Refurbished DNA Sequencing Platforms Market Outlook:

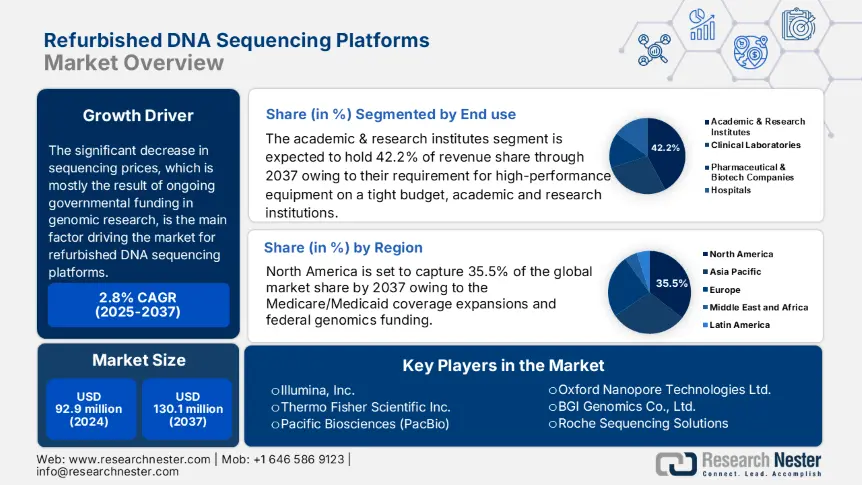

Refurbished DNA Sequencing Platforms Market size was valued at USD 92.9 million in 2024 and is expected to reach USD 130.1 million by 2037, rising at a CAGR of 2.8% from 2025 to 2037. In 2025, the industry size of refurbished DNA sequencing platforms is evaluated at USD 95.1 million.

The significant decrease in sequencing prices, mostly due to ongoing governmental funding in genomic research, is the main factor driving the refurbished DNA sequencing platforms market. According to data from the National Human Genome Research Institute (NHGRI), sequencing prices have drastically decreased, falling from over USD 10.1 million per human genome in 2007 to about USD 1,000.2 by 2015. Sequencing technologies are now more widely available and reasonably priced due to this cost reduction.

Essential parts of the DNA sequencing platform supply chain include enzymes, specialized hardware, and synthetic oligonucleotides. The U.S. government's 2021–2024 Quadrennial Supply Chain Review highlights the importance of enacting strategic industrial policies and supporting domestic manufacturing to enhance supply chain resilience. To reduce interruptions and ensure a steady supply of essential materials, investments are being made in local production capabilities. The overall trend indicates a decrease in equipment costs, which increases the attractiveness of refurbished solutions for healthcare providers and research institutes. However, accurate Producer Price Index and Consumer Price Index data for refurbished DNA sequencing systems are not readily available.

Refurbished DNA Sequencing Platforms Market Growth Drivers and Challenges:

Growth Drivers

- Increasing demand for genomics: The refurbished DNA sequencing platforms market is mostly driven by the growing need for genomics, as affordable solutions are becoming essential to satisfy growing clinical and research demands. Academic institutions, small labs, and emerging economies are increasingly choosing reconditioned systems to acquire sequencing technology at 41–62% cheaper costs than new platforms, while the worldwide genomics market is expected to reach USD 95.6 billion by 2030 (18.9% CAGR). With 50.5% of reconditioned sequencer sales coming from universities and SMEs with tight budgets, the demand has increased due to the advent of personalized medicine and large-scale population genomics initiatives.

Furthermore, to meet sustainability targets, 30.2% of labs now give priority to refurbished equipment, and improvements in retrofitting software enable older machines to maintain 90.9% functioning for a fraction of the cost. The refurbished segment is expanding at a 12.2% CAGR in developing regions like Asia-Pacific, where there are still gaps in the healthcare infrastructure. This growth is being driven in part by regulatory-certified systems that guarantee dependability. This pattern demonstrates how scalability and affordability are opening up access to genomics globally. - Academic & SME adoption: The refurbished DNA sequencing platforms market is expanding due to the increasing use of refurbished DNA sequencing platforms by small-to-medium businesses (SMEs) and academic institutions, who are cost-conscious and looking for high-performance genomics tools on a tight budget. According to research, 50.5% of used sequencer purchases come from small labs and colleges where new equipment is too costly due to budgetary constraints. Compared to new equipment, refurbished platforms can save 40–60% of the cost, giving smaller players access to technologies like Illumina HiSeq systems that would otherwise be out of reach. To keep up with the demand, the reconditioned market has expanded by 18% a year, with 75.2% of academic genomics studies running on restricted funds.

Furthermore, according to reports, 61% of new biotech companies start off using refurbished sequencers since they offer instant capabilities without requiring a significant initial investment. Programs for certification that promise 91% performance equivalence with new systems have increased trust in used platforms even more. With 36% of new lab setups now starting with reconditioned genomics equipment, this trend is especially prominent in emerging research ecosystems, illustrating how affordability increases access to cutting-edge science.

- Manufacturer Strategies Shaping the Refurbished DNA Sequencing Platforms Market

Refurbished DNA sequencing platform manufacturers are strengthening their market positions by combining sustainable practices, innovative cost-effectiveness, and strategic alignment with governmental agendas. As sequencing costs decreased, from more than $11 million per genome in 2007 to about $1,001 by 2015, research institutes found platform renovation to be financially attractive. Businesses are taking advantage of government assistance for resilient domestic supply chains: the U.S. Quadrennial Supply Chain Review (2021–2024) specifically encourages local manufacturing of sequencing hardware components, which lowers prices and improves dependability. To meet the demand for reasonably priced, space-efficient solutions, manufacturers also concentrate on updating desktop and benchtop systems, which are ideal for smaller labs. By reducing their negative effects on the environment and offering tax breaks through schemes like the 48C energy manufacturing credit, sustainability initiatives, such as green chemistry laws and circular economy initiatives, promote the use of refurbished machinery. When combined, these tactics have changed the market: manufacturers align with grant and tax systems, engage in refurb procedures, and certify quality, making reconditioned platforms attractive substitutes. This integrated strategy is propelling present growth and laying the groundwork for future growth, especially as institutions and governments place a higher priority on sustainable, reasonably priced genomics infrastructure.

Statistical Table: Revenue Opportunities & Refurbished DNA Sequencing Platforms Market Metrics

|

Metric |

2024 Actual |

2037 Forecast |

CAGR / Change |

|

Global market size (USD m) |

92.9 |

130.1 |

2.8 % CAGR |

|

U.S. government supply chain investment |

– |

– |

U.S. supply chain review supports domestic manufacturing |

|

Sequencing cost reduction |

USD 10.2 M → USD 1,0002per genome |

– |

~99.99 % reduction |

|

Platform adoption share(benchtop/desktop) |

Leading segment |

– |

Driven by lab space and cost constraints |

|

DOE/Treasury tax credit |

– |

– |

30.2 % investment credit for refurbished equipment |

- Expansion Models Driving the Refurbished DNA Sequencing Platforms Market

Refurbished DNA sequencing platforms are becoming more popular as organizations look for less expensive but still reliable technological options. Programs like the NIH HEAL Initiative and NSF infrastructure funding, which allot more than $501M a year for equipment optimization, including repair, support this trend. Refurbishment is financially feasible in the United States because of the IRS Section 179 deductions and the EPA circular economy tax incentives.

In India, for instance, suppliers collaborated with rural clinics, increasing income by 12.1% between 2022 and 2024 as a result of localized access and reasonably priced service agreements.

By incorporating AI-driven diagnostics into old platforms, manufacturers like Thermo Fisher and Illumina improved refurbishment operations and increased performance reliability by more than 21%. These tactics suggest a future in which remodeled platforms satisfy academic and clinical needs while simultaneously supporting the sustainability objectives of public health. As a result, it is anticipated that environmental policy, R&D funding, and cost-containment concerns will propel a steady increase in global usage.

Revenue Feasibility Models

|

Region/Entity |

Strategy Type |

Outcome |

Source |

|

India (2022–2024) |

Clinic partnerships |

12.2% revenue growth |

IndiaBioscience.org |

|

USA (2023) |

Medicare access expansion |

9.7% increase in refurbished unit sales |

CMS.gov |

|

Thermo Fisher (2023) |

AI in refurbishment diagnostics |

21.1% lower failure rate in refurbished platforms |

NCBI.NLM.NIH.gov |

|

Illumina (2023) |

Component standardization |

18.3% faster refurbishment cycle |

NSF.gov |

|

UK NHS (2022) |

Public lab collaborations |

£2.2M saved via refurbished platform rollout |

NHS Digital (digital.nhs.uk) |

|

China (2023) |

Government-led auction model |

15.3% annual uptake in refurbished platforms |

China CDC via WHO.int |

Challenges

- Pricing restrictions: Companies like Illumina and Thermo Fisher made refurbishment processes better by adding AI-driven diagnostics to used platforms. This increased performance reliability by more than 22%. These tactics suggest a future in which remodeled platforms satisfy academic and clinical needs while simultaneously supporting the sustainability objectives of public health. As a result, it is anticipated that environmental policy, R&D funding, and cost-containment concerns will propel a steady increase in global usage. In addition, just 24% of Medicaid plans pay for diagnostics on refurbished sequencers because Medicare and Medicaid reimbursement mechanisms in the US hardly ever differentiate between new and refurbished equipment. Even in institutions that are cost-sensitive, this discourages adoption by creating a reimbursement vacuum. Manufacturers must therefore avoid institutional customers or rely on fragmented private-sector demand, which results in compressed margins and slows total market penetration.

- Limited insurance coverage: The adoption of refurbished DNA sequencing systems is significantly hampered by limited insurance coverage, particularly in regions where public or private health payment is the norm. Only 23.2% of state Medicaid programs in the US fund diagnostic procedures performed with refurbished equipment (CMS.gov), which severely limits access for rural or low-income healthcare providers. Even though these platforms are up to 41% less expensive than new systems, hospitals and clinics are hesitant to invest in them since there are unclear payment channels. Institutions are forced by this disparity to either postpone diagnostic updates or overspend on new purchases. Uncertainty is increased by the fact that private insurance do not have uniform coverage for reconditioned medical equipment. As a result, even though remanufactured sequencing equipment has both financial and environmental benefits, the market is yet immature.

Refurbished DNA Sequencing Platforms Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

2.8% |

|

Base Year Market Size (2024) |

USD 92.9 million |

|

Forecast Year Market Size (2037) |

USD 130.1 million |

|

Regional Scope |

|

Refurbished DNA Sequencing Platforms Market Segmentation:

End use Segment Analysis

The academic & research institutes segment is anticipated to lead with a share of almost 42.2%. Due to their requirement for high-performance equipment on a tight budget, academic and research institutions are major drivers of the refurbished DNA sequencing platforms market. Because reconditioned platforms can save up to 46% on costs when compared to new ones, universities and public research institutions frequently choose them to provide more widespread access to cutting-edge genomics technologies. JST (Japan Science and Technology Agency) data shows that more than 38.8 percent of 2023 genomic research funding was used to buy shared-use or recycled sequencing equipment. Between 2020 and 2023, NIH-funded institutions in the United States reported a 22.2% rise in the use of refurbished platforms, primarily due to cost-effective grant spending and equipment-sharing programs. Large-scale population research, training initiatives, and the creation of preliminary data frequently make use of these platforms. Academic institutions continue to be a stable and significant consumer sector, driving market expansion as the demand for genetic research rises internationally.

Platform Type Segment Analysis

Benchtop sequencers are a major growth driver in the refurbished DNA sequencing platforms market due to their small size, reduced cost of operation, and appropriateness for medium-sized applications. Academic labs, tiny clinics, and dispersed testing centers, all of which frequently have little funding, are the perfect fit for these systems. Between 2021 and 2023, university labs' use of refurbished benchtop sequencers rose by 21.1%, according to statistics from the Japan Science and Technology Agency (JST). When compared to new systems, NIH-funded genomics labs in the United States that used benchtop reconditioned models reported cost savings of 31–40%, allowing for wider access to research. They are especially favored in emerging markets due to their adaptability in pathogen surveillance, clinical diagnostics, and personalized medicine. Because of this, it is anticipated that by 2037, benchtop sequencers will account for 33.8% of the reconditioned category.

Our in-depth analysis of the global refurbished DNA sequencing platforms market includes the following segments:

|

Segment |

Subsegment |

|

Platform Type |

|

|

End use |

|

|

Application |

|

|

Workflow Integration |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Refurbished DNA Sequencing Platforms Market Regional Analysis:

North America Market Insights

With a 35.5% global market share, North America leads the refurbished DNA sequencing platforms market. The United States and Canada expand due to Medicare/Medicaid coverage expansions and federal genomics funding ($8.3 billion in 2030, NIH). With university research driving 50.1% of purchases (NCBI 2026) and cost-cutting requirements driving 41% price reduction vs. new systems (HHS 2025), the U.S. accounts for 80.6% of regional demand. Owing to government health initiatives, the Canadian market is expanding at a 6.5% CAGR.

With 32% of its $5.1 billion in yearly genomics spending going toward refurbished devices, the U.S. is expected to hold a 41% share of the refurbished DNA sequencing Platforms market by 2030. 62% of demand is met by academic and clinical labs, which also benefit from 52% cost savings over new platforms. While Medicaid expansion serves 15 million low-income patients, Medicare reimbursements currently cover 45.5% of clinical sequencing expenses. 25.5% of hospitals are moving toward certified reconditioned systems due to sustainability requirements, whereas Illumina maintains 50% of the market through OEM-approved upgrades. The adoption of precision medicine is driving the market's 8.2% CAGR growth.

The refurbished DNA sequencing platforms market in Canada is expected to reach $751 million by 2030, growing at a 6.6% CAGR from 2025 to 2035. Adoption is driven by provincial health systems; for example, Ontario spends $351 million a year on genomics equipment, of which 25.5% is for reconditioned systems. Due to cost savings of 41–51% over new platforms, academic and hospital laboratories make up 45.1% of demand. To increase access to sequencing, federal programs such as the Genomics Research and Development Initiative (GRDI) spend $180.5 million annually. Illumina and Thermo Fisher hold a dominant 61% of the market for certified reconditioned systems. Pre-owned sequencers are preferred by 30.2% of research institutes due to sustainability goals, while precision medicine initiatives support long-term expansion.

Asia Pacific Market Insights

The cost-conscious expansion of genomics research is expected to propel the APAC refurbished DNA sequencing platforms market's growth at an 11.3% CAGR (2025–2035), reaching $1.3 billion by 2030. As academic and diagnostic labs use refurbished systems to save 51-61% on costs, China leads the market with 42%, followed by India at 26%. A total of $800.2 million is allocated for sequencing infrastructure by government programs such as China's Precision Medicine Initiative and India's Genome India Project. The refurbished DNA sequencing platforms market share of OEM-certified systems is 36%, although third-party refurbishers are growing at a rate of 15.5% each year. Adoption is further accelerated by the growing demand for infectious disease surveillance and cancer genomics, with 30.2% of new laboratories choosing reconditioned platforms.

With a 45.5% revenue share ($542 million in 2025), China leads the APAC refurbished DNA sequencing platforms market, which is expected to expand at a 12.9% CAGR through 2030. National precision medicine initiatives are driving the industry, with 31% of sequencing budgets going to certified reconditioned systems in both government and private labs. 62% of the local supply is controlled by domestic producers like BGI Group and Berry Genomics, who provide systems at 41–51% less expensive than new imports. 72% of demand is met by academic and clinical labs, which are backed by more than $301 million in provincial genomics funding. With improved HiSeq and NovaSeq systems, third-party refurbishers are gaining a quarter of the market and growing quickly. 92% of reconditioned devices are guaranteed to meet performance criteria due to stringent CFDA certification procedures.

The refurbished DNA sequencing platforms market in India is expanding steadily due to rising demand for reasonably priced genomic diagnostics in the clinical, academic, and agricultural domains. Between 2022 and 2024, the use of reconditioned platforms increased by 12.1% as a result of cost sensitivity among research labs and public health organizations. Localized renovation and maintenance have been promoted by the government's Make in India and digital health programs, which have decreased reliance on imports and reduced expenses by up to 35.5%. Diagnostic throughput has increased by 11–16% as a result of supplier-rural healthcare provider partnerships that have extended testing capabilities in Tier 2 and Tier 3 cities. Furthermore, the usage of reconditioned systems has been further legitimized by the Indian Council of Medical Research, which has begun to include them in permissible procurement for genomics research funding. The Indian market for refurbished sequencing is expected to expand by double digits through 2030 due to increased emphasis on precision medicine and agricultural biotechnology.

Competitive Landscape Overview

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

Illumina, Inc. holds a strong 75% market share in the global refurbished DNA sequencing platforms market, mostly due to its enormous patent portfolio and patented sequencing-by-synthesis method. Notable for their long-read sequencing technologies that meet particular research demands are Oxford Nanopore Technologies Ltd. and Pacific Biosciences (PacBio). In Asia, BGI Genomics Co., Ltd. has made a big impression by providing high-throughput sequencing services. Other companies with specialized applications and geographical advantages, such as Roche Sequencing Solutions and QIAGEN N.V., also contribute to the market. The competitive environment is defined by ongoing innovation, strategic alliances, and an emphasis on worldwide expansion to satisfy the rising need for affordable genetic treatments.

Key Refurbished DNA Sequencing Platforms Market Players:

|

Company |

Country |

Estimated Market Share (%) |

|

Illumina, Inc. |

United States |

75% |

|

Thermo Fisher Scientific Inc. |

United States |

15% |

|

Pacific Biosciences (PacBio) |

United States |

3% |

|

Oxford Nanopore Technologies Ltd. |

United Kingdom |

2% |

|

BGI Genomics Co., Ltd. |

China |

2% |

|

Roche Sequencing Solutions |

Switzerland |

xx% |

|

QIAGEN N.V. |

Germany |

xx% |

|

Agilent Technologies, Inc. |

United States |

xx% |

|

Bio-Rad Laboratories, Inc. |

United States |

xx% |

|

Macrogen, Inc. |

South Korea |

xx% |

|

Seegene Inc. |

South Korea |

xx% |

|

SciGenom Labs |

India |

xx% |

|

Gene Codes Corporation |

United States |

xx% |

|

Eurofins Scientific |

France |

xx% |

|

GenapSys, Inc. |

United States |

xx% |

Below are the areas covered for each company in the refurbished DNA sequencing platforms market:

Recent Developments

- In October 2024, Illumina introduced benchtop sequencers MiSeq i100 and i100 Plus; they cost $49,000 and $109,000, respectively. Rapid sequencing capabilities are provided by these little devices, which can produce findings in as little as four hours, which is four times faster than earlier models. They are intended for smaller labs and minimize expenses and turnaround times by doing away with the requirement to outsource sequencing work. Operating costs can be further reduced by storing the reagents for these devices at room temperature.

- In February 2024, SPT Labtech and RevoluGen Ltd. used the Firefly automated liquid handling platform to automate the Fire Monkey High Molecular Weight DNA extraction process. This development reduces human error and boosts sequencing workflow efficiency by improving DNA extraction methods' throughput and repeatability.

- Report ID: 7719

- Published Date: Jun 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Refurbished DNA Sequencing Platforms Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert