Session Border Controller Market Outlook:

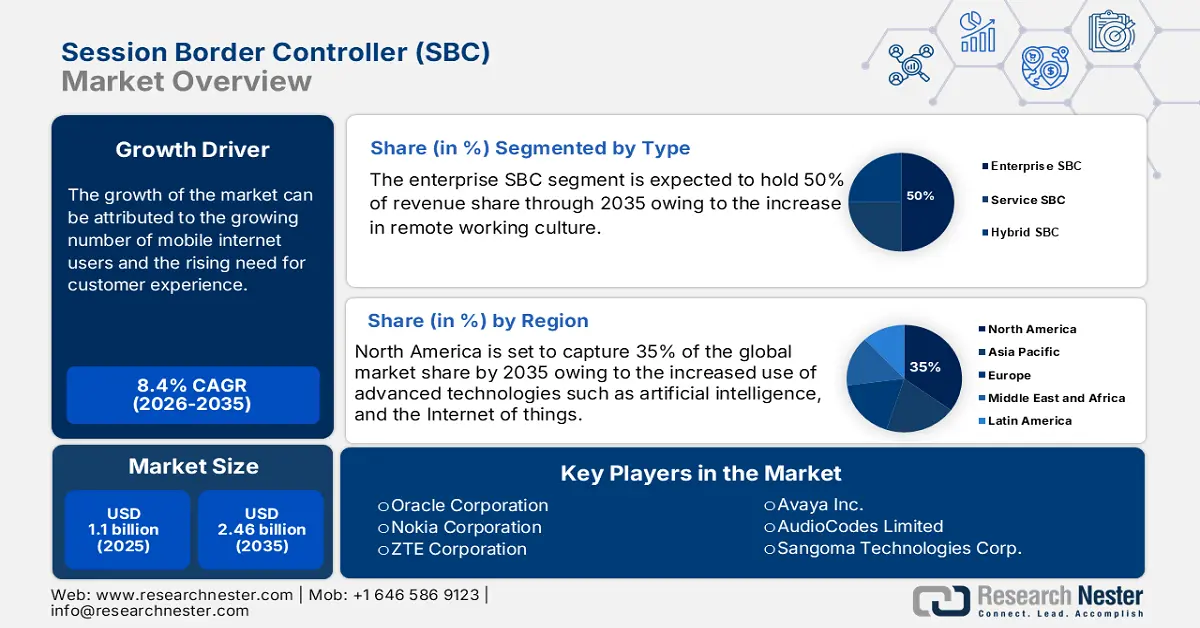

Session Border Controller Market size was over USD 1.1 billion in 2025 and is projected to reach USD 2.46 billion by 2035, witnessing around 8.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of session border controller is evaluated at USD 1.18 billion.

The rapidly rising number of internet users worldwide is a key factor expected to fuel the demand for session border controllers in the coming years. As of April 2023, there were 5.18 billion global internet users, accounting for almost 64.6% of the population. As internet users increase, several businesses and individuals adopt VoIP, Unified Communications (UCaaS), and video conferencing. Session Border Controllers (SBC) ensure secure and seamless video and voice transmission over IP networks, managing signaling and security. In addition, these SBCs act as a security gateway, protecting the VoIP networks from potential threats.

Enterprises and companies in the telecommunication sector are adopting session border controllers to enhance the security and reliability of their VoIP and SIP-based communications. These SBCs help in optimizing call quality by managing bandwidth and reducing latency. In addition, it reduces the overall costs of securing SIP trunking which eliminates the need for expensive traditional telephony infrastructure.

Key Session Border Controller Market Insights Summary:

Regional Highlights:

