Global Market Size, Forecast, and Trend Highlights Over 2025-2037

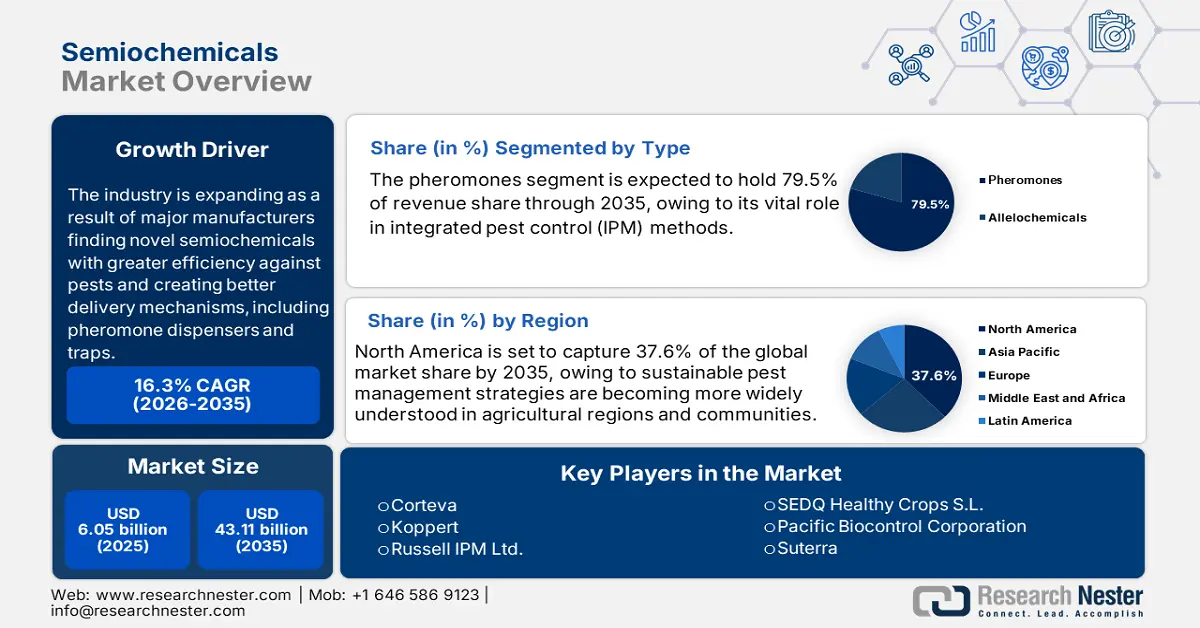

Semiochemicals Market size was USD 6.05 billion in 2024 and is estimated to reach USD 43.11 billion by the end of 2037, expanding at a CAGR of 16.3% during the forecast period, i.e., 2025-2037. In 2025, the industry size of semiochemicals is evaluated at USD 7.04 billion.

The need for sustainable bio-pesticides, such as semiochemicals, has grown as a result of the growing demand for organic food items to reduce the negative health effects of conventional products farmed with chemical fertilizers and pesticides. Due to the extensive use of crop protection and integrated pest management (IPM), the use of biopesticides in agriculture has increased over the last ten years. Important aspects of crop protection include managing insect resistance, lowering chemical residues on plants, gentle pest control, and raising awareness of the advantages of doing away with traditional pesticides. Therefore, semiochemicals have become one of the most important tools for managing a variety of high-value fruits, vegetables, and crops.

In 2023, the distribution of International Pheromone Systems' (IPS) key products is following a new route. When utilized in conjunction with Integrated Pest Management (IPM) approaches, the SPTab and CLTab effectively and sustainably manage textile and dry storage pests. Since the SPTab system doesn't use pesticides, it is ideal for food manufacturers, processing facilities, and storage facilities, particularly those with organic accreditation, to combat stored product pests like Indian Meal Moths and Cacao Moths.

