- An Outline of the Global Smart Meter Market

- Market Definition

- Market Segmentation

- Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

- Opportunities

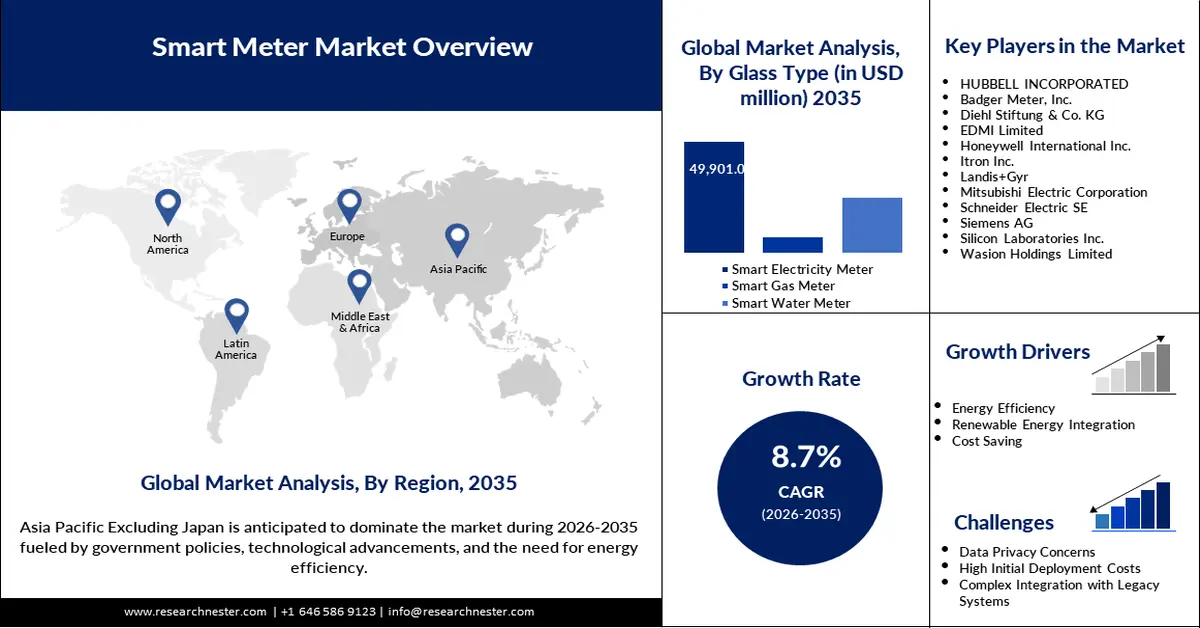

- Growth Drivers

- Major Roadblocks

- Prevalent Trends

- Government Regulation

- Comparative Analysis of the Current Technologies

- Up-Coming Technologies

- Growth Outlook

- Risk Analysis

- Pricing Benchmarking

- SWOT

- Supply Chain

- Understanding the Smart Meter Landscape: Insights by End user Segment

- Advanced Metering Infrastructure (AMI) and Auto Meter Reading (AMR): A Technology Comparison

- Regional Demand

- Root Cause Analysis (RCA) for discovering problems of the Smart Meter Market

- Porter Five Forces

- PESTLE

- Smart Meter Industry Leaders: Electric, Gas, and Water Meter Production and Sales Overview

- Smart Meter Global Industry Leaders: Projected Sales Performance Overview from 2024 to 2035

- Smart Meter Industry Leaders: Projected Sales Performance Overview from 2024 to 2035

- Comparative Positioning

- Competitive Landscape

- Competitive Model

- Market Share of Major Companies Profiled

- Business Profile of Key Enterprise

- HUBBELL INCORPORATED

- Badger Meter, Inc.

- Diehl Stiftung & Co. KG

- EDMI Limited

- Honeywell International Inc.

- Itron Inc.

- Landis+Gyr

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Siemens AG

- Silicon Laboratories Inc.

- Wasion Holdings Limited

- Xylem

- ZENNER International GmbH & Co. KG

- Arad Group

- Neptune Technology Group Inc.

- Global Smart Meter Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Units) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Smart Meter Market Segmentation Analysis (2022-2035)

- By Type

- Smart Electricity Meter, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Smart Gas Meter, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Smart Water Meter, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- By Component

- Hardware, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Software, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- By Technology

- Automatic Meter Reading (AMR), Market Value (USD Million), and CAGR, 2022-2035F

- Advanced Metering Infrastructure (AMI), Market Value (USD Million), and CAGR, 2022-2035F

- By End user

- Residential, Market Value (USD Million), and CAGR, 2022-2035F

- Commercial, Market Value (USD Million), and CAGR, 2022-2035F

- Industrial, Market Value (USD Million), and CAGR, 2022-2035F

- By Type

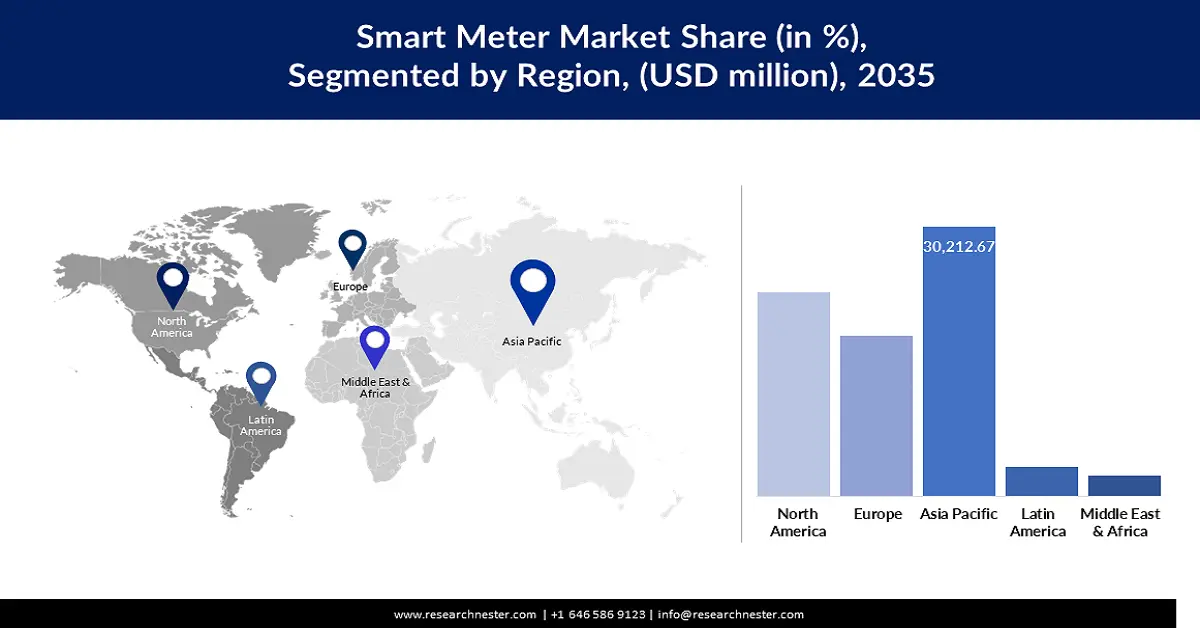

- By Region

- North America, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Europe, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Asia Pacific Excluding Japan, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Japan, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Latin America , Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Middle East and Africa, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Market Overview

- Cross Analysis of Type W.R.T. End user (USD Million), 2022-2035

- North America Smart Meter Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Units) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Smart Meter Market Segmentation Analysis (2022-2035)

- By Type

- Smart Electricity Meter, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Smart Gas Meter, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Smart Water Meter, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- By Component

- Hardware, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Software, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- By Technology

- Automatic Meter Reading (AMR), Market Value (USD Million), and CAGR, 2022-2035F

- Advanced Metering Infrastructure (AMI), Market Value (USD Million), and CAGR, 2022-2035F

- By End user

- Residential, Market Value (USD Million), and CAGR, 2022-2035F

- Commercial, Market Value (USD Million), and CAGR, 2022-2035F

- Industrial, Market Value (USD Million), and CAGR, 2022-2035F

- By Country

- U.S., Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Canada, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- By Type

