Global Secondary Aluminum Alloy Market TOC

- An Outline of the Global Secondary Aluminum Alloy Market

- Market Definition

- Market Segmentation

- Product Overview

- Assumptions and Abbreviations

- Research Methodology & Approach

- Research Process

- Primary Research

- Manufacturers

- Suppliers/Distributors

- End-Users

- Secondary Research

- Market Size Estimation

- Summary of the Report for Key Decision Makers

- Forces of the Market Constituents

- Factors/drivers impacting the growth of the market

- Market trends for better business practices

- Key Market Opportunities for Business Growth

- Decarbonization Strategy and Carbon Credit Benefits for Market Players

- Global government decarbonization plans/goals by each country under 2015 agreement agreed by 200 countries

- Measures taken by countries to reduce carbon footprints

- Carbon credits and subsidy plans/benefits rolled out by the government for market players

- Effective ways to harness carbon-credits and impact on profit margins

- Demand impact on the companies opting for carbon credit

- Major Roadblocks for the Market Growth

- Government Regulation

- Industry Risk Analysis

- Global Economic Outlook: Challenges for Global Recovery and its Impact on Global Secondary Aluminum Alloy Market

- Ukraine-Russia crisis

- Potential US economic slowdown

- Industry Pricing Benchmarking & Analysis

- Trade Outlook

- Export Analysis

- Import Analysis

- Industry Growth Outlook w.r.t Type

- Industry Supply Chain Analysis

- Analysis of Key Secondary Aluminum Alloy Manufacturers

- Regional Demand Analysis

- Competitive Positioning: Strategies to differentiate a company from its competitors

- Competitive Model: A Detailed Inside View for Investors

- Market share of major companies profiled, 2022

- Business profiles of key enterprises

- Daiki Aluminum Industry Co., Ltd.

- Century Metal Recycling Limited

- Kawashima Co., Ltd.

- Superior Aluminum Alloys, LLC

- Alucast

- Metal Exchange Corporation

- Keiaisha Co., Ltd.

- Novelis

- Shin Wen Ching Metal Enterprise., Ltd.

- Sunalco Industries Pvt. Ltd.

- Matalco Inc.

- BERMCO Aluminum

- Global Secondary Aluminum Alloy Market Outlook & Projections, Opportunity Assessment, 2022 to 2035

- Market Overview

- Market Revenue by Value (USD Million), Market Volume (Kilo Tons), and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Global Secondary Aluminum Alloy Market Outlook & Projections, Opportunity Assessment by Segment

- By Type

- Wrought Aluminum Alloys, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- Cast Aluminum Alloys, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- By Strength

- Low Strength Aluminum Alloys, Market Value (USD Million), CAGR, 2023-2036F

- High Strength Aluminum Alloys, Market Value (USD Million), CAGR, 2023-2036F

- Ultra-High Strength Aluminum Alloys, Market Value (USD Million), CAGR, 2023-2036F

- By End Use Industry

- Automotive & Transportation, Market Value (USD Million), CAGR, 2023-2036F

- Building & Construction, Market Value (USD Million), CAGR, 2023-2036F

- Aerospace & Defense, Market Value (USD Million), CAGR, 2023-2036F

- Others, Market Value (USD Million), CAGR, 2023-2036F

- By Region

- Market Overview

- Market Revenue by Value (USD Million), Market Volume (Kilo Tons), and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- North America, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- Europe, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- Asia Pacific, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- Latin America, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- Middle East & Africa, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- By Type

- North America Secondary Aluminum Alloy Market Outlook & Projections, Opportunity Assessment, 2022 to 2035

- Market Overview

- Market Revenue by Value (USD Million), Market Volume (Kilo Tons), and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- North America Secondary Aluminum Alloy Market Outlook & Projections, Opportunity Assessment by Segment

- By Type

- Wrought Aluminum Alloys, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- Cast Aluminum Alloys, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- By Strength

