Sleep Tech Devices Market Outlook:

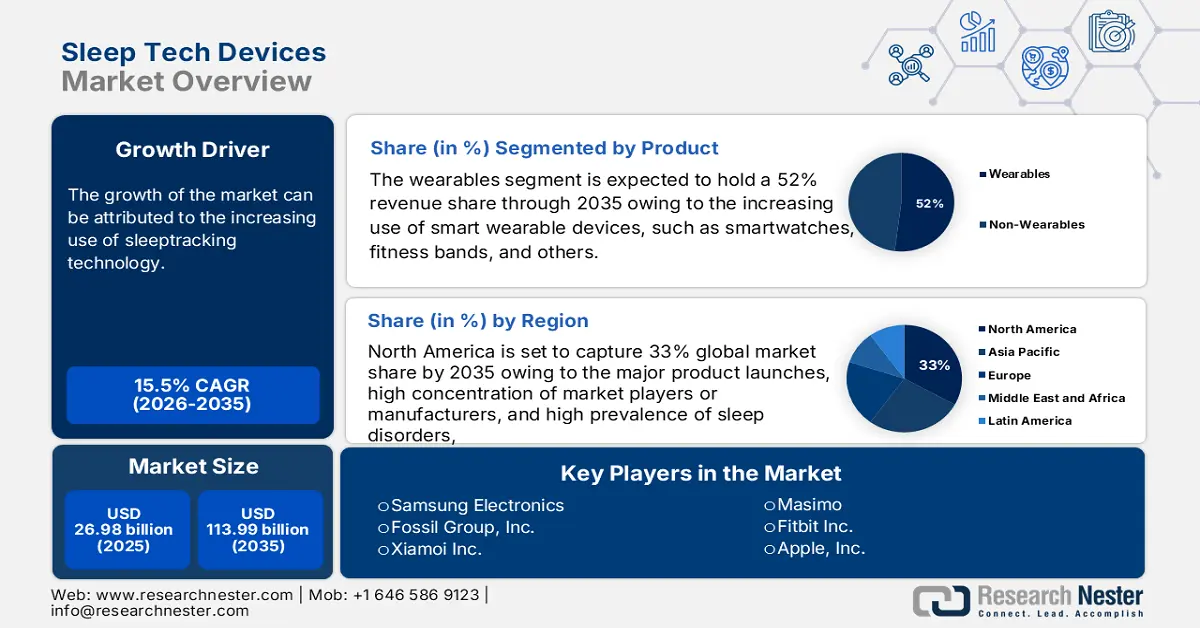

Sleep Tech Devices Market size was valued at USD 26.98 billion in 2025 and is likely to cross USD 113.99 billion by 2035, expanding at more than 15.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of sleep tech devices is assessed at USD 30.74 billion.

The growth of the market can be attributed to the increasing use of sleep-tracking technology. In the United States, around 15% of adults reported using sleep-related applications such as sleep cycle and sleep time. Moreover, in China and India, roughly a quarter of those who responded to an online survey indicated they had used sleep-tracking apps in the 12 months before the study.

In addition to these, factors that are believed to fuel the market growth of sleep tech devices include the rise in the instances of various sleep disorders among people. In the United States, between 125,000 and 200,000 people have narcolepsy. According to some estimates, the condition affects around 44-50 per 100,000 Americans. A long-term neurological condition called narcolepsy interferes with the brain's capacity to regulate sleep-wake cycles. Narcoleptics may feel rested when they first wake up and then experience extreme sleepiness for the majority of the day.

Key Sleep Tech Devices Market Insights Summary:

Regional Highlights:

