Smart Home Installation Service Market Outlook:

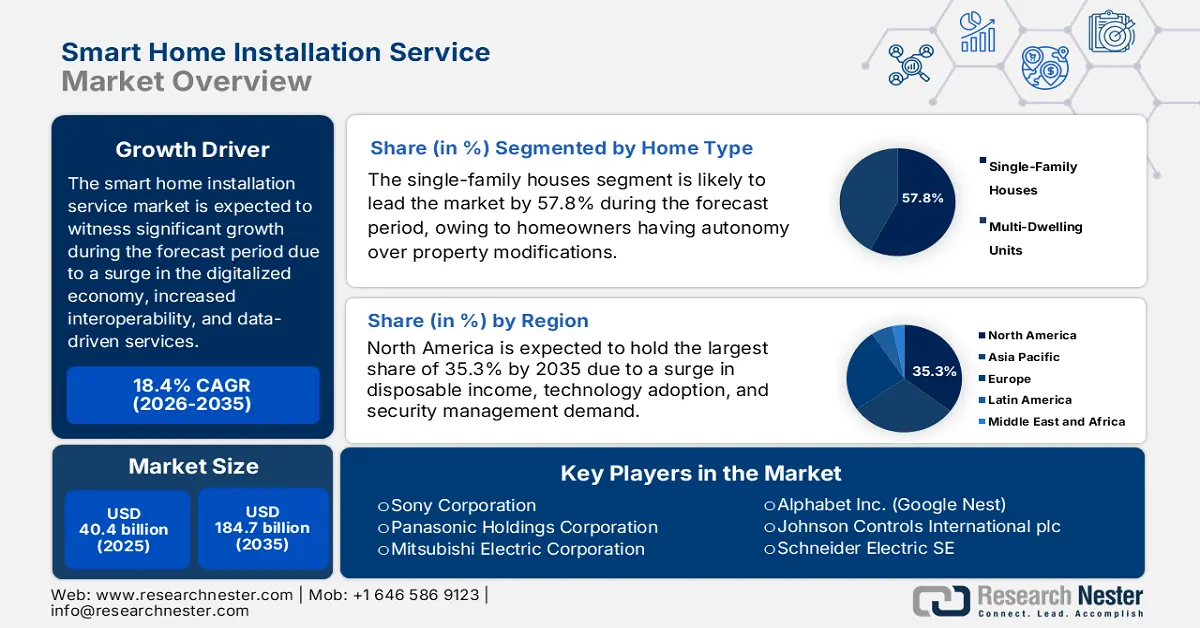

Smart Home Installation Service Market size was over USD 40.4 billion in 2025 and is estimated to reach USD 184.7 billion by the end of 2035, expanding at a CAGR of 18.4% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of smart home installation service is evaluated at USD 47.8 billion.

The worldwide market is presently witnessing a transformative phase, readily evolving from a niche luxury into a mainstream residential essential. This transition is highly uplifted by the pervasive implementation of information and communications technology (ICT), which has made interconnected living both convenient as well as a component of modernized home management. For instance, according to a data report published by the ITA in January 2024, the digitalized economy in Ireland is valued at USD 50 billion, which is 13% of the gross domestic product (GDP). In addition, more than 1,000 digital organizations operate in the country, including Microsoft, Meta, Intel, Google, Cisco, AWS, Apple, IBM, and HPE. Besides, the USD 19.0 billion Irish market has observed sustained growth in digitalized technologies, thereby making it suitable for bolstering the market’s exposure globally.

Furthermore, the rise in DIY-pro hybrid model, tactical bundling by ICT and telecom providers, increased focus on interoperability as a service, and a surge in proactive and data-driven services are also propelling the market. As per an article published by ITU in September 2023, 155 countries have a national broadband plan as well as a digitalized document as of 2022. Besides, fixed wireless access is a standard tool to bridge the digital divide, and is expected to grow from 100 million connections as of 2022 to 300 million by the end of 2028. This readily accounts for 30% of overall international mobile data traffic, which is rapidly bolstering the market’s development. Moreover, the internet penetration in Jamaica is 66% and overall, 30% in Tobago, Haiti, and Trinidad, and increased focus on integrating 5G connection is also considered a driving force for the market.

Key Smart Home Installation Service Market Insights Summary:

Regional Insights:

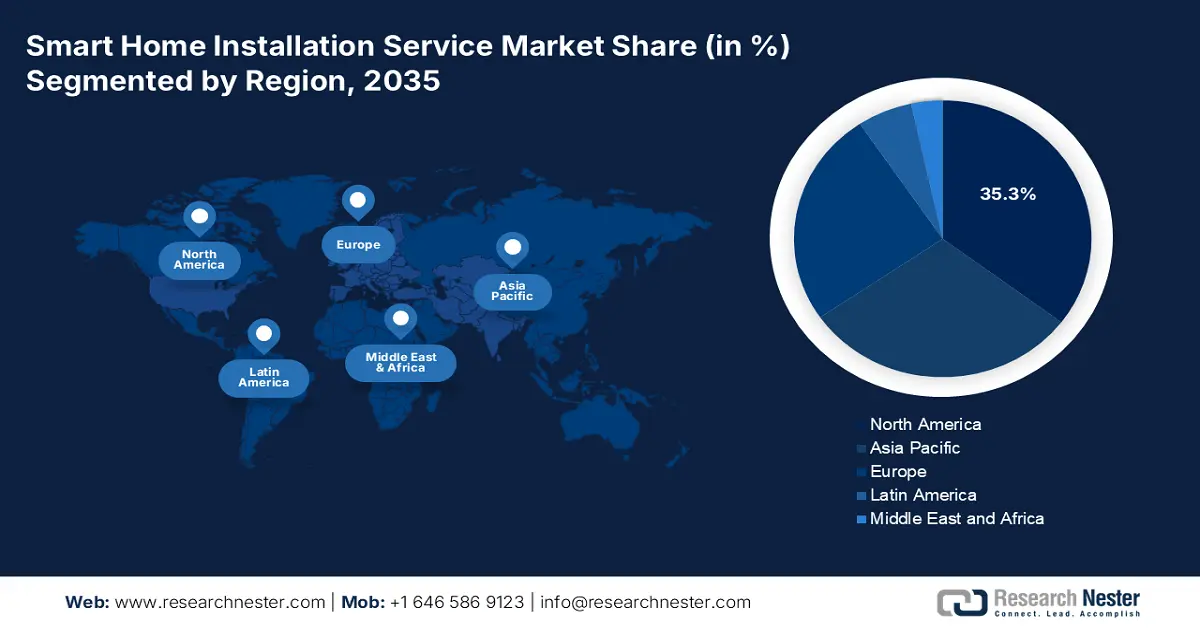

- By 2035, North America in the smart home installation service market is forecast to secure a 35.3% share, underpinned by rising disposable income and intensified demand for integrated energy and security management systems.

- Europe is projected to command strong momentum through 2035, capturing its fastest-growing position as stringent energy-efficiency directives and heightened residential security focus stimulate adoption across diverse housing structures.

Segment Insights:

- The single-family houses segment in the smart home installation service market is expected to represent a 57.8% share by 2035, bolstered by homeowner flexibility to implement extensive upgrades across large standalone properties.

- By 2035, the Wi-Fi segment is projected to hold the second-largest share as its essential role in enabling seamless device connectivity and future-ready interoperability accelerates adoption.

Key Growth Trends:

- Increase in the demand for energy management and integrated security

- Advancements in universal standards

Major Challenges:

- Technical complexity and interoperability fragmentation

- Increased cost of consumer and deployment value perception

Key Players: ADT Inc. (U.S.), Vivint Smart Home, Inc. (U.S.), Comcast Corporation (Xfinity Home) (U.S.), Resideo Technologies, Inc. (U.S.), Allegion plc (U.S.), Amazon.com, Inc. (Ring & Alexa Smart Home) (U.S.), Alphabet Inc. (Google Nest) (U.S.), Johnson Controls International plc (Ireland), Schneider Electric SE (France), Legrand SA (France), Siemens AG (Germany), Deutsche Telekom AG (Magenta SmartHome) (Germany), ASSA ABLOY AB (Sweden), Samsung Electronics Co., Ltd. (SmartThings) (South Korea), LG Electronics Inc. (South Korea), Sony Corporation (Japan), Panasonic Holdings Corporation (Japan), Mitsubishi Electric Corporation (Japan), Godrej & Boyce Mfg. Co. Ltd. (India), Trane Technologies plc (U.S.)

