RF Filter Market Outlook:

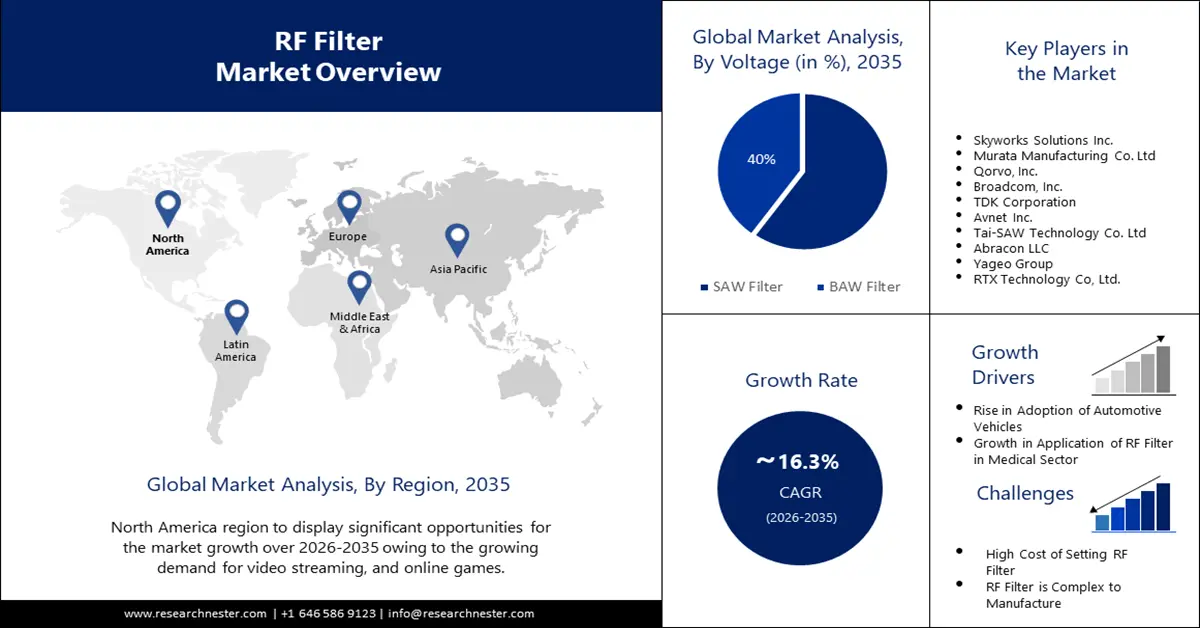

RF Filter Market size was valued at USD 17.18 billion in 2025 and is expected to reach USD 77.77 billion by 2035, registering around 16.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of RF filter is evaluated at USD 19.7 billion.

The global implementation of 5G networks is serving as a major growth factor for the RF filter market, as the technology needs advanced filters that support extensive frequencies and wide bandwidths with miniaturized designs. Various telecom operators across the globe are upgrading their networks at a fast pace to fulfill customer requirements for accelerated, high-quality mobile broadband services available through 5G technology. In December 2024, Bharti Airtel secured a multi-billion-dollar agreement with Ericsson for upgrading its 4G and 5G network coverage across India. Through this agreement, Ericsson is centralizing radio access network and Open RAN-ready solutions, and upgrading existing 4G radio software. Such developments demonstrate the requirement for RF filters in the continually expanding 5G network infrastructure.

The demand for RF filters is growing rapidly, due to increased deployment of IoT devices and elevating wireless communication specifications across standards. Modern Wi-Fi 6/6E/7 wireless technology and Bluetooth 5.3 specifications need precise frequency management options and advanced filtering systems. Various devices operating on the same spectrum require sophisticated RF filtering solutions as they need to avoid signal interferences and crosstalk. Modern electronic devices require compact and integrated RF filters to operate alongside power amplifiers and switches, as these devices are becoming progressively smaller yet more functional. Modern filter design needs a boost from system-in-package and advanced packaging technologies, which are on the rise.

Key RF Filter Market Insights Summary:

Regional Highlights:

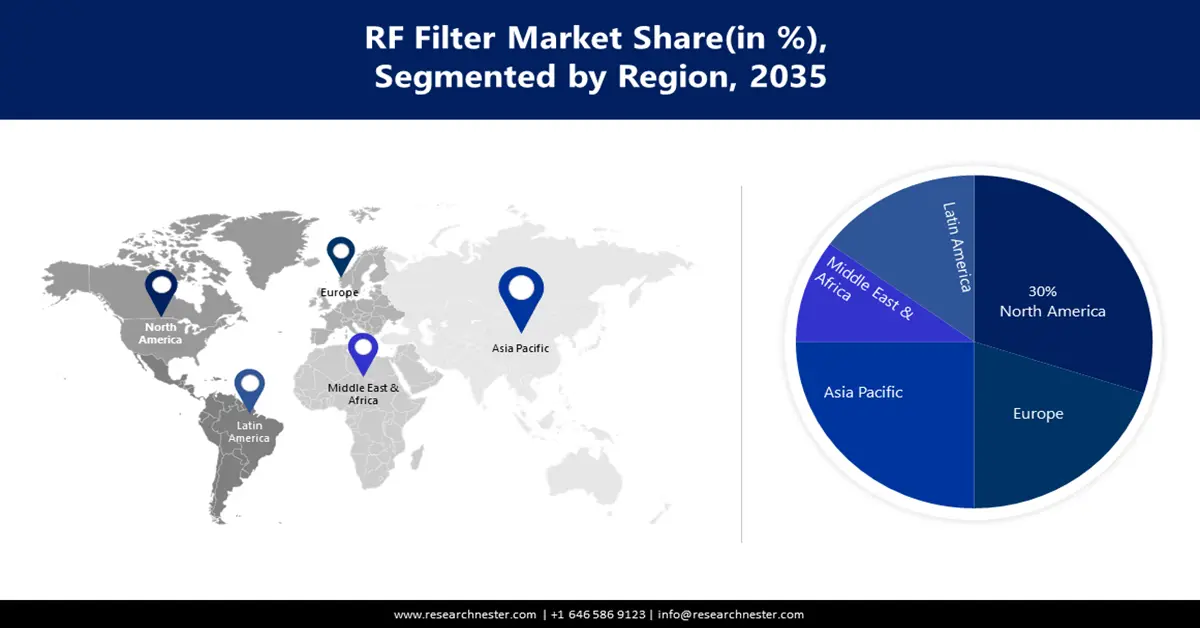

- The North America RF filter market is projected to capture a 38% share by 2035, attributed to continuous innovations in 5G, wireless, and other next-generation technologies.

Segment Insights:

- The voltage (SAW filter) segment in the RF filter market is forecasted to experience significant growth over 2026-2035, driven by the rising need for compact high-frequency components in IoT, 5G, and automotive systems.

- The mobile phone communication segment in the rf filter market is expected to hold the highest market share from 2026-2035, driven by rising demand for advanced RF filters supporting 5G networks.

Key Growth Trends:

- Rising adoption of smartphones and connected vehicles

- Growth in automotive electronics

Major Challenges:

- Thermal and power efficiency issues

Key Players: Skyworks Solutions Inc., Murata Manufacturing Co. Ltd, Qorvo, Inc., Broadcom, Inc., TDK Corporation, Avnet Inc., Tai-SAW Technology Co. Ltd, Abracon LLC, Yageo Group, RTX Technology Co, Ltd.

Global RF Filter Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.18 billion

- 2026 Market Size: USD 19.7 billion

- Projected Market Size: USD 77.77 billion by 2035

- Growth Forecasts: 16.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: China, Japan, South Korea, India, Singapore

Last updated on : 11 September, 2025

RF Filter Market Growth Drivers and Challenges:

Growth Drivers

-

Rising adoption of smartphones and connected vehicles: The rapid increase in smartphone adoption and tablet use among people, along with wearables and IoT devices, is resulting in an urgent need for advanced RF filters as they ensure seamless high-speed communication. The advanced RF filters are needed as these devices process signals through multiple frequency bands. The compact size of multi-SIM or multi-band smartphones creates difficulties for managing multiple simultaneous wireless networks (4G, 5G, Wi-Fi, Bluetooth). RF filters provide interference protection between different frequencies so that gadgets successfully operate through simultaneous transmissions with maintained performance quality.

- Growth in automotive electronics: The advanced driver assistance systems, vehicle-to-everything communication, and connected vehicles are boosting the volume of vehicle wireless communication, which demands the implementation of RF filters to achieve safety alongside minimal latency. Companies are introducing advanced products and solutions for Wi-Fi automotive and access point applications. For instance, in April 2024, Akoustis Technologies added two fresh 2.4 GHz BAW RF filters to their product line, which specifically serve Wi-Fi, automotive, and access point markets through the A10124 and A10324 models. Such developments enable automotive environments to benefit from the A10124 since it meets the standards outlined in AEC-Q200.

Challenges

-

Thermal and power efficiency issues: The RF filter market is facing major hindrances with thermal and power efficiency requirements when used in high-power applications, which include 5G base stations, satellite communications, and connected vehicles. RF filters working with massive high-frequency signals become subject to constant thermal exposure due to the processing volumes. The inability of filters to manage heat effectively is resulting in reduced operational performance and ultimately leads to safety failures of essential components. The filter faces reduced operational duration due to poor power handling efficiency, increasing their energy consumption. Environmental factors limit RF filter deployment in applications that need sustainable, long-term reliability and durability, thus hindering growth in power-centric sectors.

