Shape Memory Alloys Market Outlook:

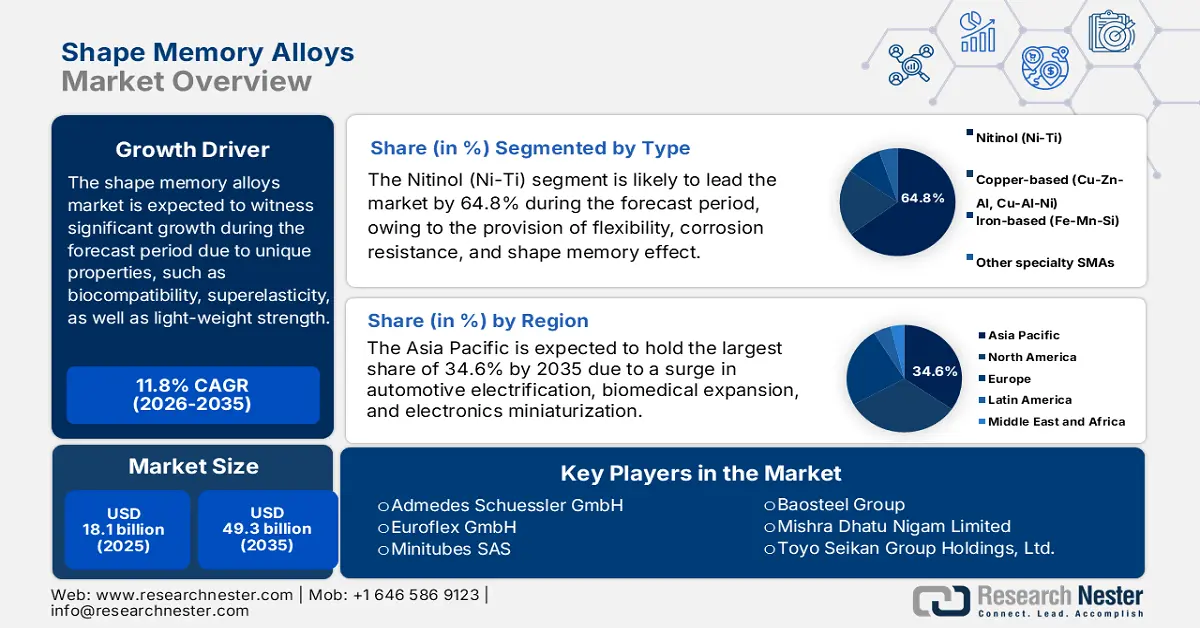

Shape Memory Alloys Market size was over USD 18.1 billion in 2025 and is estimated to reach USD 49.3 billion by the end of 2035, expanding at a CAGR of 11.8% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of shape memory alloys is evaluated at USD 20.2 billion.

The international shape memory alloys market is gaining increased importance due to the unique properties of these materials, such as lightweight strength, biocompatibility, and superelasticity. These make shape-memory alloys indispensable across the consumer electronics, automotive, aerospace, and biomedical industries. Besides, these industries are readily prioritizing performance efficiency, miniaturization, and sustainability, and meanwhile, shape memory alloys are effectively positioned as crucial enablers of cutting-edge technologies. According to an article published by NLM in September 2025, high-temperature shape memory alloys tend to exhibit severe benefits for extreme thermal conditions, deliberately maintaining almost 700 degrees Celsius in comparison to traditional alloys that are limited below 100 degrees Celsius. This, in turn, makes these alloys increasingly demanding for their application, particularly in automotive and aerospace sectors.

Furthermore, additive manufacturing, miniaturization in electronics, increased focus on sustainability, smart healthcare devices, and innovation in aerospace are other factors driving the shape memory alloys market globally. As per a report published by the Metal Powder Industries Federation in 2025, the power metallurgy products and parts sector, particularly in North America, has an approximate sales of USD 7 billion. In addition, the yearly global metal power production has readily exceeded 700,000 tons, which positively caters to the market’s upliftment. Besides, powder particles are usually specific in size and shape, ranging from 0.1 to 1,000 micrometers, while they are similar in size to the human hair diameter, ranging between 25 and 200 micrometers. Moreover, the ongoing shipments of different metal powders, especially from North America, to different nations is also fueling the shape memory alloys market’s demand internationally.