- Market Overview

- Cross Analysis of Type W.R.T. End user (USD Million), 2022-2035

- Europe Smart Meter Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Units) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Smart Meter Market Segmentation Analysis (2022-2035)

- By Type

- Smart Electricity Meter, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Smart Gas Meter, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Smart Water Meter, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- By Component

- Hardware, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Software, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- By Technology

- Automatic Meter Reading (AMR), Market Value (USD Million), and CAGR, 2022-2035F

- Advanced Metering Infrastructure (AMI), Market Value (USD Million), and CAGR, 2022-2035F

- By End user

- Residential, Market Value (USD Million), and CAGR, 2022-2035F

- Commercial, Market Value (USD Million), and CAGR, 2022-2035F

- Industrial, Market Value (USD Million), and CAGR, 2022-2035F

- By Country

- UK, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Germany, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- France, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Italy, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Spain, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- BENELUX, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Poland, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Russia, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Rest of Europe, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- By Type

- Market Overview

- Cross Analysis of Type W.R.T. End user (USD Million), 2022-2035

- Asia Pacific Excluding Japan Smart Meter Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Units) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Smart Meter Market Segmentation Analysis (2022-2035)

- By Type

- Smart Electricity Meter, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Smart Gas Meter, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Smart Water Meter, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- By Component

- Hardware, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Software, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- By Technology

- Automatic Meter Reading (AMR), Market Value (USD Million), and CAGR, 2022-2035F

- Advanced Metering Infrastructure (AMI), Market Value (USD Million), and CAGR, 2022-2035F

- By End user

- Residential, Market Value (USD Million), and CAGR, 2022-2035F

- Commercial, Market Value (USD Million), and CAGR, 2022-2035F

- Industrial, Market Value (USD Million), and CAGR, 2022-2035F

- By Country

- China, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- India, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Indonesia, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- South Korea, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Malaysia, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Australia, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Singapore, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Vietnam, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- New Zealand, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Rest of Asia Pacific Excluding Japan, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- By Type

- Cross Analysis of Type W.R.T. End user (USD Million), 2022-2035

- Japan Smart Meter Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Units) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Smart Meter Market Segmentation Analysis (2022-2035)

- By Type

- Smart Electricity Meter, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Smart Gas Meter, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Smart Water Meter, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- By Component

- Hardware, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Software, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- By Technology

- Automatic Meter Reading (AMR), Market Value (USD Million), and CAGR, 2022-2035F

- Advanced Metering Infrastructure (AMI), Market Value (USD Million), and CAGR, 2022-2035F

- By End user

- Residential, Market Value (USD Million), and CAGR, 2022-2035F

- Commercial, Market Value (USD Million), and CAGR, 2022-2035F

- Industrial, Market Value (USD Million), and CAGR, 2022-2035F

- By Type

- Market Overview

- Cross Analysis of Type W.R.T. End user (USD Million), 2022-2035

- Latin America Smart Meter Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Units) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Smart Meter Market Segmentation Analysis (2022-2035)

- By Type

- Smart Electricity Meter, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Smart Gas Meter, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Smart Water Meter, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- By Component

- Hardware, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Software, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- By Technology

- Automatic Meter Reading (AMR), Market Value (USD Million), and CAGR, 2022-2035F

- Advanced Metering Infrastructure (AMI), Market Value (USD Million), and CAGR, 2022-2035F

- By End user

- Residential, Market Value (USD Million), and CAGR, 2022-2035F

- Commercial, Market Value (USD Million), and CAGR, 2022-2035F

- Industrial, Market Value (USD Million), and CAGR, 2022-2035F

- By Country

- Brazil, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Argentina, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Mexico, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Rest of Latin America, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- By Type

- Market Overview

- Cross Analysis of Type W.R.T. End user (USD Million), 2022-2035

- Middle East & Africa Smart Meter Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Million Units) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Smart Meter Market Segmentation Analysis (2022-2035)

- By Type

- Smart Electricity Meter, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Smart Gas Meter, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Smart Water Meter, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- By Component

- Hardware, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Software, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- By Technology

- Automatic Meter Reading (AMR), Market Value (USD Million), and CAGR, 2022-2035F

- Advanced Metering Infrastructure (AMI), Market Value (USD Million), and CAGR, 2022-2035F

