Rubella Treatment Market Outlook:

Rubella Treatment Market size was valued at USD 258.2 million in 2025 and is projected to reach USD 426.9 million by the end of 2035, rising at a CAGR of approximately 5.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of rubella treatment is estimated at USD 271.4 million.

The escalating patient population and continued efforts to eliminate rubella through immunization programs are key factors facilitating upliftment in the market. As evidence the article published by the World Health Organization in May 2024 found that rubella is the leading vaccine-preventable cause of birth defects, wherein 100,000 infants are born every year across all nations affected by congenital rubella syndrome (CRS). It also stated that around 18,000 cases were reported across 78 countries in 2022, thereby positively influencing market growth.

Furthermore, from a pricing perspective, CDC in September 2025 reported that rubella is suggested as part of the combined measles, mumps, and rubella vaccine, which is available under two main brands, M-M-RII by Merck and Priorix by GlaxoSmithKline. For pediatric use, the CDC contract price for M-M-RII is around USD 26.35 per dose, wherein Priorix is USD 26.33, making them nearly identical in public sector pricing. The private sector M-M-RII displayed higher costs at USD 97.99 per dose when compared to USD 95.20 for Priorix, reflecting affordability in terms of public programs.

Key Rubella Treatment Market Insights Summary:

Regional Insights:

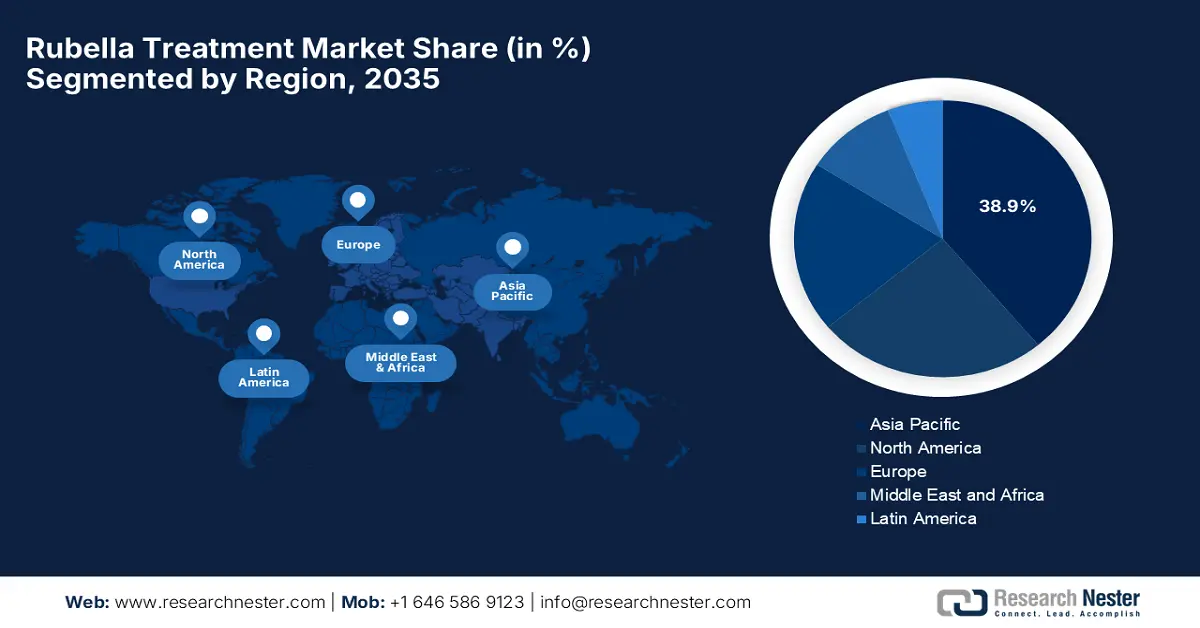

- By 2035, Asia Pacific is anticipated to secure a 38.9% share in the Rubella Treatment Market, sustained by expanding government investments and maternal health policies.

- North America is set to experience notable advancement through 2035, underpinned by its robust public health framework, reimbursement programs, and high prenatal care standards.

Segment Insights:

- Hospitals are expected to command a 46.5% share by 2035 in the Rubella Treatment Market, anchored by the segment’s ability to provide comprehensive care including diagnosis, treatment, and vaccination programs.

- The analgesic-based treatments segment is projected to secure a 42.6% share by 2035, supported by its effectiveness in managing fever and joint pain.

