Renewable Naphtha Market Outlook:

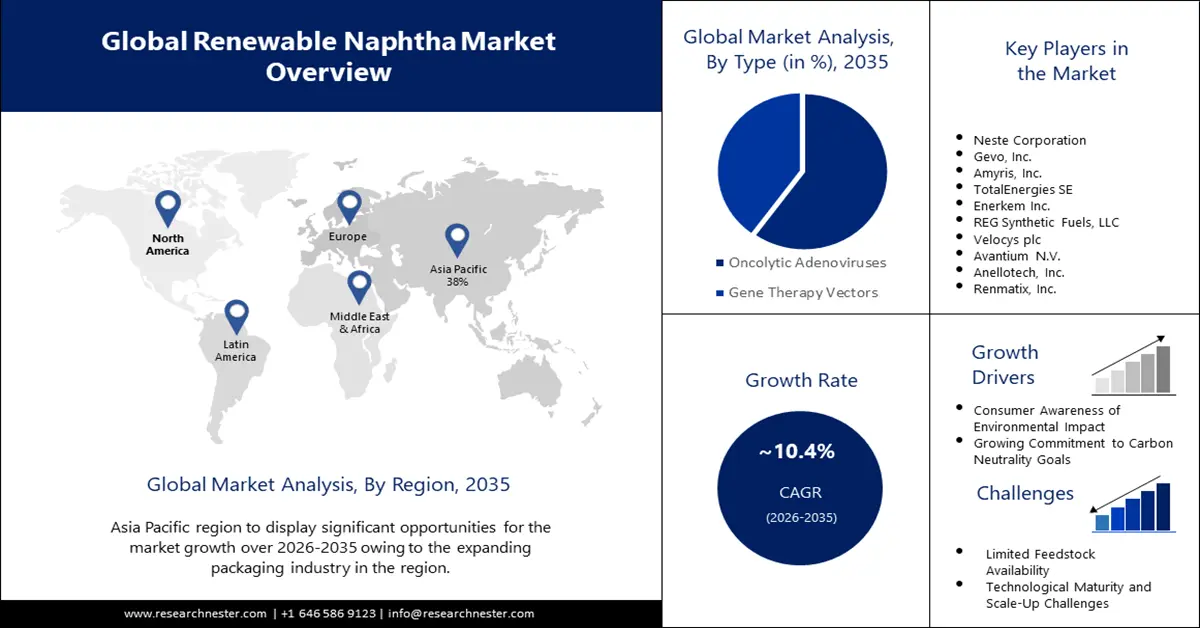

Renewable Naphtha Market size was valued at USD 698.11 million in 2025 and is set to exceed USD 1.88 billion by 2035, registering over 10.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of renewable naphtha is estimated at USD 763.45 million.

The primary driver propelling the growth of the market stems from the increasingly stringent regulations and government policies aimed at fostering a transition towards sustainable and renewable energy sources. Governments worldwide are actively seeking to reduce carbon emissions, mitigate climate change, and enhance energy security. This has resulted in a concerted effort to incentivize and mandate the adoption of renewable alternatives across various industries. Governments play a pivotal role in steering industries towards eco-friendly practices through regulatory frameworks and incentives. For instance, the European Union (EU) has been at the forefront of implementing robust policies to promote renewable energy. The Renewable Energy Directive (RED II) sets ambitious targets for the use of renewable energy in the transport sector, aiming for a 14% share of renewable energy by 2030.

This growth is attributed to the rising adoption of renewable energy and the stringent regulatory landscape pushing industries towards sustainable practices. Renewable naphtha is derived from sustainable and renewable sources, such as biomass, waste, or other organic feedstocks, as opposed to traditional fossil fuels. This shift towards renewable naphtha aligns with global efforts to reduce dependence on fossil fuels, mitigate climate change, and transition towards a more sustainable and circular economy.

Key Renewable Naphtha Market Market Insights Summary:

Regional Highlights:

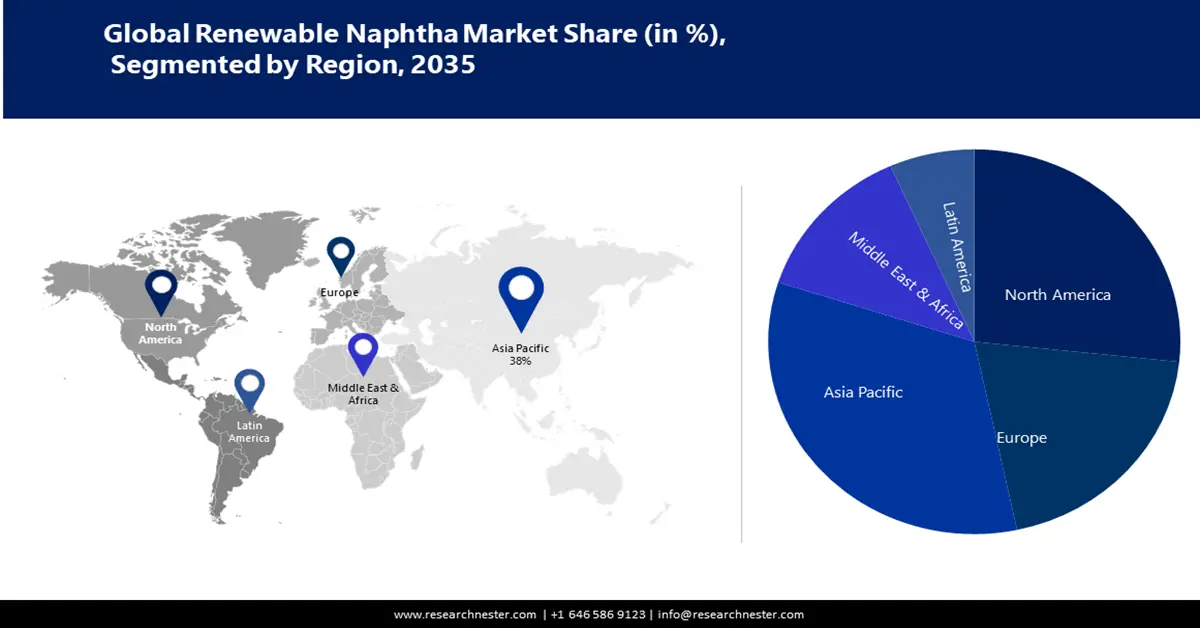

- Asia Pacific renewable naphtha market will secure over 38% share by 2035, driven by continuous technological advancements in bio-based feedstock conversion, supported by government investments and strategic policies.

- North America market will hold the second largest share by 2035, attributed to a supportive regulatory environment and ambitious government targets for renewable energy adoption.

Segment Insights:

- The bio-based segment in the renewable naphtha market is expected to capture a 60% share by 2035, driven by corporate sustainability initiatives and global sustainability trends.

- The packaging segment in the renewable naphtha market is expected to achieve significant growth through 2035, driven by technological innovations in bioplastics production and environmental awareness.

Key Growth Trends:

- Increased Corporate Sustainability Initiatives

- Rising Consumer Awareness of Environmental Impact

Major Challenges:

- Increased Corporate Sustainability Initiatives

- Rising Consumer Awareness of Environmental Impact

Key Players: Neste Corporation, Gevo, Inc., Amyris, Inc., TotalEnergies SE, Enerkem Inc., REG Synthetic Fuels, LLC.

Global Renewable Naphtha Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 698.11 million

- 2026 Market Size: USD 763.45 million

- Projected Market Size: USD 1.88 billion by 2035

- Growth Forecasts: 10.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Indonesia, Malaysia, Thailand

Last updated on : 16 September, 2025

Renewable Naphtha Market Growth Drivers and Challenges:

Growth Drivers

-

Increased Corporate Sustainability Initiatives: Corporations globally are increasingly integrating sustainability into their business strategies. As part of their commitment to environmental responsibility, many companies are adopting renewable feedstocks like renewable naphtha in their production processes. This shift aligns with consumer expectations for eco-friendly products and services, creating a market where sustainable sourcing is a key differentiator. According to a survey, 73% of global consumers say they would definitely or probably change their consumption habits to reduce their impact on the environment. This emphasizes the growing influence of consumer preferences in driving corporate sustainability initiatives, thereby boosting the demand for renewable naphtha.

-

Rising Consumer Awareness of Environmental Impact: Consumers are becoming more environmentally conscious and are making choices that reflect their awareness of the environmental impact of products. This shift in consumer behavior has led to an increased demand for products manufactured using sustainable and renewable resources, including renewable naphtha. Companies responding to this trend are likely to experience growth by offering eco-friendly alternatives. This signifies a strong consumer preference for environmentally friendly products and reinforces the potential market growth for renewable naphtha.

- Global Commitment to Carbon Neutrality Goals: Countries worldwide are setting ambitious targets to achieve carbon neutrality within specific timelines. To meet these goals, industries are seeking alternative, low-carbon feedstocks like renewable naphtha to reduce their overall carbon footprint. The alignment of renewable naphtha with carbon reduction strategies positions it as a key component in the global effort to combat climate change. As part of the Paris Agreement, many countries have committed to reaching net-zero carbon emissions by mid-century. These commitments drive industries to explore and adopt sustainable alternatives, creating a conducive environment for the growth of the renewable naphtha market.

Challenges

-

Cost Competitiveness: One of the primary challenges for renewable naphtha is the cost competitiveness compared to conventional fossil fuel-derived naphtha. The production processes for renewable naphtha often involve advanced technologies and feedstock conversion methods, leading to higher production costs. Bridging the cost gap between renewable and traditional naphtha is crucial for wider industry adoption. This cost disparity poses a challenge in making renewable naphtha economically viable for widespread commercial use.