- By End user

- Residential, Market Value (USD Million), and CAGR, 2022-2035F

- Commercial, Market Value (USD Million), and CAGR, 2022-2035F

- Industrial, Market Value (USD Million), and CAGR, 2022-2035F

- By Country

- GCC, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Israel, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- South Africa, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- Rest of Middle East & Africa, Market Value (USD Million), Volume (Million Units), and CAGR, 2022-2035F

- By Type

- Market Overview

- Cross Analysis of Type W.R.T. End user (USD Million), 2022-2035

- Global Economic Scenario

- About Research Nester

Smart Meter Market Outlook:

Smart Meter Market size was valued at USD 27.17 billion in 2025 and is set to exceed USD 62.57 billion by 2035, registering over 8.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of smart meter is estimated at USD 29.3 billion.

The smart meter market is expanding rapidly due to the shift to digital networks, the integration of renewable energy sources, and the pursuit of energy efficiency. Both governments and utility providers have been increasing their spending on smart grid technologies for better energy delivery and usage. In June 2023, Moldova’s Ministry of Energy, together with the UNDP, initiated a pilot project on the introduction of smart electricity meters, which shows the process of digitalization of the energy industry. This is a move towards the improvement of energy management, curtailment of wastage of energy, as well as the realization of national energy efficiency targets through the use of real-time monitoring and automated billing systems. However, the growing emphasis on renewable energy integration to enhance DER management and control also drives market growth.

The use of smart meters in residential, commercial, and industrial sectors is anticipated to rise considerably as a result of the growing need for real time energy management, improved grid stability, and efficient maintenance scheduling. Adani Energy Solutions announced in January 2024 that it aimed to control 25.0% of the country’s smart meter market by focusing on large orders from distribution companies. This aggressive expansion is due to the growing use of smart metering systems, which enhance efficiency, combat energy theft, and meet international goals and governmental regulations. The growing number of smart city projects across the globe escalates the demand for smart meters for effective energy management and evidence-based decision-making among utilities.

Key Smart Meter Market Insights Summary:

Regional Highlights:

- Asia Pacific leads the Smart Meter Market with a 36.4% share, propelled by increasing urbanization, government regulations on smart grid development, and demand for efficient energy management, ensuring strong growth through 2026–2035.

- North America's smart meter market is achieving significant share by 2035, driven by rising investments in AMI and smart grid upgrades, real-time data analysis, and AI/IoT integration.

Segment Insights:

- The Smart Electricity Meter segment is anticipated to hold a substantial share by 2035, driven by the increasing need for improved electricity management and grid control.

- The Software Solutions segment is poised for substantial growth from 2026-2035, driven by advancements in data analytics and grid management systems.

Key Growth Trends:

- Governmental support for smart grids

- Growing need for water and gas management

Major Challenges:

- Interoperability and integration issues

- Regulatory and privacy concerns

- Key Players: Badger Meter, Inc., Diehl Stiftung & Co. KG, EDMI Limited, Honeywell International Inc., Itron Inc., Landis+Gyr, Mitsubishi Electric Corporation, Schneider Electric SE, Siemens AG, Silicon Laboratories Inc., Wasion Holdings Limited, Xylem, ZENNER International GmbH & Co. KG, Arad Group, Neptune Technology Group Inc.

Global Smart Meter Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 27.17 billion

- 2026 Market Size: USD 29.3 billion

- Projected Market Size: USD 62.57 billion by 2035

- Growth Forecasts: 8.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Australia

Last updated on : 13 August, 2025

Smart Meter Market Growth Drivers and Challenges:

Growth Drivers

-

Governmental support for smart grids: Governments worldwide are focusing on developing smart grid systems to address issues of energy conservation and greenhouse gas emissions, which has created a need for smart meters. These initiatives are directed towards the improvement of utility networks as well as towards more precise and efficient energy distribution and utilization. In November 2022, Itron, Inc. announced a collaboration with technology providers to fast-track the deployment of smart energy infrastructure within utilities and cities globally. This partnership is evidence of the growing trend towards the adoption of sustainable energy solutions and, therefore validates the part played by smart meters in realizing energy efficiency objectives.

-

Growing need for water and gas management: The growing concern for resources has also boosted the use of smart water and gas meters along with electricity meters. These meters help in tracking and managing energy usage and distribution in real time which reduces expenses and is eco-friendly. In July 2024, Genus Power Infrastructures Limited entered the Australia market with LoRa-based Smart Ultrasonic Water Meters for improved remote reading. This development shows how smart infrastructure for utility management is being expanded to meet the rising global concern in water management and gas distribution.

- Technological innovations and the integration of IoT: Smart meters are now becoming an essential part of the IoT and communication technologies due to the fast development of these technologies. Smart meters currently use 4G NB-IoT and RF Mesh networks that are expandable to suit various locations. In September 2022, EDMI introduced MIRA, a smart metering brand that is independent of the communication network. These innovations improve the quality of the data collected, increase efficiency in the use of resources, and support the growth of smart cities and IoT-based utilities.

Challenges

-

Interoperability and integration issues: A major challenge in the smart meter industry is the compatibility issue between different metering systems and networks. Different communication paradigms and hardware platforms can also complicate integration and result in problems concerning scalability and geographic distribution. This means that utilities must embrace standard technologies in order to support interoperability across the various platforms. Interoperability issues must be solved to improve smart metering deployment and implementation of the integrated smart grid systems.

-

Regulatory and privacy concerns: The adoption of smart meters poses risks to data privacy security and regulatory issues. Due to the growing traffic of data through the residential and industrial networks, it becomes crucial to safeguard the information. Various countries have divergent legal requirements that complicate the process of defining the deployment strategies. Smart meter manufacturers and utilities need to follow these regulations in order to regain consumer confidence and manage the operational visibility and stability of the grid.

Smart Meter Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.7% |

|

Base Year Market Size (2025) |

USD 27.17 billion |

|

Forecast Year Market Size (2035) |

USD 62.57 billion |

|

Regional Scope |

|

Smart Meter Market Segmentation:

Type (Smart Electricity Meter, Smart Gas Meter, Smart Water Meter)

Smart electricity meter segment is expected to hold over 61% smart meter market share by the end of 2035. This growth is attributed to the increasing need for improved electricity management and better grid control. In June 2024, Mitsubishi Electric and Chunghwa Telecom co-developed a smart metering solution in Taiwan to address the issue of grid efficiency and to support large-scale adoption of the technology. Growing attention to the use of renewable energy and the development of the smart grid only strengthens the position of electricity meters as the fundamental component of smart utility solutions.

Component (Hardware, Software)

By the end of 2035, software solutions segment is predicted to dominate around 76.2% smart meter market share, due to the advancement of data analytics and grid management systems. Smart metering software is a crucial component that helps in the management of assets, detection of leaks and maintenance, and improvement of the performance of utilities. In May 2024, Badger Meter introduced BlueEdge as a water asset optimization suite to improve the data and functionality of the operations. This move toward software-based systems emphasizes the role of digital platforms in the development of new, efficient, and adaptive utility systems.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Component |

|

|

Technology |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Smart Meter Market Regional Analysis:

Asia Pacific Market Statistics

Asia Pacific smart meter market is anticipated to capture revenue share of over 36.4% by 2035. The growth is driven by increasing urbanization, regulation of smart grid development by the government, and the need for efficient energy management. Expenditure on smart water and gas metering is also increasing as nations focus their attention on water and energy efficiency. The development of infrastructure projects across the region is also pushing the demand for smarter metering in homes, industries, and businesses.

The growth of smart meter market in India is attributed to large-scale infrastructure projects and government policies. In July 2023, Genus Power & Infrastructures Ltd. signed a deal with GIC’s associate company, Gem View Investment, to form an advanced metering infrastructure platform with a capital of USD 2 billion. Genus will be the sole provider of smart meters for the country in a bid to achieve the government of India’s target of installing 250 million smart meters by 2025 under the National Smart Metering Programme. This is in line with the nation’s effort towards meeting energy efficiency, efficient grid management, and improved revenues for utility companies.

China holds the largest share of the smart meter market in APAC due to the accelerated smart city development and infrastructure improvement. The government has stepped up efforts to eliminate energy wastage and enhance grid efficiency through the installation of smart meters in both urban and rural regions. In the transportation and utilities industries, smart metering is connected with IoT to improve data integrity and promote the sustainable development of the two sectors. China has increased the uptake of smart meters and is already a key player in the provision of smart infrastructure in the market.

North America Market Analysis

North America region in smart meter market is estimated to hold significant revenue share by 2035, due to rising investments in AMI and smart grid upgrades. The region’s emphasis on decreasing energy use and improving the grid is forcing the adoption of advanced smart metering solutions for utilities. Due to the increasing need for real-time data analysis, smart meters are becoming the most efficient tools in energy supply chain management. The integration of IoT and AI into metering systems also promotes market growth.

The smart meter market in the U.S. is rising steadily due to significant developments in promoting sustainability. In September 2024, Trilliant announced that it would collaborate with Sense to incorporate edge analytics into AMI solutions to enable real-time data processing at rates up to 1MHz. This goes way beyond what first-generation smart meters can do, which means that utilities can now monitor energy consumption more effectively. During the forecast period, funding from the federal and state levels and increasing consumer awareness are also expected to fuel the growth in the residential and industrial sectors.

The smart meter market in Canada is also expanding due to the adoption of energy efficiency policies and the improvement of public utility infrastructure. The emphasis on the integration of renewable energy and the minimization of power losses has resulted in significant investment in smart metering. Some of the Canadian provinces are enhancing the AMI projects for enhanced grid visibility and the integration of cleaner energy solutions. The partnership of utilities and technology providers is anticipated to improve the collection of data, decrease costs of operations, and increase the efficiency of energy delivery and use, making Canada a major participant in North America smart meter market.

Key Smart Meter Market Players:

- HUBBELL INCORPORATED

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Badger Meter, Inc.

- Diehl Stiftung & Co. KG

- EDMI Limited

- Honeywell International Inc.

- Itron Inc.

- Landis+Gyr

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Siemens AG

- Silicon Laboratories Inc.

- Wasion Holdings Limited

- Xylem

- ZENNER International GmbH & Co. KG

- Arad Group

- Neptune Technology Group Inc.

Some of the leading industry players in the smart meter market include Itron Inc., Landis+Gyr, Honeywell International Inc., EDMI Limited, Siemens AG, Mitsubishi Electric Corporation, and Badger Meter, Inc., and these companies are focusing on research and development of new products and services and increasing their market presence across the globe. These companies are leading the way through the creation of sophisticated hardware, software, and whole-system metering. These are some of the key stakeholders in the sector due to their emphasis on smart grid, IoT, and utility digitization.

In November 2022, Landis+Gyr expanded its product offerings with new smart metering solutions in the electricity, heat, gas, and water sectors, thus strengthening its position in the smart meter market. This growth is indicative of a larger trend of intelligence at the edge of the grid that seeks to optimize energy delivery and minimize greenhouse gas emissions. With the increasing growth of the market, it is expected that competition will be based on product development, intersectoral cooperation, and partnerships to ensure the future growth of the global market.

Here are some leading companies in the smart meter market:

Recent Developments

- In November 2024, Diehl Metering inaugurated a new production unit in Bażanowice, Poland, doubling its production area. The 6,000m² facility houses final assembly lines and establishes new electronics capabilities, focusing on meter models like the HYDRUS smart water meter and SHARKY energy meters. This expansion aims to set industry standards.

- In May 2024, Oakter launched OAKMETER, an advanced smart energy meter designed to optimize energy management. Utilizing technologies like Advanced Metering Infrastructure and IoT, OAKMETER enables two-way communication, real-time data analytics, tamper detection, and outage identification.

- In May 2024, Diehl Metering announced that the HYDRUS 2.0 Domestic water meter can now be integrated with a LoRaWAN IoT network, enabling utilities to obtain precise consumption data. The meter's ultrasonic technology measures even the smallest drop, ensuring stability and durability in any environment. LoRaWAN technology also allows for the creation of digital twins, enabling seamless communication and remote alarm reset. The HYDRUS 2.0 Domestic range enables interoperable and flexible digital networks.

- Report ID: 6888

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Smart Meter Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.