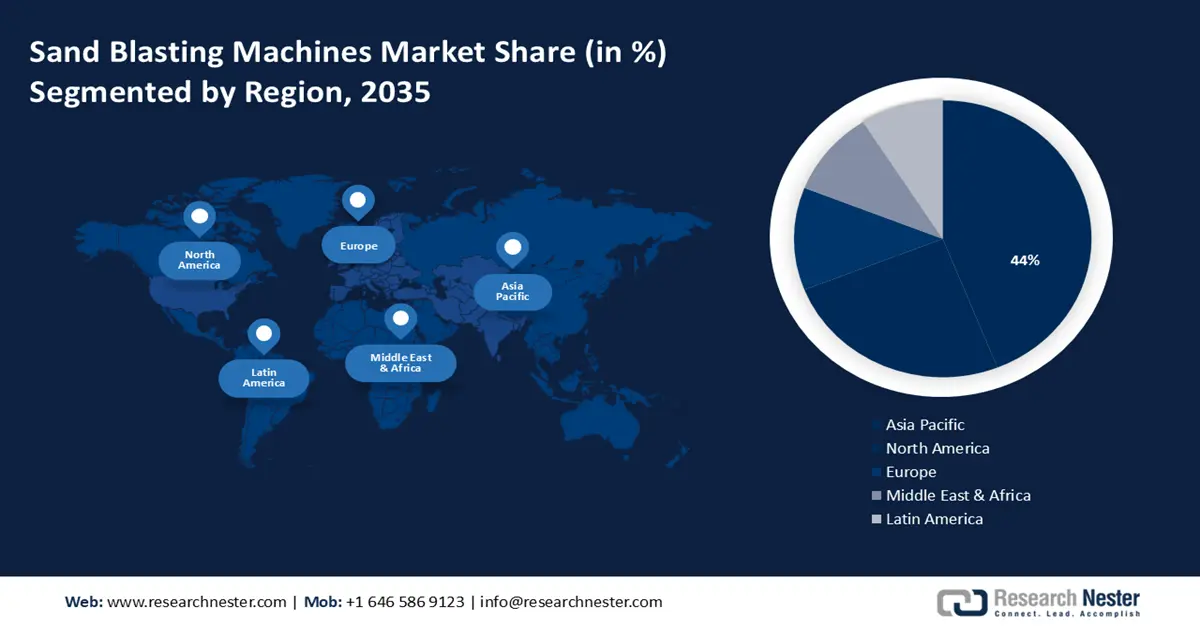

Sand Blasting Machines Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific industry is estimated to account for largest revenue share of 44% by 2035. The growth in this region is poised due to the rising infrastructure development and construction projects, attracting new businesses and consumers. World Bank July 2024 published a report, in which they provided more than 12 billion to developing countries to support infrastructure development, while highlighting that several developing countries have to spend about 4.5% of GDP for basic improvements in energy, digital, transport, and several other sectors.

China's ever-growing economy and rapid growth in heavy-duty manufacturing are set to fuel the sand blasting revenue share. The market has a primary use case in the country’s robust stainless steel industry and is a crucial raw material in shipbuilding, medical engineering, aerospace, etc. To meet the increasing steel demand, TISCO with Rösler built the vertical shot blast machine in September 2023. Similar innovations and the growing emphasis on the development of smart cities will further support the market expansion.

The Japan market is driven by ongoing innovations such as robotic blasting, air blasting, vacuum blasting, and dental sand blasting. Atsuchi Tekko is a prominent market player and offers shot peening for an extensive array of materials. Moreover, the automated sand blasting adoption in manufacturing vacuum equipment, semiconductors, and plate displays is fostering growth in the country.

North America Market Insights

Sand blasting machines market size for North America region is estimated to register significant growth through 2035. The region will account for the second position in this landscape attributed to the increasing demand for the construction sector. In addition, according to a report by the U.S. Bureau of Census in 2024, there was an increase of about 4.1% in the country’s spending on construction in 2020.

The growth in infrastructure projects, commercial structures, and housing complexes, in the U.S. is expected to boost the demand for the sand blasting machines sector. According to the U.S. Department of Treasury November 2023, as the income increases, it is expected that there will be more infrastructure per capita investments as compared to lower-income countries.

Sand blasting in Canada is in high demand owing to the prevalence of major key players such as Manus Abrasive Systems and QuickBlast. Moreover, automotive manufacturing will also act as a primary growth driver for this landscape. A recent report in 2024, sales of light vehicles in Canada are expected to gain a growth rate of about 9.6% with more than 1.9-million-unit sales.