Relapsing-Remitting Multiple Sclerosis Market Outlook:

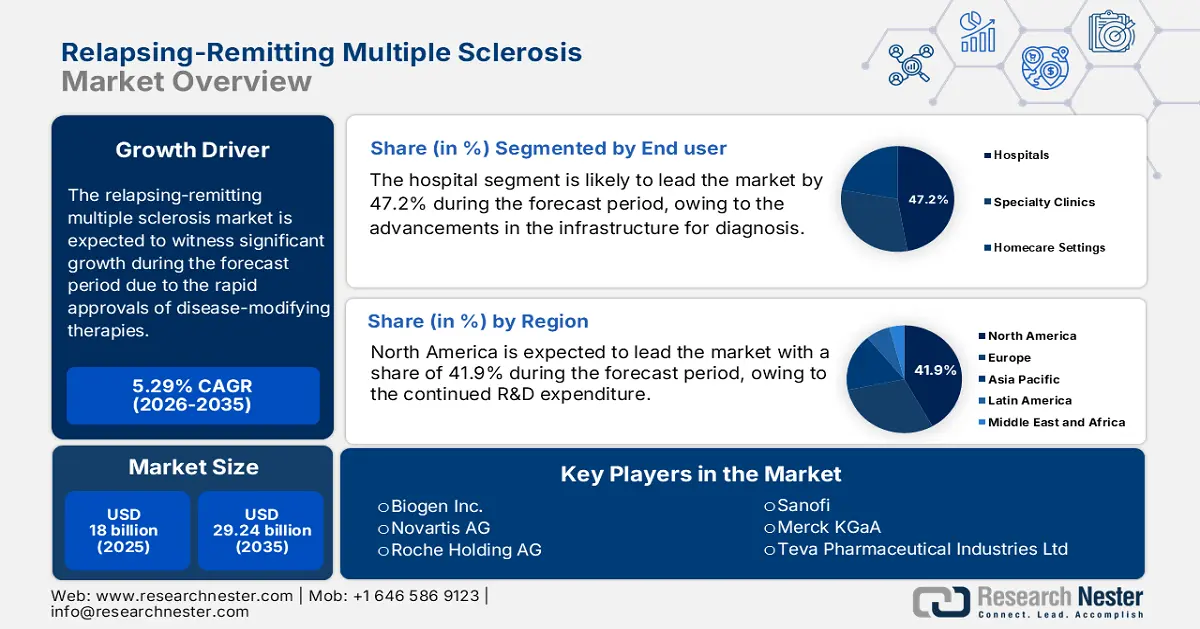

Relapsing-Remitting Multiple Sclerosis Market size was valued at approximately USD 18 billion in 2025 and is projected to reach around USD 29.24 billion by the end of 2035, rising at a CAGR of approximately 5.29% during the forecast period, i.e., 2026-2035. In 2026, the industry size of relapsing-remitting multiple sclerosis is assessed at USD 18.39 billion.

The global relapsing-remitting multiple sclerosis market is fueled by the rapid approvals of disease-modifying therapies (DMTs) and the increasing prevalence of MS in monoclonal antibody and oral drug delivery platforms. The supply chain of the market involves a multi-tiered network and commences from the supply of the raw materials and the procurement of raw materials. These are further utilized by the pharmaceutical and biotech companies to manufacture a myriad of RRMS treatments. Global regulators supervise safety and approvals, and insurance providers decide on reimbursement and pricing.

The producer price index and consumer price index for biologicals used in neurological disease have risen in recent years. Additionally, the research and development in RRMS is focused on developing effective and convenient treatment options to address medical needs. Biotech and pharmaceutical companies are infusing a humongous amount into developing novel drugs. Additionally, remarkable efforts are made in developing oral self-administered therapies to enhance patient adherence. A plethora of clinical trials are also navigating through neuroprotective and remyelination agents, endeavoring to repair nerve damage, which could transit the treatment paradigm beyond symptom control.