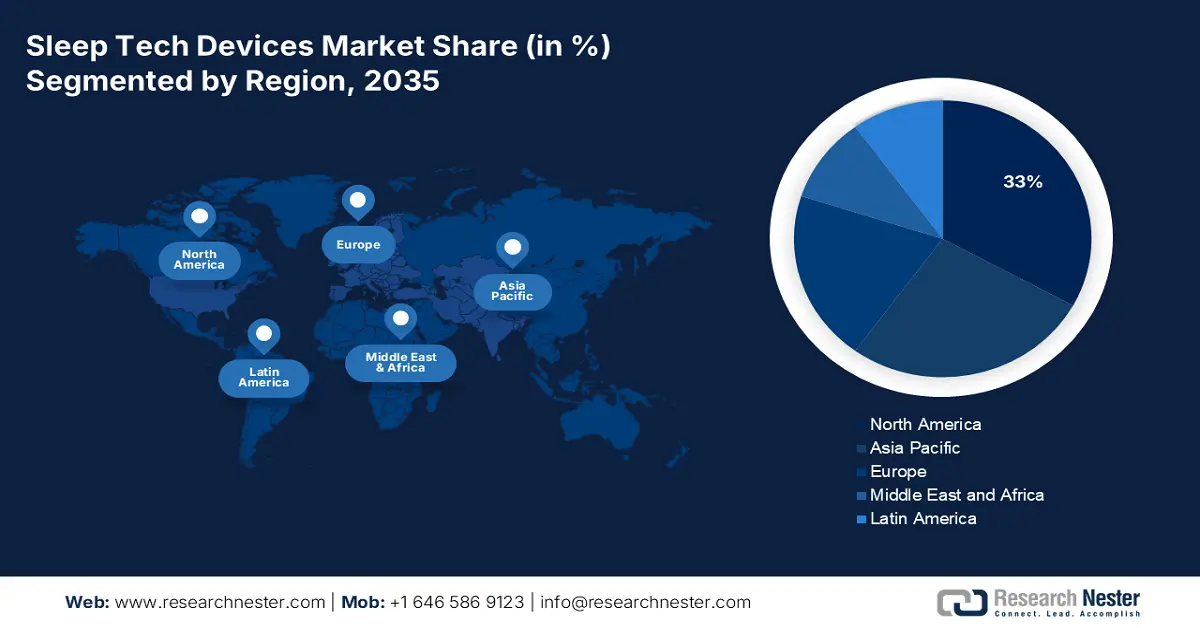

- North America sleep tech devices market is predicted to capture 33% share by 2035, driven by major product launches, high concentration of market players, and high prevalence of sleep disorders in the United States.

- Asia Pacific market will achieve a substantial CAGR during 2026-2035, attributed to the rising cases of depression and anxiety in the region.

Segment Insights:

- The wearables segment in the sleep tech devices market is expected to attain a 52% share by 2035, driven by increasing use of smart wearable devices like smartwatches and fitness bands.

- The insomnia segment in the sleep tech devices market is anticipated to capture a significant share by 2035, attributed to a rise in the number of people suffering from insomnia worldwide.

Key Growth Trends:

- Rising Advancements in Sleep Devices

- Rising Population of Old Adults

Major Challenges:

- Technology Increases Paranoia and Overthinking

- High Cost of Smart Sleeping Services

Key Players: Huawei Consumer Business Group, Samsung Electronics, Fossil Group, Inc., Xiamoi Inc., Masimo, Fitbit Inc., Apple, Inc., Nihon Kohden Corporation, Compumedics Limited, Garmin Ltd.

Global Sleep Tech Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 26.98 billion

- 2026 Market Size: USD 30.74 billion

- Projected Market Size: USD 113.99 billion by 2035

- Growth Forecasts: 15.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Russia

Last updated on : 10 September, 2025

Sleep Tech Devices Market Growth Drivers and Challenges:

Growth Drivers

- Rising Advancements in Sleep Devices - More innovations in sleep tech are likely to create huge opportunities for the market's growth. For instance, Kryo Inc. a sub company collaborated with Major League Baseball's Cincinnati Reds and Seattle Mariners. The company provided the teams with an advanced sleep technology, the OOLER sleep system. It is a technology that regulates the body temperature to initiate a deep sleep in a person.

- Rising Population of Old Adults - With increasing age the levels of melatonin decrease, which leads to fragmented sleep cycles. According to the World Health Organization, one in six individuals on the planet will be 60 or older by 2030. By this point, there are likely to be 1.4 billion people over the age of 60, up from 1 billion in 2020. The number of individuals in the globe who are 60 or older is further expected to double by 2050.

- Increasing Levels of Noise Pollution - Noise pollution is a developing issue that can cause insomnia, sleep disruption, and chronic health concerns. About 35 million people who reside in the Tokyo metropolitan region struggle with noise pollution every day. In some places, decibel levels might reach 90. Furthermore, whereas noise levels often can reach 85 dB or greater, Shanghai traffic also contributes significantly to noise pollution.

Challenges

- Technology Increases Paranoia and Overthinking – The brain is impacted by technology, which stimulates the mind and makes it difficult to go to sleep. Sleeping close to technology might result in unwelcome awakenings from sounds and blinking lights. Moreover, the amount of time we spend sleeping is typically shorter when we are using electronics. In addition, large-scale random controlled trials are still needed to confirm claims that sleep monitoring wearables can help with sleep disorders especially when it comes to serious conditions such as insomnia and hypertension.

- High Cost of Smart Sleeping Services

- Regulatory Framework for Manufacturing is Strict

Sleep Tech Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.5% |

|

Base Year Market Size (2025) |

USD 26.98 billion |

|

Forecast Year Market Size (2035) |

USD 113.99 billion |

|

Regional Scope |

|

Sleep Tech Devices Market Segmentation:

Product Segment Analysis

The wearables segment is estimated to hold 52% share of the global sleep tech devices market in the year 2035. The growth of the segment can be attributed to the increasing use of smart wearable devices, such as smartwatches, fitness bands, and others. Wearable devices are gaining popularity owing to their convenience in carrying around, they are cheaper than sleep monitors. Moreover, with the help of wearable devices, a person can continuously monitor the status of their body and the physiological activities happening within a person. In addition to this, many devices can record when a person goes to sleep at night and wakes up in the morning by monitoring the time when they are inactive. Globally, the number of linked wearable devices has increased from around 325 million in 2016 to nearly 722 million in 2019, the sales have more than doubled in only three years. Also, it is anticipated that in 2020, the number of smartwatches shipped globally exceeded 100 million.

Application Segment Analysis

Sleep tech devices market from the insomnia segment is expected to garner a significant share in the assessment period. A person has insomnia when they don't get enough sleep, don't sleep well, or have difficulties falling or staying asleep. Insomnia might be a minor annoyance for some people. Some may experience severe problems from sleeplessness. The causes of sleeplessness might also differ greatly. A rise in the number of people suffering from insomnia is expected to boost the segment growth. There are two types of insomnia, acute and chronic insomnia, and they both are very common. Around the world, one in three people experience symptoms of insomnia, and approximately 10% of adults actually have an insomnia disorder.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Gender |

|

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sleep Tech Devices Market Regional Analysis:

North America Market Insights

The sleep tech devices market in North America is predicted to hold the largest share of 33% during the time period between 2023 – 2035. Major product launches, high concentration of market players or manufacturers, and high prevalence of sleep disorders in the United States are some of the factors fuelling the growth of the sleep technology devices market in the country. For example, according to a May 2022 published report, Camden, Boulder, Colorado has the lowest percentage of adults in the United States who sleep less than seven hours, about 24.2%. The highest numbers were in New Jersey, Detroit, and Michigan, where 49.8% of adults in those cities reported short sleep.

APAC Market Insights

The Asia Pacific sleep tech devices market is set to hold a substantial market share by the end of 2035. The growth of the market can be attributed majorly to the rising cases of depression and anxiety in the region. There are around 38 million people in India who have an anxiety disorder, and nearly 56 million who suffer from depression. In addition to this, by 2022, there were around 60 million cases of depression in India, with a prevalence rate of approximately 5%. In addition to this, according to the World Health Organization, in China, around 54 million people are living with depression, additionally, nearly 41 million are suffering from anxiety disorders.

Sleep Tech Devices Market Players:

- Huawei Consumer Business Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Samsung Electronics

- Fossil Group, Inc.

- Xiamoi Inc.

- Masimo

- Fitbit Inc.

- Apple, Inc.

- Nihon Kohden Corporation

- Compumedics Limited

- Garmin Ltd.

Recent Developments

- Huawei Consumer Business Group announced the launch of next-generation smart wearable devices for smart and healthy living. The products include HUAWEI Mate Xs 2, HUAWEI WATCH GT 3Pro, HUAWEI WATCH FIT 2, HUAWEI Brand 7, HUAWEI WATCH D, and HUAWEI S-TAG. These smartwatches have cutting-edge features like health alerts, sleep induction warnings, medicine reminders, and information on activity intensity.

- Samsung Malaysia Electronics announced the launch of their new device Galaxy Fit2. It is used for monitoring the workout session and sleep quality. The Samsung Health app gives the user a Sleep Score in the morning that details how well they slept throughout the night and includes a thorough analysis.

- Report ID: 4760

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sleep Tech Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.