Global Smart Home Installation Service Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 40.4 billion

- 2026 Market Size: USD 47.8 billion

- Projected Market Size: USD 184.7 billion by 2035

- Growth Forecasts: 18.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.3% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Brazil, Australia, France

Last updated on : 19 November, 2025

Smart Home Installation Service Market - Growth Drivers and Challenges

Growth Drivers

- Increase in the demand for energy management and integrated security: The aspect of heightened customer awareness regarding home safety, along with a rise in utility expenses are primary purchase drivers for the smart home installation service market globally. Besides, professional installers are essential for deploying sophisticated systems that readily unify security hardware with energy-saving HVAC controls. According to an article published by the Security Industry Association in 2024, an estimated 210,000 people are employed in the equipment field, 7,865,000 in services, and 22,600,000 in end users as an overall part of the physical security industry. In addition, the industry is valued at USD 298 billion as of 2022, and USD 405 billion as of 2023 for equipment, distribution, and services, thus bolstering the market’s upliftment across different nations.

Physical Security Equipment and Services By Type (USD Million)

|

Years |

Equipment Growth |

Distribution Growth |

Services Growth |

|

2022 |

50,994 |

28,129 |

297,744 |

|

2023 |

55,540 |

30,785 |

318,646 |

|

2024 |

60,550 |

33,730 |

342,025 |

|

2026 |

69,795 |

39,212 |

389,224 |

Source:Security Industry Association

- Advancements in universal standards: The incorporation of the matter-based connectivity protocol diminishes brand lock-in, which empowers customers to mix products in the smart home installation service market internationally. This eventually increases the demand for skilled installers in multiple vendor environments to ensure overall device operating reliability. Based on this, as stated in the 2022 Journal of Building Cities Organization, the Clean Growth initiative in the UK has readily affirmed smart systems to be crucial to low-carbon growth, featuring £265 million for smart systems as well as £184 million for smart homes. This is considered a part of government investments in clean technology research, design, and development that comprises energy and heat efficiency.

- Governmental strategies for energy efficiency: The aspect of rebates and policies provided from administrative bodies, such as Europe’s Energy Performance of Buildings Directive and the U.S. Department of Energy, has readily encouraged homeowners to upgrade to smart thermostats. This even includes advanced energy management systems, which are frequently installed by professionals to qualify for incentives, thereby creating a positive impact in the smart home installation service market. As per an article published by the IEA Organization in June 2023, the aspect of governmental spending through the IEA Government Energy Spending Tracker has increased by 25% as of 2023. This amounted to USD 130 billion in the latest government expenditure to readily support clean energy devices, which is positively driving the smart home installation service market’s growth.

Challenges

- Technical complexity and interoperability fragmentation: Despite the promise of issuing standards, such as Matter, the smart home installation service market continues to be plagued by interoperability risks. The increased volume in devices, each with their respective proprietary protocols, along with software and firmware ecosystems, has created a persistent technical obstacle. In the case of professional installers, this means developing a unified and seamless user experience from a collection of best-in-brand products, which is labor-based and demands ongoing training. Besides, every employment can emerge as a customized integration project since an installer can experience challenges between a consumer’s present Wi-Fi 6 router, a Bluetooth-specific sensor, and a Z-wave lock. This complex has slowed down installation duration, resulting in consumer frustration.

- Increased cost of consumer and deployment value perception: The upfront expense of a professionally installed smart home system still remains one of the major barriers to mass market integration. Unlike a usual DIY plug-and-play device, a complete installation comprises significant labor expenses for skilled technicians, potential costs for network upgradation, and the premium hardware pricing. Besides, for different customers, particularly in the retrofit market, this increased initial investment is extremely difficult to justify against the perceived valuation. In addition, benefits, including security and energy savings, are compelling as they are frequently abstract and long-lasting, whereas the expense is concrete and immediate, thus causing a hindrance in the smart home installation service market.

Smart Home Installation Service Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

18.4% |

|

Base Year Market Size (2025) |

USD 40.4 billion |

|

Forecast Year Market Size (2035) |

USD 184.7 billion |

|

Regional Scope |

|

Smart Home Installation Service Market Segmentation:

Home Type Segment Analysis

The single-family houses segment, which is a part of the home type within the smart home installation service market, is anticipated to account for the largest share of 57.8% by the end of the stipulated period. The segment’s upliftment is highly driven by homeowners having absolute autonomy over property changes, which is different from tenants or condominium residents witnessing restrictions from homeowners’ associations and landlords. This freedom has permitted wide-ranging installations, which include integrated HVAC controls, hardwired security systems, and in-wall wiring without the need for third-party permissions. Additionally, the presence of a large physical footprint and an increased number of entry points in a standalone house has developed a compelling surface area and use case for smart home technology, thus making it suitable for bolstering the segment globally.

