Smart Water Metering Market Regional Analysis:

Europe Market Insights

Europe in smart water metering market is anticipated to capture around 47.1% revenue share by the end of 2035. Europe’s expansion is attributed to rising investments in water conservation efforts and policy-driven sustainable goals to support urban and rural housing communities with smart water solutions. Additionally, the European Union emphasizes building a robust circular economy in the region which necessitates mitigating NRW waste.

For instance, the EU Water Framework promotes sustainable water use, and businesses in the region are leveraging increasing opportunities to supply smart water metering solutions. For instance, in September 2024, Arqiva, from the UK, announced the connecting of two million smart water metering to its network and is poised to support per capita water consumption reduction targets for the next Asset Management Plan (AMP) in the country. With Germany, France, the UK, Netherlands leading the revenue share in the region, service providers are expected to find continuous opportunities via public and private contracts.

Germany holds a major revenue share in the Europe smart water metering market owing to sustainability initiatives and the proliferation of IoT technologies. Smart water metering are increasingly being adopted in the residential sector of Germany, offering effective leak detection and benefiting customers. A major driver of the market is the mandate by the government to roll out smart meters nationally to commercial and residential customers from 2025. Companies operating in the smart water metering sector are positioned to leverage the mandate by acquiring companies operating in Germany for their smart metering portfolios. For instance, in June 2024, Ancala announced the acquisition of Solandeo which was a full-scale smart metering solutions provider.

Furthermore, domestic companies have leveraged the rising demands by expanding smart water metering installation across Europe. For instance, Frasers group reported that in the financial year 2023, 90% of their properties had Smartvatten devices installed.

France is an emerging market in the Europe smart water metering industry. A supportive regulatory ecosystem prompting the installation of smart metering assists the sector’s growth. For instance, the Building Automation and Control Systems (BACS) decree of France boosts the adoption of smart water metering solutions. Furthermore, domestic companies of France are expanding to emerging markets in APAC such as India the Advanced Metering Infrastructure for 5 million Smart Meters project led by the EDF Group.

Key players in France are executing partnerships and agreements to improve smart remote reading infrastructure solutions. For instance, in November 2024, SUEZ and GRDF subsidiary IOWIZMI signed a 10-year contract to pool their remote reading infrastructures in the country, which stands to benefit from advancements in smart water metering technologies.

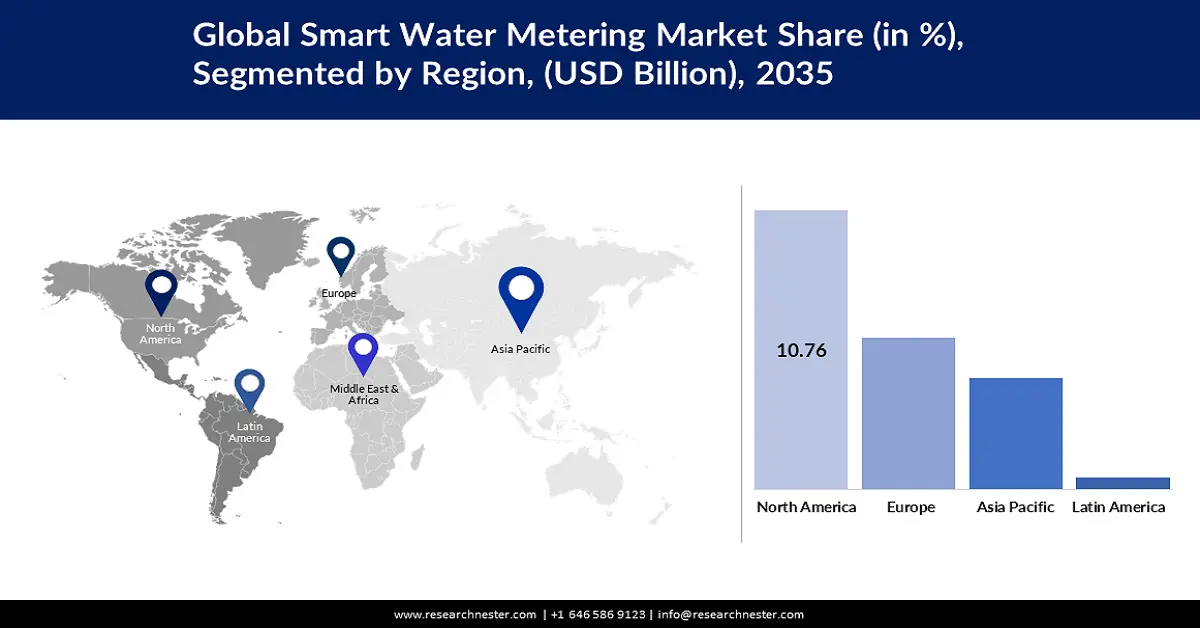

North America Market Insights

North America is projected to exhibit the fastest revenue growth in the North America smart water metering market after Europe. The rising government contracts at various levels are poised to provide profitable opportunities for businesses to install smart water metering solutions. For instance, in September 2023, the city of Sweetwater in the U.S. announced plans to install Ultrasonic Smart Water Metering in every business and home in partnership with Secure Vision of America as a part of a USD 15 million infrastructure project. Businesses with a strong presence in the region are set to benefit from an increasing number of infrastructure projects with secure funding streams.

The U.S. holds the largest revenue share in the North America smart water metering market. The demand for AMI has gained significant momentum owing to its ability to provide real-time data and remote monitoring capabilities. Federal initiatives supporting smart city projects are playing a pivotal role in the sector’s growth. For instance, in October 2024, the city of Fort Lauderdale announced plans to conduct a comprehensive audit and survey of all active water meters across the city. The initiative offers promise for major players to find opportunities to upgrade aging smart water infrastructure.

Canada is a rapidly growing market in the smart water metering industry of North America and is expected to increase its revenue share by the end of the forecast period. The rise of smart meter installation in Canada creates a profitable domestic market. Furthermore, all property owners must have a smart water metering installed in the city of Toronto, creating favorable opportunities for businesses to provide repair and upgrade solutions.

Additionally, domestic companies are expanding their smart metering services which augurs well for the future of the sector. For instance, in September 2022, Trilliant announced the successful implementation of a wireless water metering solution in Canada and specialization in the multi-residential sector.