Retinopathy of Prematurity Market Outlook:

Retinopathy of Prematurity Market size was over USD 9.91 million in 2025 and is poised to exceed USD 16.61 million by 2035, witnessing over 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of retinopathy of prematurity is estimated at USD 10.38 million.

There has been a rise fir premature births which leads to abnormal development of retinal blood vessels due to an imbalance of certain growth factors in the eyes. According to the World Health Organization (WHO), an estimated 13.4 million babies were born too early in 2020.

In addition, the growing popularity and awareness of supportive care practices and efforts to build a conducive environment for preterm infants’ overall growth and organ maturation boost the market. Moreover, premature infants need careful monitoring, so regular health check-ups and vaccination of premature kids stimulate the retinopathy of the premature market.

Key Retinopathy of Prematurity Market Insights Summary:

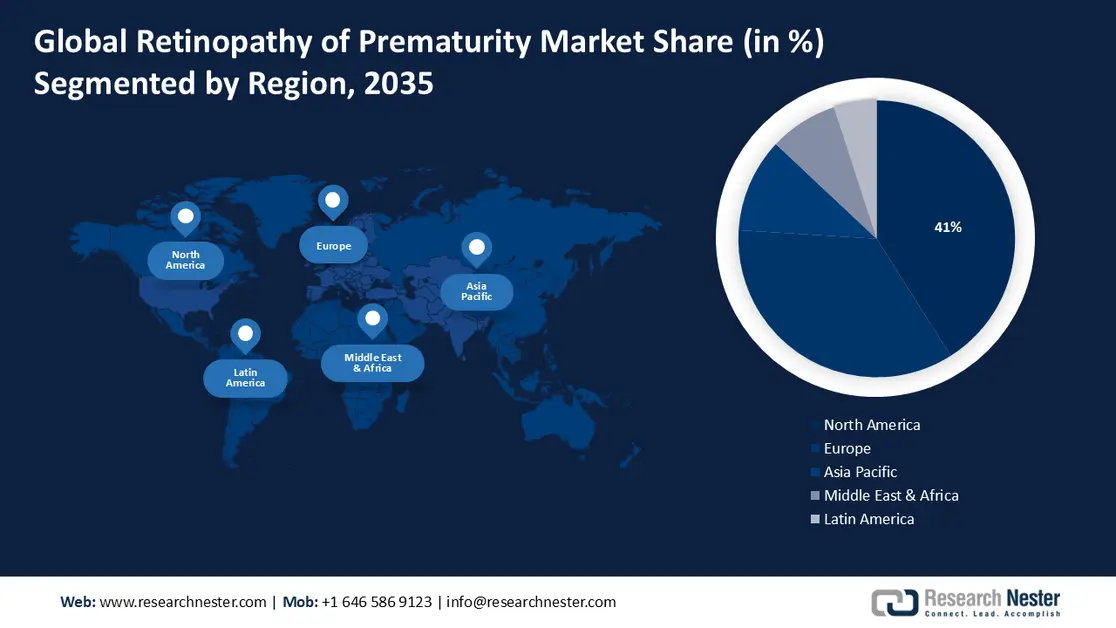

Regional Highlights:

- Across 2026–2035, the North America retinopathy of prematurity market is expected to secure a 41% share by 2035, bolstered by continuous medical technology advancements, stronger early-detection efforts, and rising adoption of AI-enabled neonatal diagnostic tools.

- By 2035, Europe is projected to account for a 35% share, reinforced by the region’s shift toward patient-centric care models, personalized treatment planning, and standardized clinical protocols for retinopathy of prematurity management.

Segment Insights:

- By 2035, the partial retinal detachment segment in the retinopathy of prematurity market is projected to secure a 56% share, supported by expanding adoption of specialized surgical procedures and advanced imaging technologies.

- By 2035, the hospital segment is anticipated to command a 54% share, underpinned by broader caregiver education initiatives and the central role of hospitals in delivering comprehensive retinopathy of prematurity treatments.

Key Growth Trends:

- Rising Healthcare Expenditure

- Adoption of Telemedicine

Major Challenges:

- Treatment Options and Availability

- Need for early detection and screening of preterm infants at risk.

Key Players: Visunex Medical System, Merge Healthcare, Natus Medical Incorporated, Servicom Medical, Advancing Eyecare, Insmed Inc, Alimera Sciences Inc., Biomar Microbial Technologies, Regeneron Pharmaceuticals, Hoffmann-La-Rochelnc.

Global Retinopathy of Prematurity Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.91 million

- 2026 Market Size: USD 10.38 million

- Projected Market Size: USD 16.61 million by 2035

- Growth Forecasts: 5.3%

Key Regional Dynamics:

- Largest Region: North America (41% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: – United States, China, Japan, Germany, United Kingdom

- Emerging Countries: – India, Brazil, South Korea, Mexico, Indonesia

Last updated on : 28 November, 2025

Retinopathy of Prematurity Market - Growth Drivers and Challenges

Growth Drivers

- Rising Healthcare Expenditure- An increase in healthcare spending globally leads to better healthcare infrastructure and improved accessibility to retinopathy of prematurity treatments. According to recent reports, global spending on health reached a new high of USD 9.8 trillion in the year 2021. Furthermore, an increase in healthcare expenditure allows for greater funding in research and development initiatives focused on understanding retinopathy of prematurity, and the development of new treatment modalities that boost the market. In addition, investment in implementing policies that support neonatal healthcare focused on retinopathy of prematurity prevention and treatment boosts stimulate the market. The Every New Born Action Plan (ENAP) is a globally endorsed strategy for ending preventable newborn deaths.

- Adoption of Telemedicine- The adoption of telemedicine in retinopathy of prematurity market involves the use of remote healthcare technologies to facilitate the diagnosis and monitoring of retinopathy of prematurity in premature infants. Furthermore, telemedicine platforms allow for transmission of digital retinal images and relevant patient data from remote locations to specialized healthcare professionals. This facilitates quick and accurate assessments, even if healthcare professionals are not physically present. Moreover, telemedicine increased the accessibility to retinopathy of prematurity expertise, particularly in regions with limited access to specialized neonatal care which stimulated the market.

- Collaborations and Partnerships Among Healthcare Institutions and Research Organizations - Collaborative efforts between healthcare institutions, research organizations, pharmaceutical companies, and public-private partnership accelerates the development and accessibility of retinopathy of prematurity treatments as partnership provides access to shared resources, including funding, research facilities, specialized equipment, transfer of technology and capacity building initiatives such as training programs for healthcare professionals which stimulate the market. In addition, collaboration and partnership in the retinopathy of prematurity market play an important role in advancing research, improving clinical practices, and promoting global efforts to address the challenges associated with retinopathy of prematurity.

Challenges

- Treatment Options and Availability- The development of effective and accessible treatment options for retinopathy of prematurity is an ongoing challenge. Limited therapeutic interventions, especially for the advanced stage of retinopathy of prematurity, impact the ability to provide optimal care.

- Lack of awareness among parents about retinopathy of prematurity may result in delays in seeking medical attention for infants.

- Another challenge in the market is the need for early detection and screening of preterm infants at risk.

Retinopathy of Prematurity Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 9.91 million |

|

Forecast Year Market Size (2035) |

USD 16.61 million |

|

Regional Scope |

|

Retinopathy of Prematurity Market Segmentation:

Disease Type Segment Analysis

The partial retinal detachment segment in the retinopathy of prematurity market is estimated to gain the largest revenue share of about 56% in the year 2035. The segment growth can be attributed to factors that rise in cases of partial retinal detachment may necessitate specialized surgical procedures for effective treatment. This could lead to growth in the market for surgical equipment and expertise related to retinopathy of prematurity management. In addition, the diagnosis of partial retinal detachment in retinopathy of prematurity often requires advanced imaging technologies expertise which leads to demand for diagnostic tools that further stimulate segment growth.

End-User Segment Analysis

The hospital segment is estimated to gain the largest market share of about 54% in the year 2035. The segment growth can be attributed to education provided by hospitals to caregivers about retinopathy of prematurity, its risk factors, and the importance of regular eye examinations for premature infants. In addition, hospitals become central in providing various treatment modalities related to retinopathy of prematurity and employ skilled healthcare professionals to carry out the interventions that stimulate segment growth. According to the National Library of Medicine, the incidence of retinopathy of prematurity ranges from 17% in the public hospital to 30% in private hospitals. About 4% preterm babies require treatment for retinopathy of prematurity.

Our in-depth analysis of the global market includes the following segments:

|

Disease Type |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Retinopathy of Prematurity Market - Regional Analysis

North American Market Insights

Retinopathy of prematurity market in North America region is anticipated to hold the largest share of about 41% by the end of 2035. The regional growth is attributed to ongoing advancements in medical technology, a focus on early detection and intervention, and a commitment to improving outcomes for premature infants at risk of developing retinopathy of prematurity. In addition, growing awareness among people regarding neonatal imaging is further expected to propel the growth of the regional market. Moreover, AI is highly being used for the diagnosis of retinopathy of prematurity in newborns. According to Pharmaceutical Technology, nearly 80% of infants treated with Eylea experienced an absence of active retinopathy of prematurity and unfavorable structural outcomes at 52 weeks of age in both trials. AI in healthcare has effectively diagnosed a blindness-causing disease in premature newborns which led to growth in the market.

European Market Insights

The Europe market is estimated to be the second largest, registering a share of about 35% by the end of 2035. The market’s expansion can be attributed to the patient-centric approach in which the shift towards patient-centric healthcare models such as gathering feedback from patient’s families allows healthcare providers to continuously improve services, adopt better strategies, and emphasize personalized treatment plans contributing to the growth of retinopathy of prematurity market in Europe. Moreover, healthcare providers in Europe aim to create personalized treatment plans based on the specific needs of each premature infant diagnosed with retinopathy of prematurity which further stimulates the market. In addition, efforts to standardize treatment protocols and guidelines for retinopathy of prematurity management ensure consistency in healthcare practices, driving market growth in the region through streamlined approaches.

Retinopathy of Prematurity Market Players:

- Visunex Medical System

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merge Healthcare

- Natus Medical Incorporated

- Servicom Medical

- Advancing Eyecare

- Insmed Inc

- Alimera Sciences Inc.

- Biomar Microbial Technologies

- Regeneron Pharmaceuticals

- Hoffmann-La-Rochelnc

Recent Developments

- January 2023: Natus Medical Incorporated, a leading provider of medical device solutions announced the closing of its acquisition of micromed holding SAS, a global provider of neurophysiology solution. Micromed products will be added to Natus neuro portfolio and developed alongside Natus technologies. The newly merged organization brings together innovative neurodiagnostic solutions and experienced team to offer a broader portfolio of products, services and support to customer worldwide. In addition, The Natus legacy of over 85 years of neurodiagnostic leadership will grow through the addition of the complete line of micromed solutions to comprise an even stronger portfolio of products across polysomnography and intensive care unit monitoring.

- November 2022: Advancing Eyecare, North America leading provider of ophthalmic instruments, announced that acquisition of Veatch Ophthalmic Instruments which is a leading U.S. distributor of ophthalmic equipment. Veatch has more than 30 years history of distributing ophthalmic technology to vision care providers throughout the US. Veatch and Advancing Eyecare, with a shared commitment to best-in-class customer support will expand product and services offering to their combined customers and capitalize on synergistic growth opportunities. In addition, AEC partnered with Cornell Capital, a US based private firm to drive growth, expand the company’s reach and further enhances AEC’s ability to provide high quality , innovative products and services to a growing customer base.

- Report ID: 5823

- Published Date: Nov 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Retinopathy of Prematurity Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.