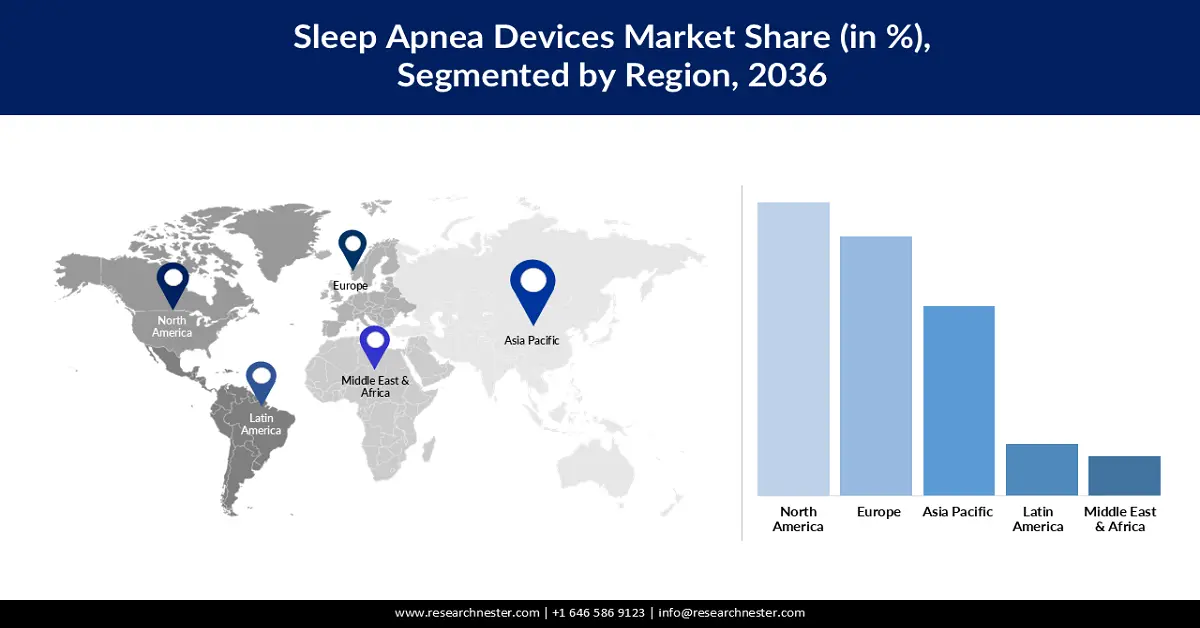

Sleep Apnea Devices Market - Regional Analysis

North America Market Insights

North America sleep apnea devices market is anticipated to acquire a revenue share of 46.7% by the end of 2036, owing to presence of leading companies and growing prevalence of sleep apnea, especially among women athletes. As revealed by the American College of Cardiology in June 2025, sleep apnea is likely to become more prevalent among younger women athletes undergoing higher levels of training, impacting around 18 million of the population in total. Public and professional campaigns are also organized across the region to educate people on the health issue, contributing to increasing the attractiveness of sleep apnea devices.

The U.S. sleep apnea devices market is expected to register a rapid CAGR during the forecast period, due to the continuous development of smart sleep apnea devices. Companies based in the U.S. are driving the development of smart sleep apnea devices. Strategic public-private partnerships are also taking place for the advancement of sleep apnea treatment. For example, in June 2025, Tampa General Hospital reported that it collaborated with the USF Health Morsani College of Medicine to participate in the launch of the Inspire V therapy developed by Inspire Medical Systems. Inspire V is a next-generation neurostimulation device used in the treatment of sleep apnea.

Sleep Apnea Research Initiatives by the National Heart, Lung, and Blood Institute in the U.S. as of January 2025

|

Research initiatives |

Research findings |

|

Support in the Apnea Positive Pressure Long-term Efficacy Study (APPLES) |

Discovery of CPAP as an effective treatment for sleep apnea and establishment of CPAP as a leading treatment option |

|

Partnership with the National Institute of Diabetes and Digestive and Kidney Diseases |

The discovery of the fact that 80% of the population with obesity and type 2 diabetes are vulnerable to sleep apnea, and the suitability of weight loss for the reduction of sleep apnea |

|

Funding for the Childhood Adenotonsillectomy Trial (CHAT) |

Awareness of the potential of tonsil surgery to improve sleep, certain behaviors, and general life quality |

Source: NIH

The market in Canada is projected to experience a robust expansion at a high CAGR between 2036 and 2036, as a consequence of increasing vulnerability of younger people with obesity to sleep apnea. As reported by Statistics Canada in March 2024, 25% of adults aged between 18 and 34 had obesity in 2022 in Canada. In addition, the prevalence of obesity among people aged 50 to 64 peaked at 35%. Thus, the demand for sleep apnea devices is likely to increase with the rising prevalence of obesity. The growing popularity of wearable healthcare devices is increasing the scope of wider use of wearable sleep apnea devices.

Europe Market Insights

Europe sleep apnea devices market is anticipated to account for a significant revenue share by the end of 2036, owing to favorable government initiatives increasing the awareness of the seriousness of the health issue and treatment for the same. For instance, in March 2025, the European Sleep Research Society revealed its involvement in organizing a program, Sleep Awareness Month. The organization also unveiled its plan to promote sleep hygiene among adolescents and children, contributing to increasing the demand for sleep apnea devices. Growing obesity across Europe is another factor influencing a surge in the need for sleep apnea devices. As reported by the European Commission in July 2024, around 50.6% of the population aged 16 and older within the region were overweight and obese in 2022.

The sleep apnea devices market in the UK is expected to witness a robust CAGR during the forecast period, as a consequence of the rapid outbreak of risk factors that include an aging population and rising obesity levels. As per the National Health Service in February 2023, a forecasted 1 in every 4 adults and 1 in every 5 children aged between 10 and 11 were living with obesity. In terms of rapid advancement, the market is growing in the UK. In May 2023, Acurable disclosed its plan to launch AcuPebble device in the U.S. for the diagnosis of OSA, following a successful exposure in Europe. The NHS used the advanced sleep apnea device, enabling earlier detection, quicker treatment, and improved management of sleep apnea.

Germany sleep apnea devices market is projected to grow rapidly throughout the forecast period with the rapid expansion of neurostimulation systems. Such an expansion is driven by various domestic and international players supplying sleep apnea devices. For instance, in September 2023, Nyxoah initiated a collaboration with ResMed Germany with the motive of increasing the market for the Genio system. The organizations worked closely to increase awareness of OSA and therapy penetration across Germany, attracting patients resistant to CPAP therapy. Strong healthcare infrastructure across the country is expected to influence increased accessibility of the sleep apnea devices.

Asia Pacific Market Insights

By the end of 2036, the sleep apnea devices market in the Asia Pacific is projected to acquire a significant revenue share, on account of the demographic shifts, including an aging population, rising awareness of sleep disorders, and increasing obesity, notably in countries such as China and Australia. Government support in the improvement of the healthcare infrastructure is also likely to accelerate the adoption of sleep apnea devices. As per the report by the Australian Institute of Health and Welfare in November 2024, published in November 2024, the government raised funds worth USD 178.7 billion in the development of healthcare infrastructure.

The People's Republic of China is the second-largest market for medical devices in the world, as per the International Trade Administration report. China’s medical device imports, including sleep apnea devices, in 2021 were USD 5.62 billion and are expected to reach USD 160 billion by the end of 2038. The market in China is predicted to undergo a rapid expansion between 2026 and 2036, with the surging poor lifestyle of people, leading to sleep disorders among young adults. As a result, the demand for sleep apnea devices can increase among young adults with rising consciousness about sleep apnea among them. The development of AI-embedded sleep apnea devices is also taking place in China, boosting the technological growth of the market. For example, in April 2025, RingConn unveiled RingConn Gen 2. The device is AI-incorporated and capable enough to track sleep patterns and sync with an intuitive application that enables monitoring of sleep apnea.

India sleep apnea devices market is poised to expand at a fast pace during the forecast period, owing to the presence of a large pool of patients suffering from OSA. A projected 82% of men and 92% of women in India are suffering from undiagnosed severe sleep apnea, indicating a surging use of sleep apnea devices for therapeutic purposes. The growing prevalence of comorbidities, including type 2 diabetes, obesity, cardiovascular diseases, cancer, and others, is expected to increase the risk of sleep apnea, influencing a surging demand for sleep apnea devices. Moreover, rising investments by public and private sectors to improve the healthcare infrastructure and increasing imports of medical devices, including sleep apnea devices is expected to fuel the market growth going ahead. For instance, as per ITA reports, the U.S. medical device exports to India rose by nearly 66.3% in FY24, reaching USD 1.45 billion.