Rolling Stock Market Outlook:

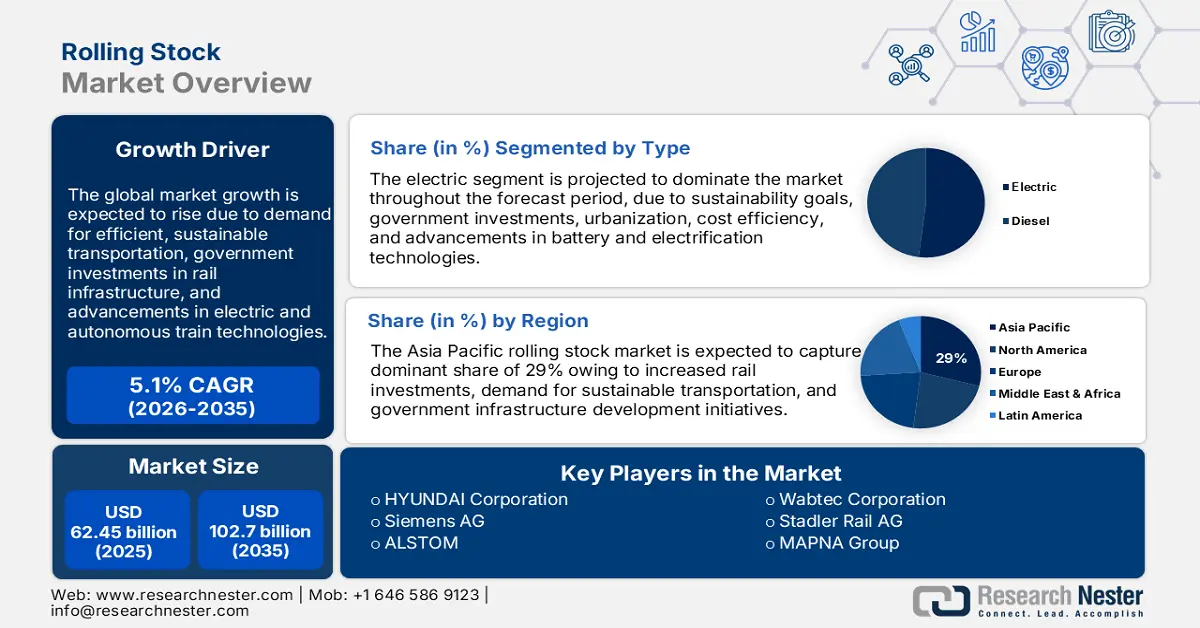

Rolling Stock Market size was over USD 62.45 billion in 2025 and is projected to reach USD 102.7 billion by 2035, witnessing around 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of rolling stock is evaluated at USD 65.32 billion.

The growth of the market can be attributed to the surging traffic congestion across the globe. They are considered one of the best means of transportation as a replacement for road traffic. As per the reported data, the average annual economic losses in the United States cities from traffic congestion accounted for USD 11.0 Billion, USD 7.6 Billion in New York and Chicago respectively, every year.

In the railway transportation industry, rolling stock refers to any vehicle that can move on rails. It includes both electric and diesel vehicles such as passenger coaches, goods wagons, and others. Nowadays, the trend of driverless trains rolling stock is increasing and does not require any driver to operate. The factors that are attributing to the growth of the global rolling stock market include the export and import of goods across the globe, and the comfort of being environmentally friendly. Moreover, the increasing use of different technologies in the form of artificial intelligence, data analytics are anticipated to further support the factors that are expanding the growth of the rolling stock market in the upcoming years.

Key Rolling Stock Market Insights Summary:

Regional Highlights:

- Asia Pacific rolling stock market is predicted to capture 29% share by 2035, fueled by growing rail infrastructure and government-funded metro projects.

- North America market will exhibit substantial growth during the forecast timeline, driven by increased metro use and railway electrification.

Segment Insights:

- The cargo train segment in the rolling stock market is anticipated to secure significant share by 2035, attributed to increased use for reliable freight transportation.

- The electric segment in the rolling stock market will command the largest share, fueled by the growing need for eco-friendly, low-emission rail transport over the forecast period 2026-2035.

Key Growth Trends:

- Surging Automation in Rolling Stock

- Surging Adoption of Public Transportation

Major Challenges:

- Requirement of High Capital and Expenditure

- Inability to Adjust the Route and Timings According to the Individual requirements

Key Players: The Kinki Sharyo Co., Ltd., HYUNDAI Corporation, Siemens AG, ALSTOM, Wabtec Corporation, Stadler Rail AG, MAPNA Group, PPF GROUP, The Greenbrier Companies, Inc., IHI Corporation.

Global Rolling Stock Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 62.45 billion

- 2026 Market Size: USD 65.32 billion

- Projected Market Size: USD 102.7 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (29% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Germany, Japan, United States, France

- Emerging Countries: China, India, Indonesia, Thailand, Brazil

Last updated on : 10 September, 2025

Rolling Stock Market Growth Drivers and Challenges:

Growth Drivers

-

Surging Automation in Rolling Stock – Different technologies, such as ATO (automatic train operation), are used in order to automate the operations of the train. Furthermore, efforts are being made to use robots to maintain the rail industry, and it is expected to boost the growth of the global rolling stock in the market. By the year 2030, it is expected that more than 30 percent of all the jobs across the globe will be automated.

-

Surging Adoption of Public Transportation –Driving more vehicles will just degrade the environment, which will affect the health of the people. Thus, the use of public transportation in the future will be more encouraged among the people, and it is projected to increase the market’s growth. As per the International Energy Agency, the passenger rail activity rises in the High Rail Scenario to 15 trillion passenger-kilometers by the year 2050.