Key Relapsing-Remitting Multiple Sclerosis Market Insights Summary:

Regional Highlights:

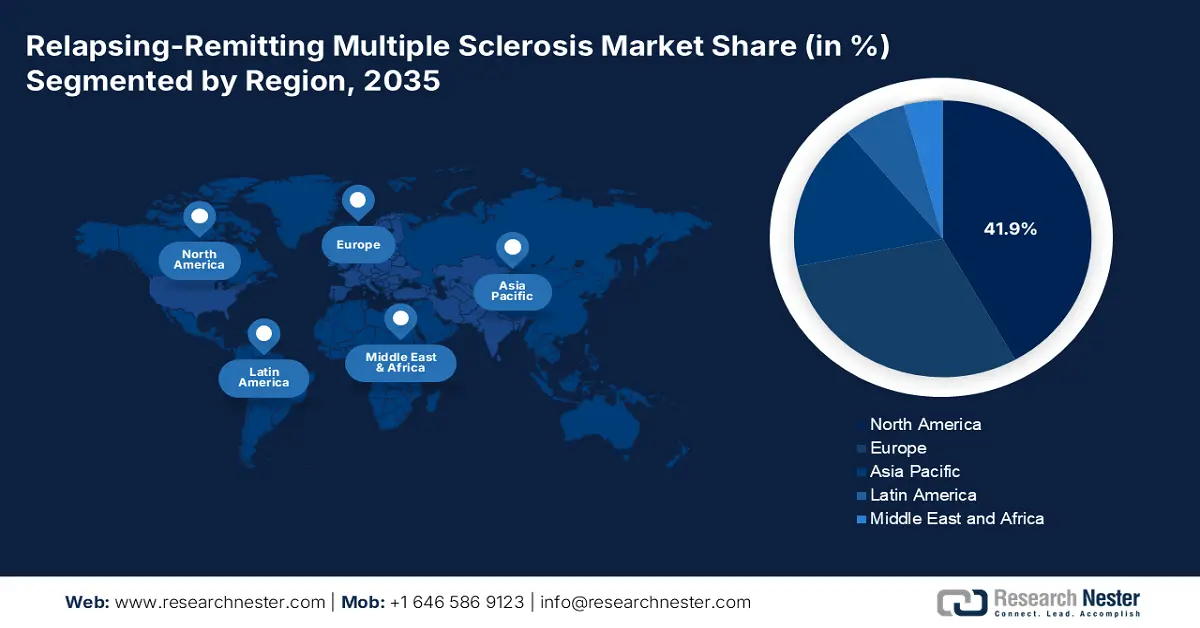

- North America is projected to retain a 41.9% share by 2035 in the relapsing-remitting multiple sclerosis market, bolstered by high disease prevalence, robust reimbursement systems, and extensive R&D expenditure.

- Asia Pacific is anticipated to secure a 17.2% share by 2035, expanding rapidly owing to improved diagnosis rates, strengthening healthcare infrastructure, and greater adoption of biologics and oral therapies.

Segment Insights:

- The hospitals segment is projected to account for 47.2% share by 2035 in the relapsing-remitting multiple sclerosis market, fueled by advancements in diagnostic infrastructure, infusion-based therapies, and imaging enhancements.

- The injectable therapies segment is anticipated to capture 43.6% share by 2035, sustained by the growing reliance on first-line treatments such as glatiramer acetate and interferon beta-1a.

Key Growth Trends:

- Rising patient pool and diagnosed prevalence

- Rise of biosimilars and follow-on products that expand access

Major Challenges:

- Therapy retention and coverage gaps

- Complex disease biology and unmet needs

Key Players: Biogen Inc., Novartis AG, Roche Holding AG (Genentech), Sanofi, Merck KGaA, Teva Pharmaceutical Industries Ltd, Bristol-Myers Squibb (BMS), Johnson & Johnson (Janssen), Eisai Co., Ltd., Mitsubishi Tanabe Pharma, Sun Pharmaceutical Industries, Lupin Ltd, Dr. Reddy’s Laboratories, CSL Limited, Hanmi Pharmaceutical Co., Celltrion Healthcare, Biocon Biologics, Pharmaniaga Berhad, AbbVie Inc., UCB Pharma.

Global Relapsing-Remitting Multiple Sclerosis Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 18 billion

- 2026 Market Size: USD 18.39 billion

- Projected Market Size: USD 29.24 billion by 2035

- Growth Forecasts: 5.29% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, France, Canada

- Emerging Countries: China, India, South Korea, Malaysia, Brazil

Last updated on : 6 October, 2025

Relapsing-Remitting Multiple Sclerosis Market - Growth Drivers and Challenges

Growth Drivers

- Rising patient pool and diagnosed prevalence: According to data published by the MS International Federation in 2023, the number of people with multiple sclerosis reached 2.9 million. The presence of a larger diagnosed population enlarges the tap on the unaddressed market for the therapies associated with the RRMS and further increases demand for long-term treatments. These factors encourage the health system and payers to vehemently in various diagnosis-to-treatment strategies that help bring patients into earlier care. Cumulatively, these factors are propelling the market growth and rendering lucrative opportunities to the market players.

- Rise of biosimilars and follow-on products that expand access: The market is witnessing significant changes with the rising availability of the low-cost versions of complex biologic drugs. Numerous original biologic drugs have already lost their patents or are about to lose. This further means that companies can now produce biosimilars, and these alternatives are crucial as they make treatment cost-efficient for the patients. In August 2023, the FDA approved Tyruko, a biosimilar to Tysabri, for relapsing forms of MS. These lower prices enable the healthcare systems to treat more patients without compromising their budgets.

- Telemedicine, remote care, and digital therapeutics enhancing adherence and continuity of care: The widespread expansion of telehealth infrastructure has lowered the barriers for accessing impeccable care and has enabled smoother follow-up for the people, helping to enhance adherence. According to the Centers for Disease Control and Prevention in 2021, 37% of U.S. adults utilized telemedicine in the past 12 months. Healthcare providers, as well as patients, are relying on remote care, which is reducing loss-to-follow-up. Cumulatively, these factors are increasing the market volumes for RRMS medicines as treatment is becoming more accessible across the geographies.

Challenges

- Therapy retention and coverage gaps: A plethora of patients are discontinuing with the treatment, mainly due to the high cost and lack of insurance coverage. The intermittence in consistent treatment and coverage mitigation significantly impacts long-term health outcomes and raises the likelihood of relapse. Patients in underserved and rural areas experience a negative impact due to limitations in specialty clinics and delays in neurologist appointments.

- Complex disease biology and unmet needs: Despite various advancements in the treatment, RRMS has remained heterogeneous, with numerous patients going through relapses despite the treatments. The current therapies primarily target inflammatory processes and have a limited ability to promote neuroprotection.

Relapsing-Remitting Multiple Sclerosis Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.29% |

|

Base Year Market Size (2025) |

USD 18 billion |

|

Forecast Year Market Size (2035) |

USD 29.24 billion |

|

Regional Scope |

|

Relapsing-Remitting Multiple Sclerosis Market Segmentation:

End user Segment Analysis

The hospitals dominate the segment and are projected to hold the relapsing-remitting multiple sclerosis market share of 47.2% by 2035. The segment is driven by the advancements in the infrastructure for diagnosis, infusion-based therapies, and enhancements in imaging. However, there is a transformation among the outpatient and home-based care models, which is mainly due to product innovation, such as Novartis’s Kesimpta, which supports patient self-injection. This shift has expanded access to treatment in Europe and the Asia Pacific regions. Further, the incorporation of digital tools in healthcare development by various companies has significantly increased the utilization, highlighting the need for home care and digitally enabled end users in the market.

Route of Administration Segment Analysis

The injectable therapies lead the segment and are anticipated to hold the relapsing-remitting multiple sclerosis market share of 43.6% by 2035. The injectable therapies dominate due to the requirement for first-line treatments, including glatiramer acetate and interferon beta-1a. Though the oral therapies are used, most of Europe and developing nations in the healthcare system rely on injectable therapies due to their established clinical protocols, cost efficiency, and better reimbursement mechanisms. The biosimilar injectables are approved by the EMA for broader access under centralized procedures.

Product Type Segment Analysis

The DMTs segment (monoclonal antibodies and advanced biologics) are projected to command the single largest share by 2035. The growth of the market can be attributed to the strong clinical efficacy in lowering rates of relapse and disability progression. Public-facing MS organisations document growing diagnosed prevalence and expanded treated populations (MSIF Atlas), while NIH/NCBI literature and MS society guidance list mAbs among the most potent DMT classes - both facts that support a large share for high-value biologics. Clinical evidence and professional reviews show that mAbs typically produce larger absolute treatment effects than older injectables, which supports premium pricing.

Our in-depth analysis of the global relapsing remitting multiple sclerosis market includes the following segments:

|

Segments |

Subsegments |

|

Route of Administration |

|

|

End user |

|

|

Product Type |

|

|

Treatment Modality |

|

|

Origin |

|

|

Distribution Channel |

|

|

Payer Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Relapsing-Remitting Multiple Sclerosis Market - Regional Analysis

North America Market Insights

North America leads the relapsing-remitting multiple sclerosis market and is anticipated to retain the market share of 41.9% by 2035. Market growth can be attributed to a high rate of prevalence of disease, well-established reimbursement systems, and humongous R&D expenditure. Government reimbursement under Medicare and Medicaid continues to be at the heart of treatment access. North America pharmaceutical companies continue to broaden mAb pipelines and introduce subcutaneous relapsing-remitting multiple sclerosis treatments. In the U.S., the relapsing-remitting multiple sclerosis market is powered by an established reimbursement ecosystem, ongoing government R&D spending, and growing exposure to biologics and oral immunomodulators.

The market in Canada is flourishing owing to the very high national prevalence of cases of RRMS, creating a significant base of patients. According to data published by the government of Canada, 4377 people are diagnosed with MS each year. CIHR and MS Canada co-funded targeted competitions and grant programs (plus CIHR project databases showing active MS awards), which help advance translational work and clinical trials in Canada - attracting biotech partners and increasing the likelihood of domestic trial activity and launch readiness.

Asia Pacific Market Insights

The APAC is the fastest-growing region in the relapsing-remitting multiple sclerosis market and is projected to hold a share of 17.2% by 2035. The market is driven by rising diagnosis rates, enhanced public healthcare infrastructure, and growing use of biologics and oral therapies. The Asia Pacific nations are also collaborating with multinational pharma companies to boost localized fill-finish and packaging capabilities. Affordability is still a limitation in the region, but burgeoning government subsidies, streamlined drug approval processes, and decentralized clinical trials are bridging the treatment gaps. Digital healthcare investments in prominent countries such as India, Malaysia, and South Korea increase the rates of diagnosis-to-treatment conversion further, facilitating relapsing-remitting multiple sclerosis market growth by the end of 2035.

Japan dominates the relapsing-remitting multiple sclerosis market in the Asia Pacific. The Japan Agency for Medical Research and Development (AMED) continues to invest in advanced biomarker and imaging research programs, most notably aiming at early-stage RRMS detection and customized immunotherapy. Major healthcare systems in Japan have implemented bundled pricing for DMTs to make them more affordable. These efforts have enhanced high-cost therapies such as monoclonal antibodies and S1P receptor modulators' access in both urban and rural hospitals.

Europe Market Insights

The relapsing-remitting multiple sclerosis market in Europe is projected to hold the market share of 29.9% at a CAGR of 6.4% by 2035. The region is enhanced by robust pharmacovigilance, pan-European clinical trials, and aligned care pathways. The market in the region is widening owing to a burgeoning addressable patient pool. The European Medicines Agency’s sustained focus on timely review and guidance for innovative neurological therapies supports faster market entry for new oral agents, monoclonal antibodies, and emerging modalities, while national HTA bodies and cross-country assessments shape reimbursement and uptake patterns across markets.

The RRMS market in the UK is also thriving extraordinarily owing to mushrooming disease prevalence, robust NHS support, and a steadfast pipeline of latest therapies. The government is rendering explicit technology appraisals, enabling the timely adoption of oral agents and further managing access agreements to increase affordability. Together, the UK market benefits from a combination of large patient need, centralized NHS reimbursement, rapid uptake of innovative drugs, and strong advocacy infrastructure, making it one of the leading RRMS markets in Europe.

Key Relapsing-Remitting Multiple Sclerosis Market Players:

- Biogen Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novartis AG

- Roche Holding AG (Genentech)

- Sanofi

- Merck KGaA

- Teva Pharmaceutical Industries Ltd

- Bristol-Myers Squibb (BMS)

- Johnson & Johnson (Janssen)

- Eisai Co., Ltd.

- Mitsubishi Tanabe Pharma

- Sun Pharmaceutical Industries

- Lupin Ltd

- Dr. Reddy’s Laboratories

- CSL Limited

- Hanmi Pharmaceutical Co.

- Celltrion Healthcare

- Biocon Biologics

- Pharmaniaga Berhad

- AbbVie Inc.

- UCB Pharma

The relapsing-remitting multiple sclerosis market is highly competitive and dominated by various multinational and regional biopharma players. These players have a strong base in the neurological R&D pipeline. Key players in the relapsing-remitting multiple sclerosis market, including Biogen, Novartis, and Roche dominated due to patent protection, broad treatment portfolios, and global access strategies. The relapsing-remitting multiple sclerosis market is being driven by strategic initiatives such as the development of biosimilars, collaborations for digital adherence, regional expansion, and next-generation oral and B-cell therapies. Companies in India, Malaysia, and South Korea are rapidly increasing their presence via providing cost-effective biosimilars.

Below is the list of some prominent players operating in the relapsing-remitting multiple sclerosis market:

Recent Developments

- In September 2025, Sanofi showcased patient-focused data across multiple sclerosis at ECTRIMS 2025. The company presented 14 abstracts across new potential medicines, including three oral presentations, highlighting its commitment to addressing significant unmet needs in MS treatment.

- In September 2025, Merck presented new data highlighting the durable effects of MAVENCLAD® (cladribine tablets) in relapsing multiple sclerosis at ECTRIMS 2025. The data reinforce its role in delivering durable, effective care for individuals with RMS.

- Report ID: 7921

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Relapsing-Remitting Multiple Sclerosis Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.