Key Growth Trends:

- Improved diagnostic awareness

- Growing focus on maternal & neonatal health

Major Challenges:

- Limited access

- Complex diagnostics

Key Players: Merck & Co., Inc.,GlaxoSmithKline plc (GSK),Sanofi Pasteur,Pfizer Inc.,Novartis AG,Takeda Pharmaceutical Company,Bavarian Nordic A/S,CSL Limited,Serum Institute of India Pvt. Ltd.,Biological E. Limited,Johnson & Johnson,AstraZeneca PLC,Mitsubishi Tanabe Pharma,Green Cross Corp,KM Biologics,Panacea Biotec,Bio Farma,Zuellig Pharma,Probiomed,Sinovac Biotech Ltd.

Global Rubella Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 258.2 million

- 2026 Market Size:USD 271.4 million

- Projected Market Size: USD 426.9 million by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.9% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- •Emerging Countries: India, Brazil, South Korea, Mexico, Indonesia

Last updated on : 30 September, 2025

Rubella Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Government programs & public health initiatives: The immunization campaigns by governments, international bodies, and national maternal health strategies are prompting a greater business environment for the market. In April, the Union Health Minister in India launched the National Zero Measles-Rubella Elimination Campaign to achieve 100% immunization coverage through the administration of two MR vaccine doses. In India, the MR vaccination coverage has reached 93.7% for the first dose and 92.2% for the second, hence positively influencing market growth.

- Improved diagnostic awareness: The enhancements in terms of diagnostic tools, such as serological tests, immunoassays, and point-of-care diagnostics, are enabling earlier detection of rubella infections, facilitating upliftment in the rubella treatment market. In this regard, the CDC in June 2024 stated that Rubella IgG serology testing is the primary method for assessing immunity before, during, and after pregnancy. Besides, the IgG avidity testing helps distinguish recent infection (low avidity) from past exposure or vaccination (high avidity), which is especially useful in early pregnancy to assess the risk of congenital rubella syndrome.

- Growing focus on maternal & neonatal health: There has been consistent progress in the awareness of rubella risk during pregnancy, which encourages prenatal screening, prophylactic / post-exposure treatments, and immunoglobulin therapies. As of June 2023, the HealthDirect Australia report states that women planning pregnancy should get screened for rubella immunity and get vaccinated if not immune, avoiding pregnancy for 28 days after vaccination, providing an optimistic opportunity for pioneers in this field.

Reported Rubella Cases and Incidence in 2023 (Selected Countries)

|

Country |

Reported Rubella Cases (2023) |

Reported Rubella Incidence (per 1 million population) |

|

Chad |

10,918 |

5,651 |

|

Somalia |

2,407 |

1,311 |

|

Guinea-Bissau |

255 |

1,184 |

|

Nigeria |

10,221 |

449 |

|

Ethiopia |

1,085 |

84 |

|

All 19 non-RCV Countries |

27,989 |

78% of global reported cases |

Source: NIH

MR Vaccine Prices per Dose 2021-2025

|

Year |

Supplier |

Presentation |

Price (USD) |

|

2021 |

Serum Institute of India |

10-dose |

USD 0.6360 – USD 0.6460 |

|

2022 |

Serum Institute of India |

10-dose |

USD 0.6560 |

|

2023 |

Serum Institute of India |

10-dose |

USD 0.6560 |

|

2024 |

Serum Institute of India |

10-dose |

USD 0.7210 |

|

2025 |

Serum Institute of India |

10-dose |

USD 0.7930 |

|

2021 |

BE Vaccines (Singapore pore) |

5-dose |

USD 0.9360 |

|

2022 |

BE Vaccines (Singapore) |

5-dose |

USD 0.9360 |

|

2023 |

BE Vaccines (Singapore) |

5-dose |

USD 0.9900 |

|

2024 |

Serum Institute of India |

5-dose |

USD 0.8200 |

|

2025 |

Serum Institute of India |

5-dose |

USD 0.8200 |

|

2025 |

Serum Life Sciences (UK) |

5-dose |

USD 1.1760 |

Source: UNICEF

Challenges

- Limited access: One of the most considerable obstacles for the rubella treatment market is the limited access in certain regions. Despite the proven effectiveness of the measles-mumps-rubella (MMR) vaccine in preventing rubella infections, vaccine hesitancy fueled by misinformation, cultural fears, and fear about side effects creates a barrier for market upliftment, affecting overall coverage. This further necessitates strong public health communication and education to build trust.

