- Introduction

- Study Objective

- Scope of the report

- Market Taxonomy

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- Primary Research

- SPSS Approach

- Data Triangulation

- Executive Summary

- Global Industry Overview

- Market Overview

- Regional Synopsis

- Industry Supply Chain Analysis

- DROTs

- Driver

- Restraint

- Opportunities

- Trends

- Government Regulation: How they would Aid the Business?

- Competitive Landscape

- Alcinéo

- Asseco South Eastern Europe Group

- Bindo Labs Limited

- CM.com

- Fairbit

- Fime

- NCR VOYIX CORPORATION

- NEC Corporation

- PAX Global Technology Limited

- Tidypay

- Wizzit (Pty) Ltd

- Worldline S.A.

- Yazara

- SWOT Analysis

- Ongoing Technological Advancements

- Advancement Of SoftPOS

- Company Share in The Market

- Analysis Of Strategic Initiatives Adopted by Key Players

- Analysis On Key Stake Holder & Buying Criteria

- Merger And Acquisition Analysis

- Analysis on End Use Industry

- Growth Forecast of Global SoftPOS Market by Enterprise Size

- Use Case Analysis

- Recent Development Analysis

- Industry Risk Assessment

- Growth Outlook

- Global Outlook and Projections

- Global Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), 2024-2037, By

- Operating System, Value (USD Million)

- Android

- iOS

- Others

- Enterprise Size, Value (USD Million)

- Micro & Small Business

- Medium & Large Business

- End use Industry, Value (USD Million)

- Retail

- Restaurants/Hospitality

- Service Based Industries

- Others

- Operating System, Value (USD Million)

- Regional Synopsis, Value (USD Million), 2024-2037

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- Global Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037,

- Operating System, Value (USD Million)

- Android

- iOS

- Others

- Enterprise Size, Value (USD Million)

- Micro & Small Business

- Medium & Large Business

- End use Industry, Value (USD Million)

- Retail

- Restaurants/Hospitality

- Service Based Industries

- Others

- Country Level Analysis Value (USD Million), 2024-2037

- U.S.

- Canada

- Operating System, Value (USD Million)

- Overview

- Asia Pacific

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037,

- Operating System, Value (USD Million)

- Android

- iOS

- Others

- Enterprise Size, Value (USD Million)

- Micro & Small Business

- Medium & Large Business

- End use Industry, Value (USD Million)

- Retail

- Restaurants/Hospitality

- Service Based Industries

- Others

- Country Level Analysis Value (USD Million), 2024-2037

- China

- Japan

- India

- Indonesia

- Australia

- South Korea

- Vietnam

- Malaysia

- Rest of Asia Pacific

- Operating System, Value (USD Million)

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037,

- Operating System, Value (USD Million)

- Android

- iOS

- Others

- Enterprise Size, Value (USD Million)

- Micro & Small Business

- Medium & Large Business

- End use Industry, Value (USD Million)

- Retail

- Restaurants/Hospitality

- Service Based Industries

- Others

- Country Level Analysis Value (USD Million), 2024-2037

- UK

- Germany

- France

- Italy

- Spain

- NORDIC

- Russia

- Rest of Europe

- Operating System, Value (USD Million)

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037,

- Operating System, Value (USD Million)

- Android

- iOS

- Others

- Enterprise Size, Value (USD Million)

- Micro & Small Business

- Medium & Large Business

- End use Industry, Value (USD Million)

- Retail

- Restaurants/Hospitality

- Service Based Industries

- Others

- Operating System, Value (USD Million)

- Country Level Analysis Value (USD Million), 2024-2037

- Saudi Arabia

- UAE

- Oman

- South Africa

- Morocco

- Tunisia

- Algeria

- Rest of Middle East & Africa

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

SoftPOS Market Outlook:

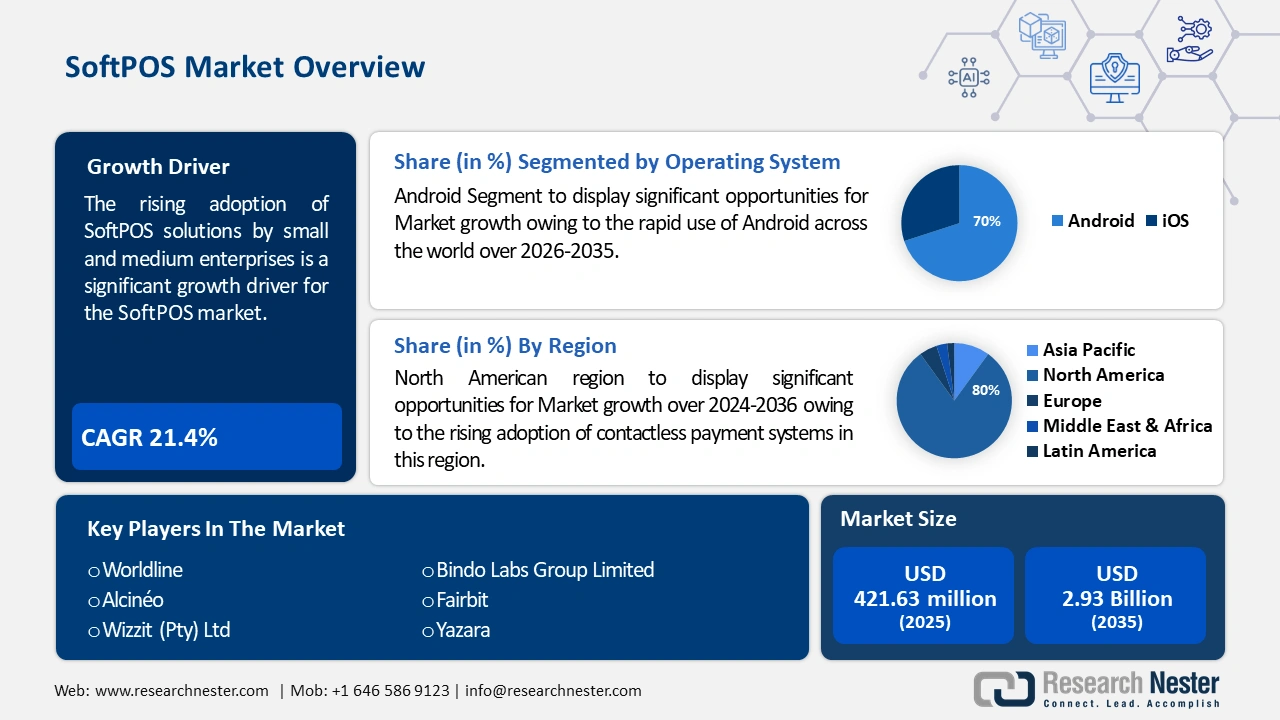

SoftPOS Market size was over USD 421.63 million in 2025 and is projected to reach USD 2.93 billion by 2035, witnessing around 21.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of softPOS is evaluated at USD 502.84 million.

The demand for softPOS continues to be driven at a steady pace as businesses look for cost-effective and flexible payment means. The ability to transform smartphones into POS terminals eliminates the need for traditional hardware and increases adoption for both small retailers and large enterprises. The softPOS market is driven by an increasing penetration of smartphones and consumer demand for contactless transactions. One important development was the NCR VOYIX CORPORATION’s introduction of a complete softPOS suite in August 2023 to ease the integration of omnichannel payment experiences for merchants of all sizes. This expansion mirrors the industry trend of softPOS integration across verticals, which is a key part of the retail and service landscape in modern times.

The softPOS market is witnessing growth due to government support toward digital payments and contactless technologies. In July 2024, the government of India announced to support small businesses in adopting digital payment solutions like softPOS systems with a USD 1.2 billion initiative. This initiative fits into broader projects aimed at improving financial inclusion and reducing cash transactions, which naturally provide a springboard for the entry of market participants. Furthermore, countries in Southeast Asia and Africa are also adapting the softPOS technologies for rollout, as they realize the ability of the softPOS technologies to not just enhance the local economies but also simplify business processes.

Key SoftPOS Market Insights Summary:

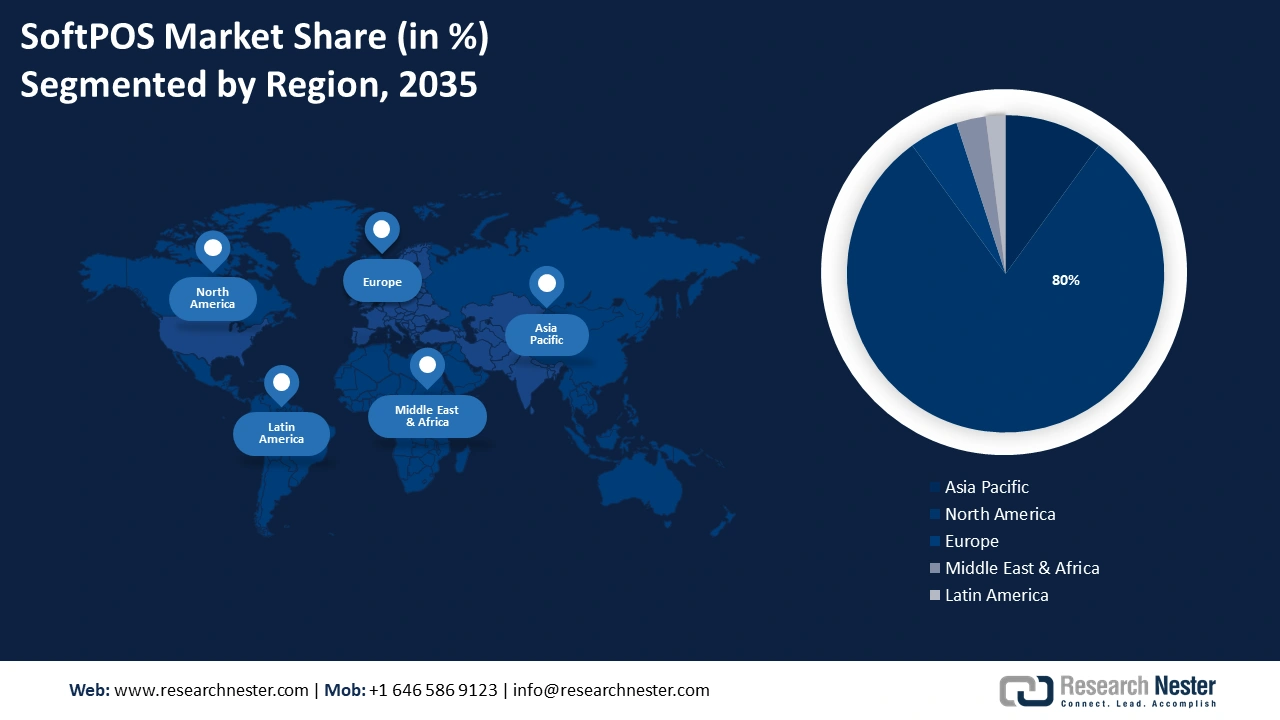

Regional Highlights:

- North America softpos market will dominate aroundn 80% share by 2035, driven by the demand for flexible and contactless payment options.

- Asia Pacific market will account for considerable share by 2035, fueled by growing smartphone usage and digital payment penetration.

Segment Insights:

- The micro & small business segment in the softpos market is projected to attain a 61.20% share by 2035, fueled by the affordability and accessibility of softPOS solutions.

- The android segment in the softpos market is projected to hold a 55.70% share by 2035, fueled by the cost-effectiveness and widespread use of Android devices.

Key Growth Trends:

- Increasing digital payments and contactless adoption

- Micro and small business digitization

Major Challenges:

- Security and compliance concerns

- Infrastructure limitations in emerging markets

Key Players: Asseco South Eastern Europe Group, Bindo Labs Limited, CM.com, Fairbit, Fime, NCR VOYIX CORPORATION, NEC Corporation, PAX Global Technology Limited, Tidypay, Wizzit (Pty) Ltd, Worldline S.A., Yazara.

Global SoftPOS Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 421.63 million

- 2026 Market Size: USD 502.84 million

- Projected Market Size: USD 2.93 billion by 2035

- Growth Forecasts: 21.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (80% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 16 September, 2025

SoftPOS Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing digital payments and contactless adoption: The primary growth driver for the softPOS market is the accelerated shift of the market towards digital payments. As more and more consumers prefer cashless transactions, businesses are building interest in mobile POS solutions. In September 2023, Tidypay, a member of Visa's strategic partnership program, announced Tap to Phone technology that will allow micro and small businesses in Europe to accept payments on smartphones. The softPOS solution of this initiative becomes accessible to all sectors. With the rise of digital wallets and fintech services, the need for softPOS will be on the rise, helping small businesses and entrepreneurs in remote areas become more accessible to finance.

-

Micro and small business digitization: SoftPOS systems are being adopted by micro and small businesses to cut costs upfront and improve operational efficiency. This trend is reflected in the 61.2% softPOS market share projection for the segment. Using Android-based softPOS, PAX Global Technology Limited and NEC Corporation will launch softPOS solutions for small businesses in Asia Pacific in April 2024, strengthening support for the digital SME transformation. Small businesses can leverage low-cost high-impact technologies to grow their customer base and integrate into digital ecosystems with improved operational transparency and financial management.

- Expansion of e-commerce and omnichannel retail: Demand for flexible payment solutions accelerates due to the rapid growth of e-commerce, making softPOS more attractive. Retailers are adopting SoftPOS to merge the online and offline channels. In October 2023, Worldline S.A. added omnichannel retail strategies to its softPOS services in Latin America. This expansion shows the expansion driven by e-commerce growth of the demand for versatile payment technologies. With online and brick-and-mortar retail merging increasingly these days, businesses are putting in place technology so that customers have a seamless, uninterrupted experience when they shop, which builds loyalty and sales volume.

Challenges

-

Security and compliance concerns: SoftPOS comes with sensitive financial data and hence the hurdle of making sure secure transactions and adhering to regulatory frameworks. Security of data breaches and fraud demands robust encryption, strict device management, and compliance with the PCI DSS (Payment Card Industry Data Security Standard). Small businesses and emerging softPOS markets, which are often the first adopters, may not have the resources to take the necessary high-level security measures. In addition, there are evolving regulatory requirements across regions, which increase complexity and require continuous updates and compliance monitoring.

-

Infrastructure limitations in emerging markets: However, the digital infrastructure and unreliable internet connectivity in emerging markets hinder the adoption of SoftPOS solutions at a fast pace. The payment process becomes a bottleneck for many small retailers working in rural and underdeveloped regions, as payment processing is not seamless and is not real-time. Nevertheless, adoption rates remain inconsistent, and issues regarding hardware shortages, network instability, and so on are holding back softPOS market growth in less developed regions.

SoftPOS Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

21.4% |

|

Base Year Market Size (2025) |

USD 421.63 million |

|

Forecast Year Market Size (2035) |

USD 2.93 billion |

|

Regional Scope |

|

SoftPOS Market Segmentation:

Enterprise Size Segment Analysis

Micro and small business segment is expected to capture around 61.2% softPOS market share by the end of 2035. This is due to the affordability and accessibility of softPOS solutions that eliminate the need for expensive hardware. Asseco South Eastern Europe Group launched a specialized softPOS app aimed at microenterprises and is integrated seamlessly with existing payment platforms. Small businesses play a crucial role in market growth, and this development shows. An increase in the adoption of softPOS by micro-enterprises will grow as these micro-enterprises start to use digital tools to optimize business processes, leading to greater financial inclusion and market competitiveness.

Operating System Segment Analysis

By the end of 2035, android segment is projected to capture around 55.7% softPOS market share. This is owing to the fact that Android devices are widely used and are cost-effective compared to iOS devices. For example, Fairbit’s new Android-compatible softPOS system was rolled out in June 2024 to expand its services in Southeast Asia, where the region’s digital economy is growing. It is an indicator of Android’s leading role in market expansion. Android-based solutions continue to be the preferred choice for businesses across diverse economic environments owing to their affordability and customization.

Our in-depth analysis of the global market includes the following segments:

|

Enterprise Size |

|

|

Operating System |

|

|

End use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

SoftPOS Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific region in softPOS market is projected to hold considerable revenue share by 2035. Growing smartphone usage, digital payment penetration, and the region’s drive towards financial inclusion are driving the growth. Governments and fintech firms are also adopting SoftPOS to facilitate economic digitization by expanding SoftPOS adoption across small and medium enterprises (SMEs). SoftPOS systems are further accelerated by the surge in e-commerce and mobile banking across Asia Pacific.

SoftPOS is a thriving market in India due to the rapid rise of fintech in the country, and government attempts to increase digital payments. In August 2024, Pine Labs, in collaboration with Visa, launched Pine Labs Mini at the Global Fintech Fest in Mumbai to address SMEs and local merchants. This device simplifies in-store digital payment, a traditional QR code with more sophisticated SoftPOS technologies. Driven by the growing SME sector in India and the demand for contactless payments, the SoftPOS segment is anticipated to witness higher growth in the country, and the country is expected to be a key player in the Asia Pacific market.

China SoftPOS market is anticipated to rise at a stable pace due to the advanced mobile payment ecosystem and wide adoption of contactless technology in the country. SoftPOS integration has been accelerated across retail, hospitality and transportation sectors as the government’s thrust on digital transformation and cashless transactions gained momentum. SoftPOS solutions are being picked up by major fintech firms that serve the country’s massive unbanked and underbanked populations. SoftPOS adoption is set to rise rapidly with super apps and mobile wallets, and China is set to lead Asia Pacific digital payment landscape.

North America Market Insights

By the end of 2035, North America region is likely to hold substantial softPOS market share, due to the growing demand for flexible and contactless payment options. Strong digital infrastructure, high smartphone penetration, and emphasis on financial inclusion make the SoftPOS systems an easy choice for new adoption in the region. As consumers increasingly move to cashless transactions, businesses are investing in technologies allowing mobile devices to act as payment terminals to make customers’ lives easier and cut costs for merchants.

The growth of the SoftPOS market in the U.S. is driven by partnerships between fintech companies and large acquirers. In November 2022, Phos partnered with Elavon to create a Tap to Pay solution that enabled ISOs and ISVs to use mobile devices to transform them into contactless payment terminals. This innovation addresses other sectors, such as retail and service industries, with a huge adoption of SoftPOS technology for small and mid-sized businesses. As U.S. consumers increasingly favor digital payments, the market is expected to thrive, with significant contributions from independent vendors and technology providers.

Canada SoftPOS market is anticipated to rise at a significant pace as the country strives to become a leading contactless, secure payment market. This has seen fintech firms ally with financial institutions, and small retailers and service providers have started to adopt. With the cashless payment rate on the rise, businesses are using SoftPOS technology to increase payment flexibility and accommodate changing consumer demand. These are part of the wider push of the government to digitize financial services and accelerate the pace of payment infrastructure innovation.

SoftPOS Market Players:

- Alcinéo

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Asseco South Eastern Europe Group

- Bindo Labs Limited

- CM.com

- Fairbit

- Fime

- NCR VOYIX CORPORATION

- NEC Corporation

- PAX Global Technology Limited

- Tidypay

- Wizzit (Pty) Ltd

- Worldline S.A.

- Yazara

The softPOS market is very competitive as key players are focusing on technology development and strategic partnerships to provide better service. Companies included Asseco South Eastern Europe Group, Bindo Labs Limited, CM.com, Fairbit, Fime, NCR VOYIX CORPORATION, NEC Corporation, PAX Global Technology Limited, Tidypay, Wizzit (Pty) Ltd, Worldline S.A. and Yazara. To capitalize on growing demand, these companies are expanding their geographic reach and leveraging innovation. Emerging players are also introducing niche solutions for particular industries to further intensify competition and create a dynamic softPOS market landscape.

In October 2023, CM.com launched a next-generation softPOS platform with advanced AI-driven fraud detection capabilities. Security is addressed and user experience is improved, resulting in a reinforcement of the competitive position of CM.com in the market. As technology advances, the softPOS sector is predicted to become more competitive, driving innovation and growth in the market. Continuous research and development, alongside strategic alliances, will remain key to maintaining market leadership.

Here are some leading companies in the softPOS market:

Recent Developments

- In October 2024, PXP Financial and Phos by Ingenico jointly introduced a SoftPOS solution that enables contactless payments directly on Android devices. This innovation eliminates the need for additional hardware, simplifying transaction processes for merchants.

- In September 2024, Bindo Labs Limited collaborated with PAX to integrate its payment app into A930 devices, enhancing the functionality of Android-based SoftPOS terminals. This partnership supports seamless mobile payment solutions for retail and hospitality businesses.

- In February 2024, PayTabs Group partnered with Nearpay to enhance its SoftPOS offerings across Jordan and regional markets. The collaboration focuses on improving user experiences and expanding the reach of mobile-based payment solutions for small and medium-sized enterprises.

- Report ID: 5916

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

SoftPOS Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.