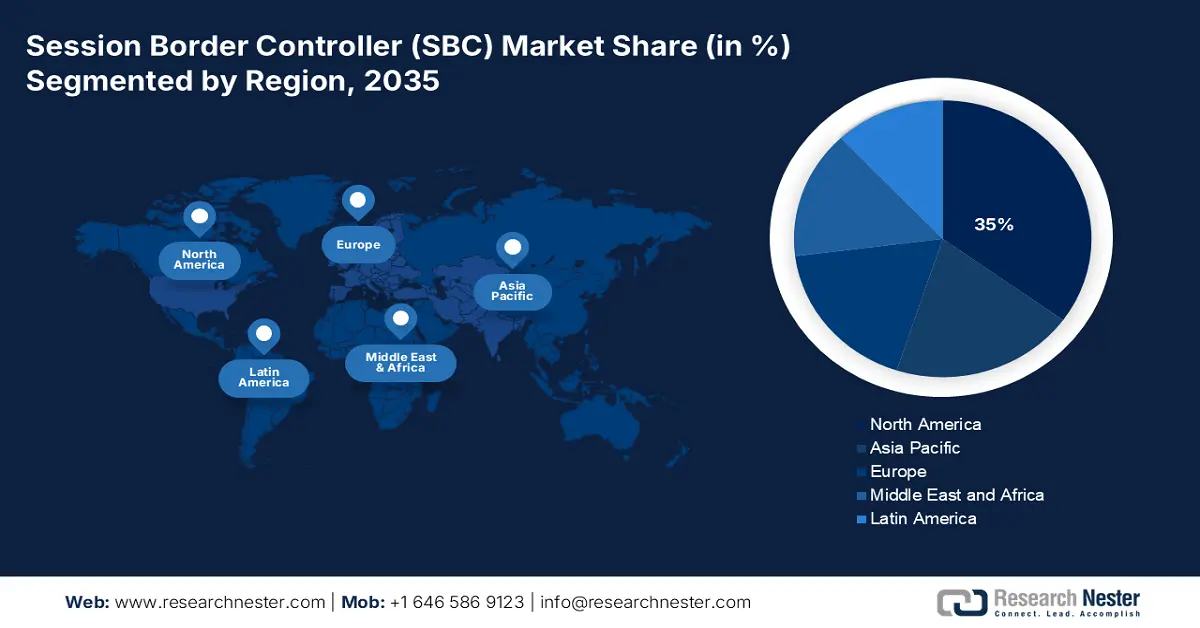

- By 2035, North America is projected to command a 35% share of the session border controller market, bolstered by growing adoption of AI, ML, IoT, and rising demand for IP-based communication across enterprises.

- Asia Pacific is anticipated to record robust growth through 2035, reinforced by rapid industrialization, expanding communication infrastructure, and increasing need for advanced SBC solutions.

Segment Insights:

- By 2035, the Enterprise SBC segment in the session border controller market is expected to hold a 50% share, driven by expanding UC and VoIP adoption and rising cybersecurity priorities.

- The 5001–10000 segment is set to witness strong CAGR through 2035, underpinned by large-scale UC deployments and intensifying security and compliance requirements.

Key Growth Trends:

- Rising preference for cloud based services and remote work

- Increasing demand for fast networks

Major Challenges:

- Complex interoperability

- High product pricing and competitive market

Key Players: Cisco Systems, Inc., Oracle Corporation, Sangoma Technologies Corp., Huawei Technologies Co., Ltd., ZTE Corporation, Avaya Inc., Ribbon Communications Operating Company, Inc. (ECI Telecom Ltd.), AudioCodes Limited, Patton Electronics Co., Nokia Corporation.

Global Session Border Controller Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.1 billion

- 2026 Market Size: USD 1.18 billion

- Projected Market Size: USD 2.46 billion by 2035

- Growth Forecasts: 8.4%

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Indonesia, Vietnam, Brazil, Mexico

Last updated on : 19 November, 2025

Session Border Controller Market - Growth Drivers and Challenges

Growth Drivers

- Rising preference for cloud-based services and remote work: The steady shift towards cloud-based services and rising preference for remote work has accelerated the demand for SBCs. According to a report by the Bureau of Labor Statistics published in October 2024, the average number of people working remotely increased from 15% in 2020 to approximately 27% in 2023. Cloud-based SBCs offer flexibility and scalability, making them an ideal choice for businesses and enterprises adopting these trends.

- Increasing demand for fast networks: The 5G networks with low latency and high-speed voice and video communications have gained immense popularity in recent years for real-time applications such as video conferencing, online gaming, and IoT communications. This has resulted in the rising need for SBCs to manage traffic and security. Moreover, several telecom providers are investing in fiber broadband, leading to increasing demand for VoIP and SIP-based communications.

Challenges

- Complex interoperability: Though session border controllers are rapidly gaining traction, the complex interoperability with the product is one of the factors that is limiting its adoption to a certain extent. Many enterprises use hybrid communication networks that involve legacy PBX and cloud-based UCaaS. Thus, ensuring seamless interoperability among different vendors can be challenging.

- High product pricing and competitive market: Enterprises with lower budgets might opt for alternative cost-effective solutions like open-source SBCs instead of commercial SBCs. This can affect the overall sales of SBCs, hampering market growth. In addition, the market is dominated by industry giants, making it difficult for smaller vendors to compete.

