Self-compacting Concrete Market Outlook:

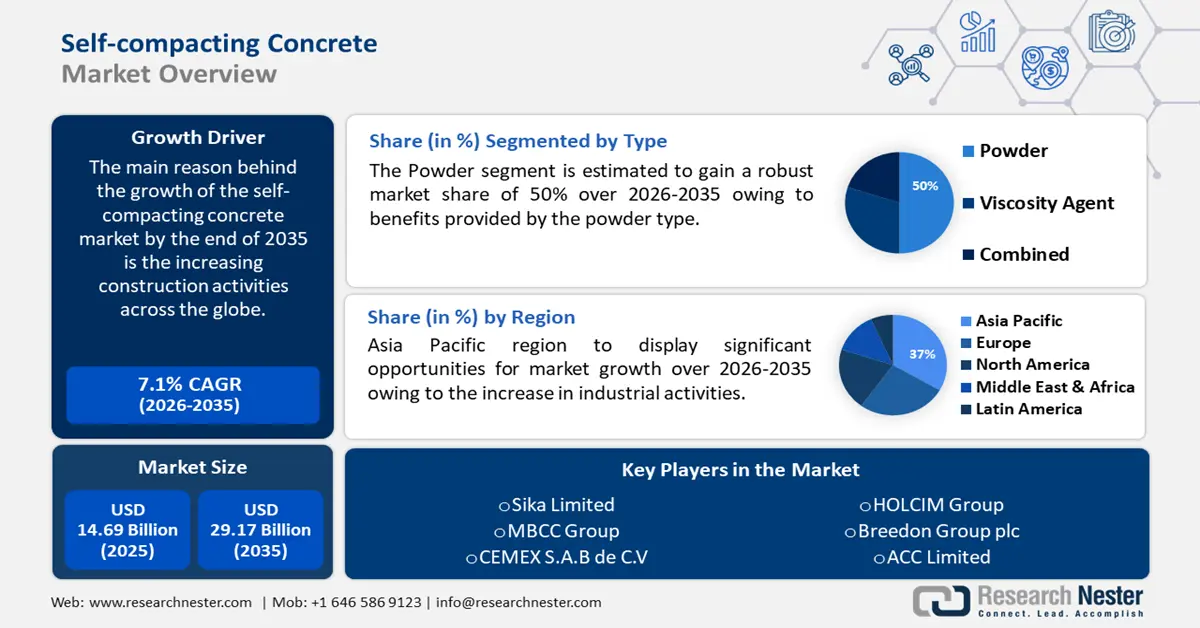

Self-compacting Concrete Market size was valued at USD 14.69 billion in 2025 and is expected to reach USD 29.17 billion by 2035, expanding at around 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of self-compacting concrete is evaluated at USD 15.63 billion.

The market is growing due to the increasing construction industry across the globe. The world's largest industry, construction is predicted to more than double in size between 2020 and 2030 owing to rising development and a demand for both residential and non-residential construction projects.

For instance, in the next 15 years, the amount of building work completed worldwide will increase to around USD 4 trillion. Moreover, the size of the world construction industry was over USD 8 trillion in 2022 and is expected to grow to USD 16 trillion by 2029.

In addition to this, a factor that is believed to fuel the growth of the self-compacting concrete market is the increase in the need for vibration-free concrete. Vibrations might affect the entire construction, therefore self-compacting concrete is extensively being used since it has a high fluidity type that doesn't vibrate, which speeds up construction and lessens related difficulties.

Key Self-compacting Concrete Market Insights Summary:

Regional Highlights:

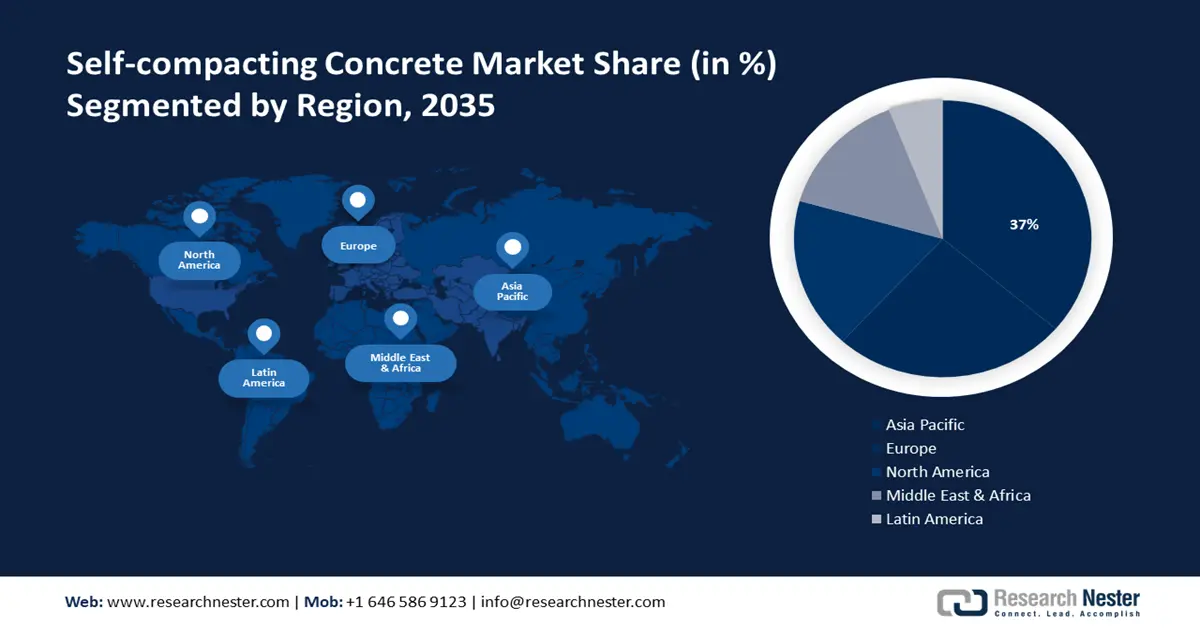

- Asia Pacific self-compacting concrete market will hold more than 37% share by 2035, driven by increased industrial activities and growing investment in major infrastructure projects, apartment buildings, and commercial spaces.

Segment Insights:

- The powder segment in the self-compacting concrete market is projected to hold a 50% share by 2035, driven by superior strength, durability, and flowability offered by powder-based SCC.

- The columns segment in the self-compacting concrete market is expected to capture a 25% share by 2035, fueled by demand for intricate, reinforced column designs using SCC.

Key Growth Trends:

- Surge in the demand for efficient construction techniques

- Growing trend for enhanced aesthetic

Major Challenges:

- Exorbitant cost of raw materials

Key Players: Sika Limited, MBCC Group, CEMEX S.A.B de C. V, HOLCIM Group, Breedon Group plc, ACC Limited, UltraTech Cement Ltd., Firth, Buzzi Unicem S.p.A., Unibeton.

Global Self-compacting Concrete Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14.69 billion

- 2026 Market Size: USD 15.63 billion

- Projected Market Size: USD 29.17 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 16 September, 2025

Self-compacting Concrete Market Growth Drivers and Challenges:

Growth Drivers

- Surge in the demand for efficient construction techniques - The goal of construction businesses is to finish projects on schedule. This is increasing the demand for cutting-edge materials that can speed up construction without sacrificing quality. The drive for efficiency in building is aligned with SCC's unique capacity to flow and compact under its weight, without the need for standard vibration methods.

- This feature expedites the placement procedure and lessens the need for manual labor, which saves money and accelerates project completion. Thus, the growth of self-compacting concrete market is being driven by an increase in demand for effective construction approaches.

- Growing trend for enhanced aesthetic - Architecture and design elements are always changing. This is increasing the demand for building supplies that can satisfy these needs without sacrificing effectiveness or quality. Surfaces produced by SCC are remarkably smooth and homogeneous because of their remarkable flowability and ease of filling intricate formwork and reinforcing systems. This intrinsic feature saves time and costs by doing away with the requirement for labor-intensive manual finishing procedures. As a result, SCC is increasingly the go-to option for projects where aesthetics is important.

- Precision and fine detailing are frequently needed for modern building projects, with an emphasis on immaculate surface finishes. Because of SCC's ability to provide outstanding finishes, architects, and designers are coming to them more and more to realize their creative ambitions. This is accelerating the self-compacting concrete market's progress.

- Growing shift towards sustainable construction practices - Waste and water consumption are accounted for by buildings and the construction sector at 33%. Materials that minimize environmental effects and reduce waste are becoming more and more popular as a result of the global move towards sustainable construction practices.

- Because of its effective placement method, SCC produces less construction waste, which is consistent with sustainability standards and makes it a desirable option for projects that care about the environment. Therefore, it is predicted that in the coming years, the self-compacting concrete market will grow impelled by the rise in the need for restoration services and the trend toward sustainable and efficient building.

Challenges

- Exorbitant cost of raw materials - Microsilica, sometimes referred to as silica fume, can cost anywhere between USD 500 and USD 1000 per metric ton on average. The cost of silica fume is mostly determined by its quality, purity, and processing cycle have a direct impact on material cost.

- The price of silica fume is larger requires more transportation, and is also somewhat affected by the product packaging. Moreover, silica fume is roughly three to four times more expensive than cement, especially in the Arabian Gulf countries. The cost of silica fume concrete is higher than that of fly ash or GGBS concrete, raising the total cost of the concrete since it is produced from coke which is a natural resource and must be extracted with significant investment.

- Availability of alternatives which can be a barrier to the widespread adoption of self-compacting concrete

- Quality control issues leading to variations in raw materials which may hinder the self-compacting concrete market growth.