- Complex diagnostics: This is yet another factor hindering the expansion of the rubella treatment market across major economies. The difficulty in accurately diagnosing rubella infections, especially in pregnant women, is that it can be mild or even absent, making clinical diagnosis unreliable. Moreover, serology testing, particularly IgM tests, can produce false positives due to cross-reactivity with other infections or lingering antibodies from past vaccinations, leading to misdiagnosis.

Rubella Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 258.2 million |

|

Forecast Year Market Size (2035) |

USD 426.9 million |

|

Regional Scope |

|

Rubella Treatment Market Segmentation:

Healthcare Channel Segment Analysis

Based on the healthcare channel hospitals segment, it is projected to garner the largest revenue share of 46.5% in the rubella treatment market during the forecast timeline. The dominance of the segment is effectively attributable to the comprehensive care offered by the subtype, including diagnosis, treatment, and vaccination programs. The existence of robust infrastructure and skilled healthcare personnel enables hospitals to manage rubella cases effectively, hence denoting a wider segment scope.

Type Segment Analysis

In terms of type, the analgesic-based treatments segment is likely to attain a significant share of 42.6% in the rubella treatment market by the end of 2035. The growth in the segment is highly subject to its effectiveness in managing conditions such as fever and joint pain, which are common in rubella infections. In January 2025, the Council of Scientific and Industrial Research (CSIR), under the Ministry of Science & Technology, developed indigenous technology for manufacturing paracetamol, a widely used analgesic and fever reducer, denoting a positive segment outlook.

Treatment Type Segment Analysis

Based on treatment type, the vaccination segment is predicted to grow at a remarkable rate in the rubella treatment market during the assessed timeframe. The global public health strategy to eliminate rubella and prevent congenital rubella syndrome is the key factor driving growth in this segment. As evidence, the WHO report published in August 2025 revealed that Nepal has eliminated rubella as a public health problem, marking a major event in protecting its population from vaccine-preventable diseases, effectively attributed to sustained immunization efforts.

Our in-depth analysis of the rubella treatment market includes the following segments:

|

Segment |

Subsegments |

|

Healthcare Channel |

|

|

Type |

|

|

Drug Type |

|

|

Treatment Type |

|

|

Route of Administration |

|

|

Age Group |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Rubella Treatment Market - Regional Analysis

APAC Market Insights

Asia Pacific is the dominant region in the rubella treatment market and is expected to hold the market share of 38.9% by the end of 2035. The market in the region is driven by the expanding government investments and maternal health policies. South Korea and Japan have higher vaccination rates. Further, South Korea and Malaysia are actively investing in maternal-fetal care via screening-linked treatment protocols supported by subsidized hospital programs. Multinational and regional players lead the market via localized production and public-private care models.

India is expected to lead the regional rubella treatment market on account of government support with the launch of multiple measles-rubella vaccination campaigns targeting children to increase immunization coverage and reduce the incidence of rubella. In March 2024, the country’s MoHFW noted that India has been honored with the prestigious Measles and Rubella Champion Award for its outstanding efforts in reducing measles and rubella cases through comprehensive vaccination campaigns and robust surveillance under the Universal Immunization Programme.

China holds a strong position in the Asia Pacific’s rubella treatment market, owing to the increasing vaccination efforts. For instance, in November 2022, the study by Vaccine reported that Beijing introduced a three-dose rubella-containing vaccine schedule, which is administered at 8 months, 18 months, and 6 years of age. In addition to this routine schedule, extra immunization efforts were directed toward high-risk groups. Besides, the study also revealed a wide variety of rubella virus strains circulating in the city, reinforcing the need for strong vaccine coverage and providing a promising opportunity for pioneers in this field.

North America Market Insights

The rubella treatment market in North America has a huge opportunity in the years ahead, which is driven by the robust public health framework, government reimbursement programs, and high prenatal care standards. For instance, in June 2022, GSK Plc reported that it had received US FDA approval for Priorix, its measles, mumps, and rubella (MMR) vaccine, for use in individuals aged 12 months and older, which will now provide US healthcare providers with an additional option to help protect patients against these contagious diseases.

The U.S. rubella treatment market is progressing steadily, supported by increasing maternal care programs and Medicaid or Medicare reimbursement reforms. Prenatal intervention demand related to rubella has grown, as rubella outbreaks have occurred among unvaccinated communities. The January 2025 article from CDC states that the rubella vaccine is given only as part of the MMR or MMRV combination vaccines, with two doses recommended for children, which should be first at 12 to 15 months and second at 4 to 6 years.