North America Metal Powder Shipments (2023-2024)

|

Metal Type |

2023 |

2024 |

|

Iron and Steel |

320,234 |

301,126 |

|

Stainless Steel |

6,300 |

5,607 |

|

Copper and Copper Base or Tin |

13,056 |

9,497 |

|

Aluminum |

23,650 |

29,000 |

|

Molybdenum |

843 |

987 |

|

Tungsten |

3,186 |

2,750 |

|

Tungsten Carbide |

4,759 |

5,761 |

|

Nickel |

4,400 |

4,100 |

|

Total Shipment |

376,428 |

358,828 |

Source: Metal Powder Industries Federation

Key Shape Memory Alloys Market Insights Summary:

Regional Insights:

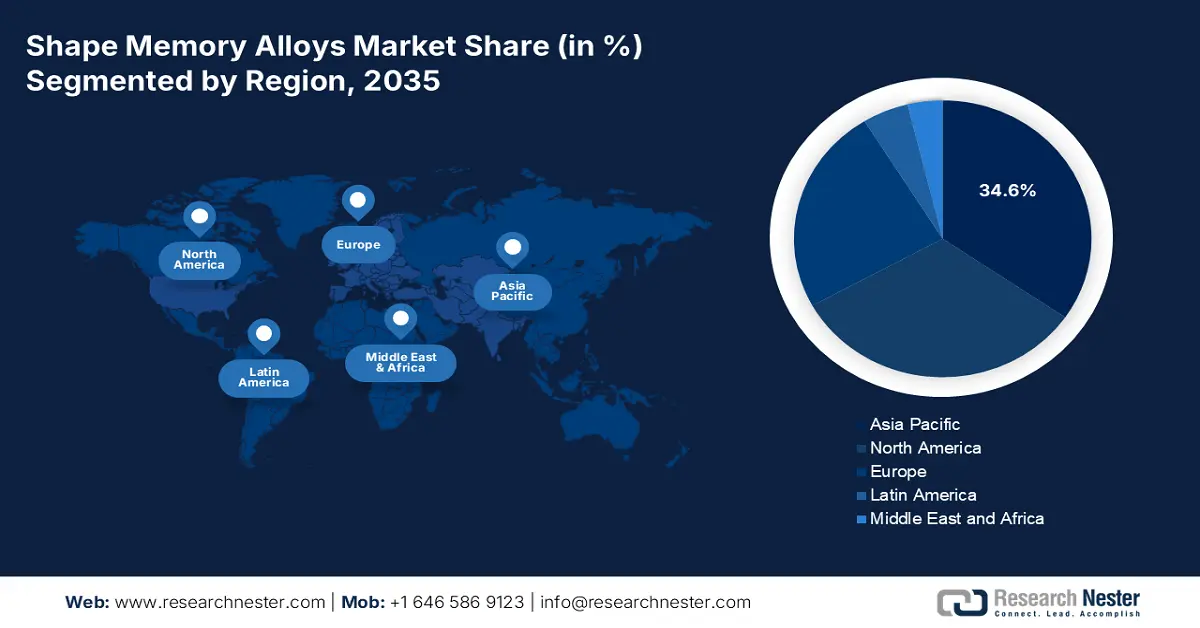

- Asia Pacific is projected to command a 34.6% share by 2035 in the shape memory alloys market, supported by accelerating automotive electrification, electronics miniaturization, and rapid expansion of biomedical manufacturing ecosystems.

- Europe is expected to register the fastest growth during the forecast period toward 2035, stimulated by rising adoption across automotive electrification, aerospace actuation, additive manufacturing, and medtech applications.

