Run-of-River Hydroelectricity Market Outlook:

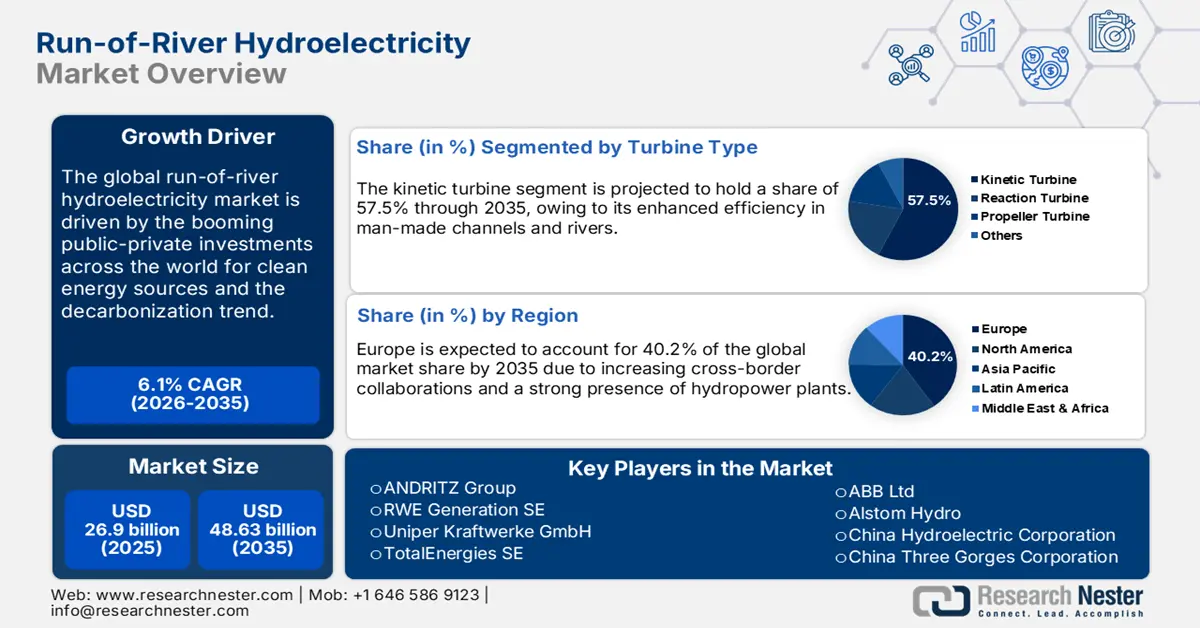

Run-of-River Hydroelectricity Market size was valued at USD 26.9 billion in 2025 and is expected to reach USD 48.63 billion by 2035, expanding at around 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of run-of-river hydroelectricity is evaluated at USD 28.38 billion.

Easy access to the purest form of raw material, water, significantly contributes to the economies worldwide, expanding their clean energy mix, particularly through hydropower. The contribution of hydropower globally is over 55.0% of any other renewables combined, states the International Energy Agency (IEA). Furthermore, the International Hydropower Association (IHA) estimates that the worldwide hydropower fleet increased to 1,412GW in 2023. The conventional hydropower capacity also surpassed 7.2 GW to 1,237 GW, and pumped storage hydropower (PSH) by 6.5 GW to 179 GW. Europe dominates the hydropower production, followed by North America, owing to the presence of a mature fleet of hydropower stations. The rise in public investments and supportive government policies is augmenting the hydropower generation activities globally.

The integration of energy storage solutions with run-of-river hydropower is set to offer lucrative opportunities for clean energy technology producers. The cost-effective electricity access compared to other sources in the long term, cross-border export opportunities, and multipurpose use of the river are mainly attracting investment in the run-of-river hydro power projects. This being a small-scale project below 10 MW also attracts public-private investments to earn lucrative gains in the long run. The allocation of positive budgets for these run-of-river hydroelectricity farms is attracting many new companies to enter the market. In the coming years, a combination of renewable technologies and positive investment actions is set to augment the sales of run-of-river hydropower technologies.

Key Run-of-River Hydroelectricity Market Insights Summary:

Regional Highlights:

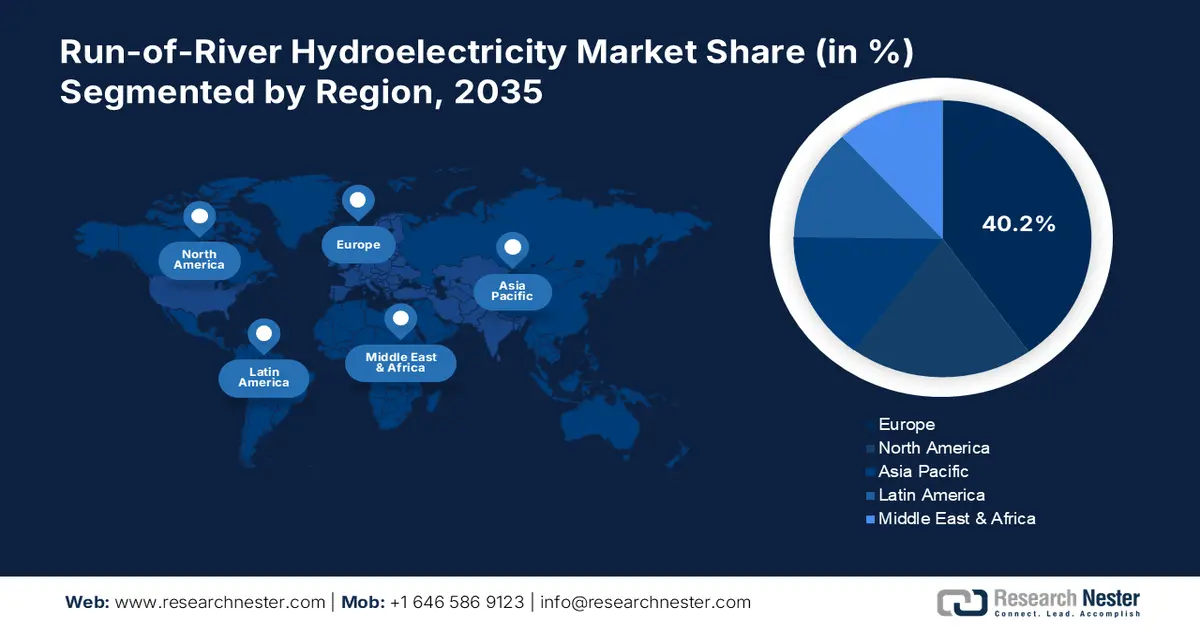

- Europe is projected to secure over 40.2% share by 2035 in the run-of-river hydroelectricity market, supported by extensive grants, incentives, and strong commitments to net-zero emission goals.

- North America is anticipated to maintain a substantial share through 2035, propelled by government-led hydro capacity expansion initiatives and rising public-private investment efforts.

Segment Insights:

- The kinetic turbine segment is expected to command around 57.5% share by 2035 in the run-of-river hydroelectricity market, bolstered by its adaptability across diverse water channels and rising technological advancements.

- The industrial segment is poised to exceed 68.8% share by 2035, underpinned by escalating clean-energy adoption in manufacturing and supportive tax credits.

Key Growth Trends:

- Clean energy economy race

- Developing regions to offer higher returns

Major Challenges:

- Geographical limitations hamper technology sales

- High initial capital investment

Key Players: ANDRITZ Group, RWE Generation SE, Uniper Kraftwerke GmbH, TotalEnergies SE, Électricité de France SA, ABB Ltd, Alstom Hydro, China Hydroelectric Corporation, China Three Gorges Corporation, CPFL Energia S.A., GE Energy, Gerdau S.A., Sinohydro Corporation, General Electric (GE) Co., Turbine Generator Maintenance Inc., Arani Power Systems, Elliott Group.