Technology Segment Analysis

By the end of 2035, the Wi-Fi segment, as a part of technology, is expected to hold the second-largest share in the smart home installation service market. The segment’s growth is propelled by its provision of a crucial wireless network for smart home devices to communicate and connect, while Matter is considered the latest standard that ensures unusual devices from different brands can operate together, improve compatibility, and simplify installation. Besides, for a successful smart home installation, a stabilized and robust Wi-Fi network is regarded as the foundational need, while Matter is essential for future-proofing the system. According to an article published by the World Economic Forum in September 2024, the aspect of mobile network coverage has extended to 92% of the world, and the Edison Alliance has successfully aimed to connect 1 billion people to standard digitalized services, such as education and healthcare, by the end of 2025, which denotes a positive impact on the segment’s growth.

Solution Segment Analysis

The retrofit and upgrade sub-segment in the solution segment is predicted to cater to the third-largest share in the smart home installation service market by the end of the forecast duration. The segment’s development is highly fueled by its importance for widely adopting the smart home technology, owing to the provision of a sustainable, non-invasive, and cost-effective path to modernize living without demanding a complete structural overhaul. In addition, this approach has made smart living accessible to a much broader range of homeowners, particularly those in old properties. As per an article published by the RICS Organization in July 2025, 62% of energy is utilized by space heating, 17% for water heating, 15% by appliances, and 3% for both cooking and lighting. As a result, there is a huge demand for retrofitting, with the intention of optimizing energy by reducing its expenses and consumption.

Our in-depth analysis of the smart home installation service market includes the following segments:

|

Segment |

Subsegments |

|

Home Type |

|

|

Technology |

|

|

Solution |

|

|

Service Provider |

|

|

System Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Home Installation Service Market - Regional Analysis

North America Market Insights

North America in the smart home installation service market is projected to account for the largest share of 35.3% by the end of 2035. The market’s growth in the region is highly fueled by an increase in disposable income, early technological adoption, and a strong need for integrated energy and security management systems. For instance, according to an article published by the NIST Government in September 2025, the organization has provided over USD 3.3 million to provide support for cybersecurity across 13 states in the region. This fund provision has resulted in providing 514,000 employment opportunities in cybersecurity in the U.S., which is positively impacting the market in the region. In addition, the professional retrofitting of the current housing stock with standardized systems, effectively based on the matter-based protocol to ensure interoperability, is also driving the market in the region.

The smart home installation service market in the U.S. is growing significantly, owing to an increase in consumer demand for security and energy efficiency, which is readily supported by federal strategies. Besides, the U.S. Department of Energy promotes smart energy management systems and thermostats, which frequently need professional installation for optimal savings. As per an article published by Advances in Applied Energy in September 2025, the domestic smart thermostat sector is currently valued at an estimated USD 2.3 billion as of 2024, and is projected to grow by 17.3% by the end of 2032. Meanwhile, the Environmental Protection Agency's ENERGY STAR program proactively certifies advanced home-based products, thus validating their efficiency as well as encouraging consumer adoption. This, in turn, uplifts the service market for proper integration and setup.

The smart home installation service market in Canada is also growing due to increased influence by government-specific energy conservation and green building programs. Besides, the Natural Resources Canada (NRCan) has offered initiatives and grants, such as the Canada Greener Homes Grant, which provides homeowners with generous eligible retrofits for installing energy monitoring systems and smart thermostats. According to an article published by the Government of Canada in October 2025, the NRCan provides grants ranging from USD 125 to USD 5,000, along with USD 600 for post-retrofit evaluations, and almost USD 40,000 as a repayment term for 10 years to provide assistance in undertaking the majority of home retrofits. Besides, USD 5,600 is also considered a maximum grant for a household, which in turn denotes an optimistic outlook for the overall market.