Segment Insights:

- The Nitinol (Ni-Ti) segment is forecast to capture a dominant 64.8% share by 2035 in the shape memory alloys market, underpinned by its corrosion resistance, biocompatibility, superelastic behavior, and strong shape recovery characteristics.

- The vacuum induction melting + vacuum arc remelting (VIM/VAR) sub-segment is anticipated to secure the second-largest share by 2035, reinforced by its ability to deliver high-purity, compositionally precise alloys with superior fatigue and mechanical performance.

Key Growth Trends:

- Increased demand for biomedical

- Focus on automotive electrification

Major Challenges:

- Increased production expenses and raw material volatility

- Restricted fatigue life and performance reliability

Key Players: Fort Wayne Metals (U.S.), SAES Getters S.p.A. (Italy), Nippon Steel Corporation (Japan), Furukawa Electric Co., Ltd. (Japan), ATI Inc. (U.S.), Dynalloy Inc. (U.S.), G.RAU GmbH & Co. KG (Germany), Memry Corporation (U.S.), Nitinol Devices & Components, Inc. (U.S.), Seabird Metal Materials Co., Ltd. (China), Ultimate NiTi Technologies (South Korea), Admedes Schuessler GmbH (Germany), Euroflex GmbH (Germany), Minitubes SAS (France), Baosteel Group (China), Mishra Dhatu Nigam Limited (India), Toyo Seikan Group Holdings, Ltd. (Japan), CSIRO Materials Science Division (Australia), Malaysian Structural Materials Technology Centre (Malaysia).

Global Shape Memory Alloys Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 18.1 billion

- 2026 Market Size: USD 20.2 billion

- Projected Market Size: USD 49.3 billion by 2035

- Growth Forecasts: 11.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34.6% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Japan, Germany, France

- Emerging Countries: India, South Korea, Vietnam, Mexico, Brazil

Last updated on : 19 December, 2025

Shape Memory Alloys Market - Growth Drivers and Challenges

Growth Drivers

- Increased demand for biomedical: There has been a continuous rise in orthopedic and cardiovascular incidences, which is fueling the demand for the shape memory alloys market, with increased focus on surgical instruments, guidewires, and stents. According to an article published by the World Health Organization in July 2025, approximately 19.8 million people died from cardiovascular diseases as of 2022. This represented an estimated 32% of global deaths, and 85% of these deaths took place, owing to heart stroke and attack. Besides, the July 2022 WHO article indicates that an estimated 1.7 billion people suffer from musculoskeletal conditions globally. This health condition is highly responsible for disability, with low back pain being the notable cause across 160 countries, thereby enhancing the market’s demand.

- Focus on automotive electrification: The shape memory alloys market readily enables adaptive safety systems and light-weight actuators, which significantly support electric vehicle adoption as well as efficiency objectives. As per an article published by the World Resources Institute in December 2025, internationally, 22% of passenger vehicles have been purchased as of 2024, which is 8 times more than in the past 5 years. Additionally, China has emerged as the leader in overall passenger electric vehicle sales, accounting for 11.3 million as of 2024. This is followed by 1.5 million in the U.S., 570,000 in Germany, 550,000 in the UK, and 450,000 in France. Therefore, with a continuous surge in electric vehicles, there has been a massive demand for shape memory alloys across different countries globally.

International Increase in Passenger Electric Vehicle Sales (2022-2035)

|

Year |

Sales % |

|

2022 |

15 |

|

2023 |

18 |

|

2024 |

22 |

|

2025 |

33.6 |

|

2026 |

45.6 |

|

2027 |

58.1 |

|

2028 |

69.7 |

|

2029 |

78 |

|

2030 |

85 |

|

2031 |

90 |

|

2032 |

94 |

|

2033 |

96 |

|

2034 |

97 |

|

2035 |

97.5 |

Source: World Resources Institute

- Modernization in industries: Developing nations, such as India and China, are generously investing in the shape memory alloys market, particularly in the production capacity. The ultimate objective is to support the automotive and medtech industries, readily demanding alloys. As per an article published by the U.S. Department of Energy in August 2022, the Office of Fossil Energy and Carbon Management (FECM) has significantly notified almost USD 6 million funding availability for research and development projects. These projects are meant to repurpose domestic coal resources for products that can be readily employed in clean energy technologies, including advanced manufacturing and batteries. This ensures expansion in innovation for coal and coal wastes, constituting the potential to develop localized job opportunities for power plant communities.