Session Border Controller Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.4% |

|

Base Year Market Size (2025) |

USD 1.1 billion |

|

Forecast Year Market Size (2035) |

USD 2.46 billion |

|

Regional Scope |

|

Session Border Controller Market Segmentation:

Type Segment Analysis

The enterprise SBC segment in session border controller market is projected to hold the largest revenue share of 50% by the end of 2035 owing to increasing adoption of UC and VoIP in several small to large-scale enterprises, rising cybersecurity concerns, and growing number of contact centers. Enterprise SBCs are installed between trusted and untrusted networks at the borders. They use real-time communication protocols such as SIPs to process traffic. Owing to the coronavirus impact, the increase in remote working culture has increased which has made enterprise SBCs essential for secure and constant connectivity in the organizations. In May 2024, AudioCodes was ranked as the leading global enterprise SBC vendor in 2023, with a revenue share of 23.1%.

Session Capacity Segment Analysis

The 5001-10000 segment in session border controller market is likely to register rapid CAGR throughout the stipulated timeframe. This growth can be attributed to the rising number of large-scale UC deployments and increasing security and compliance requirements in large enterprises and telecom carriers. Moreover, besides establishing tunnels for data encryption and other purposes, SBCs ensure security and privacy during the development of sessions and while monitoring SIP messages passing through a router.

Our in-depth analysis of the global session border controller market includes the following segments:

|

Type |

|

|

Session Capacity |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Session Border Controller Market - Regional Analysis

North America Market Insights

The North America session border controller market is poised to account for largest revenue share of 35% during the forecast period. The increased usage of advanced technologies such as AI, ML, and IoT and the rise in the demand for session border controllers among small, medium, and large enterprises are expected to drive the market in this region. In addition, the adoption of IP-based communication across several enterprises, expansion of cloud-based services, and presence of robust telecommunication infrastructure are expected to fuel session border controller market growth going ahead.

In the U.S., the rising adoption of cloud-based tools and remote work has resulted in growing need for secure communication channels, fueling the demand for session border controllers. To fulfill the rising demand, several manufacturers are launching their advanced and highly efficient products In June 2024, Patton, a leading manufacturer of voice and data network equipment announced the launch of SmartNode Session Border Controller (SBC) that covers capacity requirements for large enterprises, service providers, and government.

APAC Market Insights

The session border controller market in the Asia Pacific is likely to expand at a robust CAGR during the forecast period attributed to the swift pace of industrialization and urban development in China, India, Japan, and South Korea and rising investments in communication infrastructure. This is expected to increase the demand for advanced solutions such as SBCs to manage and secure the burgeoning communication networks. In addition, the growing adoption of data points such as downstream and upstream value chain analysis, technical trends, and case studies are other factors expected to fuel the market in Asia Pacific in the coming years.

The session border controller market in India is expected to grow at a rapid pace due to rapidly growing telecom sector, rising adoption of advanced solutions, and presence of leading companies. High usage of mobile devices and UC platforms in India has resulted in the growing integration of SBCs to ensure secure and reliable communication across several devices and platforms. Moreover, many organizations are adopting virtualization and cloud-based communication solutions as these provide flexibility and are affordable.

Session Border Controller Market Players:

- Cisco Systems, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Oracle Corporation

- Sangoma Technologies Corp.

- Huawei Technologies Co., Ltd.

- ZTE Corporation

- Avaya Inc.

- Ribbon Communications Operating Company, Inc. (ECI Telecom Ltd.)

- AudioCodes Limited

- Patton Electronics Co.

- Nokia Corporation

The global session border controller market is highly competitive, comprising key players operating at global and regional levels. These key players are focused on developing advanced products and services to cater to the growing demand. In recent years, there has been a shift towards cloud-based and virtualized SBC solutions and integration of AI and ML to ensure secure and seamless communication across different platforms and devices. The industry giants are focused on strategic alliances such as product launches, mergers and acquisitions, partnerships, and license agreements. Here is a list of key players operating in the global session border controller market:

Recent Developments

- In December 2024, Microsoft partnered with certain session border controller vendors, including AudioCodes, Ribbion Communication, Thinktel, TE-Systems, Cisco, Nokia, and M5 Technologies among others to certify their work with direct routing.

- In January 2024, TelcoBridges announced the availability of its award-winning ProSBC software as a fully managed service. ProSBC as a service includes a product license subscription with professional services and offers benefits such as fast deployment, expert configuration, and high reliability.

- Report ID: 720

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Session Border Controller Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.