Europe Market Insights

Europe in the smart home installation service market is expected to emerge as the fastest-growing region during the predicted period. The market’s upliftment is highly driven by the presence of strict energy-efficient directives and a robust customer focus on home security. Besides, the smart adoption of advanced systems into both sustainable and new building projects, along with historic housing stock retrofitting is also bolstering the market in the overall region. As per an article published by NLM in November 2022, the smart grid and smart applications component hugely benefit the Internet of Things (IoT), with a 10% growth rate and data from different economies. This has permitted regional small and medium-sized enterprises (SMEs) to successfully enter this field. Meanwhile, countries in the region comprise strong manufacturing bases and increased disposable income, especially in the UK and Germany, which is also fueling the market.

The smart home installation service market in the UK is gaining increased traction, owing to an increase in the rate of homeownership and a robust DIY-pro hybrid culture shifting to professional services for complicated integrations. Therefore, reflecting on this demand, government-based strategies indirectly provide support to the market. For instance, the country’s Product Security and Telecommunications Infrastructure Act has mandated aggressive standards for connectable customer devices, which has enhanced the demand for professional setup to ensure compliance. As per a data report published by the UK Government in April 2025, an average of 65% of households, particularly in England, owned their respective homes. Besides, 70% of households, among the White British population, owned their own homes, thereby denoting a huge growth opportunity for the market in the country.

Rent To Buy Housing Ownership in the UK

|

Duration |

Cost-effective Rent |

Social Rent |

Intermediate Affordable Housing - Intermediate Rent |

Intermediate Affordable Housing - Rent to Buy |

Intermediate Affordable Housing - Affordable Home Ownership |

|

2023-2024 (Overall year) |

3,248 |

3,961 |

182 |

681 |

2,996 |

|

2023-2024 (October to March) |

2,085 |

3,186 |

163 |

461 |

2,208 |

|

2023-2024 (April to September) |

1.163 |

775 |

19 |

220 |

788 |

|

2024-2025 (Overall Year) |

2,665 |

5,680 |

139 |

366 |

2,295 |

|

2024-2025 (October to March) |

1,580 |

3,675 |

49 |

127 |

1,188 |

|

2024-2025 (April to September) |

1,085 |

2,005 |

90 |

239 |

1,107 |

Source: UK Government

The smart home installation service market in Germany is also developing due to an upsurge in its manufacturing prowess in IoT, as well as a robust regulatory push for energy transition. The fund provision from the Federal Ministry for Economic Affairs and Climate Action (BMWK) specifically focuses on smart home technologies for optimizing energy utilization. In addition, this directly increases the need for qualified installers, thus suitable for bolstering the market in the country. Moreover, the smart home systems integration with renewable energy sources, such as home battery storage and solar panels, is also a dominant trend for the market’s upliftment. As per an article published by the IMC Organization in March 2025, the smart home sector in the region is predicted to reach USD 67.5 billion by the end of 2031, along with a 13.9% growth rate, thus making it suitable for the market’s growth.

APAC Market Insights

Asia Pacific in the smart home installation service market is projected to expand steadily by the end of the forecast duration. The market’s upliftment in the overall region is fueled by rapid urbanization, huge government investments in the smart city infrastructure, and a burgeoning middle-class relevance. Besides, India and China are considered primary growth engines for the market in the region, with their massive population as well as continuous construction advancements. As per an article published by the TM Forum Organization in January 2023, there has been an increase in registered mobile money service accounts by 30% to 328 million in the East Asia and Pacific region, along with an 11% to 283 million in South Asia. Therefore, the overall transaction valuation across the region was almost USD 300 billion, thus boosting the market’s growth.

The smart home installation service market in China is gaining increased exposure, owing to the huge domestic manufacturing of IoT devices, along with the existence of top-down policy support. Besides, the government’s New Infrastructure strategy has explicitly included investments in IoT and 5G networks, which are essential backbones for smart homes. Moreover, the country is considered the world’s largest market for smart home devices in terms of volume, which has created a massive and progressive service market for professional integration and installation. As stated in the December 2024 The People’s Republic of China article, there has been a rapid growth in 5G subscriptions, which is supported by huge infrastructure development, and the country has readily deployed almost 4.2 million 5G base stations. This has eventually led to an upsurge in 5G-based mobile phone subscriptions, which have reached 1.0 billion, thus driving the overall market.