Challenges

- Increased production expenses and raw material volatility: The availability of shape memory alloys, particularly Nitinol (Nickel-Titanium), requires precise composition control and advanced thermomechanical processing. Nickel and titanium are expensive metals, and their prices fluctuate due to geopolitical tensions, mining restrictions, and supply chain disruptions. The production process involves vacuum induction melting, vacuum arc remelting, and stringent quality checks, all of which increase costs. Manufacturers face difficulties in scaling production while maintaining consistency in transformation temperatures and fatigue resistance. This cost barrier limits adoption in price-sensitive industries such as consumer electronics and automotive, thereby negatively impacting the shape memory alloys market globally.

- Restricted fatigue life and performance reliability: While the shape memory alloys market is valued for its superelasticity and shape recovery, it readily suffers from limited fatigue life under cyclic loading. In biomedical applications, such as stents and orthodontic wires, repeated stress can lead to microstructural degradation, reducing performance reliability. Aerospace and automotive sectors demand long-term durability, but SMA components often fail to meet stringent fatigue thresholds compared to traditional alloys. This reliability issue hinders broader adoption in mission-critical systems. Research into alloying elements, surface treatments, and thermomechanical optimization is ongoing, but scaling these improvements into mass production remains challenging.

Shape Memory Alloys Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.8% |

|

Base Year Market Size (2025) |

USD 18.1 billion |

|

Forecast Year Market Size (2035) |

USD 49.3 billion |

|

Regional Scope |

|

Shape Memory Alloys Market Segmentation:

Type Segment Analysis

The Nitinol (Ni-Ti) segment, which is part of the type, is anticipated to garner the largest share of 64.8% in the shape memory alloys market by the end of 2035. The segment’s upliftment is highly attributed to its unique combination, pertaining to corrosion resistance, biocompatibility, super-elasticity for extreme flexibility, and the shape memory effect for returning to the actual shape during the heating process. According to an article published by NLM in September 2025, shape memory alloys tend to undergo considerable and recoverable large-scale strains of almost 8%, owing to their energy dissipation, self-centering, and shape recovery capabilities. Based on this ability, NiTi can be strained to 7.7% with 500 MPa ultimate stress, along with a residual strain of less than 0.5%. Therefore, with all these capabilities and qualities, there is a huge growth opportunity for the segment.

Manufacturing Process Segment Analysis

By the end of the forecast timeline, the vacuum induction melting + vacuum arc remelting (VIM/VAR) sub-segment, which is part of the manufacturing process, is predicted to account for the second largest share in the shape memory alloys market. The sub-segment’s growth is effectively driven by ensuring precise alloy composition by melting raw materials in a controlled vacuum environment, minimizing contamination from oxygen, nitrogen, and carbon. This step is critical for achieving the exact nickel-to-titanium ratio that governs transformation temperatures and superelastic properties. VAR further refines the ingot by remelting under vacuum, eliminating inclusions, segregations, and porosity, while enhancing homogeneity and fatigue resistance. Therefore, VIM/VAR delivers alloys with superior purity, consistency, and mechanical performance, which are essential for biomedical and aerospace applications where reliability is non-negotiable.

