Servo Motor Market Outlook:

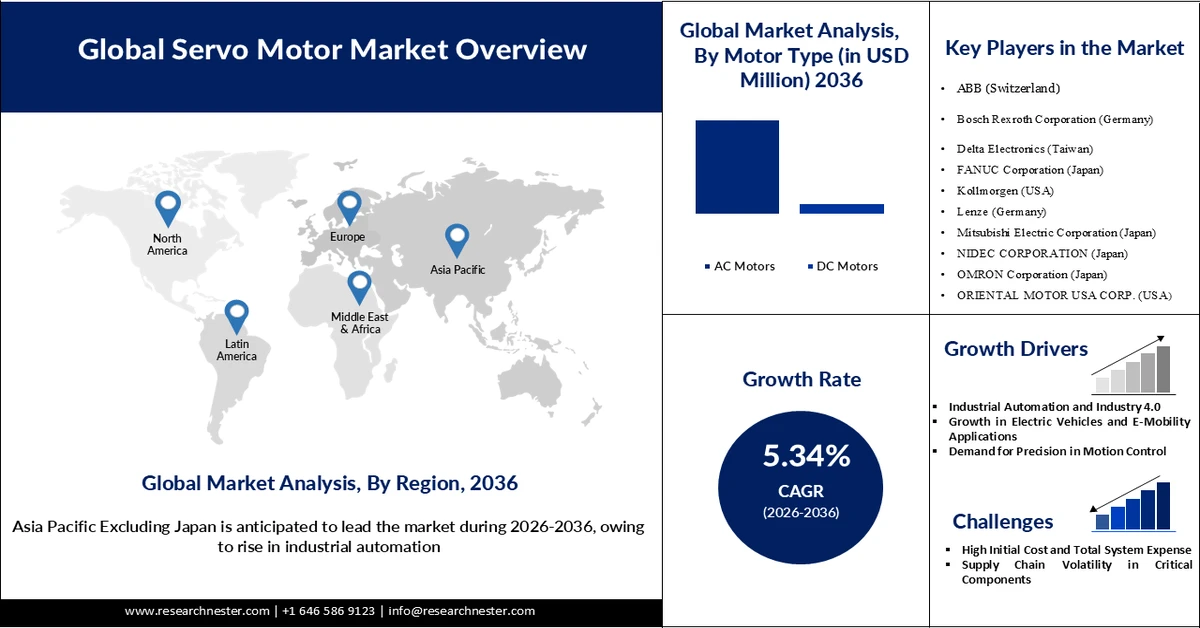

Servo Motor Market size is valued at USD 13.87 billion in 2025 and is forecasted to reach a valuation of USD 25.03 billion by the end of 2036, rising at a CAGR of 5.34% during the forecast period, i.e., 2026-2036. In 2026, the industry size of servo motor is estimated at USD 14.88 billion.

The rising industrial automation has primarily contributed to the growth of the market. Industrial automation has introduced newer machines and robotics, which require precision and control of the machines, enabling them to perform to their full potential. Asia Pacific is experiencing significant demand for servo motors owing to the rise in electronic and electrical manufacturing and lower costs. The low cost of production and high skill set are propelling the expansion of the market. In January 2026, Siemens and NVIDIA partnered to build an AI industrial automation system that will serve in the end-to-end manufacturing process and will save operational costs significantly. Siemens has also planned to sell the AI-driven industrial automation system to lead the market. Servo motors are employed by different industries, including automotive, aerospace, manufacturing, and automation, which further enhances the scope of the market.

Key Servo Motor Market Insights Summary:

Regional Insights:

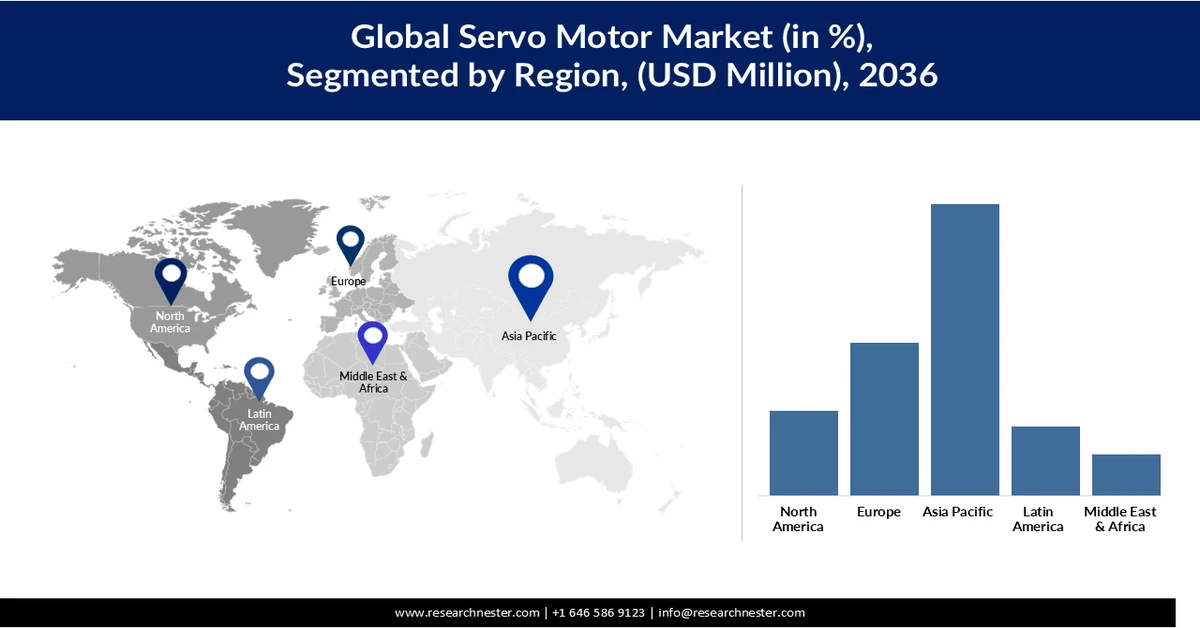

- Asia Pacific Excluding Japan is anticipated to capture 41.57% share by 2036 in the servo motor market, stemming from large-scale electronics manufacturing and government-backed adoption of smart factories and Industry 4.0 frameworks.

- Europe is forecast to secure 22.08% share by 2036, attributable to stringent energy-efficiency regulations accelerating the deployment of precision CNC systems and industrial robotics.

Segment Insights:

- The AC servo motor segment is projected to account for 87.09% share by 2036 in the servo motor market, supported by seamless integration with advanced servo drives and enhanced industrial communication networks.

- The rotary segment is expected to command an 83.70% share by 2036, anchored in its reliability, high performance, and wide applicability across precision-centric industrial applications.

Key Growth Trends:

- Global Growth in Electric Vehicles

- Expansion in Robotics

Major Challenges:

- High Initial Cost

- Supply Chain Volatility

Key Players: ABB, Bosch Rexroth Corporation, Delta Electronics, FANUC Corporation, Kollmorgen, Lenze, Mitsubishi Electric Corporation, NIDEC CORPORATION, OMRON Corporation, ORIENTAL MOTOR U.S. CORP., Panasonic Corporation, Parker Hannifin Corp., Rockwell Automation, Schneider Electric.

Global Servo Motor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 13.87 billion

- 2026 Market Size: USD 14.88 billion

- Projected Market Size: USD 25.03 billion by 2036

- Growth Forecasts: 5.34% CAGR (2026-2036)

Key Regional Dynamics:

- Largest Region: Asia Pacific Excluding Japan (41.57% share by 2036)

- Fastest Growing Region: Asia Pacific Excluding Japan

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: India, Vietnam, Mexico, Brazil, Indonesia

Last updated on : 4 February, 2026

Servo Motor Market - Growth Drivers and Challenges

Growth Drivers

- Global Growth in Electric Vehicles: Electric vehicle production has accelerated over the past few years due to large-scale innovation in semiconductors and lithium-ion batteries. Servo motor plays a vital role in EVs, including batteries and steering rotors that enhance the accuracy and safety of the vehicle. In 2024, global electric car production reached 17.3 million, demonstrating the spiking demand of the segment, which is directly increasing the demand for servo motors. Constant support from the regional government in adopting electric vehicles has further accelerated the growth of high-performance servo motors.

- Expansion in Robotics: The use of robotics across the segments has increased, especially in service, logistics, and manufacturing, which demand servo motors and precision motion systems. In 2024, global industrial robot installations reached 542,000 units, demonstrating sustained demand for servo motors. Automation has extended to healthcare and robotic surgery, which demands multiple servomotors for precision within robotics. As businesses and healthcare facilities move towards productivity and efficiency, the market will see a significant scope in the future.

- Demand for Precision in Motion Control: Manufacturing is witnessing a rise across the regions that demands precision control and exact positioning. Servo motor ensure submilimeter accuracy through closed loop feedback and improve real time correction, enabling its use in robotics and CNC. The dependence of aerospace, robotics, and medical equipment for multi axle precison movement has significantly raised the market potential. At Automation India Expo 2025, the global motion controls displayed next-generation servo motors, high performance, and real-time response specifically made for robotics and medical systems, which underscores the industry focus on motion accuracy.

Challenges

- High Initial Cost: Servo motors rely on advanced components such as control electronics that increase the cost of servo motors, enhancing dependency on alternative motion sensors. The systems further employ high-resolution encoders with a precision controller that can position the speed and accuracy effectively, further elevating the cost of the market.

- Supply Chain Volatility: Rare earth magnets and semiconductors act as a restraint for the global market. Permanent magnets entirely depend on neodymium and dysprosium, which are not widely available, and sourcing them can cause a significant enhancement in price because of their limited availability.

Servo Motor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2036 |

|

CAGR |

5.34% |

|

Base Year Market Size (2025) |

USD 13.87 billion |

|

Forecast Year Market Size (2036) |

USD 25.03 billion |

|

Regional Scope |

|

Servo Motor Market Segmentation:

Motor Type Segment Analysis

The AC servo motor segment will hold the largest market share of 87.09% by the end of 2036, owing to seamless integration of the system with modern servo drives and enhanced industrial communication networks. Their compatibility with a variety of connectors makes them highly useful in robotics, semiconductor fabrication, and automotive assembly. AC servo motors are furthermore energy efficient, compact, and deliver complex solutions, elevating the demand in more applications. DC servo motor will also hold good potential in the future owing to its capability of use in variable currents, where the performance of DC servo motors succeeds AC servo motors.

System Configuration Segment Analysis

The rotary segment will hold the largest share of 83.70% by the end of 2036 due to the reliability, high performance, and applicability. Rotary servos play a crucial role in robotics joints and CNC machines as they can deliver higher torque while maintaining precision control of speed. Flexibility in adjusting their gear further increases their adoption in the market. These systems are also compatible with multiple drives that further increases the demand. The linear servo motor will also hold a significant share in the market owing to its capability to handle low resolutions.

Industry Vertical Segment Analysis

The automotive segment will hold a share of 22.37% owing to robotic welding, painting, coating, and assembly across vehicle production lines. The development of electric vehicle have further enhanced their use as they are highly used in battery cell and pack assembly. The rise in precision manufacturing within the automotive segment has raised the demand for servo motors. Other segment such as healthcare and medical devices, will also witness some growth because of medical imaging systems and robotic surgery, which require servo motor. As healthcare infrastructure and advanced surgical intervention methods improve, robotic surgeons across departments will increase, increasing the adoption of servomotors.

Our in-depth analysis of the global market includes the following segments:

|

Segments |

Subsegments |

|

Motor Type |

|

|

System Configuration |

|

|

Power |

|

|

Voltage |

|

|

Application |

|

|

Industry Vertical |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Servo Motor Market - Regional Analysis

Asia Pacific Excluding Japan Market Insight

The market in Asia Pacific Excluding Japan is expected to hold a market share of 41.57%, owing to the large-scale manufacturing of electrical and electronic products, including markets, which significantly enhance the scope of the market. The region has seen investment from the government to adopt smart factories and integrate Industry 4.0 measures, including the adoption of robotics. The vast areas of development include manufacturing, automotive, and other industrial applications.

India is witnessing a growth in the automotive sector, which fuels the growth of the servo motor market. The rising EV adoption within the region has further accelerated the growth in steering precision and battery cells. Industrial automation is also expanding because of government investment, propelling the use of robotic arms in manufacturing and boosting the market.

China is the leading manufacturer of electrical components, which include servo motors. The Chinese electric vehicle production heavily relies on cheaper and inexpensive servo motors that reduce the cost of manufacturing. China is also considered the hub for robotics, where manufacturers aim towards precision and accuracy, leading to wider adoption of AC servo motors for durability, enhancing the growth of the market.

Europe Market Insight

The region will hold approximately 22 08% by the end of 2036 due to its stringent regulations on efficiency and electricity consumption. Compliance of Europe has driven the manufacturers towards the adoption of precision CNC systems and industrial robotics. The regulatory pressure has elevated the digitization of the industries and pushed them towards adopting energy-efficient and reliable power systems such as servo motors, which enhances the market potential. As a part of their sustainability, the government has urged consumers to shift to EVs, which has increased the use of servo motors in batteries and steering to enhance precision and accuracy.

The market in the UK is saturated with key players that compete intensely for pricing, quality, and innovation, which is effectively fueling the growth of the servo motor market. The large population of the UK further demands sustainable transportation, increasing the use of electric vehicles and buses for commuting that employ a servo motor, expanding the market significantly.

Germany has an equal focus on sustainability, which has pushed consumers towards HEVs and EVs to minimise the impact on the environment. Apart from advanced manufacturing, automotive engineering, and industrial automation within the region, these have propelled the growth of the market, as robotic arms employ servo motors to enhance accuracy in movements and precision.

North America Market Insight

The region is expected to hold a share of 12.31% owing to the large-scale development in industrial automation, equipped with robotics that demand servo motors in their operation. Major industries, including automotive and manufacturing, are intensifying the adoption of automation, creating a larger market scope for the market. Continuous government push to adopt Industry 4.0 measures further elevates the market expansion. The EV market is growing in North America, which demands servo motors in battery cells and axles that enable free movement.

Specifically in the U.S., the adoption of EVs has increased in recent years, which has significantly fueled the growth of the servo motor market. major players such as ABB Ltd, Siemens AG, and Mitsubishi Electronics are focused on domestic product penetration, enabling low-risk testing.

Canada has advanced manufacturing with the latest technologies, including Industry 4.0 initiatives, which enhance precision in motion. The precision in motion can be obtained from servo motors that can withstand high temperatures and are widely used in precision robotic surgeries and manufacturing.

Key Servo Motor Market Players:

- ABB (Switzerland)

- Bosch Rexroth Corporation (Germany)

- Delta Electronics (Taiwan)

- FANUC Corporation (Japan)

- Kollmorgen (U.S.)

- Lenze (Germany)

- Mitsubishi Electric Corporation (Japan)

- NIDEC CORPORATION (Japan)

- OMRON Corporation (Japan)

- ORIENTAL MOTOR U.S. CORP. (U.S.)

- Panasonic Corporation (Japan)

- Parker Hannifin Corp. (U.S.)

- Rockwell Automation (U.S.)

- Schneider Electric (France)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Panasonic Corporation: A Japanese company that specialises in battery, consumer electronics, and industrial automation equipment manufacturing. It is also one of the prominent players in the servo motor market as it sells automation controllers and energy efficiency motors for various applications.

- Parker Hannifin Corp.: A leading manufacturer of automation technologies, hydraulic systems, and servo motors. The company is widely available for industries such as automotive, aerospace, and industrial automation, and serves them with servo motors. The products are widely used for precision control.

- Rockwell Automation: Recognised as the largest business with automation and information technology solutions. The business is extended towards various verticals, including automotive, defence, and information technology. The portfolio includes a variety of drives and servo motors that are essential in robotic manufacturing for effective and accurate movements.

- Schneider Electric: The global automation and energy management solution that manufactures and sells low to medium-range voltage electrical distribution for industrial use, such as manufacturing. The servo motors are made for motion controls that enhance performance and minimize energy consumption.

Below is the list of the key players operating in the global market:

The players operating in the global market are expected to face intense competition during the forecast timeline. The market is associated with both established key players and new entrants. However, the market is moderately fragmented. New entrants impose immense competition for the existing players, prohibiting them from acquiring the majority of the revenue share. Specialised manufacturers maintain a competitive landscape in the market. Key players in the market are significantly supported by the governments for research and innovation.

Corporate landscape of the global servo motor market

Recent Developments

- In November 2024, Panasonic Corporation and Arm Today developed a strategic partnership to enhance automotive design and architecture. The shared vision of the organization's stack with flexibility that meets the future demands.

- In October 2022, Mitsubishi Motors claimed to have achieved carbon neutrality in its supply chain by 2050. It will focus on the electrification of vehicles, which will significantly reduce carbon emissions and reduce environmental degradation.

- Report ID: 8382

- Published Date: Feb 04, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Servo Motor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.