RF Filter Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

16.3% |

|

Base Year Market Size (2025) |

USD 17.18 billion |

|

Forecast Year Market Size (2035) |

USD 77.77 billion |

|

Regional Scope |

|

RF Filter Market Segmentation:

Application

The mobile phone communication segment in RF filter market is poised to generate the highest revenue by the end of 2035. Mobile communication systems require advanced RF filter technologies as they are becoming increasingly complex for the development of 5G networks. This is encouraging companies to introduce ultraSAW filters to offer superior filtering abilities through their high frequency precision and low-loss properties. Advanced technologies are improving mobile device performance by strengthening signals along with decreasing interference patterns, thus delivering stable connections during 5G speed operations.

Voltage

The SAW filter segment is likely to register significant growth in RF filter market during the forecast period. The demand for SAW filters is increasing due to the rapidly expanding need for high-frequency low-loss components suited for 5G, IoT devices, and automotive systems. These filters maintain wireless communication system signal integrity and thus ensure fast and reliable connections. Modern industries are boosting their wireless communication adoption across complex applications, resulting in an increased necessity for advanced SAW filters to minimize system interference and enhance operational efficiency.

The modern compact devices demand higher-performing SAW filters as manufacturers require space-efficient solutions that deliver maximum performance capabilities. SAW filters allow manufacturers to place several communication bands into small device footprints, thus benefiting devices that need to handle multiple bands. The rising requirement for space-saving and efficient components is boosting SAW filter development by leading manufacturers to create more powerful solutions in downsized designs.

Our in-depth analysis of the global RF filter market includes the following segments:CV

|

Voltage |

|

|

Application

|

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

RF Filter Market Regional Analysis:

North America Market Insights

The North America industry is anticipated to dominate the majority revenue RF filter market share of 38% by 2035, owing to the continuous innovations in 5G, wireless, and other next-generation technologies. The requirement for sophisticated RF filters is rising since users need advanced frequency handling, credible signals, along with enhanced network performance. The RF filters maintain performance and minimize interference during wireless communication system upgrades that require increased speeds and bandwidths.

The filters are experiencing rising demand with the increasing adoption of connected devices and IoT applications across healthcare services, residential homes, and industrial sectors. The smooth operation of devices that rely on dependable wireless communication systems necessitates RF filters as integral components for signal management. Rapid expansion of IoT networks, as well as smart technologies, are other factors fueling the growth of the RF filter market.

The region holds the first position in 5G network deployment as countries such as China and Japan are establishing themselves as technology leaders. Advanced RF filters require rapid attention as 5G network expansion is creating higher frequencies and complicated signal processing needs in 5G infrastructure. The market is growing rapidly since mobile operators and manufacturers are continuously expanding 5G services while demanding critical high-performance RF filters to ensure problem-free connectivity with solid signal integrity.

Rising emphasis on smart cities and the adoption of IoT is accelerating the RF filter market in India. The filters serve as a fundamental requirement to maintain smooth and high-quality communication processes in cities having dense populations, along with their associated signal interference and congestion issues. Advanced RF solutions are witnessing an increased demand as the government is committed to upgrading the telecom ecosystem.

RF Filter Market Players:

- Skyworks Solutions, Inc

- Company Overview

- Business Strategy

- Key Technology Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Murata Manufacturing Co. Ltd.

- Qorvo, Inc.

- Broadcom, Inc.

- TDK Corporation

- Avnet Inc.

- Tai-SAW Technology Co. Ltd

- Abracon LLC

- Yageo Group

- RTX Technology Co, Ltd.

The RF filter market is highly competitive, with key players continually advancing their product offerings to cater to the growing demand for efficient communication systems. Leading companies such as Qualcomm, Broadcom, Murata Manufacturing, and Skyworks Solutions dominate the market, focusing on innovations in filter designs for 5G networks, IoT devices, and automotive applications. Strategic partnerships, mergers, and acquisitions are common, enabling companies to strengthen their market positions. Additionally, these players invest in research and development to enhance filter performance, reduce size, and improve integration with next-generation wireless technologies, ensuring their competitive edge in a rapidly evolving industry. Here are some key players operating in the global RF filter market:

Recent Developments

- In October 2024, Anatech announced three new ceramic bandpass filters with center frequencies of 2275 MHz, 5725 MHz, and 6245 MHz, offering various bandwidths and insertion losses.

- In October 2024, Bourns introduced the SRF0502 Series line filters, featuring a compact 2.5 mm profile designed for EMI suppression in mission-critical applications.

- Report ID: 5078

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

RF Filter Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.