- Low Strength Aluminum Alloys, Market Value (USD Million), CAGR, 2023-2036F

- High Strength Aluminum Alloys, Market Value (USD Million), CAGR, 2023-2036F

- Ultra-High Strength Aluminum Alloys, Market Value (USD Million), CAGR, 2023-2036F

- By End Use Industry

- Automotive & Transportation, Market Value (USD Million), CAGR, 2023-2036F

- Building & Construction, Market Value (USD Million), CAGR, 2023-2036F

- Aerospace & Defense, Market Value (USD Million), CAGR, 2023-2036F

- Others, Market Value (USD Million), CAGR, 2023-2036F

- By Country

- US, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- Canada, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- By Type

- Europe Secondary Aluminum Alloy Market Outlook & Projections, Opportunity Assessment, 2022 to 2035

- Market Overview

- Market Revenue by Value (USD Million), Market Volume (Kilo Tons), and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Europe Secondary Aluminum Alloy Market Outlook & Projections, Opportunity Assessment by Segment

- By Type

- By Strength

- By End User

- By Country

- Germany, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- UK, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- France, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- Italy, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- Spain, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- Netherlands, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- Russia, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- Rest of Europe, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- Asia Pacific Secondary Aluminum Alloy Market Outlook & Projections, Opportunity Assessment, 2022 to 2035

- Market Overview

- Market Revenue by Value (USD Million), Market Volume (Kilo Tons), and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Asia Pacific Secondary Aluminum Alloy Market Outlook & Projections, Opportunity Assessment by Segment

- By Type

- By Strength

- By End User

- By Country

- China, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- India, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- Japan, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- South Korea, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- Singapore, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- Australia, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- Rest of Asia Pacific, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- Latin America Secondary Aluminum Alloy Market Outlook & Projections, Opportunity Assessment, 2022 to 2035

- Market Overview

- Market Revenue by Value (USD Million), Market Volume (Kilo Tons), and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Latin America Secondary Aluminum Alloy Market Outlook & Projections, Opportunity Assessment by Segment

- By Type

- By Strength

- By End User

- By Country

- Brazil, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- Mexico, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- Argentina, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- Rest of Latin America, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- Middle East & Africa Secondary Aluminum Alloy Market Outlook & Projections, Opportunity Assessment, 2022 to 2035

- Market Overview

- Market Revenue by Value (USD Million), Market Volume (Kilo Tons), and Compound Annual Growth Rate (CAGR)

- • Year-on-Year (Y-o-Y) Growth Trend Analysis

- Middle East & Africa Secondary Aluminum Alloy Market Outlook & Projections, Opportunity Assessment by Segment

- By Type

- By Strength

- By End User

- By Country

- GCC, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- Israel, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- South Africa, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

- Rest of Middle East and Africa, Market Value (USD Million) & Market Volume (Kilo Tons), CAGR, 2023-2036F

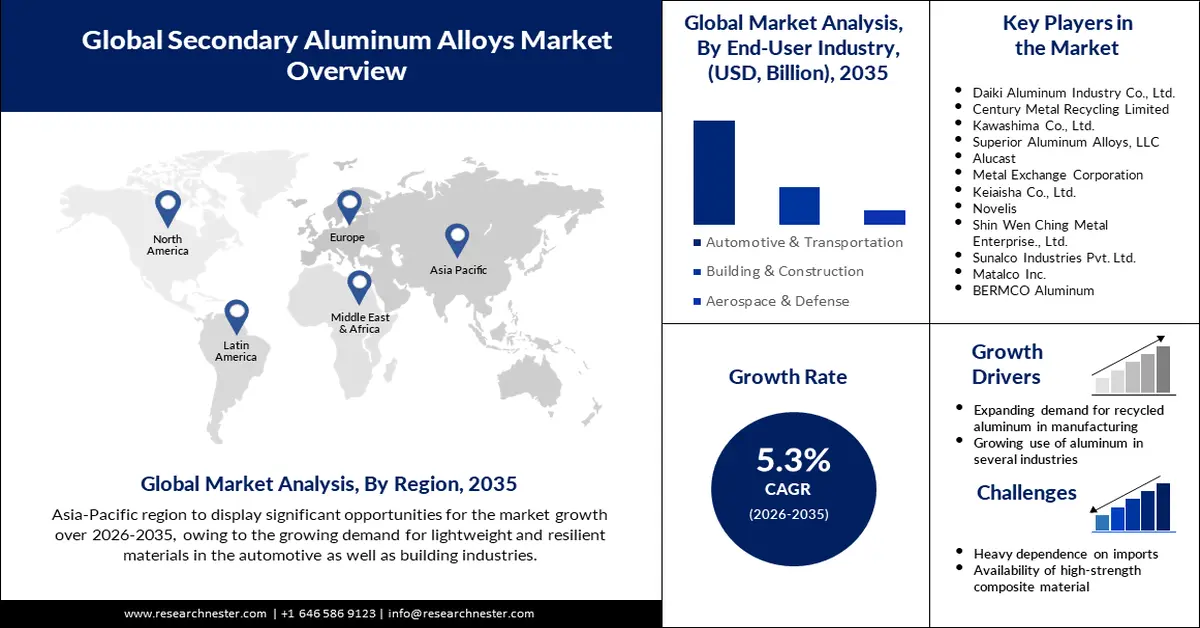

Secondary Aluminum Alloy Market Outlook:

Secondary Aluminum Alloy Market size was over USD 104 billion in 2025 and is poised to exceed USD 174.31 billion by 2035, witnessing over 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of secondary aluminum alloy is evaluated at USD 108.96 billion.

The market for secondary aluminum alloys is expanding quicker due to rising demand for ecologically friendly and environmentally-friendly goods, increased knowledge of the numerous advantages of recycling, and the cost-effectiveness of employing recycled aluminum.

Globally, increasing industrialization has resulted in increased urbanization and economic development. Because of rising industrialization, there is a demand for industrial secondary aluminum alloy for a wide range of purposes, including building and construction. Furthermore, rising GDP in the major countries boosts spending power or capacity on specific things. This, in turn, is simultaneously propelling secondary aluminum alloy requirements which are driving the market positively.

Key Secondary Aluminum Alloy Market Insights Summary:

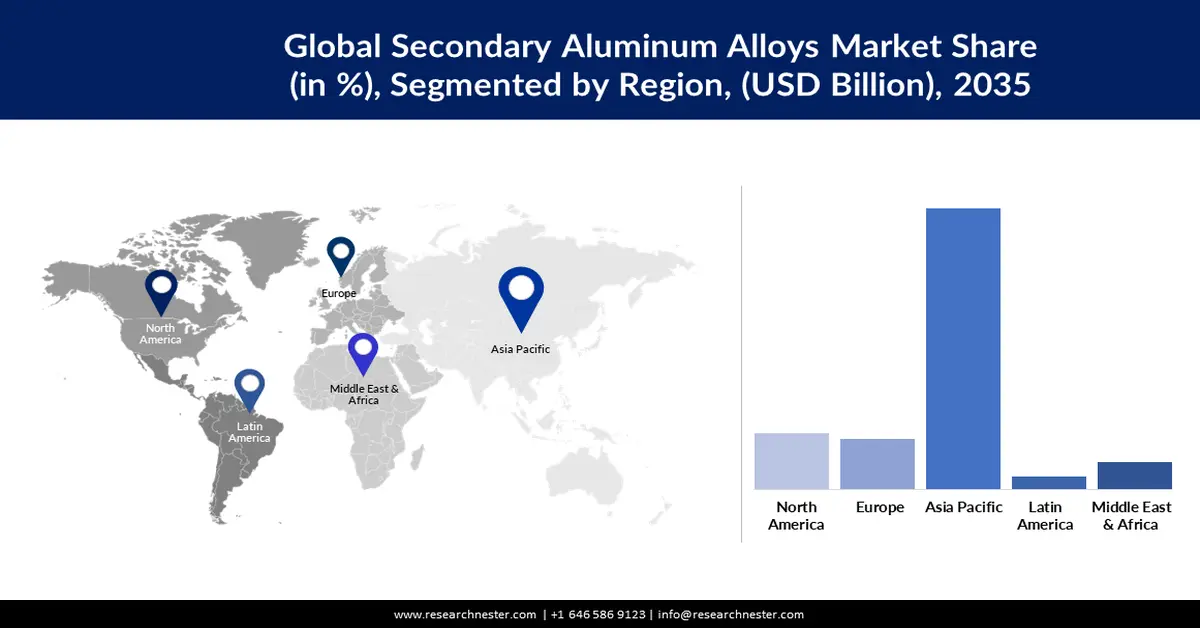

Regional Highlights:

- Asia Pacific is projected to command a 65% share by 2035 in the Secondary Aluminum Alloy Market, owing to the region’s rising focus on sustainable and eco-friendly practices.

- Over 2026–2035, the Middle East & Africa market is expected to grow at a CAGR of 5.5%, underpinned by a stable supply of aluminum scrap generated by expanding industrial activities.

Segment Insights:

- The automotive & transportation segment is anticipated to secure the largest revenue share by 2035 in the Secondary Aluminum Alloy Market, propelled by increasing demand for lightweight materials in EVs.

- The high-strength aluminum alloys segment is set to grow at a CAGR of 5.4% over 2026–2035, supported by rising requirements for products with high tensile strength, corrosion resistance, recyclability, and longer shelf life.

Key Growth Trends:

- Increasing Demand in the Automobile Industry

- Growing Demand for a Green and Safe Environment

Major Challenges:

- Heavy Dependence on Imports

- Lack of Automation

Key Players: Daiki Aluminum Industry Co., Ltd., Century Metal Recycling Limited, Kawashima Co., Ltd., Superior Aluminum Alloys, LLC, Alucast, Metal Exchange Corporation, Keiaisha Co., Ltd., Novelis, Shin Wen Ching Metal Enterprise., Ltd., Sunalco Industries Pvt. Ltd., Matalco Inc., BERMCO Aluminum.

Global Secondary Aluminum Alloy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 104 billion

- 2026 Market Size: USD 108.96 billion

- Projected Market Size: USD 174.31 billion by 2035

- Growth Forecasts: 5.3%

Key Regional Dynamics:

- Largest Region: Asia Pacific (65% Share by 2035)

- Fastest Growing Region: Middle East & Africa

- Dominating Countries: China, United States, India, Japan, Germany

- Emerging Countries: Indonesia, Vietnam, Brazil, Mexico, United Arab Emirates

Last updated on : 19 November, 2025

Secondary Aluminum Alloy Market - Growth Drivers and Challenges

Growth Drivers

- Increasing Demand in the Automobile Industry –The growing emphasis on decreasing vehicle weight, enhancing fuel efficiency, and minimizing carbon emissions is likely to increase demand for secondary aluminum alloys in the automotive industry in the future years. For instance, in 2022, BMW, a German manufacturer of luxury vehicles, announced to use alloy-cast wheels using secondary aluminum.

- Growing Demand for a Green and Safe Environment – Secondary aluminum alloys are manufactured from repurposed aluminum, resulting in improvements in waste reduction and resource conservation. Moreover, major companies have also started adopting secondary aluminum in order to contribute to reducing greenhouse gases and creating a better environment. According to the Aluminum Association, there is a 10% rise in aluminum end-of-life recycling rates, which cuts greenhouse gas emissions in the industry by 15%.

- Growing Age of Airplanes- The active global commercial fleet now stands at 25,368 aircraft, with a 3.4% net annual increase predicted over the next ten years that will increase the total to 35,501. Moreover, the average lifespan of the active fleet will have reduced from 11.2 to 9.7 years by 2027. Over 20,400 new aircraft will be added as a replacement for 50% of existing aircraft. Aluminum is the primary composite material of the aircraft; therefore, a higher replacement will lead to demand for more secondary aluminum alloys.

