SATCOM Transceivers Market Outlook:

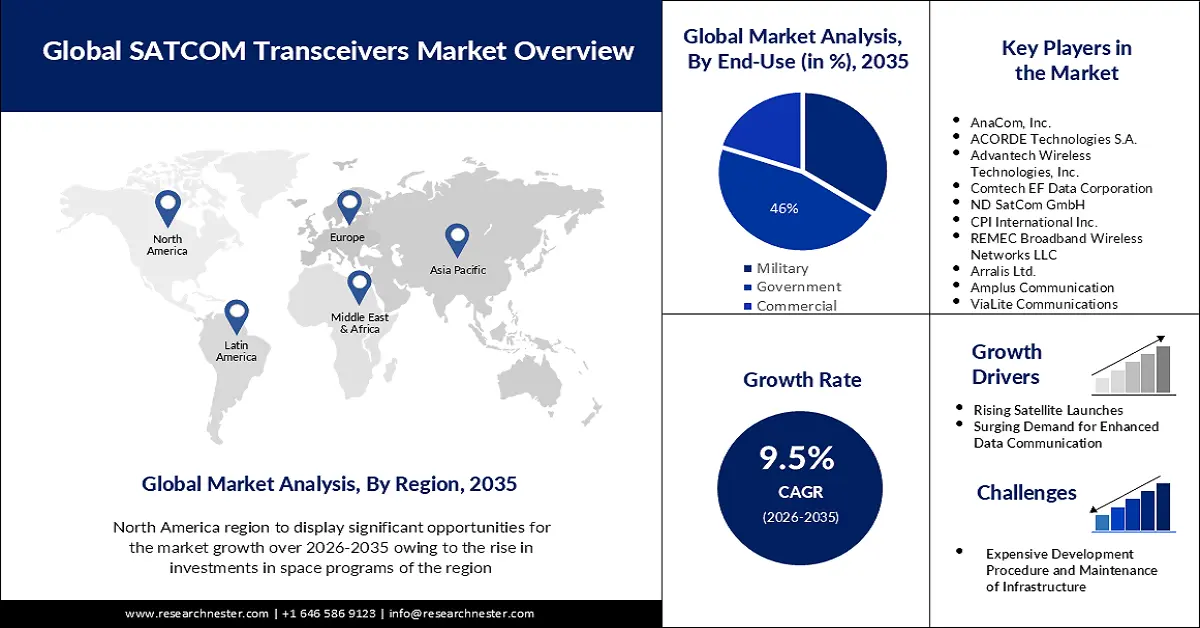

SATCOM Transceivers Market size was valued at USD 37.45 billion in 2025 and is expected to reach USD 92.81 billion by 2035, expanding at around 9.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of SATCOM transceivers is assessed at USD 40.65 billion.

The major factor for the growth of the market is the rising number of satellites present in the world and the rising demand for satellite communication for several applications such as radio broadcasting, internet application & navigations, remote sensing, water monitoring, and weather monitoring applications which requires SATCOM transceivers for proper operation. For instance, it was revealed that in 2022, there were an estimated total of 6,900 active satellites orbiting the Earth, an increase of 2,100 active satellites on 2021's value.

SATCOM is also referred to as satellite communication which is an artificial geostationary satellite that enables long-range communications by receiving radio signals from the Earth, amplifying them, and sending them back to receivers at various locations across the world. Therefore, SATCOM transceivers are being highly utilized for television, telephone, radio, internet, and military applications which are anticipated to bring lucrative growth opportunities for market growth. Furthermore, the need for improved satellite communication and the development of small satellites is also estimated to create a positive outlook for market growth during the forecast period.

Key SATCOM Transceivers Market Insights Summary:

Regional Insights:

