Smart Polymers Market Outlook:

Smart Polymers Market size was over USD 12.72 billion in 2025 and is anticipated to cross USD 26.22 billion by 2035, growing at more than 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of smart polymers is assessed at USD 13.58 billion.

Sensitivity–responsive polymers, or smart polymers, react even to slight changes in temperature, pH, light, and humidity. It's possible for the fluctuation to be entirely consistent and predictable across the board. These items are commonly used in 3D printing, cell treatment, and medical devices because of their responsiveness. These compounds can also be utilized as proteins, medications, and cell carriers.

Additionally, its physical characteristics, such as injectability and shape memory, make it suitable for use in electrical and electronics as well as biotechnology and medicinal applications. It is projected that each of these reasons would grow the industry. In the following 70 years, the amount of plastic produced annually has grown by about 230 times, reaching 460 million tonnes in 2019, thus aiding in the market’s growth.

Key Smart Polymers Market Insights Summary:

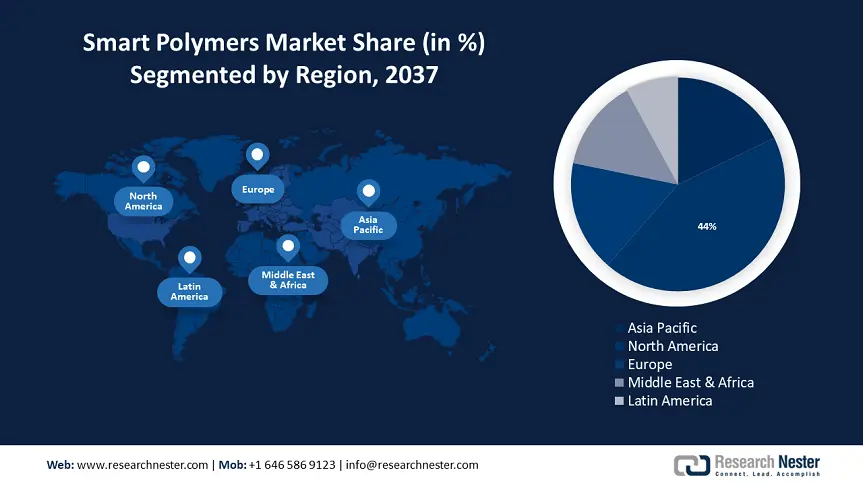

Regional Highlights:

- The North America smart polymers market will dominate around 44% share by 2035, driven by the growing healthcare industry and military applications.

Segment Insights:

- The physical segment in the smart polymers market is projected to capture a 35% share by 2035, fueled by extensive applications of physical smart polymers in biomedical fields, automotive, and electronics.

- The drug delivery (application) segment in the smart polymers market is forecasted to witness significant growth till 2035, attributed to enhanced therapeutic efficacy and controlled drug administration.

Key Growth Trends:

- Rising demand for physical stimuli-responsive polymer

- Increasing demand due to favorable properties of smart polymers

Major Challenges:

- Associated adverse reactions of smart polymer

- Complexity synthesis and manufacturing

Key Players: Lubrizol Corporation, Evonik Industries AG, Clariant AG, Croda International plc, SMP Technologies Inc., Autonomic Materials, Inc., Enovis Corporation, Nanoshel LLC, Airex AG, Mitsui Chemicals.

Global Smart Polymers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 12.72 billion

- 2026 Market Size: USD 13.58 billion

- Projected Market Size: USD 26.22 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 17 September, 2025

Smart Polymers Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for physical stimuli-responsive polymer – The largest portion of the overall market is occupied by physical stimuli-responsive polymer. These materials exhibit high sensitivity to environmental factors like ultrasound variations, changes in electric potential, temperature fluctuations, UV radiation, and magnetic field alterations. The increasing demand for physical stimuli-responsive polymer is anticipated to propel the growth rate of the market.

- Increasing demand due to favorable properties of smart polymers – Advantageous qualities like flexibility, toughness, resilience, and biocompatibility are present in smart polymers. These polymers are resistant to deterioration and damage. These elements have aided the adoption of smart polymer in critical applications across a multitude of end–user industries.

Thus, smart materials like phase change materials, smart fabrics, sensors, actuators, and much more are made using smart polymers. The smart polymers market is anticipated to increase as a result of the increasing demand for these goods. - Growing usage in the textile applications – When exposed to external stimuli including heat, light, pH, and others, shape memory polymer (SMP) can both fix a programmed shape and revert from a distorted shape to its original permanent shape. By integrating shape memory polymers into the fabric, industrialists have created smart textiles, motivated by this characteristic of the material.

Many intriguing and enhanced qualities, including comfort, smart controlled drug release, fantasy design, wound measurement devices, smart wetting capabilities, protection against harsh environmental changes, and good aesthetic appeal, are made possible by the insertion of SMPs into the fabric.

Therefore, it is anticipated that the growing use of smart polymers in smart textile applications will boost market growth because of the previously mentioned aspects. Nowadays, synthetic textiles comprise up to 60% of all textiles used; polyester, the most common type, is derived from the same substance as plastic bottles.

Challenges

- Associated adverse reactions of smart polymer – The smart polymers market growth rate is anticipated to be limited by the harmful effects on human health that smart polymers can cause during the forecast period. These health risks encompass skin irritation, gastrointestinal disturbances, coughing, and potential kidney damage.