Challenges

- Heavy Dependence on Imports - Around 85-90% of the total raw material needed for recycling is sourced through scrap imports, which can pose various risks for recyclers. Such risks include exposure to currency fluctuations, volatility in global scrap prices, and upfront cash payments that can lead to working capital shortages, and longer turnaround times. Furthermore, the heavy reliance on imports means that any potential increase in duty rates on scrap imports could negatively affect the profitability of recyclers unless they can effectively pass on the costs to customers which is anticipated to hamper the market growth.

- Lack of Automation

- Availability of High-Strength Composite Material

Secondary Aluminum Alloy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 104 billion |

|

Forecast Year Market Size (2035) |

USD 174.31 billion |

|

Regional Scope |

|

Secondary Aluminum Alloy Market Segmentation:

End-User Segment Analysis

By the end of 2035, the automotive & transportation segment in the secondary aluminum alloy market is estimated to gain the largest revenue share. The use of aluminum instead of steel improves passenger and commercial vehicle performance, fuel efficiency, safety, and durability while also providing several environmental advantages. Cast secondary aluminum alloy is used to make seats, gearboxes, cylinder heads, auxiliary equipment, pistons, and engine blocks. Wrought secondary aluminum alloys are utilized in truck trailers, railways, and automotive bodywork. Furthermore, increased demand for EVs is predicted to drive market development, since EVs' low weight requirements would necessitate a higher amount of plastics and aluminum in them than conventional fuel cars.

Strength Segment Analysis

Secondary aluminum alloy market from the high-strength aluminum alloys segment is expected to grow at the fastest CAGR of 5.4%. The growth is attributed to its strong penetration in the automotive and transportation industries, as well as Asia Pacific's fast-rising automotive market. The need for goods with high tensile strength, corrosion resistance, minimal maintenance, recyclability, and extended shelf lives in various end-use sectors is the key factor driving the expansion of the high-strength aluminum alloy segment.

Our in-depth analysis of the global secondary aluminum alloy market includes the following segments:

|

Type |

|

|

Strength |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Secondary Aluminum Alloy Market - Regional Analysis

APAC Market Forecast

Asia Pacific industry is predicted to hold largest revenue share of 65% by 2035, Significant factors, including the rising focus on sustainable and eco-friendly practices, are catering to the region’s market growth. Besides, the Asia-Pacific region is also growing at a rapid pace, with countries such as China, India, Japan, and South Korea being major producers and consumers of these alloys. Moreover, companies are also investing significantly in secondary aluminum alloys, which is also expected to create a positive impact on the market in the upcoming years.

Middle East & Africa Statistics

Over the forecast period, the Middle East & Africa secondary aluminum alloy market is projected to expand at a CAGR of 5.5%. The region's expansion is expected to be fueled by a stable supply of aluminum scrap generated by numerous companies that produce wasted aluminum products. As these regions' economies and industrial activities expand, so does the amount of scrap aluminum accessible for recycling. Each year, the Middle East generates a massive amount of aluminum garbage. Over 500 million aluminum cans of the beverage are utilized in UAE alone, out of which just 5% is recycled and the rest is collected by scrap dealers or goes directly to landfills.

Secondary Aluminum Alloy Market Players:

- Daiki Aluminum Industry Co., Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Century Metal Recycling Limited

- Kawashima Co., Ltd.

- Superior Aluminum Alloys, LLC

- Alucast

- Metal Exchange Corporation

- Keiaisha Co., Ltd.

- Novelis

- Shin Wen Ching Metal Enterprise., Ltd.

- Sunalco Industries Pvt. Ltd.

- Matalco Inc.

- BERMCO Aluminum

Recent Developments

- OSTI, a U.S. Department of Energy, created an innovative technique for turning scrap AA7075 aerospace alloys into high-strength secondary alloys that can be cast.

- Raffmetal, an Italian manufacturer of aluminum products, and Cromodor Wheels, an Italian producer of aluminum components, agreed to work together to create and test novel, highly recyclable aluminum alloy wheels.

- Report ID: 3578

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Secondary Aluminum Alloy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.