Transformation Temperature Segment Analysis

Based on the transformation temperature segment, the medium transformation range (20–80°C) sub-segment in the shape memory alloys market is projected to cater to the third largest share during the stipulated timeline. The sub-segment’s development is extremely propelled by initiating a close alignment with human body temperature, making it ideal for biomedical applications such as stents, orthodontic wires, and surgical instruments. At approximately 37°C, Nitinol devices can exploit superelasticity and shape recovery, enabling minimally invasive procedures and reducing patient trauma. Beyond healthcare, medium-range SMAs are widely used in aerospace actuators, automotive safety systems, and consumer electronics, where ambient operating conditions fall within this window. The balance between flexibility, durability, and responsiveness makes this segment highly versatile.

Our in-depth analysis of the shape memory alloys market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Manufacturing Process |

|

|

Transformation Temperature |

|

|

Form |

|

|

Function |

|

|

End use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Shape Memory Alloys Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the shape memory alloys market is anticipated to hold the highest share of 34.6% by the end of 2035. The market’s upliftment in the region is primarily attributed to automotive electrification implementing compact SMA actuators, electronics miniaturization, and expansion in the biomedical. Besides, in terms of medical devices growth, the June 2025 ITA report denoted that the medical device sector in India is predicted to grow from USD 12 billion as of 2024 to USD 50 billion by the end of 2030. In addition, the country’s international medical device market share is predicted to surge from 1.6% to a range between 10% and 12% over the upcoming 25 years. Besides this, the overall region comprises a massive share of medtech clusters, OEM integration, and robust electronics ecosystems, thereby creating an optimistic outlook for the shape memory alloys market’s growth.

China in the shape memory alloys market is growing significantly, owing to standards alignment, energy efficiency, a wide-ranging industrial policy for supporting cleaner processes, and eventually benefiting thermomechanical, melting, and remelting lines. As per an article published by the State Council in September 2023, the consumer electronics sector in the country is continuously witnessing stabilized growth, with the majority of electronic device, communications, and computer manufacturers experiencing profits, amounting to 276.3 billion yuan (USD 38.3 billion) as of 2024. Besides, for instance, the mobile phone output has reached 810 million units, including 593 million smartphones. Therefore, with the country’s focus on electronic devices, there is a huge growth opportunity, along with increased expansion for the overall market in the country.

India in the shape memory alloys market is also growing due to industrial modernization, automotive electrification, and expansion in medtech capacity. In addition, standards development, process electrification, and policy for emphasizing sustainable chemistry are optimizing the environmental performance and processing quality. According to an article published by the PIB Government in September 2025, the industrial production index of the country upsurged to 3.5% year-over-year (YoY), which has been possible by the 5.4% YoY manufacturing growth. Besides, schemes such as Skill India, National Manufacturing Mission, PM MITRA, and PLI are readily fueling the industrial production processes, which in turn are uplifting the demand for shape memory alloys in the overall nation.

Europe Market Insights

Europe in the shape memory alloys market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by the presence of automotive electrification integrating compact SMA actuators, aerospace actuation, and light-weight structures, and an increase in the medtech adoption. According to an article published by the ITA in August 2024, the additive manufacturing industry in France displays 3% of the international additive market and is significantly valued at USD 600 million as of 2023. In addition, with a 17% growth rate, this industry is projected to reach a turnover of an estimated USD 700 million by the end of 2030. Moreover, standards and regulatory alignment also enhance qualification and commercialization cycles across different regional OEMs, which is creating an optimistic outlook for the shape memory alloys market’s growth in the region.

The shape memory alloys market in Germany is gaining increased traction due to automotive Tier-1 integration of actuators, aerospace primes, along with the medtech device manufacturing. In addition, the country’s ecosystem is focused on supply chain certification, testing infrastructure, and standards development, which readily escalates the commercialization of nitinol wires and tubes, as well as actuator components. As per a data report published by the GTAI in 2025, the medical technological industry in the country accounts for EUR 538 billion for the overall healthcare expenditure as of 2024, along with more than EUR 35 billion for the medical technology industry as of 2025. Besides, the domestic medtech market in the country is continuously growing at 3.3%, with approximately 1,500 medtech manufacturers, with over 20 employees, which positively caters to the market’s growth.

Medical Technology Industry by Product Area in Germany (2025)

|

Medical Technology Segments |

Market Size (EUR Billion) |

Segment Share of Total Market Volume |

|

Consumables |

8.6 |

24.3% |

|

Diagnostic Imaging |

6.1 |

17.1% |

|

Orthopedics and Prosthetics |

4.7 |

13.2% |

|

Dental Products |

3.5 |

12.3% |

|

Other Medical Products |

12.7 |

35.6% |

|

Total |

35.6 |

|

Source: GTAI

The shape memory alloys market in France is also developing due to the rapid adoption of progressive manufacturing, medtech development, and the presence of strong aerospace programs. Additionally, the double-digit growth ensured through the 2030 strategy readily supports OEM expansion for qualified SMA utilization in morphing structures, guidewires, and stents, thereby uplifting the market’s exposure. As stated in a data report published by France 2030 in March 2023, based on the Hybrid HPC Quantum approach, there has been the provision of €72.3 million in budget for ensuring research and development. In addition, the country’s government has significantly entrusted GENCI by acquiring quantum and simulators for an amount of €36.3 million. Moreover, collaboration between industry associations and research institutions has escalated standards-driven qualification, thus denoting a positive impact on the market’s upliftment.

North America Market Insights

North America is projected to experience considerable growth in the shape memory alloys market by the end of the specified period. The market’s growth in the region is extremely driven by automotive smart components, aerospace actuation systems, and biomedical device manufacturing. Besides, as per a clinical study conducted by the Oak Ridge National Laboratory in July 2023, three different Nitinol alloy compositions have been readily evaluated, with a size range between 20 to 53 µm for Alloy A, along with 53 to 109 µm for Alloy B and C. The clinical evaluation was readily performed in an argon-based atmosphere, with oxygen controlled below 500 ppm. Based on the processing, it has been evaluated that Alloy C demonstrated a significant increase in oxygen content, ranging from 53 to 109, 109 to 250, and more than 250 µm. Therefore, this further indicates higher oxygen content for the ingot, effectively utilized for atomization, thereby driving the market’s growth.

Measured Powder Composition for Nitinol Alloys (2023)

|

Alloy Type |

Certified Ni Composition (weight% %) |

Certified Ni Composition (%) |

|

Alloy A |

54.8 |

49.8 |

|

Alloy B |

55.8 |

50.8 |

|

Alloy C |

56.0 |

51.0 |

Source: Oak Ridge National Laboratory

The U.S. in the shape memory alloys market is gaining increased exposure, owing to an increase in demand, particularly in aerospace and biomedical, the existence of governmental programs and expenditure, along with federal budget allocation for chemical strategies. As per an article published by the Association for Manufacturing Technology in December 2025, there has been an increase in the latest orders for metalworking machinery, amounting to USD 538.9 million. This denotes a 9% surge from September 2025, as well as a 40.3% surge since October 2024. Additionally, machinery orders are readily tracked by USMTO, totaling USD 4.4, constituting a 19.7% increase over the past 10 months as of 2024. Moreover, this particular machinery further surpassed USD 500 million, demonstrating a rise in generous investments, thereby making it suitable for bolstering the market in the country.

Canada, in the shape memory alloys market, is also growing due to an increase in biomedical applications, aerospace and defense, automotive electrification, along with advanced manufacturing and sustainability. As stated in an article published by the Government of Canada in November 2025, the Minister of Energy and Natural Resources declared for more than USD 10 million in federal funding to assist in paving the way for adopting electric vehicles. This particular funding comprises USD 9 million through the Zero Emission Vehicle Infrastructure Program (ZEVIP). This is for projects with the New Brunswick Power Corporation and Green Economy Canada to successfully install 1,200 electric vehicle chargers. In addition, the remaining USD 1.3 million has been provided through the Energy Innovation Program for developing the latest magnetic materials to diminish the cost and optimize electric vehicle motors performance, thus fueling the market’s exposure.

Key Shape Memory Alloys Market Players:

- Johnson Matthey (U.K.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Fort Wayne Metals (U.S.)