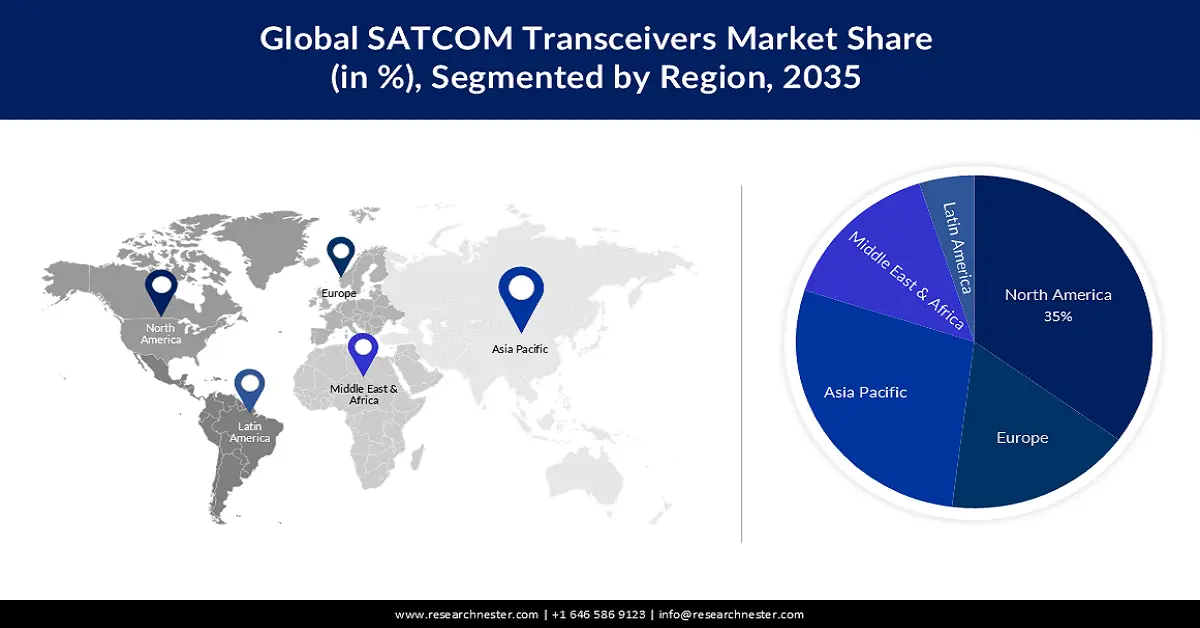

- North America is forecasted to command a 35% share of the SATCOM transceivers market by 2035, propelled by expanding satellite launches for 5G connectivity and heightened government spending on military communication networks.

- Asia Pacific is projected to secure around 24% share by 2035, underpinned by rising regional investments in national space programs and increasing satellite deployments for scientific research.

Segment Insights:

- The telecommunication segment in the SATCOM transceivers market is expected to capture about 38% share by 2035, driven by expanding global telecom investments and rising reliance on long-distance data transmission systems.

- The government segment is set to achieve nearly 46% share by 2035, owing to the accelerating use of satellite communication in defense operations and growing governmental expenditure on space initiatives.

Key Growth Trends:

- Growing Number of Satellite Launches

- Rising Integration of the Internet of Things (IoT)

Major Challenges:

- Surging Cyber Security Concerns

- Requirementenso of High Investments at Every Stage

Key Players: AnaCom, Inc., ACORDE Technologies S.A., Advantech Wireless Technologies, Inc., Comtech EF Data Corporation, ND SatCom GmbH, CPI International Inc, REMEC Broadband Wireless Networks LLC, Arralis Ltd., Amplus Communication, ViaLite Communications.

Global SATCOM Transceivers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 37.45 billion

- 2026 Market Size: USD 40.65 billion

- Projected Market Size: USD 92.81 billion by 2035

- Growth Forecasts: 9.5%

Key Regional Dynamics:

- Largest Region: Europe (majority share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Australia, United Arab Emirates, Brazil

Last updated on : 20 November, 2025

SATCOM Transceivers Market - Growth Drivers and Challenges

Growth Drivers

-

Growing Number of Satellite Launches – Every year, numerous satellites are being launched for earth observation services in numerous sectors such as civil engineering, agriculture, energy, oil & gas, and other industries. Satellites are also used for delivering high-resolution images with low-cost investments. However, for communicating with the satellites, the need for SATCOM transceivers is generated. Thus, with the high number of satellites being launched every year, the global market is expected to grow during the forecast period. For instance, in 2019, there were a total of 95 satellites launched.

- Rising Integration of the Internet of Things (IoT) – The Internet of Things (IoT) has entered into the global market as almost all of the internet-powered devices in infrastructure, environmental monitoring, military support, shipping, aviation, and others are serviced by satellites. Therefore, the rapid growth of the IoT industry is anticipated to bring lucrative growth opportunities for the expansion of the global market in the near future.

- Increasing Adoption of Automation Processes Across the World – Recent statistics that have been published in 2022, stated that automation is expected to boost global productivity by almost 2% every year. Also, almost 85% of global businesses are forecasted to introduce robots and automation in the next ten years.

- Escalation in the Use of Artificial Intelligence (AI) - It has been stated that AI is predicted to contribute almost USD 16 trillion to the global economy by 2030, and nine out of ten leading businesses are forecasted to invest in AI technologies.

