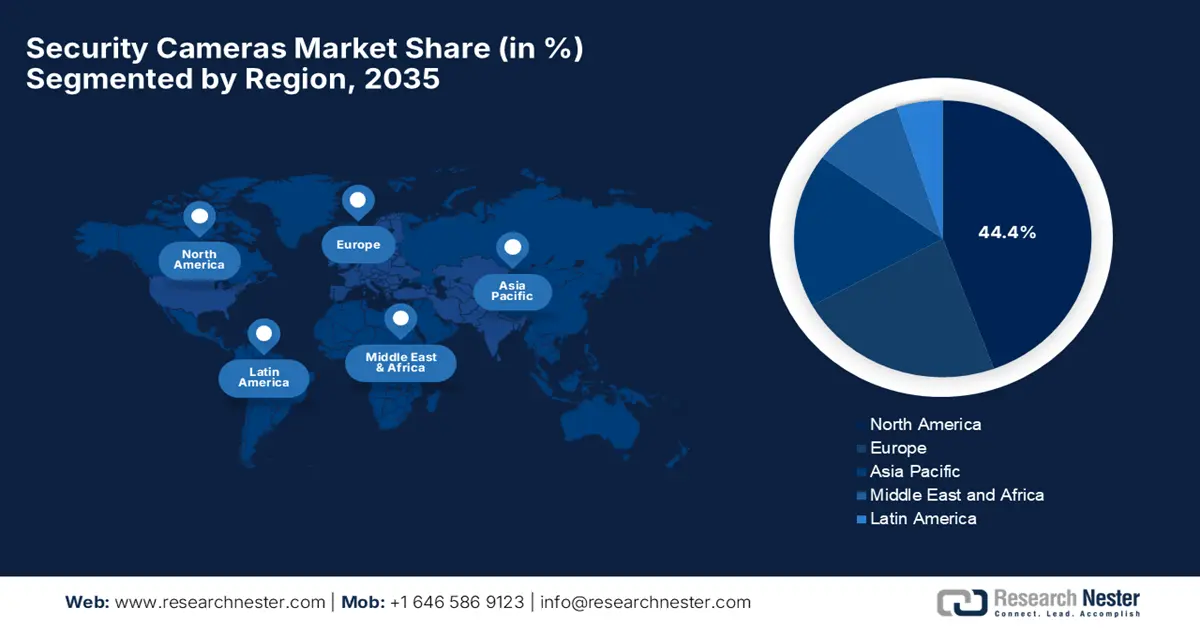

Security Cameras Market - Regional Analysis

North America Market Insights

North America is the dominant player in the security cameras market, capturing the largest revenue share of 44.4% by the end of 2035. The region’s progress in this field is fueled by rising crime rates, technological improvements, and regulations regarding public safety. The region is witnessing heightened demand for smart surveillance systems, encouraging continuous innovations and partnerships among key players. In this regard, Arlo Technologies in May 2025 introduced Arlo Secure 6, which is a next-generation smart home security subscription service that consists of AI-based innovations such as fire detection, advanced audio alerts, event captions, and video search for enhanced monitoring that enhances the Arlo cameras' capabilities. The company also notes that this service builds on existing person, vehicle, and custom detection, providing users with deeper insights and faster responses to emergencies, hence contributing to overall security cameras market growth.

The U.S. is progressing in the security cameras market, influenced by the presence of pioneering market players that are consistently putting efforts into offering innovative solutions to various sectors. The country’s market also benefits from supportive initiatives that are enhancing security infrastructure. As of the September 2025 report, the Nonprofit Security Grant Program (NSGP), which is managed by FEMA, provides funding to nonprofit organizations at high risk of terrorist attacks to support target hardening and physical security enhancements. For fiscal year 2025, a total of USD 274.5 million was made available, and that was equally split between urban area (NSGP-UA) and state (NSGP-S) programs, building on previous years’ funding. Therefore, this drives demand for security cameras by funding physical security upgrades, including CCTV and IP-based surveillance, in high-risk nonprofit facilities. Further, such a program highlights the role of government grants and institutional adoption in expanding the market potential.

The security cameras market in Canada is gaining momentum owing to a rise in safety concerns, increased adoption of surveillance technologies, and government initiatives which are aimed at enhancing public security. Both commercial and residential sectors in the country are making strong investments in IP-based, wireless, and AI-enabled cameras to improve monitoring and crime prevention. In this context, the Manitoba government in December 2025 launched a USD 10 million business security rebate program to help small businesses repair property damage and invest in security upgrades, which also includes security and doorbell cameras, alarm systems, and motion detectors. It also mentioned that this program provides rebates up to USD 2,500 per location on a first-come, first-served basis, thereby aiming to enhance community safety and deter crime.

APAC Market Insights

The security cameras market in the Asia Pacific is expected to register the fastest growth due to the aspects of urbanization, growing public safety concerns, and rising adoption of smart city initiatives. Governments and private enterprises in the region are deploying AI-enabled and IP-based surveillance systems to enhance monitoring capabilities. Hikvision India in May 2024 reported that it showcased its AIoT-enabled video security products at the security and fire expo West India in Mumbai, by highlighting innovations in terms of AI, robotics, and IoT technologies. The display also included advanced cameras, smart hybrid systems, thermal solutions, access control, and intelligent traffic management systems for industrial, commercial, and public sector applications. The firm notes that this event also featured technical seminars emphasizing security solutions and Hikvision India’s commitment to innovation and the Make-in-India initiative, hence denoting a positive market outlook.

China is augmenting its leadership over the regional security cameras market owing to large-scale government investments in public safety, smart city infrastructure, and industrial surveillance. The country’s market also benefits from strong local manufacturing capabilities and a growing awareness of private security needs. In September 2024, AFDATA reported that the country’s smart policing video big data application solution demonstrates large-scale government deployment of AI-enabled security cameras to support public safety and smart city governance. It was built on nationwide initiatives such as Skynet and Xueliang, and the platform integrates extensive video surveillance points with facial recognition and big-data analytics to achieve no-blind-spot monitoring. In addition, the advanced functions, such as personnel clustering, behavior analysis, and early-warning systems, enhance proactive crime prevention and policing efficiency.

In India, the security cameras market is efficiently growing on account of rising urban crime rates, government-backed smart city projects, and heightened demand for security cameras in commercial complexes, transport hubs, as well as residential societies. For instance, Honeywell in June 2025 launched its first-ever domestically designed and produced CCTV camera portfolio in the country, which is the 50 Series, by aligning with the Atmanirbhar Bharat initiative. It also stated that the class 1 certified cameras feature intelligent video analytics, enhanced imaging, gyro-based stabilization, and enterprise-grade cybersecurity, which are mainly targeted at critical infrastructure and commercial sectors. These cameras were developed at Honeywell’s Bengaluru center in collaboration with VVDN Technologies, whereas the portfolio strengthens India’s security ecosystem by promoting design in India, make in India, and make for the world.

Europe Market Insights

Europe represents one of the most prominent landscapes for the security cameras market, positively influenced by strict regulations on public safety, rising urbanization, and the adoption of intelligent surveillance systems. Both public and private sectors are making investments in high-definition cameras to improve monitoring efficiency. In December 2025, Hanwha Vision announced the launch of its first-ever ruggedised PTZ camera range, which is designed to deliver reliable, AI-powered surveillance in extreme and mission-critical environments such as ports, transportation hubs, and urban infrastructure. Besides, it is efficiently built to withstand harsh weather, strong winds, and challenging lighting conditions, and the camera combines advanced imaging, long-range zoom, and intelligent analytics powered by the Wisenet 9 AI chipset. In addition, the camera leverages military-grade durability, built-in cybersecurity, and integration with major video management systems, hence setting a high standard for resilient and intelligent surveillance solutions.

In Germany, the security cameras market is stimulated by industrial automation, smart infrastructure projects, and a focus on enhancing public and corporate security. The country strongly emphasizes data security and compliance in surveillance implementations, encouraging more players to operate in the country. In November 2025, FUJIFILM Europe GmbH announced the regional premiere of its new FUJINON SX400 surveillance camera at the Milipol 2025 security and defence exhibition, which was held in Paris. The camera is especially designed for civil and military surveillance applications, supporting use cases such as infrastructure protection, event security, and environmental monitoring. The firm also mentioned that it comprises an advanced optical zoom, high-speed autofocus, image stabilization, and haze reduction technologies to deliver clear imagery over distances of up to 1 km.

In the U.K., the security cameras market is growing exponentially due to the heightened public safety concerns, government-backed CCTV initiatives, and private sector adoption in retail, transport, and commercial buildings. The country’s market also benefits from increasing integration with smart city projects and digital infrastructure. In this context, the Greater London Authority in December 2024 reported that London’s CCTV network had received a major upgrade, with more than 300 new and enhanced cameras installed across the capital, supported by a £30 million (USD 40.1 million) investment from the Mayor of London to expand full fibre connectivity. The article also mentioned that these improvements deliver higher-quality footage, faster incident response, and reduced running costs, which helps local authorities, Transport for London, and the Met Police enhance public safety and pursue offenders more effectively, hence denoting a positive market outlook.