The industry is expanding as a result of major manufacturers finding novel semiochemicals with greater efficiency against pests and creating better delivery mechanisms, including pheromone dispensers and traps. These developments are also improving the accuracy, economy, and use of semiochemical-based pest control for farmers and pest management experts. In addition, because of their increased efficacy and environmental friendliness, semiochemicals are increasingly being considered as a viable option for pest control.

Semiochemicals Market: Growth Drivers and Challenges

Growth Drivers

-

Increasing awareness of integrated pest management (IPM): Farmers and pest management experts are becoming more aware of integrated pest management (IPM), which is helping with the semiochemicals market expansion. IPM is a comprehensive strategy to pest management that uses several methods, including biological control and the application of semiochemicals, to efficiently manage pests while reducing their negative effects on the environment. Furthermore, by altering pest behavior, lowering the demand for chemical pesticides, and encouraging long-term pest control solutions, semiochemicals are essential to integrated pest management (IPM). Over 53 million children and 6 million adults in the US spend a huge amount of their time in the more than 120,000 public and private schools across the country. IPM offers a chance to eliminate pests and lessen children's exposure to pesticides, thus establishing a safer learning environment.

- Expansion of organic farming: As people become more interested in organic foods, organic farming is becoming more and more popular worldwide. Organic farming has grown significantly in popularity worldwide due in large part to growing awareness of the negative effects of chemical fertilizers and pesticides. Organic agriculture is implemented in 187 countries, with at least 3.1 million farmers managing 72.3 million hectares of land organically. Australia has the largest amount of organic agricultural land (35.69 million hectares), along with Argentina (3.63 million hectares) and Spain (2.35 million hectares). In every region, the amount of land used for organic farming has increased. The need for environmentally friendly and bio-based pest control management solutions has grown as organic farming has expanded globally.

Challenges

-

High cost of active ingredient: It is anticipated that the high maintenance needs and expensive prices in comparison to traditional pesticides will severely limit the global market's expansion. The active ingredient in semiochemical formulations may be light- and temperature-sensitive, and they are physically unstable. In contrast to conventional techniques that use human administration and the formulation's inherent irregularity to obtain a certain release rate, the cost is expensive. Smallholder farmers are deterred from using these biopesticides in their farming operations by their high cost. Furthermore, the application's added labor expenditures raise its cost even more and impede semiochemicals market expansion.

- Limited range of effect: The ability of semiochemicals to selectively target particular pests can be both a benefit and a drawback. Semiochemicals might not be effective against every pest in a given crop or area, in contrast to broad-spectrum chemical pesticides. The use of complementary pest control techniques may be required due to this narrow scope of action, which could make integrated pest management plans more difficult to understand and raise practical challenges for farmers.

Semiochemicals Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

16.3% |

|

Base Year Market Size (2024) |

USD 6.05 billion |

|

Forecast Year Market Size (2037) |

USD 43.11 billion |

|

Regional Scope |

|

Semiochemicals Segmentation

Type Segment Analysis

The pheromones segment is projected to gain a 79.5% semiochemicals market share through 2037. The pheromone is beneficial due to its vital role in integrated pest control (IPM) methods. As signaling chemicals, pheromones are essential for controlling pest populations in forestry and agriculture because they provide focused management with little harm to the environment.

Their importance is highlighted by how well they draw in, keep out, or change the behavior of pests. The global push for sustainable farming methods and the necessity to use fewer chemical pesticides have increased demand for pheromones. This market is thriving with innovation and research aimed at creating species-specific and more effective pheromone products.

The market for allelochemicals, on the other hand, is modest and expanding quickly. Plants and other species in their surroundings, such as pollinators, pests, and nearby plants, communicate through these chemicals. As awareness of their potential increases, so does their use in agriculture.

Allelochemicals provide natural alternatives for managing pests and weeds, which are compatible with the movement toward sustainable and organic farming. Due to continued research into new applications and the creation of allelochemical-based solutions that can increase crop resilience and productivity while lowering dependency on synthetic chemicals, this market is anticipated to grow significantly.