- Complexity synthesis and manufacturing – The synthesis of smart polymers often involves complex chemical processes and precise control over molecular architecture. This complexity can lead to high production costs and scalability issues. Additionally, maintaining the consistency and purity of smart polymers during large scale manufacturing is challenging, which can affect their performance and reliability.

Smart Polymers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 12.72 billion |

|

Forecast Year Market Size (2035) |

USD 26.22 billion |

|

Regional Scope |

|

Smart Polymers Market Segmentation:

Type Segment Analysis

Physical segment is projected to account for smart polymers market share of more than 35% by the end of 2035. This dominance is driven by their extensive applications across various industries, particularly in biomedical fields such as drug delivery systems, tissue engineering, and medical devices. Physical stimuli–responsive polymers, which react to changes in temperature, light, and mechanical stress, are also pivotal in creating advanced materials for electronics, automotive, and consumer goods. Their versatility, combined with the broad range of potential applications, makes them the leading segment in the market.

Application Segment Analysis

Drug delivery segment in the smart polymers market is predicted to grow significantly till 2035. The usage of smart polymer–based drug delivery systems has increased recently due to their enhanced therapeutic efficacy, site–specific drug release, and controlled drug administration.

By responding to external cues like pH or temperature, these devices can transport drugs to the desired location, reducing side effects and improving treatment outcomes. Smart polymer–based drug delivery systems are applied in a number of therapeutic domains, such as diabetes, cancer, and inflammatory diseases.

End-Use Segment Analysis

Biomedical & Biotechnology segment in the smart polymers market is estimated to showcase high growth rate through 2035. The market is expected to increase as smart polymers are increasingly used to produce biocatalysts. When an external stimulus is present, the polymer that is connected to the enzyme undergoes conformational changes that shield it from the outside world and control its activity, functioning as a molecular switch.

This novel behavior makes smart biocatalysts easily removable from a reaction mixture and suitable for repeated usage. Numerous smart polymer–based biocatalysts have been created for use in industrial and biomedical applications. Furthermore, biosensors, biometrics, and nano–electronic devices have all made use of smart polymers. It is projected that the biotechnology sector's increasing growth will propel market expansion. According to the India Brand Equity Foundation, the global biotechnology market is projected to see a rise in the contribution of the Indian biotechnology industry from 3% in 2017 to an estimated 19% by 2025.

Our in–depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

|

End–Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Polymers Market Regional Analysis:

North America Market Insights

North America industry is predicted to dominate majority revenue share of 44% by 2035. The growing healthcare industry in conjunction with growing military and defense applications will significantly fuel demand in North America for processing light–sensitive fabrics and camouflage.

Major automakers in the United States manufacture and export automobiles to economies in the Americas, Europe, and Asia–Pacific. The automotive and automobile manufacturing market in the United States was valued at USD 82.6 billion in 2021, according to the National Automobile Dealers Association (NADA). According to the association, sales of new light vehicles should reach 15.4 million units in the US by 2022, a 3.4% rise.

Canada is one of the leading automakers in the world, producing a sizable share of the global vehicle output. Canada produced 1.12 million cars and light vehicles in 2021, a 19% drop from 2020. Canada produces about two million cars and light trucks annually, which makes up a sizeable amount of the global automobile production.

European Market Insights

The European region will also encounter huge growth for the smart polymers market during the forecast period owing to cutting–edge techniques & usage in various applications. The market is expected to grow exponentially in Europe, particularly in Germany and France, due to strict government regulations regarding the environment and the use of traditional polymers, as well as an increase in R&D initiatives in the field of nanomedicines.

Germany’s robust automotive industry is a significant consumer s are used in various of smart polymers. These materials are used in various components such as composite tires, fluid shock systems, and airbag sensors, contributing to enhanced performance and safety. The industry’s continuous investments in new technologies and materials is expected to drive further demand. As an instance, BMW declared in March 2023 that carbon fiber composites would be used in the manufacturing of its new iX electric vehicle. This is a big step because it's the first mass–produced vehicle that BMW has employed carbon fiber composites in.

The steady demand for newer and quicker electrical and electronic products is being driven by the electrical and electronics industry's rapid rate of technical innovation, which is increasing the manufacturing of these products in France. With 8.1% of the European market in 2022, France ranked as the second–largest producer of electrical and electronic goods.

In 2020, the United Kingdom's polymer production amounted to 1.67 million tonnes, which is approximately half of its consumption of 3.3 million tonnes. As a result, the UK depends significantly on imported raw materials for its polymer production.

Smart Polymers Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The Lubrizol Corporation

- Evonik Industries AG

- Clariant AG

- Croda International plc

- SMP Technologies Inc

- Autonomic Materials, Inc.

- Enovis Corporation

- Nanoshel LLC

Recent Developments

- The Lubrizol Corporation subsidiary Lubrizol Life Science Beauty (LLS Beauty), is pleased to present its newest offering: Carbopol® Fusion S–20 polymer, a ground–breaking Carbopol® polymer that raises the bar for sustainability and biodegradability without sacrificing performance

- BASF SE is adding is adding a new Ultramid® Advanced N grade to its line of polyphthalamides (PPAs). This grade is specifically designed for connectors that have undergone surface mount technology post–processing. The perfect combination of high flowability, durability, and flame retardancy is demonstrated by Ultramid® Advanced N2U40G7. Thus, it makes it possible to miniaturize electronic systems using thin–wall constructions at high power and data throughput.

- Report ID: 6247

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Polymers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.