- SAES Getters S.p.A. (Italy)

- Nippon Steel Corporation (Japan)

- Furukawa Electric Co., Ltd. (Japan)

- ATI Inc. (U.S.)

- Dynalloy Inc. (U.S.)

- G.RAU GmbH & Co. KG (Germany)

- Memry Corporation (U.S.)

- Nitinol Devices & Components, Inc. (U.S.)

- Seabird Metal Materials Co., Ltd. (China)

- Ultimate NiTi Technologies (South Korea)

- Admedes Schuessler GmbH (Germany)

- Euroflex GmbH (Germany)

- Minitubes SAS (France)

- Baosteel Group (China)

- Mishra Dhatu Nigam Limited (India)

- Toyo Seikan Group Holdings, Ltd. (Japan)

- CSIRO Materials Science Division (Australia)

- Malaysian Structural Materials Technology Centre (Malaysia)

- Johnson Matthey has significantly leveraged its expertise in advanced materials and metallurgy to support SMA applications, particularly in biomedical and industrial sectors. The company’s focus on sustainability and precision alloy development positions it as a reliable supplier for high-performance Nitinol components in Europe.

- Fort Wayne Metals is one of the leading producers of medical-grade wires and components, with a strong emphasis on Nitinol for stents, guidewires, and orthodontic devices. Its vertically integrated operations and R&D investments ensure consistent quality and innovation in SMA biomedical applications.

- SAES Getters S.p.A. has successfully pioneered SMA industrial applications, combining decades of metallurgy expertise with actuator-focused R&D. The company produces ultrapure alloys and operates large-scale SMA wire and spring production lines, serving automotive, aerospace, and luxury sectors.

- Nippon Steel Corporation is focused on applying its metallurgical leadership to SMA production, focusing on Nitinol and specialty alloys for the aerospace and automotive industries. Its innovation in high-strength, fatigue-resistant alloys supports Japan’s growing demand for advanced materials in industrial and medical applications.

- Furukawa Electric Co., Ltd. has developed SMA and superelastic alloys for use in electronics, springs, and wires. Its products exploit the unique deformation recovery properties of SMAs, enabling applications in consumer electronics and industrial components.

Here is a list of key players operating in the global shape memory alloys market:

The international shape memory alloys market is extremely competitive, with Europe, the U.S., and Japan-based organizations readily dominating aerospace and biomedical applications, while India and China are rapidly making expansions in industrial and automotive uses. Moreover, tactical strategies, such as capacity expansion, research and development in fatigue-resistant alloys, along with partnerships between aerospace OEMs and medical device manufacturers, are also fueling the market’s growth. Companies are investing in additive manufacturing and sustainable processing technologies to reduce costs and environmental impact. Besides, in March 2024, BD declared the successful enrollment of the first patient in the investigational device exemption (IDE) study, known as AGILITY. This is suitable for assessing the effectiveness and safety of the BD Vascular Covered Stent, which is a low-profile, self-expanding, and polytetrafluoroethylene encapsulated nitinol implant, thereby proliferating the shape memory alloys market internationally.

Corporate Landscape of the Shape Memory Alloys Market:

Recent Developments

- In March 2025, Ingpuls GmbH and Nanoval GmbH effectively entered into a tactical cooperation to readily optimize the availability and production of high-quality nickel-titanium (NiTi) metal powder for additive manufacturing processes.

- In January 2025, Hyundai Motor Company and Kia Corporation successfully opened innovative platforms, such as ZER01NE and Hyundai CRADLE, with the intention of developing advanced solutions for creating airless and fuel-efficient tires from shape memory alloys.

- In November 2024, Fort Wayne readily make expansion of its nitinol melting capabilities, which are available in custom-shaped bar and wire, along with shape-set assemblies, with diameter ranging from 0.0127 mm to 51.0 mm.

- Report ID: 5145

- Published Date: Dec 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Shape Memory Alloys Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.