- Increased Investment in the Research & Development (R&D) Sector – As per the World Bank, the Research and Development expenditure accounted for 2.63% of total GDP in 2020. This was a rise from 2.13% of the total GDP in 2017.

Challenges

-

Surging Cyber Security Concerns – One of the major concerns in SATCOM transceivers is the rising concern regarding cyber-security and cyber-crimes which is considered to be a major threat to the sustainability of satellite systems. It generates various vulnerabilities as SATCOM transceivers are mission-critical, and include communications, launch systems, tracking and command, and telemetry which requires secure and reliable communication systems. Thus, the recent surge in cyber security concerns is estimated to hamper market growth during the forecast period.

-

Requirement of High Investments at Every Stage

-

Shortage of Skilled Professionals

SATCOM Transceivers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.5% |

|

Base Year Market Size (2025) |

USD 37.45 billion |

|

Forecast Year Market Size (2035) |

USD 92.81 billion |

|

Regional Scope |

|

SATCOM Transceivers Market Segmentation:

Segment Analysis

The global SATCOM transceivers market is segmented and analyzed for demand and supply by application into telecommunication, medical, industrial, scientific, electronics, and others. Out of these segments, the telecommunication segment is estimated to gain the largest market share of about 38% in the year 2035. The major growth factor for segment expansion is the rising need for telecommunication for the transmission of information over wire, radio, optical, or other electromagnetic systems. Moreover, there has been a significant rise in the investments made in the telecommunication sector which is also anticipated to bring in favorable opportunities for segment growth during the forecast period. For instance, it has been calculated that the IT sector spending on telecommunication services was almost USD 1 trillion in 2021. It has also been revealed that global telecom services spending rose from almost USD 1,575 billion in 2018 to USD 1,600 billion in 2024.

End Use Segment Analysis

The market is also segmented and analyzed for demand and supply by end-use into commercial, government, and military. Amongst these three segments, the government segment is expected to garner a significant share of around 46% in the year 2035. The major factor for segment growth during the forecast period is the recent surge in the utilization rate of satellite communication in government processes such as military and naval operations. Another factor that is anticipated to create favorable opportunities for segment growth is the rising investments by the government in space projects. For instance, it has been calculated that in 2022, global government expenditure for space programs amounted to almost USD 100 billion.

Our in-depth analysis of the global market includes the following segments:

|

By Component |

|

|

By Application |

|

|

By Frequency Band |

|

|

By Industry |

|

|

By End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

SATCOM Transceivers Market - Regional Analysis

North American Market Forecast

North America industry is predicted to dominate majority revenue share of 35% by 2035, ascribing to the growing launch of satellites to provide 5G internet connectivity and strong presence of prominent market players in the region. Also, the rising government spending on military and government communication networks along with the presence of major key players. According to recent statistics, it has been stated that the United States government spending spent almost USD 60 billion on its space programs in 2022, making it the country with the highest space expenditure in the world.

APAC Market Statistics

Asia Pacific SATCOM transceivers market is estimated to be the second largest, registering a share of about 24% by the end of 2035. The market in Asia Pacific is estimated to witness noteworthy growth over the forecast period on the back of the increasing investments in space programs, mainly by the Indian government. In FY 2020, government expenditure on the space sector in India reached a value of more than USD 18 billion, up from USD 15 billion in FY 2019 and USD 10 billion in FY 2018, respectively. In addition, the rise in the launch of satellites for scientific research & development is also expected to fuel the market growth in the region in the coming years.

Europe Market Forecast

Further, the market in the European region, amongst the market in all the other regions, is projected to hold a majority of the share by the end of 2035. The growth of the market in the region is primarily attributed to the rising smart city and infrastructure modernization projects along with space exploration activities. Another factor for market growth is the escalation in the demand for advanced satellite communication services in the region.

SATCOM Transceivers Market Players:

- AnaCom, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ACORDE Technologies S.A.

- Advantech Wireless Technologies, Inc.

- Comtech EF Data Corporation

- ND SatCom GmbH

- CPI International Inc

- REMEC Broadband Wireless Networks LLC

- Arralis Ltd.

- Amplus Communication

- ViaLite Communications

Recent Developments

-

In the News

- CPI International Inc. was awarded an order by Eutelsat totaling more than USD 25 million to support a next-generation very high throughput satellite (VHTS) system.

- ND SATCOM unveiled the SKYWAN 5G Release 2.0 which is claimed to redefine customers’ possibilities by powering the next level of immersive VSAT experiences.

- Report ID: 4006

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

SATCOM Transceivers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.