Global Run-of-River Hydroelectricity Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 26.9 billion

- 2026 Market Size: USD 28.38 billion

- Projected Market Size: USD 48.63 billion by 2035

- Growth Forecasts: 6.1%

Key Regional Dynamics:

- Largest Region: Europe (40.2% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Canada, Norway, India

- Emerging Countries: Brazil, Indonesia, Vietnam, Turkey, Chile

Last updated on : 3 December, 2025

Run-of-River Hydroelectricity Market - Growth Drivers and Challenges

Growth Drivers

- Clean energy economy race: The increasing importance of a clean energy mix and decarbonization goals is necessitating governments worldwide to increase their renewable capacities. Many countries are investing in hydropower projects such as run-of-river, diversions, and pumped storage, owing to the most cost-effective availability of the main raw material. The IEA report states the clean technologies market is poised to cross USD 2.0 trillion by 2030, up from USD 700.0 billion in 2023. The race of countries to define their clean energy economy is anticipated to double the earning opportunities of run-of-river technology producers.

- Developing regions to offer higher returns: The high-potential economies are emerging as opportunistic marketplaces for run-of-river technology providers. For instance, the IHA study states that Ecuador is witnessing significant investments in hydropower projects. Recently, Ecoener SA invested USD 200 million for the development of 2 run-of-river hydropower projects in Santa Rosa and El Rosario, with a total of 99 MW of capacity. Furthermore, the cross-border investments are set to offer high revenues to the market players in the years ahead. In September 2022, the 102 MW Gulpur run-of-river plant was inaugurated in Pakistan, for which ANDRITZ Group had supplied electromechanical and hydro-mechanical equipment back in 2015.

Challenges

- Geographical limitations hamper technology sales: The limited availability of suitable river locations is expected to hinder the run-of-river (ROR) hydroelectricity market growth to some extent. These type of hydropower projects requires a suitable water flow and river topography to generate energy. Unavailability of such particular river locations makes it less intrusive and unsuitable for run-of-river hydropower projects. This not only limits the number of new projects but also the sales of technologies.

- High initial capital investment: The run-of-river hydroelectricity projects are capital-intensive owing to the integration of advanced technologies and infrastructure. This makes it less attractive for small-scale investors and also limits the market entry of new companies. The high capital expenditure on these complex projects limits their number in price-sensitive markets. Thus, less access to financing is expected to lower the expansion of run-of-river hydropower farms in regions with low budgets.

Run-of-River Hydroelectricity Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 26.9 billion |

|

Forecast Year Market Size (2035) |

USD 48.63 billion |

|

Regional Scope |

|

Run-of-River Hydroelectricity Market Segmentation:

Turbine Type Segment Analysis

Kinetic turbine segment is expected to account for run-of-river hydroelectricity market share of around 57.5% by 2035. The enhanced ability of the kinetic turbine to operate effectively in man-made channels, rivers, tidal waters, and ocean currents is mainly contributing to its sales growth. The ongoing technological advancements are poised to boost the sales of advanced kinetic turbines in the years ahead. Furthermore, the public-private investment strategies are also driving the sales of hydropower kinetic turbines. For instance, in November 2020, the U.S DOE invested around USD 35.0 million for the development of hydrokinetic turbines. Such investments are driving the introduction of advanced kinetic turbine designs for riverine currents.

End use Segment Analysis

In run-of-river hydroelectricity market, industrial segment is poised to hold revenue share of more than 68.8% by 2035. The high energy demand in industrial structures is mainly driving the segment growth. The industries are more focused on sustainable manufacturing practices, and the use of renewable energy is one part of it. The tax credits and subsidies are necessitating several industries to invest in clean energy. The collaboration of industrial companies with run-of-river hydroelectricity stations is poised to offer lucrative benefits at both ends. The lower environmental impact and flexibility also increase the industrial use of run-of-river hydroelectricity.

Our in-depth analysis of the global run-of-river (ROR) hydroelectricity market includes the following segments:

|

Turbine Type |

|

|

Capacity |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Run-of-River Hydroelectricity Market - Regional Analysis

Europe Market Insights

Europe run-of-river hydroelectricity market is expected to capture revenue share of over 40.2% by 2035. The supportive government policies in the form of grants, schemes, and incentives are set to increase the expansion of run-of-river hydroelectricity capacity in the region. The net-zero emission goals and the Paris Agreement are necessitating the EU countries to invest in a clean energy mix. The strong presence of mature run-of-river hydroelectricity farms is also aiding the region to dominate the global landscape. The upgrade needs and introduction of advanced technologies are further set to drive the overall market growth during the foreseeable period.