The smart home installation service market in India is also growing due to the government’s flagship Smart Cities Mission that has been a significant catalyst. In addition, this particular mission comprises core elements, such as digitalized connectivity and smart energy management, thus directly generating the need for professional installation services in urban-based residential projects. As per a data report published by the MEITY Government in January 2025, the country’s digital economy accounted for 11.7% between 2022 and 2023, which has been projected to increase by 13.4% by the end of 2025. Additionally, the valuation between 2022 and 2023 amounted to ₹28.9 lakh crore (USD 368 billion) in terms of GVA and ₹31.6 lakh crore (USD 402 billion) in terms of the gross domestic product. Therefore, with this continuous upliftment, there is huge growth opportunity for the market in the country.

Key Smart Home Installation Service Market Players:

- ADT Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Vivint Smart Home, Inc. (U.S.)

- Comcast Corporation (Xfinity Home) (U.S.)

- Resideo Technologies, Inc. (U.S.)

- Allegion plc (U.S.)

- Amazon.com, Inc. (Ring & Alexa Smart Home) (U.S.)

- Alphabet Inc. (Google Nest) (U.S.)

- Johnson Controls International plc (Ireland)

- Schneider Electric SE (France)

- Legrand SA (France)

- Siemens AG (Germany)

- Deutsche Telekom AG (Magenta SmartHome) (Germany)

- ASSA ABLOY AB (Sweden)

- Samsung Electronics Co., Ltd. (SmartThings) (South Korea)

- LG Electronics Inc. (South Korea)

- Sony Corporation (Japan)

- Panasonic Holdings Corporation (Japan)

- Mitsubishi Electric Corporation (Japan)

- Godrej & Boyce Mfg. Co. Ltd. (India)

- Trane Technologies plc (U.S.)

- ADT Inc. is considered a legacy leader in professional security monitoring that provides a trusted brand reputation with seamless expansion into a wide-ranging smart home installation. Its core contribution caters to monitored integrated systems and professionally installed device provision that bundles life safety, automation, and security services. Besides, as per its 2024 annual report, the organization generated USD 4,898 million in overall revenue, along with USD 359 million in monthly revenue, and 12.7% as gross revenue attrition.

- Vivint Smart Home, Inc. readily specializes in subscription-based and completely integrated smart home systems that are commercialized through a direct-to-home sales model. The firm is considered a notable innovator in vertically integrated solutions for designing its own equipment as well as managing the overall consumer experience from installation to continuous support.

- Comcast Corporation has significantly leveraged its huge consumer base by effectively bundling its Xfinity Home security, along with automation service, with television and internet plans. This particular approach has successfully fueled the mainstream incorporation of smart home services by providing a single point of contact and convenience for billing and installation. Meanwhile, as stated in its 2024 annual report, the company has generously generated USD 43.0 per share based on 55,961,536 shares purchased in the first quarter. This resulted in an increased revenue, amounting to USD 1.9 billion.

- Resideo Technologies, Inc. is regarded as the most critical supplier of software platforms, security sensors, and thermostats. Its major contribution is emphasized on empowering a massive network of third-party networks with tools and products that are required to offer service and deploy smart home systems.

- Allegion plc is one of the leading international manufacturers of security solutions and products, readily specializing in access control systems and intelligent locks for residential doors. The organization’s contribution remains in offering the ultimate hardware that provides secure accessibility and keyless entry within professionally installed smart home ecosystems.

Here is a list of key players operating in the global market:

The international smart home installation service market is highly characterized and fragmented by intense competition among device manufacturers, telecom giants, and specialized security firms. Notable players are rapidly pursuing strong and tactical approaches, such as vertical integration, wherein organizations, including Google and Amazon, both control the installation service layer and the device ecosystem. Moreover, strategic collaborations are also necessary, with telecom providers, such as Deutsche Telekom and Comcast, collectively bundling installation with connectivity plans to uplift consumer acquisition. Besides, in August 2025, Samsung Electronics declared the extension of its very own proprietary One UI platform to its home appliance lineup for delivering an intuitive and unified software experience across different smart appliances, thus boosting the smart home installation service market’s growth globally.

Corporate Landscape of the Smart Home Installation Service Market:

Recent Developments

- In September 2025, LG Electronics ushered in the latest Europe-based smart home appliance field by unveiling its outstanding AI platform, LG ThinQ AI. The purpose is to offer an ever-evolving and personalized consumer experience with active appliance management.

- In September 2024, ZTE Corporation introduced a progressive AI-based Screen solution that tends to integrate smart speakers with mobile phone screens, TV screens, and other device screens.

- Report ID: 8251

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.