Source Segment Analysis

The chemically synthesized segment is anticipated to witness significant growth in the forecast period. The production scalability and dependability of this industry are essential for satisfying the need for pest management solutions worldwide. The stability and efficacy of chemically manufactured semiochemicals make them preferred because they enable accurate management of insect populations in forestry and agriculture. Their robust semiochemicals market presence is a result of their broad availability and adaptability to certain pest targets.

Semiochemicals derived from animals are very crucial to the industry, especially in fields like pest monitoring and mating disruption. These natural resources are prized for their genuineness and precision, providing incredibly efficient approaches to controlling insect behavior. But when compared to their chemically manufactured competitors, their market share has been constrained by issues with supply and scalability.

Growing interest in organic and sustainable agriculture is propelling the growth of the plant-based semiochemicals market. These compounds, which are derived from plants, provide environmentally beneficial substitutes for artificial chemicals. Their natural origin and minimal environmental impact make them appealing, as they correspond with customer demands for more environmentally friendly farming methods. This market is anticipated to expand as research progresses, reflecting a growing trend toward sustainable farming practices.

Our in-depth analysis of the global semiochemicals market includes the following segments:

|

Type |

|

|

Source |

|

|

Function |

|

|

Mode of Application |

|

|

Crop Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

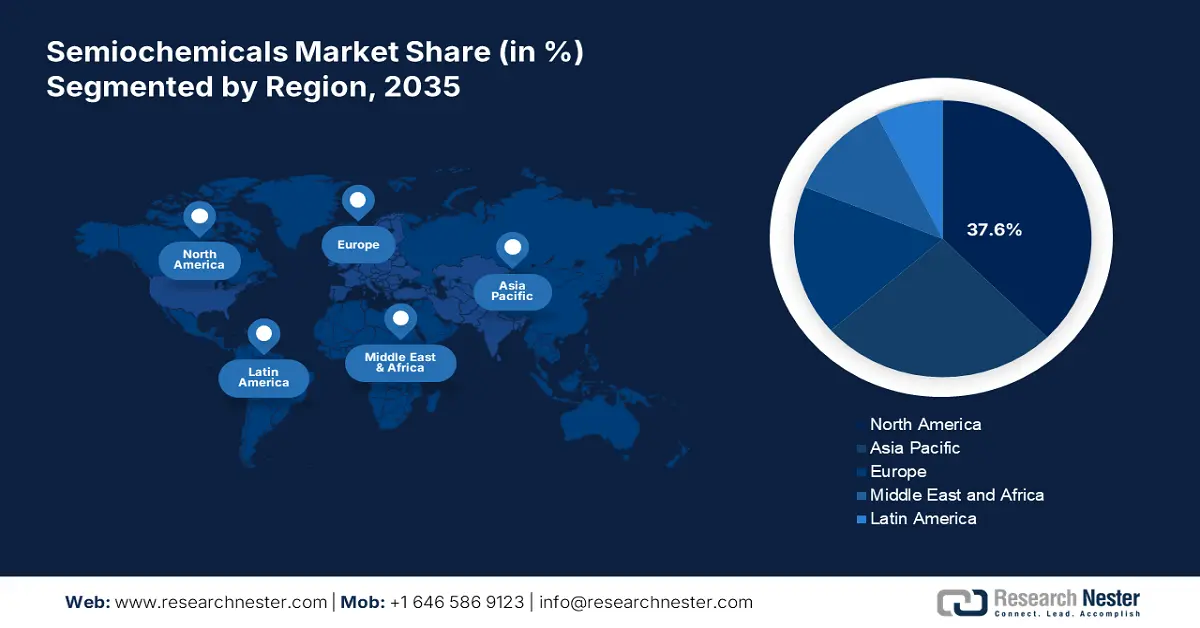

Semiochemicals Industry - Regional Synopsis

North America Market Insights

North America is expected to dominate the semiochemicals market with a share of 37.6% during the forecast period. The need for sustainable pest management strategies is becoming more widely understood in agricultural regions and communities. This insight is driving investment in innovative solutions such as semiochemicals. Customers in this market are more inclined to invest in semiochemicals because they are aware of their advantages, which include better pest control, economic effectiveness, and less environmental impact.