-

Limited Feedstock Availability

- Technological Maturity and Scale-Up Challenges

Renewable Naphtha Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.4% |

|

Base Year Market Size (2025) |

USD 698.11 million |

|

Forecast Year Market Size (2035) |

USD 1.88 billion |

|

Regional Scope |

|

Renewable Naphtha Market Segmentation:

Type Segment Analysis

The bio-based segment is estimated to hold 60% share of the global renewable naphtha market by 2035. Corporate sustainability initiatives play a crucial role in driving the adoption of bio-based naphtha. Companies across various industries are setting ambitious sustainability goals, aiming to reduce their environmental impact. Bio-based naphtha aligns with these objectives, allowing companies to demonstrate their commitment to sustainable practices and enhance their overall environmental footprint. In a survey, 87% of executives indicated that their companies prioritize sustainability in response to stakeholder expectations. This emphasis on sustainability underscores the strategic importance of adopting bio-based naphtha as part of broader corporate sustainability goals. The growth of the bio-based segment in the market is driven by a confluence of factors, including global sustainability trends, supportive government policies, technological advancements, consumer preferences for biodegradable plastics, and the commitment of companies to sustainability.

End User Segment Analysis

The packaging segment in the renewable naphtha market is expected to garner a significant share in the year 2035. Ongoing technological innovations in the production of bioplastics contribute significantly to the growth of the renewable naphtha-based packaging segment. Advances in processing technologies and the development of novel bio-based materials enhance the performance and versatility of renewable naphtha-based packaging solutions, making them increasingly attractive to the packaging industry. Research published in the journal Nature Reviews Materials emphasizes the continuous advancements in the field of bioplastics, including improvements in material properties, durability, and processing methods. These technological innovations enhance the capabilities of renewable naphtha-based packaging, addressing performance concerns and expanding its applications. The packaging segment in the market is driven by a combination of environmental awareness, regulatory measures, consumer preferences, brand commitments to CSR, and technological innovations.

Our in-depth analysis of the global renewable naphtha market includes the following segments:

|

Type |

|

|

End User |

|

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Renewable Naphtha Market Regional Analysis:

APAC Market Insights

The renewable naphtha market in the Asia Pacific region is projected to hold the largest revenue share of 38% by the end of 2035. Continuous technological advancements in bio-based feedstock conversion contribute to the growth of the market in the Asia Pacific region. Innovations in processes such as biomass conversion, pyrolysis, and gasification enhance the efficiency and cost-effectiveness of renewable naphtha production. The Council of Scientific and Industrial Research (CSIR), for instance, has been actively involved in developing and promoting technologies for the conversion of biomass into bio-based chemicals. This indicates a commitment to technological advancements that can drive the growth of the renewable naphtha sector. The growth of the market in the Asia Pacific region is propelled by government investments, the shift toward sustainable practices, strategic policies, increasing public awareness, and ongoing technological advancements.

North American Market Insights

The renewable naphtha market in the North American region is projected to hold the second-largest share during the forecast period. The presence of a supportive regulatory environment is a crucial driver for the market in North America. Regulations and incentives that promote renewable energy and sustainable practices encourage industries to explore and invest in renewable naphtha as a viable alternative. This regulatory support provides stability and confidence for businesses in adopting renewable feedstocks. In Canada, the federal government's commitment to achieving net-zero emissions by 2050 is reinforced by policies and initiatives supporting the transition to renewable energy sources. This commitment provides a regulatory framework that encourages the adoption of renewable naphtha as part of broader sustainability goals. Ambitious government targets for renewable energy play a pivotal role in driving the growth of the market in North America. Governments at the federal and state levels have set specific goals to increase the share of renewable energy in the overall energy mix. These targets create a conducive environment for investments and advancements in renewable technologies, including the production of renewable naphtha.

Renewable Naphtha Market Players:

- Neste Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Gevo, Inc.

- Amyris, Inc.

- TotalEnergies SE

- Enerkem Inc.

- REG Synthetic Fuels, LLC

- Velocys plc

- Avantium N.V.

- Anellotech, Inc.

- Renmatix, Inc.

Recent Developments

- Gevo partnered with Neste, a global leader in renewable fuels, to form a joint venture to build and operate a renewable jet fuel (RJF) production facility in the United States. This USD 885 million project aims to produce low-carbon jet fuel from renewable feedstocks, significantly reducing greenhouse gas emissions in the aviation industry.

- Gevo signed a multi-year agreement with Southwest Airlines to supply SAF made from renewable ethanol. This agreement marks a significant step in scaling up the adoption of SAF and decarbonizing the airline industry.

- Report ID: 5639

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Renewable Naphtha Market Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.