Solar Control Window Films Market Outlook:

Solar Control Window Films Market size was valued at USD 980.8 million in 2025 and is projected to reach USD 2.52 billion by the end of 2035, rising at a CAGR of 11.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of solar control window films is estimated at USD 1.08 billion.

The solar control window films market is poised for dynamic growth as businesses and homeowners across the globe are opting for energy-efficient solutions that enhance comfort and reduce reliance on artificial cooling. As of the November 2025 data from the U.S. General Services Administration, a Lawrence Berkeley National Laboratory (LBNL) study at the Goodfellow Federal Center in St. Louis demonstrated up to 29% heating and cooling energy reduction in hot climates using spectrally selective films. These industry‑validated analyses highlight the role of government‑evaluated technologies in improving building energy efficiency without endorsing any specific commercial products. It also mentioned that the films reduce glare and protect interior furnishings from UV damage, contributing to occupant comfort and long-term asset preservation. In addition, the federal initiatives, such as the GSA’s high-performance building program, continue to evaluate and promote such energy-saving measures across public facilities.

Furthermore, innovations in terms of film technology, such as improved UV protection, glare reduction, and aesthetic customization, are readily expanding the appeal of these products, stimulating business in the market. In this regard, in March 2025, Toray Industries announced that it has launched a 50-micrometer-thick PICASUS IR nano-multilayer window film, which offers superior transparency and enhanced heat shielding, with the high heat insulation type improving performance by a substantial 40% over the standard version. The firm also mentioned that this film is suitable for both automotive and building applications, maintaining visibility and appeal by effectively reducing solar heat gain. Hence, Toray’s development underscores ongoing R&D investment in high-performance window films to meet the heightened demand in sustainable and comfortable indoor environments, making it suitable for overall market growth.

Key Solar Control Window Films Market Insights Summary:

Regional Highlights:

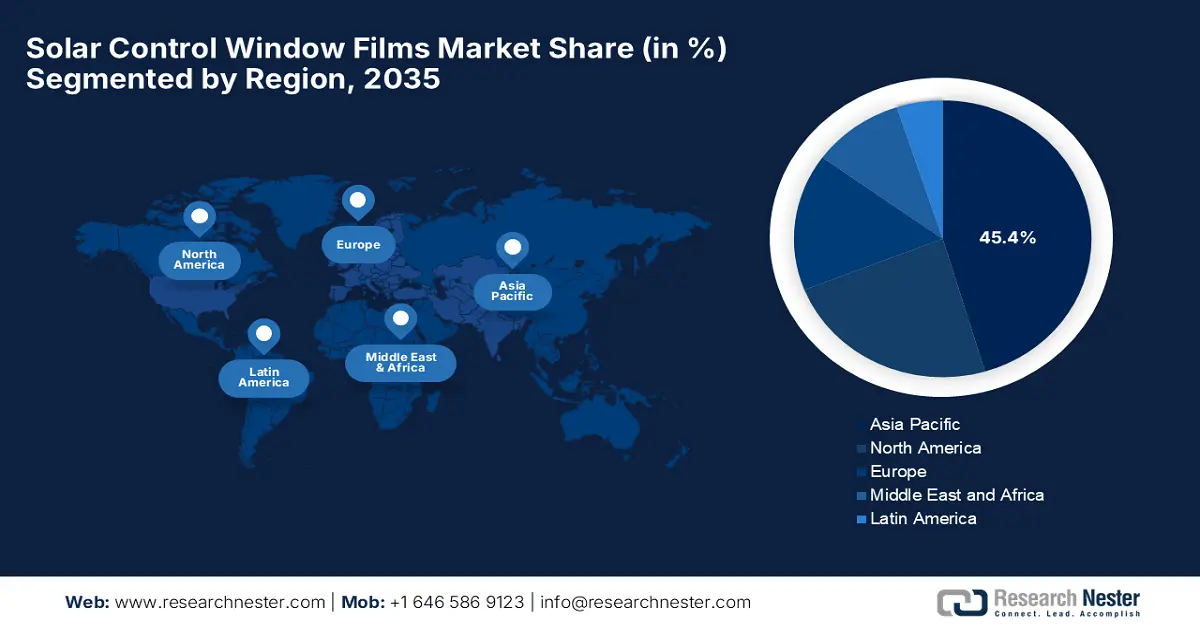

- Asia Pacific is projected to capture around 45.4% revenue share by 2035 in the solar control window films market, reinforced by large-scale commercial and residential construction, accelerating urbanization, supportive energy-efficiency policies, and extensive infrastructure development.

- North America is expected to maintain a strong regional position by 2035, bolstered by heightened focus on sustainability across commercial and residential sectors and the expanding adoption of advanced window film technologies that enhance thermal efficiency.

Segment Insights:

- In the installation stage segment, the new build subtype is projected to secure the largest revenue share of 85.6% by 2035 in the solar control window films market, underpinned by its specification during curtain-wall fabrication that ensures superior adhesion and consistent quality.

- By 2035, the vacuum-coated films segment is anticipated to expand at a considerable pace, supported by their strong infrared and solar heat reflectivity that reduces cooling demand and aligns buildings with energy-efficiency objectives.

Key Growth Trends:

- Energy efficiency & sustainability

- Rising temperatures

Major Challenges:

- Market fragmentation and competition

- Regulatory and compliance challenges

Key Players: 3M Company (U.S.), Eastman Chemical Company (U.S.), Saint-Gobain Performance Plastics (France), Avery Dennison Corporation (U.S.), Lintec Corporation (Japan), Madico, Inc. (U.S.), Garware Hi-Tech Films Ltd (India), Johnson Window Films, Inc. (U.S.), Nexfil Co., Ltd. (South Korea), Solar Screen International SA (Luxembourg), Dexerials Corporation (Japan), Purlfrost Ltd. (United Kingdom), Hüper Optik USA (U.S. / Germany), Global Window Films (U.S.), Armolan Window Films (U.S.)

Global Solar Control Window Films Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 980.8 million

- 2026 Market Size: USD 1.08 billion

- Projected Market Size: USD 2.52 billion by 2035

- Growth Forecasts: 11.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (around 45.4% share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 13 January, 2026

Solar Control Window Films Market - Growth Drivers and Challenges

Growth Drivers

- Energy efficiency & sustainability: The increasing emphasis on green buildings and net-zero structures is driving demand in the market. These solar films help to reduce solar heat gain, lower air conditioning requirements, and cut carbon footprints. In this regard, Eastman Chemical Company in February 2023 announced that it acquired Ai-Red Technology (Dalian) Co., Ltd. to strengthen its performance films business by expanding manufacturing capacity for architectural window films in the Asia Pacific. Besides, this move supports the heightened demand for window films used in energy-efficient and sustainable buildings, wherein solar control films help reduce heat gain and cooling energy use. This investment reinforces the firm’s prominent position in innovation and growth in building and construction solutions aligned with sustainability goals.

- Rising temperatures: The changing global climate and higher temperatures make heat mitigation highly essential. Solar films help keep interiors cool, reduce HVAC strain, and enhance comfort, fostering a profitable business environment for the solar control window films market over the forecasted years. In this regard, the Window Film Company in December 2025 announced that it had installed high-performance dual-reflective solar control window film at the Padel Club, which reduces glare and reflects solar heat to maintain stable indoor temperatures. It also mentioned that the film consists of a tinted interior surface, thereby preserving natural views, enhancing comfort, and energy efficiency. Therefore, this upgrade supports the club’s commitment to a comfortable, energy-efficient environment amid growing visitor numbers, contributing to overall market growth.

- Government regulations: Stricter building codes and energy efficiency regulations promote the increasing adoption of energy-saving solutions such as solar films. According to the article published by the California Energy Commission, the 2025 California Energy Code (Title 24, Part 6) strengthens building efficiency requirements, which include the expanded use of heat pumps, electric-readiness, and improved ventilation standards. It also stated that all new residential and nonresidential buildings for which permits were applied for on or after January 1, 2026, must comply. In addition, these updates aim to reduce energy use, lower carbon footprints, and support California’s green building goals. The code also encourages adoption of energy-saving technologies, such as high-performance glazing and solar control films, to help meet cooling and heating targets, benefiting the market.

Challenges

- Market fragmentation and competition: The solar control window films market is extremely fragmented, which is hosting numerous regional, national, and global players who are vying for market share. This, in turn, leads to intense price competition and challenges in maintaining brand differentiation. Most of the small-scale installers and domestic distributors dominate in some specific regions, which makes national or global expansion very difficult. On the other hand, manufacturers need to make sure of consistent product quality and installer training across geographies, which in turn adds operational complexity. The competition from substitute technologies, such as energy-efficient glass or smart windows, further pressures traditional film providers, thereby hindering market expansion.

- Regulatory and compliance challenges: Solar control window films are subject to different regional building codes and energy-efficiency regulations, which can complicate market entry as well as product development. In this context, architectural films for commercial buildings may necessitate particular fire ratings, UV rejection levels, or certification under green building standards such as LEED or BREEAM. Automotive films are also regulated differently in terms of visible light transmission to ensure driver safety. Therefore, maintaining a pace with these constantly evolving regulations across numerous regions can increase compliance costs and delay product launches, ultimately slowing down market growth. Manufacturers need to make investments in certification processes, testing facilities, and legal expertise, which can be challenging for smaller and medium-sized companies.

Solar Control Window Films Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.1% |

|

Base Year Market Size (2025) |

USD 980.8 million |

|

Forecast Year Market Size (2035) |

USD 2.52 billion |

|

Regional Scope |

|

Solar Control Window Films Market Segmentation:

Installation Stage Segment Analysis

In the installation stage segment, the new build is expected to capture the largest revenue share of 85.6% in the solar control window films market over the forecasted years. The dominance of the subtype is largely driven by specifications during curtain-wall fabrication, which guarantees optimal adhesion and quality. In September 2025, Heliatek reported that it deployed 80 HeliaSol solar film modules at Cologne/Bonn Airport, installing them directly onto the 27-meter-high chimney of the airport’s combined heat and power plant. These ultra-light, adhesive-backed films enable integration on curved surfaces without substructures, generating around 4,400 kWh of green electricity on a yearly basis by maintaining very low reflectivity to avoid glare in sensitive airport environments. In addition, this pilot project demonstrates how solar film technologies can be specified into infrastructure assets to support new-build and on-site energy-efficient installations aligned with sustainability strategies.

Film Type Segment Analysis

By the conclusion of 2035, the vacuum-coated films will grow at a considerable rate in the market. The subtype is widely specified since it reflects a significant amount of infrared and solar heat, reducing cooling loads and helping buildings meet energy-efficiency goals. This growth is also reinforced by increasing adoption in commercial new-build projects, wherein the vacuum-coated films are integrated into curtain-wall glazing to ensure uniform performance and long-term durability. In addition, government-backed building energy codes and green certification programs are encouraging their use to lower HVAC energy consumption. The advancements in terms of coating technology are improving optical clarity while maintaining high heat rejection. Together, the presence of all of these factors positions vacuum-coated films as a preferred solution for energy-efficient and sustainable building design.

Absorber Type Segment Analysis

In the market, ceramic films are expected to grow at a significant rate over the forecasted years. The subtype maintains performance in high heat, blocks UV radiation, and doesn’t interfere with communications systems, features as beneficial for improving comfort. In June 2024, Onyx Coating announced the launch of its Vunyx ceramic window films, which are designed with advanced ceramic and sputtering technology to reject up to 98% of infrared heat, block up to 99% of UV rays, and reduce glare by maintaining crystal-clear visibility. The company also notes that the non-metallic, signal-friendly design ensures no interference with GPS or phone connectivity, making it suitable for high-performance automotive and potential architectural applications. Further, it is built for durability with a lifetime warranty. Vunyx films offer long-lasting comfort, energy efficiency, and reliable performance for installers and end users alike, hence denoting a wider segment scope.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Installation Stage |

|

|

Film Type |

|

|

Absorber Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Solar Control Window Films Market - Regional Analysis

APAC Market Insights

The Asia Pacific solar control window films market is expected to dominate the entire global landscape, capturing around 45.4% of the total revenue share by 2035. Large-scale commercial, residential construction, rapid urbanization, energy efficiency policies, and infrastructure expansion are the key factors propelling the region’s leadership. For instance, in June 2023, Toray Industries announced that it had developed the PICASUS high heat-insulating solar control film for mobility applications by using nano-multilayer technology to block infrared rays while also maintaining glass-like transparency. It is applied to electric vehicle windshields, wherein the film reduces air-conditioning power consumption by approximately 30%, extends cruising range by 6%, and lowers cabin temperatures by 2°C, all by supporting 5G communications due to its metal-free design. Furthermore, Toray is conducting full-scale tests for commercial deployment, highlighting its potential in energy efficiency, passenger comfort, and carbon neutrality.

China solar control window films market is highly augmented by large-scale commercial construction and widespread residential high-rise development. The country’s market also benefits from regulatory emphasis on energy efficiency and green buildings, driving the integration of solar control films during initial glazing, particularly in curtain-wall and smart-building projects. In November 2025, YUXINFILM announced at the Warsaw Motor Show that it would debut its next-generation automotive window films and paint protection films, which consist of heat rejection, 99% UV protection, enhanced shatter resistance, and advanced self-healing technology. The company is mainly focused on improving interior comfort, safety, and vehicle aesthetics while demonstrating its innovations to global industry professionals. Hence, this launch reflects YUXINFILM’s prominent role in advancing solar control and protective film technologies in the automotive sector.

India market is positively influenced by a combination of factors such as rising temperatures, energy costs, and steadily progressing urban infrastructure. Solar control films are widely adopted in the country’s commercial offices, IT parks, and residential complexes with a prime focus on improving indoor comfort and reducing air-conditioning loads. In December 2024, ITPB CapitaLand upgraded its buildings in Bengaluru with Saint-Gobain Solar Gard exterior grade solar control films. The company also notes that EPD-verified films enhance building aesthetics by reducing solar heat gain, blocking harmful UV rays, and improving energy efficiency. Also, this project demonstrates the practical benefits of solar control window films in commercial buildings, showing how such films contribute to occupant comfort and operational energy savings, hence denoting a positive market outlook.

North America Market Insights

The North America market is efficiently propelled by the rising emphasis on energy efficiency and sustainability in both commercial and residential sectors. Companies in the region are leveraging innovative film technologies that maintain optical clarity at the same time, enhancing thermal performance. In June 2025, American Window Film (AWF) announced that it had acquired Solar Vision, which is a 3M authorized dealer, to expand AWF’s presence in Colorado. Therefore, this acquisition strengthens AWF’s national footprint and enables broader delivery of solar control, security, decorative, and anti-graffiti window films to commercial, government, as well as residential clients. Furthermore, this move reflects AWF’s strategy to grow its market reach by leveraging Solar Vision’s established expertise and high-profile project portfolio.

The U.S. solar control window films market is dominating the entire regional landscape through federal and state energy efficiency programs, which incentivize building owners to implement heat-rejecting solutions. The commercial sector, such as in office complexes and institutional facilities, is a key adopter due to the rising cooling costs and sustainability targets. In this context IRS reported that from January 1, 2023, through December 31, 2025, U.S. homeowners can claim the energy-efficient home improvement credit, receiving up to 30% of qualifying expenses for energy-efficient upgrades, including exterior windows and skylights that reduce solar heat gain and improve building performance. The credit was applied to primary residences, by covering new systems and materials, and requires compliance with energy efficiency standards such as Energy Star's Most Efficient. In addition, this federal incentive encourages the adoption of solar control films and other energy-saving building envelope improvements, supporting reduced cooling costs and sustainability goals.

The aspect of extreme temperature variations and the heightened demand for energy-efficient buildings are the key fueling factors for the Canada solar control window films market. The construction industry in the country is mainly opting for these films during new builds and retrofits, integrating them into curtain walls, glass facades, and residential glazing projects. In this context, in March 2023, 3E Nano Inc., which was co-founded by University of Toronto Engineering Professor Nazir Kherani, announced that it received USD 5 million in federal funding from Sustainable Development Technology Canada to commercialize its solar-energy-control window coatings. It also notes that this nano-thin, multi-layer dielectric–metal–dielectric film is reported to enhance thermal insulation, reflecting near- and mid-infrared light by also allowing visible light through, effectively reducing building heating as well as cooling loads. This funding supports the startup’s goal of scaling production for both residential and commercial applications.

Europe Market Insights

The Europe solar control window films market holds a prominent position in the international landscape owing to the presence of strict energy performance directives and sustainability mandates. The region’s market also benefits from the heightened demand for non-metallic and low-reflectivity films that align with both environmental goals and occupant comfort requirements. In April 2023, Saint-Gobain Solar Gard reported that it became the first window film brand to obtain verified environmental product declarations (EPDs) for 92 architectural window films, thereby covering solar control, safety, low-E, interior and exterior (SENTINEL) films, as well as decorative designs across Europe and other nations. The company states that these solar control films balance light transmission and heat rejection, reducing energy consumption by also improving summer and winter comfort, and the safety films enhance protection against impact, breakage, and intrusion. The EPDs are valid until 2028, are based on life cycle assessments from cradle to grave, and verified against international standards ISO 14044 and ISO 14025 by The International EPD System.

Germany solar control window films market mainly focuses on emphasizing green construction and retrofit activities to comply with national energy efficiency standards. Manufacturers in the country concentrate on high-performance films that combine durability, clarity, and heat rejection for long-term use. In this regard, Heliatek in May 2024 reported that it completed a double‑façade installation of its HeliaSol solar films on buildings at Erlanger Stadtwerke (ESTW) in Germany by installing around 100 films in just three days using professional high-altitude climbers. The films’ integrated backside adhesive allowed efficient application directly to metal façades, demonstrating that building surfaces can generate clean energy. Moreover, such instances underscore ESTW’s commitment to sustainability and innovation by showcasing Heliatek’s easy-to-install solar film technology, hence denoting a positive market outlook.

The France solar control window films market is witnessing increased adoption of these films, especially in commercial and institutional buildings, which also include offices, schools, and hospitals. Retrofit installations are common in the country owing to historic building stock, with films providing enhanced UV protection and reduced glare by efficiently preserving the window aesthetics. In November 2025, Solar Grad stated that at CHU Grenoble Alpes University Hospital in France, Luxiglass installed Sentinel Plus Silver 35 solar control films to reduce excessive heat and glare by improving thermal comfort for staff. This upgrade refreshed the building by preserving natural light, enhancing workplace conditions. Therefore, this project demonstrates the practical benefits of premium solar control films in commercial healthcare facilities, encouraging both national and international players to make investments in this field.

Key Solar Control Window Films Market Players:

- 3M Company (U.S.)

- Eastman Chemical Company (U.S.)

- Saint‑Gobain Performance Plastics (France)

- Avery Dennison Corporation (U.S.)

- Lintec Corporation (Japan)

- Madico, Inc. (U.S.)

- Garware Hi‑Tech Films Ltd (India)

- Johnson Window Films, Inc. (U.S.)

- Nexfil Co., Ltd. (South Korea)

- Solar Screen International SA (Luxembourg)

- Dexerials Corporation (Japan)

- Purlfrost Ltd. (United Kingdom)

- Hüper Optik USA (U.S. / Germany)

- Global Window Films (U.S.)

- Armolan Window Films (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- 3M Company is a global leader in terms of solar control and energy-efficient window films, which offer solutions for both automotive and architectural applications. The company strongly promotes innovation through coatings and nanotechnology to improve heat rejection, UV protection, and glare reduction. In addition, 3M is also focused on sustainability by developing eco-friendly products and expanding its international distribution network.

- Eastman Chemical Company is based in the U.S. and is the maker of LLumar, Vista, and SunTek films, and is one of the prominent players in automotive and architectural window films. The company prioritizes mainly R&D to enhance optical clarity, infrared rejection, and durability of its films. Eastman has a worldwide footprint that spans more than 100 countries, and it leverages strategic alliances with distributors and installers to expand market penetration.

- Saint Gobain Performance Plastics, through its Solar Gard brand, mainly concentrates on high-performance architectural and automotive films. The company makes investments in materials science innovation by offering solutions that combine solar control, UV protection, and safety features. In addition, Solar Gard’s films are widely recognized for reliability and performance in commercial, residential, as well as automotive applications.

- Avery Dennison Corporation is a frontrunner in automotive and architectural window films, which has a strong emphasis on nanotechnology-based products. Simultaneously, the firm is focused on combining aesthetic appeal, heat rejection, and UV protection by ensuring compatibility with electric vehicles and modern electronics. Strategic initiatives opted by the firm include global expansion, sustainability-oriented product development, and partnerships with installers and OEMs.

- Lintec Corporation is a central player in this field, and it develops high-performance solar control films for architectural and automotive applications, which include eco-friendly products made from recycled PET. The company invests in R&D to improve infrared rejection, optical clarity, and durability by efficiently expanding global distribution networks. Lintec is also concentrated on collaborations with distributors, architects, and installers, allowing it to strengthen its market presence, positioning it as a prominent manufacturer in the market.

Below is the list of some prominent players operating in the global market:

The market is hosting players such as 3M, Eastman, Saint-Gobain, and Avery Dennison. These key pioneers in this field are making investments in advanced materials, nanotechnology, and sustainability-focused products to meet regulatory demands. R&D for UV rejection, recycled PET, mergers & acquisitions, distribution networks, and partnerships with OEMs to increase global reach are a few strategies opted by the major firms to strengthen their international market positions. In this regard, in September 2024, ORAFOL announced that it had acquired a stake in Group M.A.M., marking its debut into the solar control window films industry. Also, this acquisition enabled ORAFOL to introduce ORAGUARD HelioShield spectrally selective films, which block UV and infrared radiation by allowing visible light to pass, keeping indoor spaces bright without overheating. Hence, this strategic move expands ORAFOL’s product portfolio and demonstrates a focus on reducing energy consumption.

Corporate Landscape of the Solar Control Window Films Market:

Recent Developments

- In July 2025, Lintec announced that it will release BR-50UH RECYCLE 100, which is a solar control window film made from 100% recycled PET, and it blocks 57% of near-infrared heat and over 99% of UV rays while remaining highly transparent and shatter-resistant.

- In February 2025, Avery Dennison launched the Encore automotive window film with three options: Encore, Encore Supreme, and Encore Supreme IR for superior heat rejection, UV protection, and clarity. Using dye-free, metal-free nanotechnology, the films block over 99% of UV rays and repel up to 93% of infrared heat, compatible with electric vehicles.

- Report ID: 1973

- Published Date: Jan 13, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Solar Control Window Films Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.