The long history of the U.K. of generating electricity from water is making it an investment-worthy marketplace for leading run-of-river hydropower companies. The government support for new developments and infrastructure upgrades is driving the sales of advanced run-of-river hydroelectricity technologies. The British Hydropower Association (BHA) states that hydropower accounts for 2.0% of the total electricity production in the country, and run-of-river hydroelectricity offers a steady supply of energy in the winter season.

Spain is emerging as a high-earning market for run-of-river hydroelectricity technology manufacturers owing to the green transformation trend and adequacy of proper geological topography for the construction of hydro plants. The country has over 120 operable hydroelectric plants and offers a stable supply of clean energy to around 7.5 million homes in the country. Technological advancements and the strong presence of manufacturers are attracting positive foreign direct investments in the country.

North America Market Insights

The North America run-of-river (ROR) hydroelectricity market is expected to register a high share throughout the forecast period. The continuous efforts of governments to expand hydroelectricity capacity are creating a favorable environment for technology and equipment producers. The public-private investments for the construction of new farms or to upgrade the existing ones are also likely to offer double-digit percent revenue growth opportunities to market players. The U.S. and Canada are both profitable marketplaces, owing to their high concentration on achieving decarbonization goals and increasing clean energy mix capacity.

The rising investments in environmental development projects are likely to increase the sales of run-of-river hydroelectricity technologies in the U.S. In September 2024, the U.S. Department of Energy (DOE) revealed that the Grid Deployment Office selected around 293 capital improvement facilities for negotiations in around thirty-three states. These projects are estimated to receive over USD 430.0 million in incentives for the maintenance and improvement of hydroelectric farms. The government support is set to play a vital role in the expansion of run-of-river hydropower projects in the country in the years ahead.

Canada is a lucrative marketplace for run-of-river hydroelectricity technology producers owing to its supremacy in hydropower production. The country accounts for the 3rd position across the world in hydroelectricity generation and captured nearly 393'789 gigawatt-hours of it in 2022. The run-of-river hydroelectricity projects in the country vary between less than 1 MW to almost 1900 MW in size. The increase in cumulative capacity installations is anticipated to drive higher returns to industry giants in the years ahead.

Run-of-River Hydroelectricity Market Players:

- ANDRITZ Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- RWE Generation SE

- Uniper Kraftwerke GmbH

- TotalEnergies SE

- Électricité de France SA

- ABB Ltd

- Alstom Hydro

- China Hydroelectric Corporation

- China Three Gorges Corporation

- CPFL Energia S.A.

- GE Energy

- Gerdau S.A.

- Sinohydro Corporation

- General Electric (GE) Co.

- Turbine Generator Maintenance Inc.

- Arani Power Systems

- Elliott Group

The companies involved in the run-of-river hydroelectricity market are employing several organic and inorganic tactics to earn high profits and increase their reach. They are investing significantly in research and development activities to introduce innovative technology and stand out in the crowd. The key players are also collaborating with public entities and partnering with other companies to boost their revenue shares. Considering the increasing hydropower infrastructure development actions across the developing regions, the industry giants are adopting regional expansion strategies to emerge as a dominant player in the domestic market.

Some of the key players include run-of-river (ROR) hydroelectricity market:

Recent Developments

- In June 2024, ANDRITZ Group announced that it offered services to Uniper Kraftwerke GmbH to renew three governors for the machines of the hydropower plant in Dingolfing, Lower Bavaria. The design phase and production procurement of components are set to be completed by mid-2025.

- In January 2023, RWE Generation SE announced the completion of a battery system with a total capacity of 117 megawatts in Germany. This new battery storage system is special owing to its virtual connection with RWE’s run-of-river power plants along the Moselle River.

- Report ID: 7525

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.