Self-compacting Concrete Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 14.69 billion |

|

Forecast Year Market Size (2035) |

USD 29.17 billion |

|

Regional Scope |

|

Self-compacting Concrete Market Segmentation:

Type Segment Analysis

The powder segment in the self-compacting concrete market is estimated to gain the largest revenue share of about 50% in the year 2035. The segment growth can be credited to the several benefits provided by it. SCC compositions can use a variety of cementitious ingredients, including Portland cement, fly ash, slag, and other supplemental cementitious materials. The strength, durability, and environmental properties of the mix are all directly impacted by the type of powder selected.

The composition and amount of cementitious materials have a major impact on SCC's overall performance and compressive strength. Certain elements, such fly ash or slag, can be added to improve long-term strength and lower the heat of hydration. The SCC mix's rheological characteristics and flowability are influenced by the type of powder used. A few extra resources can increase workability and lower the chance of segregation.

Application Segment Analysis

The columns segment is predicted to hold 25% share of the global self-compacting concrete market during the forecast timeline. The segment’s growth is propelled by the growing use of self-compacting concrete in columns to increase compressive and deformation strength. The need for a range of fluidities and the capacity to fill complex molds without causing vibrations during production has grown dramatically as a result of the growing number of construction projects that prioritize efficient building techniques and high-quality aesthetics.

Because of these characteristics, self-compacting concrete is ideal for intricate column designs and scenarios with thick reinforcement. Therefore, because of its superior surface polish and ease of placing, self-compacting concrete is being used in column applications at a rate that is driving significant growth for self-compacting concrete market.

Our in-depth analysis of the self-compacting concrete market includes the following segments:

|

Type |

|

|

Application |

|

|

End-user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Self-compacting Concrete Market Regional Analysis:

APAC Market Insights

Self-compacting concrete market in the Asia Pacific is anticipated to hold the largest with a share of about 37% by the end of 2035. The market growth in the region is also expected on account of the increase in industrial activities. Additionally, the region's market dynamics are being fueled by the growing investment in major infrastructure projects, apartment buildings, and commercial spaces, particularly in China, India, and Southeast Asian nations.

According to a report, as of May 2022, China had about USD 5 trillion worth of infrastructure projects in development or operation, valued at over 25 million dollars. Additionally, the Asia Pacific region's growing population is driving up demand for self-compacting concrete due to a surge in the requirement for efficient construction methods.

European Market Insights

The Europe region will also encounter vast expansion for the self-compacting concrete market during the forecast period and will hold the second position owing to the growing adoption of sustainable construction practices. For instance, the goal of the Horizon Europe INBUILT project, which was launched in January 2024 is to promote sustainable building methods throughout Europe. The project's main goal is to replace conventional construction models with more eco-friendly and effective techniques. To preserve resources and be in line with Europe's sustainability goals, this adjustment is imperative.

In addition to this, the increased adoption of innovative building technologies is another factor the self-compacting concrete market size. Furthermore, the region's market revenue is being enhanced by the enforcement of strict quality requirements, an increase in infrastructure upgrades and urban redevelopment projects, and a growing demand for energy-efficient buildings.

Self-compacting Concrete Market Players:

- Sika Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- MBCC Group

- CEMEX S.A.B de C. V

- HOLCIM Group

- Breedon Group plc

- ACC Limited

- UltraTech Cement Ltd.

- Firth

- Buzzi Unicem S.p.A.

- Unibeton

Recent Developments

- HOLCIM Group announced the acquisition of READY-MIX CONCRETE ASSETS of Ol-Trans to make it the leader in the northern part of Poland, boost Holcim's sales of ECOPact green concrete in Poland, and provide better access to environmentally friendly options, such as Agila Fibro, a self-compacting concrete that uses over 45% less steel reinforcement.

- Breedon Group plc announced the acquisition of Micromix (Northern) Limited which trades as Express Minimix, a 'mini mix' concrete operator to expand their industry-leading range of goods and services available to both current and potential clients.

- Gunge Concrete Industries Co., Ltd.'s subsidiary Mitsui Chemicals Co., Ltd. has created a method for creating decorative concrete with polyolefin resin formwork through 3D printing. Concrete goods with excellent design quality can be produced by integrating the concrete manufacturing technology of Gunge Concrete Industry with the 3D printing-friendly polyolefin material developed by Mitsui Chemicals.

- Kajima Corporation, Nippon Concrete Industries Co., Ltd., and Yokohama City announced by the production of carbon negative concrete, known as "CO 2-SUICOM®”. The product is designed to absorb and fix low-concentration CO 2 that is present in the exhaust gas when city gas equipment is used. It was erected as a component of the fundamental solar power generation system at Motomachi Elementary School in Yokohama City.

- Report ID: 5661

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Self-compacting Concrete Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.