series relays called REF601, REJ601, and REM601, which offer basic protection and control for primary and secondary distribution in utilities and industries. The update includes easier relay configuration via USB, enhanced fault data analysis, improved overcurrent and thermal overload protection, cold load pickup functionality, and support for IEC 61869 sensors, hence denoting a positive market outlook.

Germany is the key power engine for the instantaneous overcurrent relay market, which has high standards for grid reliability and protection. The presence of industrial demand and renewable energy integration is constantly driving the adoption in this field. Manufacturers in the country are focusing on technologically advanced, modular, and IEC-compliant relay solutions. Siemens, in November 2022, announced the launch of the Reyrolle 7SR46, which is a dual-powered protection relay especially designed for overcurrent and earth fault protection in medium voltage distribution transformer stations. The company also underscored that this relay can operate using power from current transformers or an auxiliary battery, providing redundancy and ensuring protection even in remote substations without reliable power. It also features a compact enclosure, USB connectivity, and multiple communication interfaces, which enable easy monitoring, control, and fault analysis.

The U.K. also holds a strong position in the regional instantaneous overcurrent relay market due to its pivotal role in supporting grid resilience and renewable energy expansion. The country also benefits from the offshore wind farms and distributed energy systems, which increase the complexity of protection requirements. The market emphasizes digital, modular, and communication-enabled relays wherein the regulatory standards drive utilities to adopt high-speed, accurate protective devices. The country is emphasizing digital, modular, and communication-enabled relays that offer precise fault detection, real-time monitoring, and interoperability with modern substation automation systems. Furthermore, stringent regulatory standards and grid codes, especially the country’s smart grid and decarbonization objectives, are compelling utilities and transmission operators to invest in high-speed, accurate protective devices.

Key Instantaneous Overcurrent Relay Market Players:

- ABB Ltd. - Switzerland

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens AG - Germany

- Schneider Electric SE - France

- Eaton Corporation Plc - U.S.

- Mitsubishi Electric Corporation - Japan

- Toshiba Corporation - Japan

- Schweitzer Engineering Laboratories, Inc. - U.S.

- Fuji Electric Co., Ltd. - Japan

- Rockwell Automation, Inc. - U.S.

- Crompton Greaves Limited - India

- Mikro MSC Berhad - Malaysia

- Hitachi, Ltd. - Japan

- Lucy Electric - U.K.

- Omron Corporation - Japan

- ABB Ltd. is recognized as the predominant leader in the field of power and automation technologies, which offers a wide range of protective relays, including instantaneous overcurrent relays. The primary focus of the company lies in digital substations, grid automation, and smart protection systems, integrating relays with SCADA and IEC 61850 communication protocols. In addition, the R&D investment and innovation enable utilities to adopt reliable fault protection, support renewable integration, and grid modernization.

- Siemens AG is delivering advanced numerical relays, which are designed for extremely high-speed overcurrent protection in transmission and distribution networks. On the other hand, its relays are widely utilized in industrial and utility applications due to their precision and flexibility. The firm deliberately focuses on digitalization and IoT integration to enhance relay monitoring and analytics, thereby enabling predictive maintenance and enhanced fault diagnostics as well.

- Schneider Electric SE is one of the prominent players in energy management and automation solutions, which also includes instantaneous and microprocessor-based overcurrent relays. In this regard, the company emphasizes eco-efficient and modular designs for industrial and utility, facilitating a highly scalable grid protection. Furthermore, it is extremely focused on digital transformation, IoT-enabled relays, and renewable energy integration, which helps customers improve network reliability, thereby reducing operational costs.

- GE Vernova is based in the U.S., which provides advanced protection relays and integrated digital grid solutions. Also, its instantaneous overcurrent relays are widely adopted by transmission networks and industrial applications for rapid fault detection and isolation. The company focuses on smart grid modernization, renewable energy integration, and FACTS solutions such as STATCOMs, which complement relay protection. R&D in digital relays, grid automation software, and partnerships with utilities are a few strategies adopted by the firm to secure its market position.

- Schweitzer Engineering Laboratories is best known for its specialized protection, automation, and control products, particularly in microprocessor-based instantaneous overcurrent relays. Besides, the firm is emphasizing high reliability, cybersecurity, and precision fault detection in harsh industrial and utility environments. Furthermore, it is readily expanding digital protection solutions, with training programs, and collaborating with regional utilities to support smart grid deployment.

Below is the list of some prominent players operating in the global instantaneous overcurrent relay market:

The global instantaneous overcurrent relay market is extremely competitive, wherein the global leaders are leveraging digitalization, smart-grid compatibility, and expanded service offerings to differentiate. Firms such as Siemens, Schneider Electric, and ABB are encouraging advanced numerical relays that integrate communications and analytics for utility networks. On the other hand, the players based in the U.S., such as SEL and GE, focus heavily on performance, reliability, and retrofit upgrades in transmission and distribution. In this regard, GE Vernova, in May 2024, announced that it collaborated with TECO, which is enhancing Taiwan’s power grid through the deployment of advanced ±200 Mvar STATCOM systems at key substations, supporting the integration of renewable energy and improving grid stability. Thus, such projects highlight the increasing complexity of power systems, which in turn necessitate faster protection mechanisms.

Corporate Landscape of the Instantaneous Overcurrent Relay Market:

Recent Developments

- In August 2025, Power and Data Management LLC announced the launch of its VFI Transformer, which is a medium-voltage padmount solution integrating vacuum fault interrupter technology and advanced relay systems, for modern data centers and hyperscale computing environments.

- In April 2024, ABB introduced the REX615, which is the newest addition to its Relion relay family, designed to provide comprehensive protection and control for power generation and distribution. It was built on the trusted 615 and 620 series; the REX615 combines modular hardware and scalable software.

- Report ID: 8269

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.