The U.S. leads from the forefront due to its growing need for safer and more reliable pest control solutions. This demand is being driven by worries about outdated farming practices and the rise in pest-related problems. Organic retail sales in the U.S. rose by an average of 8% yearly. Organic retail sales were expected to reach over USD 52 billion in 2021, or about 5.5% of global retail food sales. U.S. farms and ranches produced about USD 11 billion worth of organic products in 2021. Furthermore, imports are helping to meet consumer demand.

In Canada, robust agricultural infrastructure is supported by a network of technology suppliers and specialists. With industry experts promoting their use, this setting fosters the creation and integration of semiochemical solutions. Many prominent businesses in semiochemical technology are situated in the region, driving research and innovation and providing a wide range of high-quality goods on the semiochemicals market. Recent regional advancements, such as remote sensing and spatial imaging, assist farmers in dealing with pest challenges and will further fuel market expansion.

Asia Pacific Market Insights

The Asia Pacific semiochemicals market is undergoing significant transformation, influenced by increasing farmers' understanding of crop protection and yield-boosting techniques. It is anticipated that the expanding organic farming sector would increase demand in the area. In the region, several national and international policies are being implemented to improve the agricultural sector, to raise agricultural productivity, and to improve working conditions. According to an international labor organization, about 30% of all employed people in the region work in agriculture, many of them as smallholder farmers with low output. Around 563 million people were employed in the agriculture sector in the region as of 2021. Agriculture has had a long-term reduction in total employment, with the rate of decline slowing down in recent years.

In China, growing populations and changing consumer tastes are causing major shifts in the horticulture and agricultural landscapes. Semiochemicals' appeal as efficient and long-lasting pest control methods grows as industry places a greater emphasis on environmentally friendly solutions. China leads the world in the adoption of semiochemicals due to a combination of its cultural heritage, growing semiochemicals markets, and the need for environmentally friendly practices. The growing amount of land utilized for organic farming is expected to further increase demand in the area. Various policies are being undertaken to enhance the agricultural industry to improve working conditions and increase agricultural productivity.

In India, the high demand for organic products has made it necessary for farmers to include biological crop protection techniques in their pest control plans. Growing demand for organic food products, more emphasis on sustainable agricultural methods, and advancements in pest control technology are all benefiting the industry. India accounts for 30% of global organic production, with 2.30 million hectares. In total, there are 27,59,660 farmers (11,60,650 PGS and 15,99,010 India Organic), 1703 processors, and 745 traders in the organic industry. In recent years, there has been a significant nationwide growth in the amount of land used for organic farming.

Companies Dominating the Semiochemicals Market

- SEDQ Healthy Crops S.L.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pacific Biocontrol Corporation

- Suterra

- Corteva

- Koppert

- Russell IPM Ltd.

- Pherobank B.V.

- ISCA Technologies, Inc.

- Biobest Group NV

- ISAGRO S.p.A.

- Troy Biosciences, Inc.

- International Pheromone Systems

- Agrisense BCS Ltd.

Leading businesses in the semiochemicals market are constantly working on new product development and innovation to stay ahead of the competition. Establishing new production facilities is a strategic move by the majority of the major players to increase their geographic footprint. Long-term strategies to attain sustainable growth in the semiochemicals market include partnerships, collaborations, production agreements, expansion, investment, mergers, and acquisitions.

Recent Developments

- In December 2021, Provivi collaborated with CABI on the BioProtection Portal to improve crop protection awareness. Provivi assists farmers in protecting crops in a sustainable and organically effective manner by utilizing contemporary research. Their goal is to use cutting-edge technologies to develop safer, more scalable pest control solutions.

- Report ID: 7655

- Published Date: May 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Semiochemicals Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert