Series Capacitor Market Outlook:

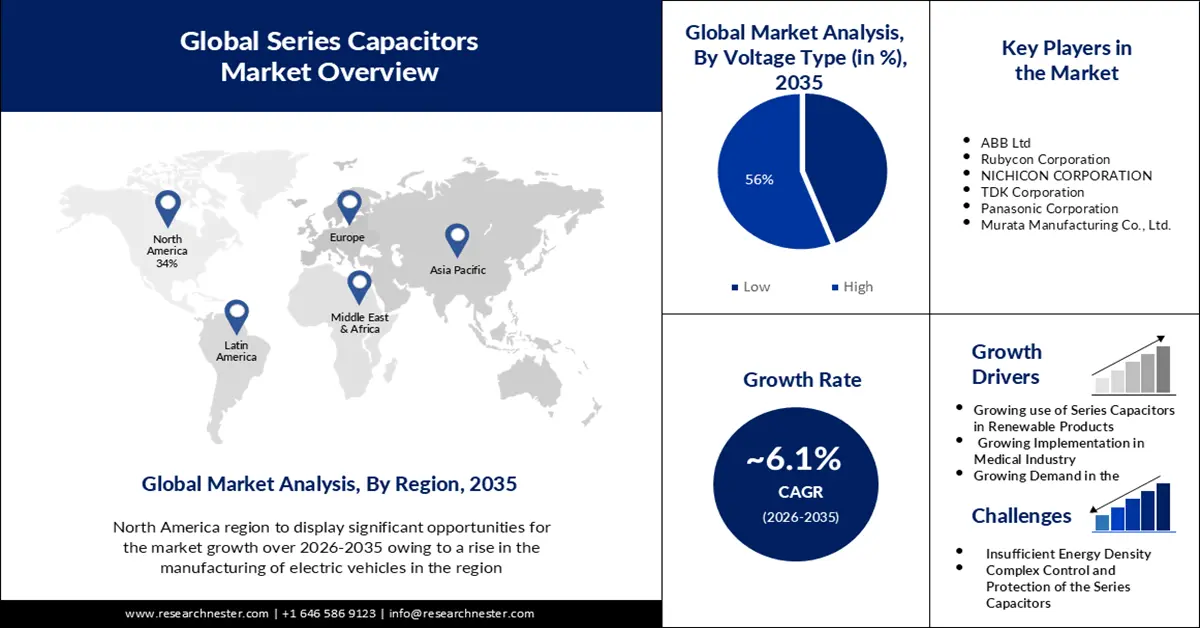

Series Capacitor Market size was over USD 18.98 billion in 2025 and is poised to exceed USD 34.31 billion by 2035, growing at over 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of series capacitor is estimated at USD 20.02 billion.

The reason behind the growth of the market is the rising demand for electric vehicles. The demand for electric vehicles is increasing consistently due to favorable government regulations and rising incentive policies for the adoption of electric vehicles across the globe. According to a report, in just three years, the percentage of electric vehicles in overall sales has more than tripled, rising from 4% in 2020 to 14% in 2022. It is anticipated that EV sales will rise significantly until 2024. Moreover, electric vehicles have fueled the demand for capacitor technologies with high performance and reliability. Series capacitor in electric vehicles are designed to prevent ripple currents from returning to the power source and to smooth out DC bus voltage variations.

Also, due to limitations on the number of components that may put on the substrate and the size & working temperature of those components, the design of communication base stations is getting harder as they get smaller and utilize higher frequency bands. Passive components like capacitor are increasingly being chosen for these applications due to their smaller size and lower cost.

Key Series Capacitor Market Insights Summary:

Regional Insights:

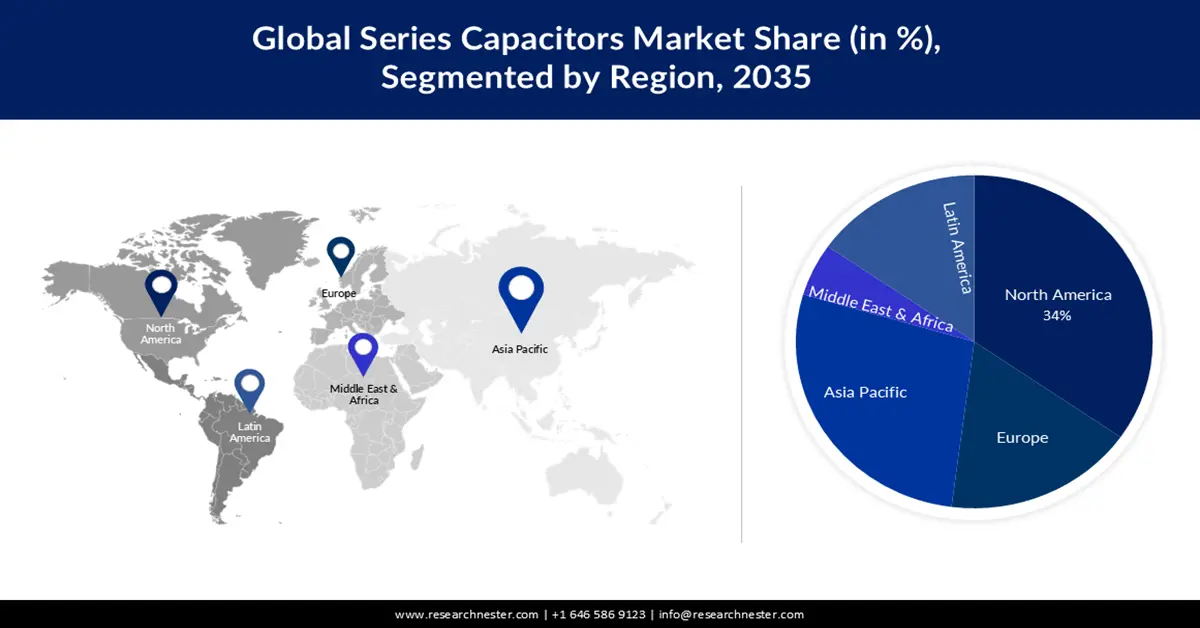

- By 2035, North America is expected to capture a 34% share of the series capacitor market as advancements in ultra-small case-size capacitors stimulate electronics and EV manufacturing, impelled by the rising need for enhanced power transmission efficiency.

- The Asia Pacific region is projected to reach a 27% share by 2035, its expansion strengthened by the rapid growth of the automotive and EV industries, attributed to increasing capacitor adoption across automotive, power, and utility sectors.

Segment Insights:

- The High Voltage segment of the series capacitor market is set to command a 56% share by 2035 as demand strengthens for high-voltage capacitors used in stable power transmission and grid optimization, propelled by increasing utilization in the chemical, electronics, utility, and automotive industries.

- The Energy segment is anticipated to secure a 36% share by 2035 as capacitor bank deployment accelerates in long-distance power transmission, owing to government initiatives focused on enhancing energy generation and distribution infrastructure.

Key Growth Trends:

- Growing use of Series Capacitor in Renewable Products

- Increasing Implementation in Medical Industry

Major Challenges:

- Reducing the High Frequency Circuit's Impedance

- Insufficient Energy Density May Hinder Market Growth

Key Players: General Electric, Vishay Intertechnology, Inc., AVX Corporation, Siemens AG, ABB Ltd, Rubycon Corporation, NICHICON CORPORATION, TDK Corporation, Panasonic Corporation, Murata Manufacturing Co., Ltd.

Global Series Capacitor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 18.98 billion

- 2026 Market Size: USD 20.02 billion

- Projected Market Size: USD 34.31 billion by 2035

- Growth Forecasts: 6.1%

Key Regional Dynamics:

- Largest Region: North America (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Vietnam, Indonesia, Mexico

Last updated on : 26 November, 2025

Series Capacitor Market - Growth Drivers and Challenges

Growth Drivers

- Growing use of Series Capacitor in Renewable Products - New application areas have been made possible by the growth of EDLC's renewable application portfolio. These include, among other tiny gadgets, solar-powered watches, and display lights. Additionally, computers use tiny batteries and electric double-layer capacitor as backup memory sources. Because of their high cost and limited scalability, manufacturers make these graphene and carbon nanotube-based capacitor. This growing use of series capacitor in renewable products is anticipated to support the growth of market.

- Increasing Implementation in Medical Industry - Electronics are being used in a growing range of medical applications, ranging from large imaging machines to smart tags for surgical packs. In medical systems, passive components are crucial for functions including imaging, patient monitoring, medicine delivery, and dispensing. Batteries or series capacitor used to power implantable medical electronic devices frequently need to be removed from the body after serving their intended purpose because they are not biodegradable. Requirements include passing stringent screening procedures, having a longer service life, and high reliability. To meet consumer demand today, capacitor design and material often need to be improved and made smaller. Because of the rising use of these products and components in the medical industry, it is projected that the series capacitor market will grow during the forecast period.

- Growing Demand in the Consumer Electronics Sector – One of the key factors that is anticipated to propel the market in the coming years is the growing demand for capacitor from the consumer electronics industry. Cell phones and other portable consumer gadgets are developing quickly to keep up with the demands of the modern world. For instance, the smartphone mobile network subscriptions hit about 6.4 billion in 2022, and by 2028, it's expected to top 7.7 billion. The top three nations in terms of smartphone mobile network subscriptions are China, India, and the US. Because they can store almost as much energy as a battery and have the benefit of conventional capacitor' high-speed energy discharge, series capacitor are an attractive power supply for portable electronic gadgets.

Challenges

- Reducing the High-Frequency Circuit's Impedance - Capacitor connected in series have the primary drawback of lowering the circuit's impedance at high frequencies. This is because the impedance is inversely proportional to the capacitance and the overall capacitance of a parallel circuit is greater than the sum of the individual capacitances of the capacitor. This can lead to interference or distortion in circuits that are intended to have a high impedance because it permits high-frequency signals to flow through the circuit. Therefore, this factor may hamper the series capacitor market growth.

- Insufficient Energy Density May Hinder Market Growth

- Complex Control and Protection of the Series Capacitor may Hamper the Market Growth

Series Capacitor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 18.98 billion |

|

Forecast Year Market Size (2035) |

USD 34.31 billion |

|

Regional Scope |

|

Series Capacitor Market Segmentation:

Voltage Type Segment Analysis

Series capacitor market for the high voltage segment is anticipated to hold the largest share of 56% during the projected period. In residential & commercial buildings, high-voltage capacitor are mainly used to ensure a continuous power supply and to transmit extra-high voltage (EHV) and ultra-high voltage (UHV). Additionally, because of its insulating qualities and capacity to withstand high temperatures, capacitor are becoming increasingly in demand across a wide range of industries. Further, as electronics have become more ingrained in customers' daily lives, more mobile phones, televisions, multimedia players, and smart televisions that make use of these devices are being produced. They can split the power system to increase the flexibility of the grid and provide enormous stability, power flow control, resilience, and reliability. Because of these advantages, HV capacitor are widely used in the chemical, electronics, utility, and automotive industries.

Application Segment Analysis

Energy segment in the series capacitor market is expected to hold a share of 36% by the end of 2035. The growth can be attributed to the increased demand for these capacitor banks owing to several benefits, including easy installation & maintenance, less assembly, simple design, and cost-effectiveness. They are widely used in energy and power applications for transmitting power over long distances. The ongoing projects undertaken by governments to enhance energy generation and distribution infrastructure will likely result in high demand for market. As per a report, compared to earlier projections of 867 TWh, the amount of electricity generated from fossil fuels for 2030 is now only 595 TWh. EU nations' proportion of renewable energy in power generation will rise from 55% to 63% by 2030. The number of renewable applications for EDLC has grown, opening up new application areas. Examples of these include solar-powered watches and display lights, among other small devices.

Our in-depth analysis of the global market includes the following segments:

|

Voltage Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Series Capacitor Market - Regional Analysis

North American Market Insights

North America industry is predicted to account for largest revenue share of 34% by 2035. The development of ultra-small case-size capacitor for portable electronic devices has accelerated growth in North America and led to a rise in the manufacturing of electric vehicles. For example, as fuel prices have risen, the use of electric vehicles has increased in many different countries and areas. Electric vehicles employ lithium-ion batteries that offer a hybrid charging mechanism in place of gasoline and diesel engines. Also, the need for improved power transmission efficiency is driving the adoption of series capacitor in the region. By compensating for reactive power and enhancing voltage stability, series capacitor help optimize power flow and reduce transmission losses.

APAC Market Insights

Series capacitor market in the Asia Pacific region is poised to hold a share of 27% by the end of 2035. The growth can be attributed to the expansion of the automotive industry in the region. The growing popularity of EVs in the region is propelling the market growth. For instance, by 2028, it is projected that Asia's market for electric vehicles will have 9.30 million units sold. Also, the availability of raw materials and the strong presence of small-scale capacitor manufacturing companies in the region. Also, the growing use of capacitor in the automotive power, and utility sectors is propelling market growth in the region.

Series Capacitor Market Players:

- General Electric

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Vishay Intertechnology, Inc

- AVX Corporation

- Siemens AG

- ABB Ltd

Recent Developments

- Siemens and Skeleton Technologies have reached an agreement on a comprehensive technical collaboration for the creation, design, and execution of a completely digital, automated manufacturing process for the manufacture of supercapacitor in Germany. During the course of the five-year project, the production line, which will be installed in a new Skeleton plant in Markranstädt, Leipzig, will assist in reducing production costs by almost 90%.

- New UBC 550 Series ultra-broadband capacitor have been released by AVX Corporation, a top producer and supplier of advanced electronic components as well as interconnect, sensor, control, and antenna solutions. These capacitor are intended to provide dependable, repeatable performance in ultra-broadband microwave and millimeter-wave RF applications with exacting operating requirements, from 16KHz to 70+GHz. The new UBC 550Z, 550U, and 550L Series ultra-broadband capacitor are constructed from the highest-grade ceramic and are single-piece, surface-mount, multilayer devices. They are robust and small.

- Report ID: 5498

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Series Capacitor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.