There is a huge exposure for the rubella treatment market in Canada, backed by the strong emphasis on vaccination programs, public health initiatives, and government agencies actively promoting immunization to control outbreaks. In March 2025, the country’s government reported that in 2025, the majority of measles cases occurred among individuals who were unvaccinated, accounting for 82% of reported cases, one dose (4%) or two or more doses (10%) of the measles-containing vaccine, highlighting gaps in vaccine coverage and the urgent need to increase awareness in the country.

Rubella Vaccine Recommendations from CDC

|

Category |

Recommendation |

|

Adults |

1 or 2 doses of MMR if no evidence of immunity; important for healthcare workers, travelers, and childbearing-aged women |

|

Pregnant Women |

Should NOT get MMR during pregnancy; vaccinate immediately after delivery if no immunity |

Source: CDC

Europe Market Insights

Europe is retaining its strong position in the rubella treatment market due to the presence of robust public reimbursement frameworks and government-backed maternal health programs. In July 2024, NIH analyzed rubella immunity among 7,937 pregnant women in Rome from 2021 to 2023, which found that 91% were immune while 9% were susceptible. Besides the WHO declaring rubella eliminated in Italy in 2022, the 9% susceptibility rate exceeds the National Plan's target of under 5% for women of childbearing age, which highlights the continued importance of preconceptional rubella vaccination, denoting a positive market outlook.

Germany is augmenting its leadership in the regional rubella treatment market due to increased maternal infection screening and a strong focus on prevention through vaccination, as there is no specific antiviral treatment for rubella once infection occurs. Besides the efforts to increase vaccination coverage and public awareness, which contribute significantly to managing the disease burden, they are also readily fostering a profitable business environment for the rubella treatment industry.

The U.K. is one of the most influential landscapes for the rubella treatment market, backed by a highly organized public health framework where the primary focus is on prevention through a robust national immunization program. The country’s government in September 2025 stated that MMR vaccine coverage remains high but shows a slight decline over recent years, wherein the first dose coverage is around 92% to95% and the second dose is between 84% to 89%. The UK continues to maintain strong surveillance and vaccination efforts, including plans to bring the second MMR dose forward.

UK Measles and Rubella Elimination Indicators

|

Year |

MMR 1st Dose Coverage (%) |

MMR 2nd Dose Coverage (%) |

Measles Cases |

Measles Incidence per Million |

Measles WHO Status |

Rubella WHO Status |

|

2021 |

93.8 |

86.5 |

2 |

0.00 |

Eliminated |

Eliminated |

|

2023 |

92.3 |

84.5 |

481 |

6.00 |

Eliminated |

Eliminated |

|

2024 |

92.3 |

84.5 |

3,681 |

51.3 |

Pending |

Pending |

Source: GOV.UK

Key Rubella Treatment Market Players:

- Merck & Co., Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GlaxoSmithKline plc (GSK)

- Sanofi Pasteur

- Pfizer Inc.

- Novartis AG

- Takeda Pharmaceutical Company

- Bavarian Nordic A/S

- CSL Limited

- Serum Institute of India Pvt. Ltd.

- Biological E. Limited

- Johnson & Johnson

- AstraZeneca PLC

- Mitsubishi Tanabe Pharma

- Green Cross Corp

- KM Biologics

- Panacea Biotec

- Bio Farma

- Zuellig Pharma

- Probiomed

- Sinovac Biotech Ltd.

The rubella treatment market is very competitive, with strong market players from global pharmaceutical giants to regional players. Leading manufacturers such as Pfizer, GSK, Sanofi, and Merck lead the vaccine manufacturing. Meanwhile, companies like CSL, Grifols, and Kedrion are specializing in IVIG therapies for congenital rubella syndrome. Further manufacturers such as Bharat Biotech, Serum Institute of India, and LG Chem focus on affordability and access in low- and middle-income regions. As governments expand maternal health programs, competitive advantage is dependent on cost, biologic R&D, and responsive supply chain infrastructure.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In January 2025, Micron Biomedical reported that it secured a USD 7.5 million grant from the Bill & Melinda Gates Foundation, bringing total support to USD 43 million, to advance its needle-free measles-rubella vaccine technology and fund a Phase 2 trial in infants.

- In November 2023, Indian Immunologicals announced the launch of Mabella, which is a measles and rubella vaccine for children, developed in partnership with Polyvac Institute of Vietnam, with a collective goal to enhance immunization efforts and improve protection against measles and rubella among children.

- Report ID: 3621

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Rubella Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.