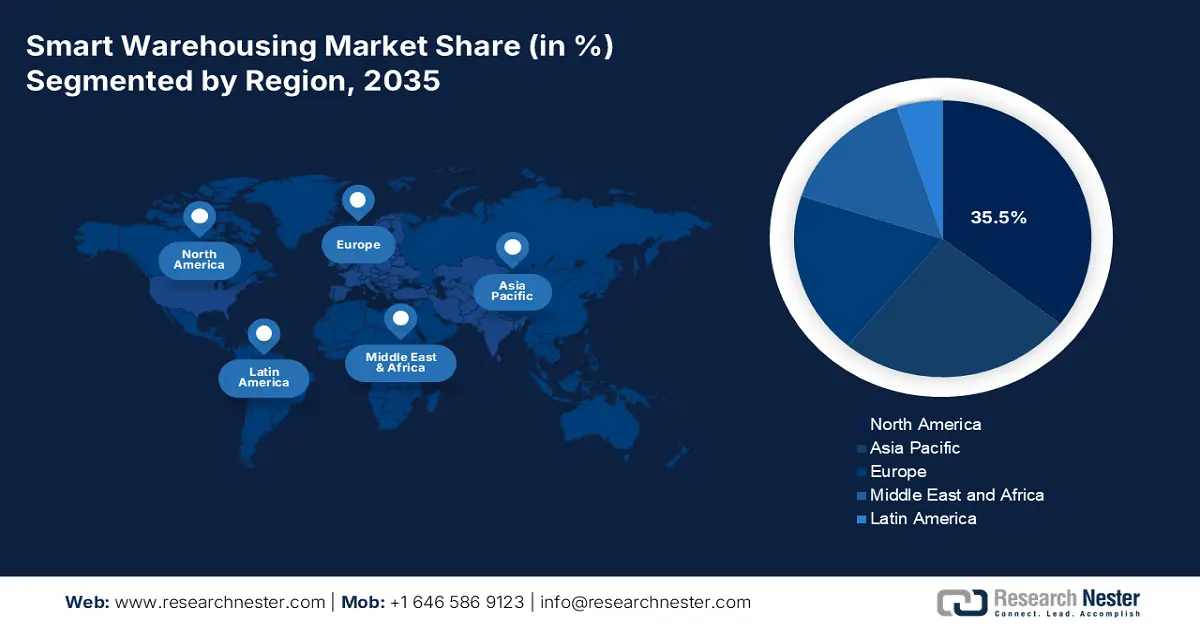

Smart Warehousing Market - Regional Analysis

North America Market Insight

The North America smart warehousing market is anticipated to hold 35.5% of the share by 2035, fueled by the presence of technologically advanced infrastructure and early adoption of automation technologies. Canada and the United States are dominating the market by integrating modern technologies such as IoT and robotics into various operations. Also, government initiatives are supporting the development of smart warehousing by allocating a budget for ICT initiatives. In the U.S., the smart warehousing market is projected to garner USD 11.8 billion by 2030. The growth is propelled by increasing demand for supply chain management and automation in logistics. In 2022, the Department of Defense (DoD) launched a 5G Smart Warehouse at the Naval Base Coronado in California.

The U.S. leads the world in smart warehousing, helped by its already established logistics system and rapid adoption of technologies associated with Industry 4.0. For example, some of the biggest names in e-commerce, such as Amazon and Walmart, are aggressively investing in automation, robotics, and IoT (the Internet of Things) to enhance their warehouse operations. The associated high labor cost in the U.S. is another supporting factor pushing companies in that direction. Meanwhile, cloud computing is enabling new software such as AI-enabled inventory management systems, while autonomous mobile robots (AMRs) have also entered the market to work in warehouses as new solutions.

Canada is also witnessing significant growth due to the rising adoption of smart warehousing solutions. Government bodies are actively supporting broadband expansion and ICT developments that are crucial for smart warehousing infrastructure. The Deloitte Smart Factory in Montreal is an exemplary establishment of smart housing in Canada, integrating advanced technologies. These developments showcase countries’ will to expand the smart warehousing operations with the rising demand for modern supply chains. Also, companies such as Shopify are also investing in automated fulfillment centers, fostering efficiency.

APAC Market Insight

The Asia Pacific market is anticipated to garner 27.5% share of the global market, driven by government-led initiatives in various countries and the rapid expansion of the e-commerce sector. For instance, the e-commerce sales in China alone have surpassed USD 1.74 trillion in 2022, instilling the need for automated warehousing solutions. Additionally, in South Korea, the smart factory initiative has been launched, and the government has infused USD 1.08 billion to innovate manufacturing facilities. The development across Asia Pacific countries showcases the efforts made by the public and private sectors to advance the logistics and transportation sector.

India is seeing rapid growth in smart warehousing and fulfilment centres due to the rise of e-commerce platforms such as Flipkart and Amazon India, and the influx of consumer demand from tier 2 and 3 cities. The Government initiatives, such as "Make in India" and the National Logistics Policy development, are improving infrastructure in logistics centres and leading to a higher level of automation of smart warehousing. There is a strong labor market; however, the need for higher levels of efficiency, in the context of smart warehousing, is beginning to push technology acceptance in areas such as AI, IoT, and real-time tracking.

China's advanced status as the foremost nation in global manufacturing and e-commerce is fostering rapid growth in the smart warehousing sector. The government's emphasis on smart logistics since the "Made in China 2025" initiative is stimulating many industries to move in this direction. While some industries have struggled with labor shortages up to now, there are increasing labor costs that will inevitably "push" companies to more automated storage and retrieval systems (AS/RS). China also produces the greatest volume of hardware for automation, which helps to enable the use of smart technologies.

Europe Market Insight

There is an enormous surge in smart warehousing in Europe due to rapid e-commerce growth, shifting consumer expectations for faster. In response, businesses and companies are increasingly investing in automation, robotics, and AI to improve efficiencies while reducing labor costs. Moreover, to help businesses modernize, the European Union has strict environmental standards and sustainability goals. This is creating an impetus for energy-efficient, digital warehousing systems. As well, governments and the EU have developed funding programs to support digitization. Finally, logistics hubs such as Rotterdam, Hamburg, and Antwerp, along with Europe's extensive and efficient transport networks provides the perfect geographic location for smart warehouse implementations.

The complications of the supply chain in the UK post-Brexit and the need for improved efficiency in domestic logistics are allowing the UK to make further advancements in smart warehousing and artificial intelligence, robotics, and warehouse management systems (WMS) is the strongest driving force behind this change, in addition to the e-commerce sector, especially retailer and grocery deliveries. Labor shortages and the costs of labor have also contributed to the appeal of automating warehousing processes. Companies are deploying drones and autonomous vehicles to check inventory and move inventory from one place to another. Government funding is also providing more assistance to change the digital infrastructure.

The smart warehousing industry in France is growing as companies look to optimize logistics in relation to workforce challenges and rising consumer expectations. The French government has high political capital for Industry 4.0 and digitization policies, further reinforced with financial support for the deployment of solutions that automate logistics and support an automated smart warehousing system. A central geographic and economic location in Europe presents a market opportunity to operate as a logistics hub with increasing demands for high-performance warehousing. Additionally, the sustainability agenda is spurring the deployment of energy-efficient smart systems.