-

Increasing Initiatives by the Government for Development of Railway Infrastructure– The governments of countries with large population are working on metro projects for easy transportation. As these projects lead to less sound pollution, no air pollution, and a reduction in traffic congestion, the government is therefore making more investments. Thus, it is anticipated to rise the growth of the market over the forecast period. The Government of India, and the Asian Development Bank signed around USD 500 million loan in order to expand the metro rail network in Bengaluru through constructing the two new metro lines totaling 50 kilometers in length.

-

Surge in Mining & Industrial Activity– The increase in mining activities, through the production of coal and others, is expected to expand the growth of the global rolling stock market. In addition, the intra- and inter-state trade of coal and other mine products is mainly done through the use of railroads for transportation. According to the data in 2020, at least 50 new coal mines will be opened in India by Coal India Limited in the next five years.

-

Rising Demand for Safer Transport Means- There has been a surge in the number of road accident cases across the globe. On the contrary, the rolling stock moves at a fixed speed, and it is anticipated to drive the market’s growth. In the year 2022, there were more than 150,000 deaths owing to road accidents in India. Moreover, more than 55 percent of the road accidents were owing to the over speeding.

Challenges

- Requirement of High Capital and Expenditure - The existing capacity of several rail franchises in relation to the rolling stock is not able to fill the rising demand. Moreover, the loading and unloading of goods require a huge cost, in addition to the wear and tear, that is further contributing to the expenditure. In addition, there is a requirement for the modernization of tracks, and signal technology for smooth operations.

- Inability to Adjust the Route and Timings According to the Individual requirements

- Lack of Advanced Infrastructure

Rolling Stock Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 62.45 billion |

|

Forecast Year Market Size (2035) |

USD 102.7 billion |

|

Regional Scope |

|

Rolling Stock Market Segmentation:

Type Segment Analysis

The global rolling stock market is segmented and analyzed for demand and supply by type into electric, and diesel. Out of the two types of rolling stock, the electric segment is estimated to gain the largest market share in the year 2035. The growth of the segment can be attributed to the surging need to opt for an environmentally friendly option that emits less carbon monoxide emissions as compared to diesel rail. Moreover, the global warming issue has been a great concern for different means of transportation, and the regulatory authorities are taking necessary actions to reduce the emissions. Therefore, it is anticipated to boost the growth of the segment in the region. For instance, diesel, in particular, plays a much larger role in freight rail, accounting for roughly two-thirds of total energy consumption globally in 2021. In the Net Zero Scenario, continuous progress on freight electrification will reduce this share to around 40% by 2030, as per the International Energy Agency.

End-user Segment Analysis

The global rolling stock market is also segmented and analyzed for demand and supply by end-user into passenger transit, and cargo train. Out of these, the cargo train segment is anticipated to hold the significant share over the forecast period. The growth of the segment can be attributed to the increasing use of rolling stock as a reliable source for transporting goods from one location to another. Moreover, it is an effective way of transportation used for industrial as well as commercial goods, that is expected to drive the segment’s growth in the market. In addition, the rolling stock is used for international or domestic trade, along with the support through government funding, that is further projected to expand the growth of the segment in the market.

Our in-depth analysis of the global rolling stock market includes the following segments:

|

By End Use |

|

|

By Type |

|

|

By Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Rolling Stock Market Regional Analysis:

APAC Market Insights

The market share of rolling stock in Asia Pacific, amongst the market in all the other regions, is projected to be the largest with a share of about 29% by the end of 2035. The growth of the market can be attributed majorly to the increasing presence of rolling stock and rail traction transformer manufacturers in the region. Along with this, the surging adoption of passenger rail for commuting, is another factor that is expected to boost the growth of the market in the region. In addition, the rising funds allocated by the government for the development of the railway industry through metro projects, and electrified network train routes is another factor that is projected to drive the market’s growth in the region. As per the estimates, in the year 2022, railways will have transported nearly 1400 million tons of freight in India.

North American Market Insights

North America region is projected to register substantial growth through 2035. The growth of the market can be attributed majorly to the increasing use of metros among the other rolling stock. Furthermore, the presence of developed infrastructure for the railway tracks is increasing the efficiency and decreasing the cost of transportation in the North America region. In addition, the increasing electrification of rail in the North America region is expected to rise the growth of the rolling stock market in the region.

Middle East and Africa Market Insights

Further, the market in the Middle East and Africa, amongst the market in all the other regions, is projected to have the second fastest growth by the end of 2035. The surging demand for developing an infrastructure of a railway system for transporting of goods such as oil, diesel, as well as passengers is the factor that is expected to drive the rolling stock in the region. Furthermore, the region places an emphasis on creating a railway infrastructure to facilitate cross border travel and trade, that is another factor that is predicted to boost the growth of the market in the Middle East and Africa region. UAE oil exports accounted for more than 25 percent of the total UAE gross domestic product according to recent data.

Rolling Stock Market Players:

- The Kinki Sharyo Co., Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- HYUNDAI Corporation

- Siemens AG

- ALSTOM

- Wabtec Corporation

- Stadler Rail AG

- MAPNA Group

- PPF GROUP

- The Greenbrier Companies, Inc.

- IHI Corporation

Recent Developments

-

The Greenbrier Companies, Inc. announced that it has acquired a 100% stake in GBX Leasing ("GBXL"), its joint venture with The Longwood Group in railcar leasing ("Longwood"). This contributes to Greenbrier's strategy of expanding its lease fleet and service offerings.

-

Stadler Rail AG signed a contract with Ferrocarrils de la Generalitat Valenciana for the supply of 16 TRAMLINK trams with the possibility of extending the order by a further 12 vehicles.

- Report ID: 4798

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Rolling Stock Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.